BP Valuation Doubling On The Horizon? CEO's Plans And Stock Market Implications (FT)

Table of Contents

The CEO's Strategic Vision for BP's Future

BP's CEO has unveiled an ambitious strategic plan aiming to reshape the company's future. This vision centers around several key elements designed to drive growth and enhance BP's long-term investment appeal. The keywords here are strategic plan, renewable energy, energy transition, and diversification.

-

Increased Investment in Renewable Energy: BP is significantly increasing its investment in renewable energy sources like solar, wind, and hydrogen. This diversification strategy aims to reduce reliance on fossil fuels and capitalize on the growing demand for clean energy. This directly impacts the BP valuation as it signals a move towards a more sustainable and potentially more profitable future.

-

Divestment from Certain Fossil Fuel Assets: To fund its renewable energy initiatives and streamline operations, BP is actively divesting from certain less profitable or higher-emission fossil fuel assets. This strategic move demonstrates a commitment to the energy transition and reduces long-term risk associated with declining demand for traditional energy sources.

-

Focus on Efficiency Improvements: BP is implementing operational efficiency improvements across its entire business, aiming to reduce costs and maximize profitability in both its traditional oil and gas operations and its expanding renewable energy portfolio. This focus on efficiency is crucial for improving the company's overall financial performance, a key factor influencing BP valuation.

-

Technological Innovation: The CEO's strategy emphasizes investment in cutting-edge technologies to enhance operational efficiency, reduce environmental impact, and drive innovation across all energy sectors. This commitment to technological advancement is expected to yield competitive advantages, supporting sustainable growth and positively impacting the BP share price.

Market Analysis: Assessing the Feasibility of a Doubled Valuation

Assessing the feasibility of a doubled BP valuation requires a thorough market analysis. This includes examining current market conditions, the potential impact of the CEO's strategy, and inherent risks. Keywords to focus on in this section include stock market prediction, financial modeling, and valuation analysis.

-

Current Market Valuation and Influencing Factors: BP's current market valuation is influenced by numerous factors, including prevailing oil prices, geopolitical events (like the war in Ukraine), and overall investor sentiment towards the energy sector. These factors introduce volatility into any prediction.

-

Impact on Future Earnings and Cash Flows: The CEO's strategy aims to boost BP's future earnings and cash flows through both operational efficiency gains and the growth of its renewable energy business. Successful execution of these plans would significantly support a higher BP valuation.

-

Valuation Models and Plausibility: Various valuation models, such as discounted cash flow (DCF) analysis, can be employed to assess the plausibility of a doubled valuation. These models require making assumptions about future oil prices, renewable energy market growth, and the overall macroeconomic environment, all of which introduce uncertainty.

-

Potential Risks and Uncertainties: Several risks could hinder the achievement of a doubled valuation. These include unforeseen fluctuations in oil prices, intense competition in the renewable energy sector, and potential regulatory changes impacting the energy industry.

