Boston Celtics Sold For $6.1 Billion: Fans React To Private Equity Takeover

Table of Contents

The $6.1 Billion Sale: Details and Implications

Who bought the Celtics?

The Boston Celtics were purchased by [Insert Name of Private Equity Firm Here], a prominent private equity firm with a history of significant investments across various sectors. While their previous investments haven't included many high-profile sports franchises, their stated goals for the Celtics include enhancing team performance, improving fan experience, and driving further revenue growth.

- Name of the firm: [Insert Name of Private Equity Firm Here]

- Previous investments in sports: [List any relevant previous investments, or state "Limited prior investments in professional sports."]

- Stated goals for the Celtics: Increased investment in player acquisition, upgraded facilities, and enhanced fan engagement initiatives.

Financial Aspects of the Sale

The $6.1 billion sale price shattered previous records in the NBA, highlighting the immense value of established franchises like the Boston Celtics. This record-breaking valuation underscores the lucrative nature of professional sports and the significant investment potential in established teams.

- Comparison to other recent NBA team sales: [Compare the sale to other recent high-profile NBA team sales, citing specific examples and dollar amounts]. This sale significantly surpasses previous records, signaling a new era of valuations in the NBA.

- Potential impact on player salaries and team operations: The influx of capital could lead to increased player salaries, improved coaching staff, and better resources for team operations. However, this also raises concerns about potential cost-cutting measures in other areas.

- Valuation considerations: Several factors contributed to the high valuation, including the team's rich history, strong fan base, lucrative media deals, and potential for future revenue growth.

Long-term Impact on the Celtics Franchise

The change in ownership could bring significant alterations to the Celtics' operations. New management strategies, player recruitment approaches, and even coaching changes are all possibilities under the new private equity ownership.

- Potential impact on ticket prices, merchandise, and overall fan experience: Increased investment may lead to facility upgrades, but also carries the risk of higher ticket prices and merchandise costs. The overall fan experience will be a key area to watch.

- Discussion of potential long-term financial strategies: Private equity firms are often driven by maximizing returns on investment. This might lead to a more business-focused approach, which could impact team strategy and player acquisitions.

Fan Reactions to the Private Equity Takeover

Positive Reactions

Many Celtics fans are optimistic about the sale, viewing it as an opportunity for significant improvements to the franchise. The injection of capital could potentially catapult the team to even greater heights.

- Belief in increased investment in the team: Fans believe the new ownership will bring increased resources for player signings, improved coaching, and state-of-the-art facilities.

- Potential for improved infrastructure: Upgrades to TD Garden and other team facilities are anticipated, enhancing the overall game-day experience.

- Hope for continued success on the court: Fans are hopeful that the increased investment translates directly into on-court success, leading to more championships.

Negative Reactions

Despite the optimism, concerns exist among the fanbase. The primary worry centers on the potential for the new owners to prioritize profit maximization over team success.

- Worries about prioritizing profits over team success: The core concern is that financial gains might overshadow the team's on-court performance and long-term legacy.

- Fear of increased ticket prices or decreased fan accessibility: There’s apprehension that the sale may lead to unaffordable ticket prices, alienating long-time fans.

- Concerns about the team's long-term cultural identity: Fans worry that the change in ownership could dilute the team's unique cultural identity and traditions.

Analyzing Social Media Sentiment

Social media has been abuzz since the announcement. The overall sentiment is mixed, with passionate debates unfolding across various platforms.

- Key hashtags used: #CelticsSale, #NBASale, #PrivateEquity, #BostonCeltics, #TDGarden

- Prevailing sentiment (positive, negative, neutral): A roughly even split between positive and negative sentiments, with a considerable portion expressing uncertainty and waiting to see how things unfold.

- Examples of significant fan comments or posts: [Insert examples of relevant social media posts reflecting both positive and negative sentiments].

The Future of the Boston Celtics under Private Equity Ownership

Potential Challenges

The new owners will face significant hurdles in navigating the complexities of managing a professional sports franchise.

- Balancing profit maximization with maintaining the team's competitive edge: Finding a balance between financial success and maintaining a winning team will be crucial.

- Managing fan expectations: Meeting the high expectations of the passionate Celtics fanbase will be a key challenge.

- Navigating the complexities of the NBA landscape: The NBA is a highly competitive league with strict regulations and unique challenges.

Opportunities for Growth

Despite the challenges, this sale presents opportunities for significant growth.

- Access to greater financial resources for player acquisitions and facility improvements: This provides the potential for substantial upgrades to the team and its facilities.

- Potential for expanded marketing and branding initiatives: Increased financial resources could lead to aggressive marketing and branding campaigns targeting a wider audience.

- Opportunities for international fan engagement: The global reach of private equity could help expand the Celtics' international fanbase and revenue streams.

Conclusion

The $6.1 billion sale of the Boston Celtics to a private equity firm marks a pivotal moment in the team's history, generating a mixture of excitement and apprehension among the dedicated fanbase. While the potential for increased investment and improved resources exists, concerns about the prioritization of profits and the potential impact on fan experience remain. The coming years will reveal the true impact of this significant transaction.

