Brexit Damage Control: BOE's Bailey Pushes For Enhanced EU Trade

Table of Contents

The Economic Fallout of Brexit

The post-Brexit economic impact has been multifaceted and severe, significantly impacting various sectors. The repercussions are clearly evident in two key areas:

Weakening Pound and Inflation

Brexit has dealt a heavy blow to the UK's currency. The pound's devaluation against the euro and the US dollar has fueled inflationary pressures, driving up the cost of imported goods and impacting consumer spending.

- Inflation: The Office for National Statistics (ONS) reported inflation reaching [Insert latest ONS inflation data]% in [Insert month and year], significantly impacting household budgets.

- GDP Growth: Post-Brexit, the UK's GDP growth has lagged behind pre-Brexit projections. [Cite specific data from the ONS or Bank of England].

- Currency Fluctuations: The pound has experienced considerable volatility since the Brexit referendum, further adding uncertainty to the economic outlook. [Cite specific data on currency fluctuations].

These factors contribute to the overall post-Brexit economic impact, creating a challenging environment for businesses and consumers alike. The currency devaluation and inflationary pressures are key aspects of the Brexit damage control challenge.

Disrupted Supply Chains

Brexit has introduced significant friction into UK supply chains, particularly for businesses reliant on EU trade. New customs checks, increased paperwork, and logistical bottlenecks have led to increased costs and delays.

- Food Industry: The food sector, heavily reliant on EU imports, has been particularly affected by supply chain disruptions and increased costs.

- Automotive Sector: The automotive industry has also faced challenges due to trade barriers and disruptions in the supply of parts from the EU.

- Trade Barriers: New customs duties and non-tariff barriers have added considerable complexity and expense to cross-border trade.

These supply chain disruptions represent a critical aspect of the broader Brexit damage control strategy. Addressing these issues is vital for economic recovery.

Andrew Bailey's Initiatives for Enhanced EU Trade

Andrew Bailey and the BOE have taken a proactive role in addressing the negative economic consequences of Brexit. Their strategies are focused on fostering closer trade ties and collaborative efforts with EU institutions.

Advocacy for Closer Trade Ties

Bailey has consistently advocated for closer UK-EU trade ties, emphasizing the mutual benefits of reducing trade friction. His public statements and policy recommendations highlight the importance of streamlined customs procedures and regulatory alignment.

- Speeches and Interviews: Bailey has repeatedly emphasized the need for improved UK-EU trade relations in numerous speeches and interviews. [Cite specific examples and links to speeches/interviews].

- Policy Recommendations: The BOE has issued policy recommendations aimed at mitigating the negative economic consequences of Brexit through enhanced trade cooperation. [Cite specific BOE publications].

- BOE's Brexit Strategy: The BOE's overall Brexit strategy includes elements focusing on supporting the UK economy and minimizing the disruptions stemming from Brexit.

Bailey's advocacy underlines the urgent need for improved UK-EU trade relations as a central element of Brexit damage control.

Collaboration with EU Institutions

The BOE has actively sought collaboration with EU central banks and regulatory bodies to address the shared challenges posed by Brexit's economic fallout. This cooperation aims to minimize disruptions in the financial sector and maintain stability.

- EU-UK Financial Cooperation: The BOE has engaged in discussions with its EU counterparts to ensure smooth cross-border financial flows. [Cite specific examples of collaborative initiatives].

- Cross-Border Regulatory Alignment: Efforts are underway to achieve greater regulatory alignment between the UK and the EU to facilitate trade. [Cite specific examples and potential agreements].

- Mitigating Brexit's Financial Impact: Collaborative efforts are crucial to minimize the systemic risks and negative financial consequences of Brexit.

Potential Solutions and Challenges

While enhancing EU trade is key to Brexit damage control, realizing this requires addressing several complex issues.

Negotiating New Trade Agreements

The UK and EU could negotiate new, more comprehensive trade agreements to reduce trade barriers and facilitate smoother cross-border commerce. However, achieving this requires compromise on both sides.

- Areas for Compromise: Potential areas for compromise include customs procedures, sanitary and phytosanitary regulations, and regulatory alignment.

- Obstacles to Agreements: Political disagreements and differing priorities pose significant obstacles to reaching mutually beneficial agreements.

Addressing Regulatory Divergence

Significant regulatory divergence between the UK and the EU creates barriers to trade. Finding solutions requires addressing these differences.

- Regulatory Differences and Impact: The differences in regulations impact various sectors and can lead to increased costs and compliance burdens. [Cite examples of specific regulatory differences and their impact].

- Mutual Recognition Agreements: Mutual recognition agreements could offer a path towards greater regulatory alignment and reduced trade friction.

Conclusion

The economic fallout from Brexit presents significant challenges for the UK. Andrew Bailey's push for enhanced EU trade is a critical component of Brexit damage control, aiming to mitigate the negative impacts of weakened currency, inflation, and disrupted supply chains. While negotiating new trade agreements and addressing regulatory divergence are crucial for long-term success, the BOE's initiatives, along with collaborative efforts with EU institutions, offer a path towards minimizing Brexit's negative economic consequences. To stay abreast of the latest developments in this dynamic situation, follow the latest updates on Brexit damage control, learn more about the BOE's initiatives for enhanced EU trade, and stay informed about Andrew Bailey's efforts to improve UK-EU trade relations.

