BP Chief Aims To Double Company Valuation: No US Listing Planned, FT Reports

Table of Contents

Doubling BP's Valuation: The Strategic Roadmap

BP's strategy for doubling its valuation hinges on a multi-pronged approach focusing on enhanced profitability, strategic investments, and operational excellence. The plan aims to significantly boost shareholder value and strengthen BP's position within the increasingly competitive energy landscape.

- Focus on increasing profitability: This involves rigorous cost reduction initiatives across all operations, streamlining processes, and optimizing existing assets for maximum efficiency. Reports suggest internal targets involve a double-digit percentage reduction in operational expenditure over the next three years.

- Significant investment in renewable energy: BP is committed to a substantial expansion of its renewable energy portfolio. This includes significant investments in wind, solar, and other clean energy sources, aligning the company with the global energy transition and attracting environmentally conscious investors. The company has publicly committed billions to this sector.

- Exploration and expansion of existing oil and gas reserves: While transitioning to renewables, BP acknowledges the continued importance of oil and gas production in the near term. Exploration and expansion of existing reserves will ensure a stable revenue stream during the transition phase. This strategy ensures maintaining profitability during the shift toward renewables.

- Strategic acquisitions and partnerships: Acquiring smaller, innovative companies and forging strategic partnerships will help BP gain access to new technologies, expand its market reach, and accelerate its growth trajectory. This will allow for quicker innovation and wider market penetration.

- Implementation of innovative technologies: Investing in and implementing cutting-edge technologies across all operations – from exploration to production and distribution – will enhance efficiency, reduce environmental impact, and drive down costs. This is key to maintaining a competitive edge in the energy sector.

Looney’s strategy is not merely about cost-cutting; it’s a holistic approach to transformation. He aims to reposition BP as a leader in the energy transition, attracting a new generation of investors while retaining the loyalty of existing shareholders.

Why No US Listing? Examining the Decision

The decision to forgo a US listing, despite the size and potential of the US stock market, is a significant one. Several factors underpin this strategy.

- Regulatory environment and compliance costs: Listing on the US stock market comes with stringent regulatory requirements and substantial compliance costs. These expenses could significantly offset the potential benefits of a wider investor base. The complexities of navigating US securities laws likely played a major role in this decision.

- Existing investor base and preferences: BP already enjoys a strong investor base on the London Stock Exchange. Many existing investors may prefer the familiarity and established relationships within the London market. Relocating to the US could alienate some of these key investors.

- Brexit's impact: Post-Brexit, the UK’s regulatory environment and its attractiveness to international investors are still evolving. However, London remains a significant global financial hub, offering advantages that outweigh the perceived benefits of a US listing for BP. This decision also reflects confidence in London's continued relevance as a global financial center.

- Geopolitical factors: The current geopolitical climate introduces uncertainty into international investment decisions. Maintaining a primary listing on the London Stock Exchange offers a degree of stability and familiarity in uncertain times. This reflects a cautious approach to global market volatility.

Staying on the London Stock Exchange allows BP to leverage its established relationships, minimize regulatory hurdles, and focus its resources on executing its strategic growth plan, rather than navigating complex US listing requirements.

Impact on Investors and the Energy Sector

BP's strategic roadmap, and the decision to remain off the US stock market, will have significant implications for investors and the broader energy sector.

- Potential impact on BP's share price: The success of Looney's plan will directly impact BP's share price. If the company successfully implements its strategies and achieves its valuation goals, the stock price is likely to increase. Conversely, any setbacks could negatively affect investor confidence and share price.

- Investor confidence: The ambitious nature of the plan will either attract or deter investors depending on their risk tolerance and assessment of BP's ability to execute its strategy. Successful execution will boost confidence; failure could lead to a decline in investor confidence.

- Competitive landscape: BP's moves will significantly influence the competitive landscape within the energy sector. Competitors will likely analyze BP’s strategy and adjust their own plans accordingly. The energy sector will likely witness further consolidation and innovation.

- Energy industry trends: BP's emphasis on the energy transition sets a precedent for other major energy companies. It will influence the pace and direction of the global shift toward renewable energy sources.