Call to Action: What are your thoughts on the Boston Celtics' $6.1 billion sale? Share your opinions and predictions for the team's future in the comments below! Join the conversation on the future of the Boston Celtics and the impact of private equity ownership. #CelticsSale #NBASale #PrivateEquity #BostonCeltics

Featured Posts

-

Ahy Buka Peluang Proyek Tembok Laut Raksasa Dan Implikasi Cina

May 15, 2025

Ahy Buka Peluang Proyek Tembok Laut Raksasa Dan Implikasi Cina

May 15, 2025 -

Johnstons Record Setting Goal Fuels Stars 6 2 Victory Over Avalanche

May 15, 2025

Johnstons Record Setting Goal Fuels Stars 6 2 Victory Over Avalanche

May 15, 2025 -

Dodgers Farm System Focusing On Kim Hope Phillips And Miller

May 15, 2025

Dodgers Farm System Focusing On Kim Hope Phillips And Miller

May 15, 2025 -

Elon Musk And Amber Heard New Twins Fuel Embryo Dispute Rumors

May 15, 2025

Elon Musk And Amber Heard New Twins Fuel Embryo Dispute Rumors

May 15, 2025 -

Vyvedet Li Turtsiya Voyska S Kipra Analiz Diskussii Na Haqqin Az

May 15, 2025

Vyvedet Li Turtsiya Voyska S Kipra Analiz Diskussii Na Haqqin Az

May 15, 2025

Latest Posts

-

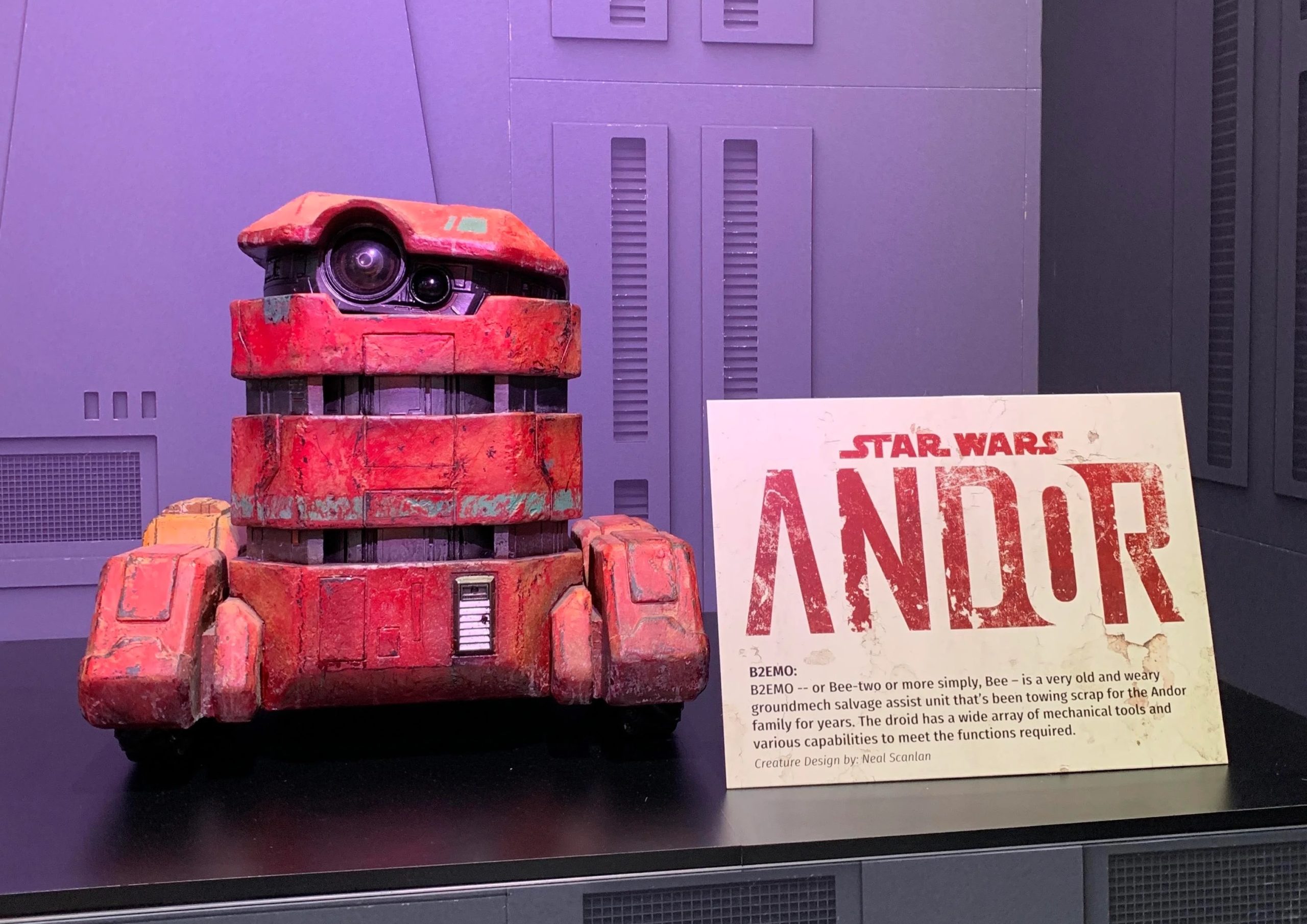

First Look At Andor Everything Fans Have Been Waiting For

May 15, 2025

First Look At Andor Everything Fans Have Been Waiting For

May 15, 2025 -

Star Wars The Andor Story Book Project Halted By Ai Technology Concerns

May 15, 2025

Star Wars The Andor Story Book Project Halted By Ai Technology Concerns

May 15, 2025 -

Get Ready For Andor Season 2 A Pre Viewing Guide

May 15, 2025

Get Ready For Andor Season 2 A Pre Viewing Guide

May 15, 2025 -

Andors First Look A Major Star Wars Event Finally Revealed

May 15, 2025

Andors First Look A Major Star Wars Event Finally Revealed

May 15, 2025 -

Star Wars Andor Author Scraps Book Over Ai Copyright Issues

May 15, 2025

Star Wars Andor Author Scraps Book Over Ai Copyright Issues

May 15, 2025