Featured Posts

-

Building A Good Life Practical Tips For Everyday Wellbeing

May 31, 2025

Building A Good Life Practical Tips For Everyday Wellbeing

May 31, 2025 -

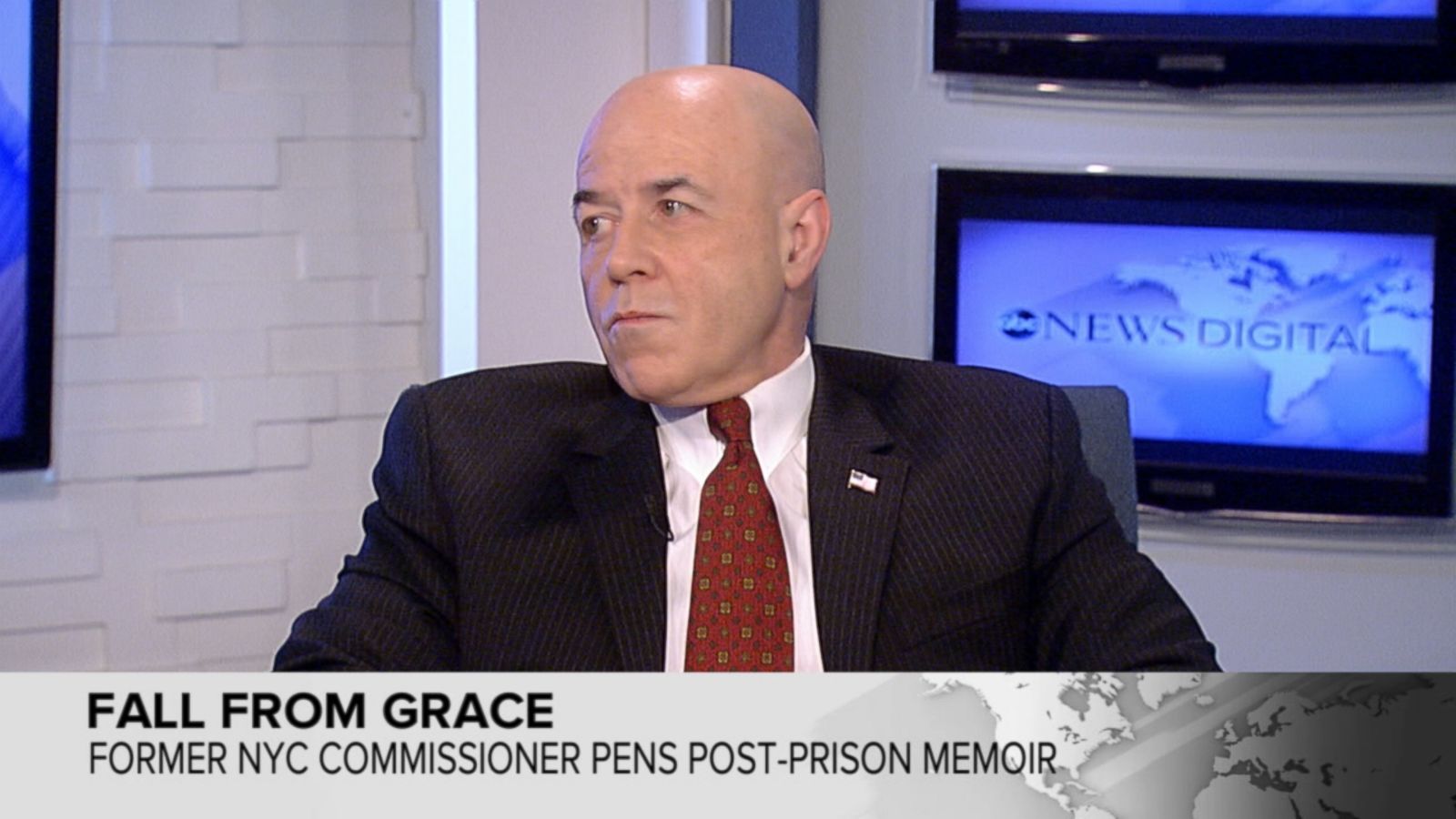

Assessing Bernard Keriks Leadership During The 9 11 Crisis And Aftermath

May 31, 2025

Assessing Bernard Keriks Leadership During The 9 11 Crisis And Aftermath

May 31, 2025 -

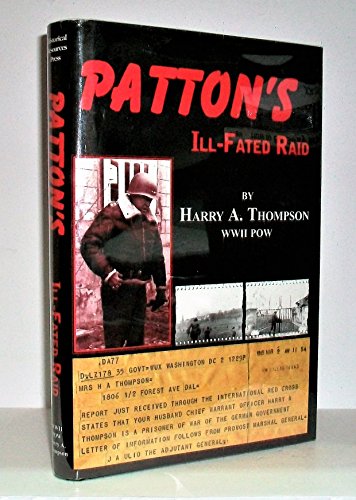

Monte Carlo Thompsons Ill Fated Race

May 31, 2025

Monte Carlo Thompsons Ill Fated Race

May 31, 2025 -

The Evolving Good Life Adapting To Change And Finding Happiness

May 31, 2025

The Evolving Good Life Adapting To Change And Finding Happiness

May 31, 2025 -

Czy Flowers Miley Cyrus Zapowiada Rewolucje W Jej Muzyce

May 31, 2025

Czy Flowers Miley Cyrus Zapowiada Rewolucje W Jej Muzyce

May 31, 2025