BP CEO Pay Cut: A 31% Decrease In Executive Compensation

Table of Contents

The Magnitude of the BP CEO Pay Cut

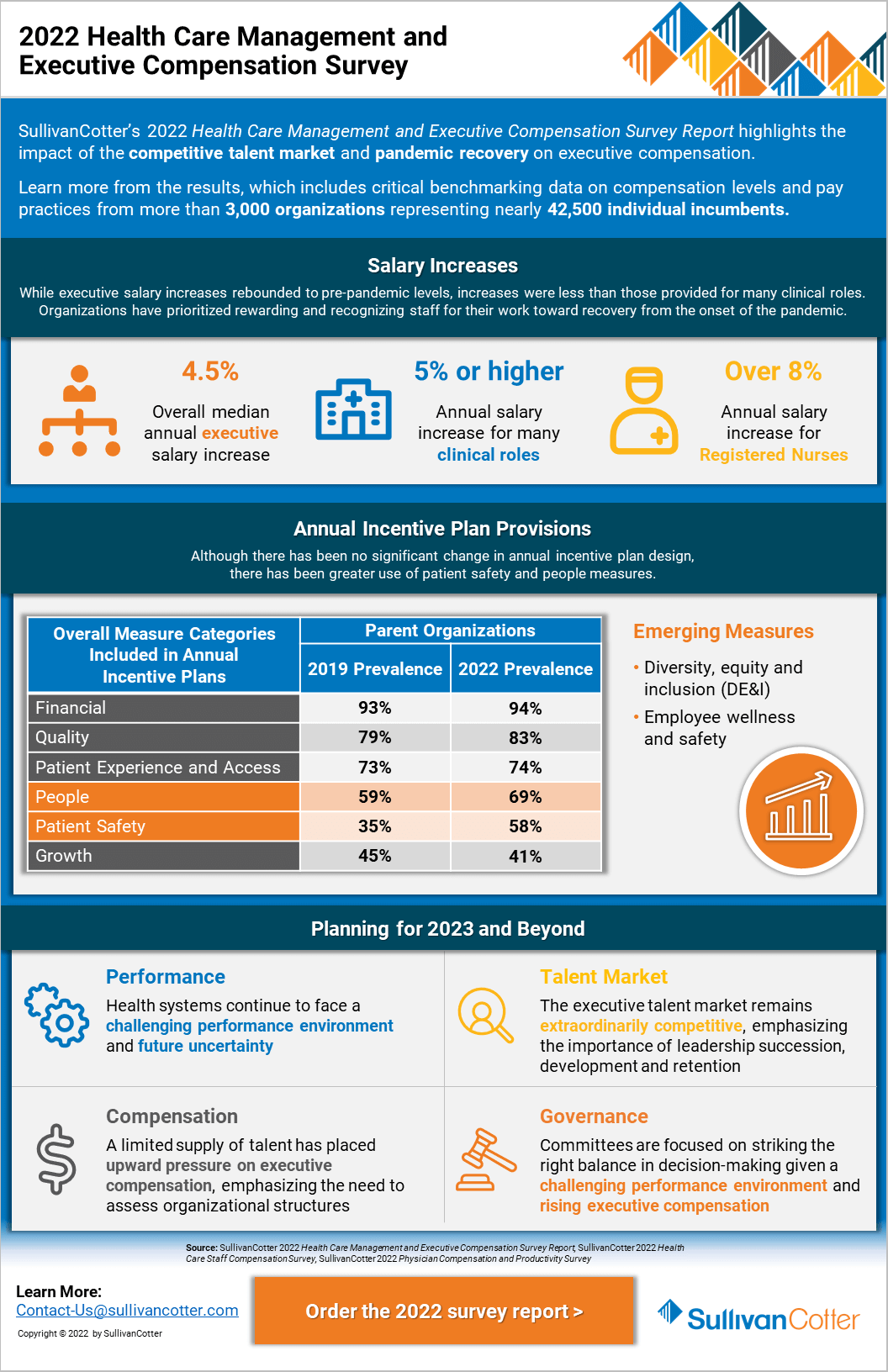

The BP CEO salary reduction represents a considerable shift in executive compensation within the energy sector. Bernard Looney's 2023 compensation package was significantly lower than his 2022 earnings. While the exact figures may vary depending on the final accounting and reporting, the reported 31% decrease represents a substantial reduction in his overall compensation. This change affects multiple components of his remuneration.

- Specific dollar amount of the pay cut: While precise figures are still emerging, reports indicate a reduction in the millions of dollars. Official BP statements should be consulted for the exact numbers once released.

- Breakdown of compensation components (salary, bonus, stock options, etc.): The reduction likely impacted all components, including base salary, annual bonuses, and long-term incentive plans tied to company performance. The extent of the reduction in each area may vary.

- Percentage change in total compensation: The reported 31% reduction is a significant decrease, showing a considerable commitment to adjusting executive pay based on performance and external factors.