The success of BP's strategy will not only influence the company's valuation and stock price but will also shape the future of the energy sector.

Conclusion

BP's ambitious goal to double its company valuation represents a significant undertaking within the volatile energy sector. The strategic roadmap outlined by Bernard Looney, focusing on enhanced profitability, renewable energy investments, and operational excellence, is a bold attempt to reshape BP’s future. The decision to avoid a US listing reflects a calculated strategy that prioritizes existing investor relationships, minimizes regulatory burdens, and capitalizes on the strengths of the London Stock Exchange. The success of this plan will significantly influence BP's share price, the competitive landscape, and the broader trajectory of the energy industry.

Call to Action: Stay informed about BP's progress in achieving its ambitious goal to double its company valuation. Follow our updates for the latest news and analysis on BP's strategic moves and their impact on the energy market. Learn more about investing in BP and similar energy companies by exploring our resources on company valuations and the energy sector.

Featured Posts

-

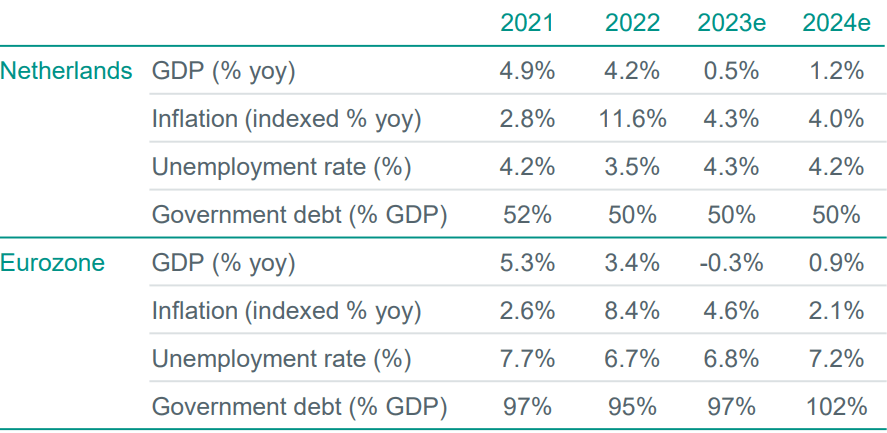

Abn Amro Huizenprijzen Ondanks Economische Tegenwind

May 21, 2025

Abn Amro Huizenprijzen Ondanks Economische Tegenwind

May 21, 2025 -

Where To Watch The Goldbergs Streaming Options And More

May 21, 2025

Where To Watch The Goldbergs Streaming Options And More

May 21, 2025 -

Saskatchewan Political Panel Examining Western Separation

May 21, 2025

Saskatchewan Political Panel Examining Western Separation

May 21, 2025 -

Vapors Of Morphine Northcote Concert Details And Tickets

May 21, 2025

Vapors Of Morphine Northcote Concert Details And Tickets

May 21, 2025 -

Interview Barry Ward On Playing Cops And Casting

May 21, 2025

Interview Barry Ward On Playing Cops And Casting

May 21, 2025

Latest Posts

-

Kwartaalcijfers Boost Abn Amro En De Aex

May 21, 2025

Kwartaalcijfers Boost Abn Amro En De Aex

May 21, 2025 -

Sterke Kwartaalcijfers Tillen Abn Amro In Aex

May 21, 2025

Sterke Kwartaalcijfers Tillen Abn Amro In Aex

May 21, 2025 -

Groeiend Autobezit Stimuleert Occasionverkoop Abn Amro Rapporteert Sterke Stijging

May 21, 2025

Groeiend Autobezit Stimuleert Occasionverkoop Abn Amro Rapporteert Sterke Stijging

May 21, 2025 -

Abn Amro Aex Stijgt Na Positieve Kwartaalresultaten

May 21, 2025

Abn Amro Aex Stijgt Na Positieve Kwartaalresultaten

May 21, 2025 -

Abn Amro Aex Stijging Na Positieve Kwartaalresultaten

May 21, 2025

Abn Amro Aex Stijging Na Positieve Kwartaalresultaten

May 21, 2025