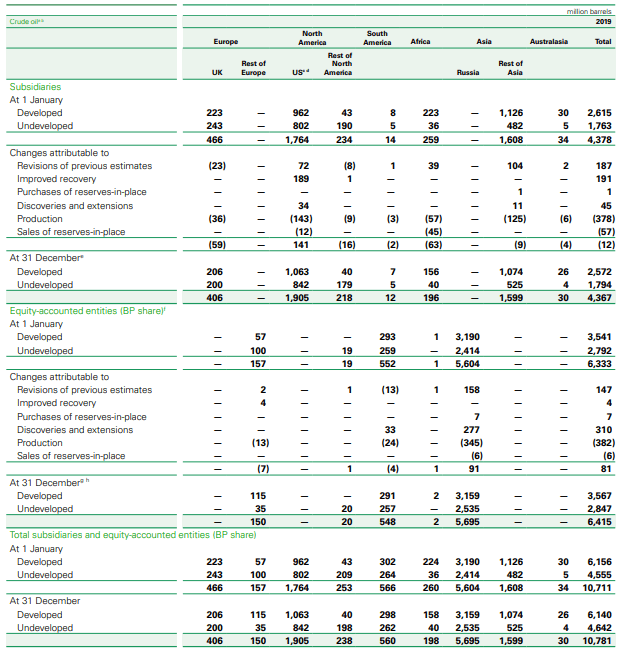

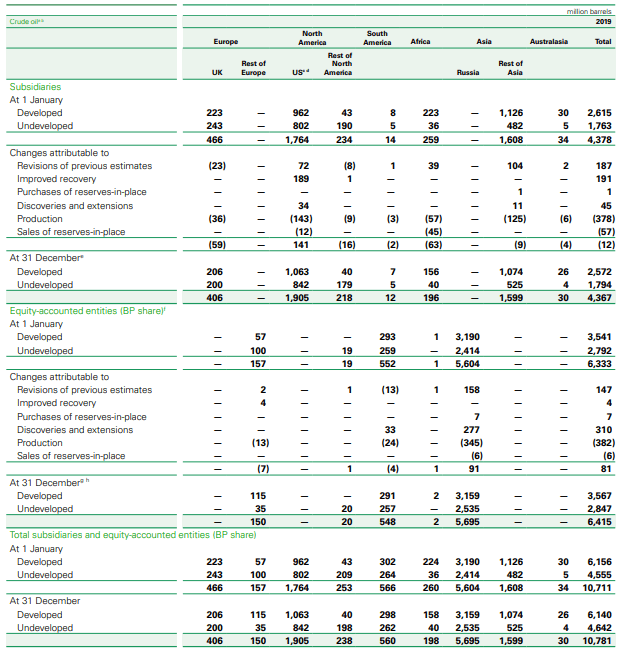

The Role of Oil Prices in BP's Valuation

Oil price volatility remains a significant factor impacting BP's valuation. This section focuses on oil price volatility, crude oil prices, and their impact on BP stock.

-

Sensitivity to Oil Price Fluctuations: BP's earnings are directly influenced by fluctuations in crude oil prices. High oil prices generally benefit the company, while low prices can negatively impact profitability and, consequently, BP valuation.

-

Impact of Different Oil Price Scenarios: Different oil price scenarios must be considered when analyzing the feasibility of a doubled valuation. High oil prices would make the transition to renewable energy easier financially, while low prices could significantly impact the feasibility.

-

Geopolitical Influences: Geopolitical events significantly impact oil prices and, therefore, BP's stock price. Instability in major oil-producing regions can cause price spikes, while diplomatic resolutions can lead to price declines.

Implications for Investors: Opportunities and Risks

For investors, the CEO's announcement presents both opportunities and risks. Key terms here include investment strategy, risk tolerance, and return on investment.

-

Opportunities and Risks Assessment: Investing in BP stock after the CEO's announcement involves a calculated risk. While the long-term vision is promising, the transition to a lower-carbon energy model is fraught with challenges and uncertainties.

-

Alignment with Investor Profiles: The CEO’s strategy might appeal more to investors with a longer-term horizon and a moderate-to-high risk tolerance, while more risk-averse investors might prefer a more cautious approach.

-

Potential Investment Strategies: Investors can consider various strategies, including direct stock purchase, using options to manage risk, or investing in diversified energy sector funds.

Conclusion

This analysis has explored the CEO's ambitious plans for BP and examined the feasibility of the company's valuation doubling. While significant challenges remain, the strategic shift towards renewable energy and operational efficiency could pave the way for substantial growth. However, the success of this strategy hinges on several factors, including oil price stability and successful execution of the company’s plans.

Call to Action: Stay informed about BP's progress and the evolving dynamics of the energy sector to make informed decisions about investing in BP. Further research into BP valuation and the energy transition is essential for understanding the long-term prospects of this energy giant. Keep an eye on future developments concerning BP valuation and its impact on the stock market. Understanding BP's strategic shift is crucial for assessing the potential for a doubled BP valuation in the coming years.

Featured Posts

-

Stephane De La Scene Suisse Aux Lumieres Parisiennes

May 21, 2025

Stephane De La Scene Suisse Aux Lumieres Parisiennes

May 21, 2025 -

Get Ready For Spring Streaming Jellystone And Pinata Smashling On Teletoon

May 21, 2025

Get Ready For Spring Streaming Jellystone And Pinata Smashling On Teletoon

May 21, 2025 -

Love Monster Exploring The Different Interpretations

May 21, 2025

Love Monster Exploring The Different Interpretations

May 21, 2025 -

Activite Des Cordistes A Nantes Impact De La Construction De Tours

May 21, 2025

Activite Des Cordistes A Nantes Impact De La Construction De Tours

May 21, 2025 -

Dokhodi Vid Finansovikh Poslug V Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus U To Pi

May 21, 2025

Dokhodi Vid Finansovikh Poslug V Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus U To Pi

May 21, 2025

Latest Posts

-

Abn Amro Voorspelt Stijgende Huizenprijzen Ondanks Renteverhogingen

May 21, 2025

Abn Amro Voorspelt Stijgende Huizenprijzen Ondanks Renteverhogingen

May 21, 2025 -

Reactie Abn Amro Op Geen Stijl Zijn Huizen In Nederland Echt Betaalbaar

May 21, 2025

Reactie Abn Amro Op Geen Stijl Zijn Huizen In Nederland Echt Betaalbaar

May 21, 2025 -

Abn Amro Rapport De Kwetsbaarheid Van De Voedingssector Door Arbeidsmigratie

May 21, 2025

Abn Amro Rapport De Kwetsbaarheid Van De Voedingssector Door Arbeidsmigratie

May 21, 2025 -

Geen Stijl En Abn Amro Debat Over Betaalbaarheid Woningen In Nederland

May 21, 2025

Geen Stijl En Abn Amro Debat Over Betaalbaarheid Woningen In Nederland

May 21, 2025 -

Risicos Voor Voedingsbedrijven Abn Amro Over Afhankelijkheid Van Goedkope Arbeidsmigranten

May 21, 2025

Risicos Voor Voedingsbedrijven Abn Amro Over Afhankelijkheid Van Goedkope Arbeidsmigranten

May 21, 2025