- Comparison to previous years' compensation: Analyzing previous years' BP CEO salary figures will offer a clearer perspective on the magnitude of this recent cut relative to historical trends.

Reasons Behind the BP CEO Pay Cut

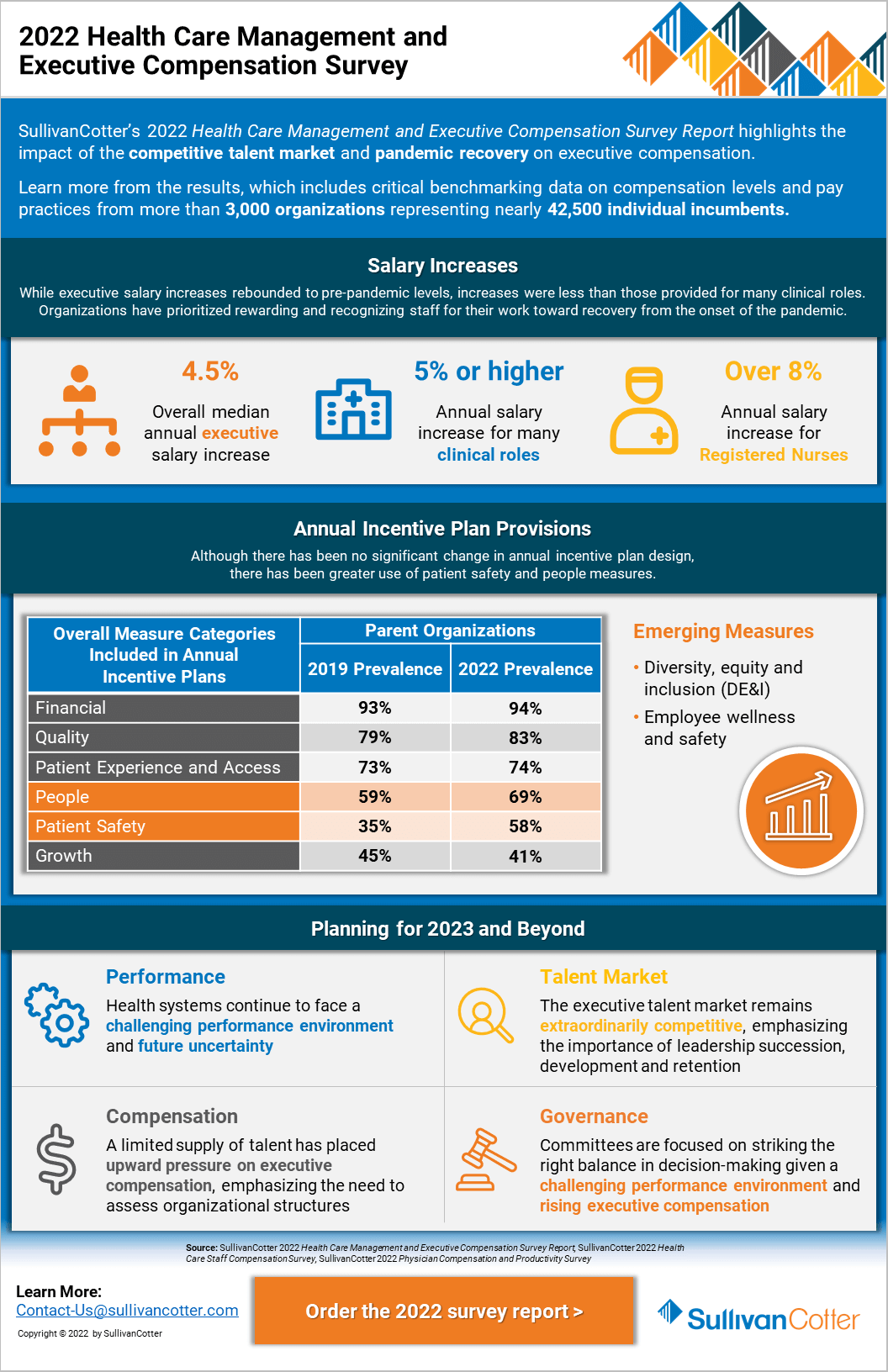

Several factors contributed to BP's decision to significantly reduce Bernard Looney's compensation. These reasons highlight the increasing pressures on energy companies to demonstrate responsible executive pay practices.

- Impact of fluctuating oil prices on BP's profitability: The volatile nature of oil prices directly impacts BP's financial performance. A year of fluctuating prices likely influenced the decision to adjust executive compensation accordingly.

- Shareholder demands for responsible executive pay: Increasing shareholder activism and a focus on corporate governance have put pressure on companies to justify executive pay packages. Shareholders are increasingly scrutinizing the alignment of executive pay with company performance and broader societal values.

- Public criticism of high executive salaries in the energy sector: The energy sector has faced public criticism regarding high executive compensation, particularly amidst concerns about environmental impact and energy affordability. This criticism undoubtedly played a role in BP's decision.

- BP's commitment to ESG goals and its influence on compensation decisions: BP, like many other energy companies, has publicly committed to Environmental, Social, and Governance (ESG) goals. A reduction in CEO pay can be viewed as a demonstration of commitment to responsible practices and aligning executive compensation with broader ESG priorities.

Implications of the BP CEO Pay Cut for the Energy Industry

The BP CEO pay cut has significant implications for the energy industry, potentially setting a precedent for future executive compensation practices.

- Potential for other energy companies to follow suit: Other energy companies may follow BP's lead, reevaluating their executive compensation strategies in response to shareholder pressure, public scrutiny, and a changing industry landscape.

- Impact on executive compensation benchmarks within the sector: This pay cut could alter the benchmarks used to determine executive compensation in the energy sector, potentially leading to adjustments across the board.

- Shifting perspectives on executive pay in the context of ESG: The decision reflects a broader shift toward integrating ESG considerations into executive compensation decisions, influencing the industry's approach to corporate social responsibility.

- Changes in corporate governance practices resulting from this event: This event could trigger changes in corporate governance practices within the energy sector, potentially leading to more robust mechanisms for determining and justifying executive pay.

Conclusion

The 31% decrease in BP CEO Bernard Looney's compensation marks a significant event in the energy industry. Driven by factors such as fluctuating oil prices, shareholder pressure, and increasing focus on ESG concerns, this pay cut has implications that extend beyond BP itself. The reduction signals a potential shift in executive compensation practices within the broader energy sector, influencing corporate governance and potentially setting a new benchmark for responsible executive pay.

Call to Action: Stay informed about the ongoing developments in BP CEO pay and executive compensation within the energy sector. Follow [Your Website/Source] for updates on BP CEO pay and other significant changes in executive compensation. Learn more about the evolving landscape of executive compensation in the energy industry by exploring our resources on [link to related content].

Featured Posts

-

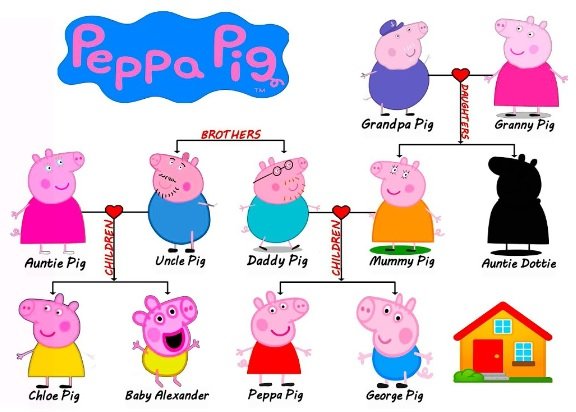

Peppa Pigs Family Welcomes A New Member Gender Reveal Celebration

May 22, 2025

Peppa Pigs Family Welcomes A New Member Gender Reveal Celebration

May 22, 2025 -

Les Novelistes A L Espace Julien Avant Le Hellfest

May 22, 2025

Les Novelistes A L Espace Julien Avant Le Hellfest

May 22, 2025 -

Adios Enfermedades Cronicas Este Superalimento Revoluciona La Salud Y La Longevidad

May 22, 2025

Adios Enfermedades Cronicas Este Superalimento Revoluciona La Salud Y La Longevidad

May 22, 2025 -

Arunas Early Exit At Wtt Chennai A Disappointing End

May 22, 2025

Arunas Early Exit At Wtt Chennai A Disappointing End

May 22, 2025 -

Understanding The Success And Longevity Of The Goldbergs

May 22, 2025

Understanding The Success And Longevity Of The Goldbergs

May 22, 2025

Latest Posts

-

Remont Pivdennogo Mostu Aktualna Informatsiya Pro Roboti Ta Finansi

May 22, 2025

Remont Pivdennogo Mostu Aktualna Informatsiya Pro Roboti Ta Finansi

May 22, 2025 -

Pivdenniy Mist Remont Pidryadniki Etapi Ta Koshtoris

May 22, 2025

Pivdenniy Mist Remont Pidryadniki Etapi Ta Koshtoris

May 22, 2025 -

Nieuwe Directeur Hypotheken Intermediair Bij Abn Amro Florius En Moneyou Karin Polman

May 22, 2025

Nieuwe Directeur Hypotheken Intermediair Bij Abn Amro Florius En Moneyou Karin Polman

May 22, 2025 -

Remont Pivdennogo Mostu Oglyad Proektu Ta Vitrat

May 22, 2025

Remont Pivdennogo Mostu Oglyad Proektu Ta Vitrat

May 22, 2025 -

Hypotheken Intermediair Karin Polman Neemt Directie Bij Abn Amro Florius En Moneyou Over

May 22, 2025

Hypotheken Intermediair Karin Polman Neemt Directie Bij Abn Amro Florius En Moneyou Over

May 22, 2025