Brexit's Economic Fallout: A Case Study Of UK Luxury Exports To The EU

Table of Contents

We define "luxury exports" as high-value goods characterized by superior quality, craftsmanship, and exclusivity. These include, but are not limited to: designer clothing and accessories, handcrafted jewelry, premium wines and spirits, luxury vehicles, bespoke furniture, and high-end cosmetics. This case study will analyze how Brexit has disrupted the flow of these goods across the English Channel.

Increased Trade Barriers and Bureaucracy

Brexit introduced significant trade barriers and increased bureaucratic hurdles for UK luxury goods entering the EU. These challenges directly impacted profitability and competitiveness within the EU market.

New Tariffs and Duties

New tariffs and duties imposed on UK luxury goods entering the EU significantly increased the cost of these products.

- Example: A 10% tariff on a £10,000 luxury watch adds £1,000 to its price, making it less competitive against EU-produced alternatives.

- Calculation: Increased costs often cannot be fully absorbed by businesses, leading to reduced profit margins or higher prices for consumers, impacting demand.

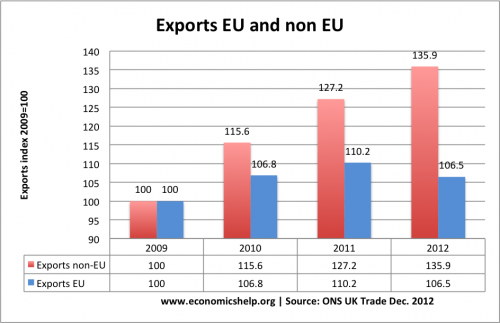

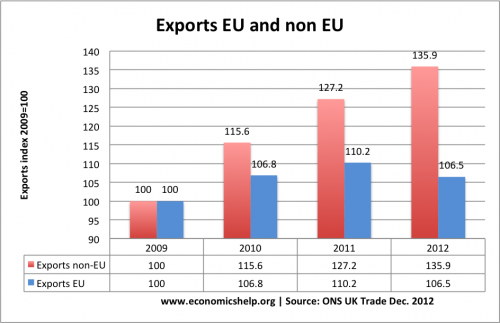

- Impact: This loss of price competitiveness directly impacts market share and revenue for UK luxury exporters. Data from the Office for National Statistics (ONS) shows a clear correlation between tariff increases and export decline.

Complex Customs Procedures

Post-Brexit, customs procedures became far more complex, adding substantial administrative burdens and logistical challenges.

- Increased Paperwork: Businesses now face extensive documentation requirements, including certificates of origin, customs declarations, and sanitary and phytosanitary (SPS) certificates.

- Logistical Challenges: Delays at border crossings due to increased checks and inspections have disrupted just-in-time inventory management, leading to stock shortages and lost sales.

- Disproportionate Impact on SMEs: Smaller businesses often lack the resources to navigate these complex procedures efficiently, leading to a disproportionately negative impact compared to larger corporations. Many SMEs have reported significant difficulties in adapting to the new regulatory environment.

Non-Tariff Barriers

Beyond tariffs, non-tariff barriers such as SPS regulations significantly impacted luxury food and drink exports.

- Specific Regulations: Stricter labelling requirements and differing food safety standards create additional compliance costs and delays.

- Certification Processes: Obtaining necessary certifications can be lengthy and expensive, further increasing the cost of exporting and potentially leading to delays in getting products to market.

- Added Costs: Compliance with these regulations often requires specialized expertise and additional investment in infrastructure, impacting profitability.

Changes in Consumer Demand and Market Access

Brexit has also impacted consumer demand and market access for UK luxury exports to the EU.

Reduced Consumer Confidence

Brexit-related uncertainty and economic instability in the UK and EU have affected consumer confidence, leading to reduced demand for luxury goods.

- Uncertainty: The uncertainty surrounding future trade relations between the UK and EU created hesitation among consumers.

- Exchange Rate Fluctuations: Fluctuations in the pound sterling against the euro have affected the price competitiveness of UK luxury goods.

- Supply Chain Disruptions: Concerns about potential supply chain disruptions due to Brexit have also influenced consumer behaviour. Market research from companies like Kantar show decreased consumer spending in the luxury sector post-Brexit.

Shifting Consumer Preferences

Some EU consumers have shifted their preferences towards competing brands from other EU countries or regions.

- Market Share Shifts: While precise data is difficult to obtain, anecdotal evidence suggests some European brands have gained market share, capitalizing on reduced UK competition.

- Market Analysis: Further research is required to quantify these shifts, but the impact is evident in decreased sales figures for several UK luxury brands in the EU market.

Impact on Tourism and Luxury Retail

Reduced tourism due to travel restrictions and Brexit-related uncertainty has negatively affected the sales of luxury goods to EU tourists.

- Tourism-Retail Connection: Luxury retail in the UK, especially in major cities, heavily relies on tourism.

- Decline in Tourism: Post-Brexit, tourism from the EU has declined, directly impacting sales of luxury goods.

- Knock-on Effect: This decline has a knock-on effect on luxury exports, as a significant portion of sales previously came from EU tourists purchasing goods during their visits.

Responses from UK Luxury Businesses

UK luxury businesses have employed various strategies to mitigate the negative consequences of Brexit.

Adaptation Strategies

Many UK luxury businesses have adapted by restructuring their supply chains, investing in new technologies, and exploring new markets.

- Restructuring Supply Chains: Some businesses have established warehousing facilities within the EU to reduce customs delays and streamline logistics.

- Technological Investments: Others have invested in technology to automate customs processes and improve supply chain visibility.

- New Market Focus: Many companies have prioritized expansion into non-EU markets to reduce dependence on the EU.

Government Support and Initiatives

While the UK government has introduced some initiatives to support businesses affected by Brexit, more targeted support for the luxury sector is still needed.

- Limited Specific Support: While general trade support schemes exist, specific programs tailored to the luxury sector's unique needs have been lacking.

- Need for Targeted Initiatives: The government should consider specific funding and assistance for navigating new trade regulations, improving logistics, and boosting marketing efforts in new markets.

Long-Term Sustainability

The long-term sustainability of the UK luxury sector depends on its ability to adapt to the new realities of post-Brexit trade.

- Future Growth: Successful adaptation strategies are key to ensuring future growth and competitiveness. This requires investment in innovation, technology, and skilled labor.

- Global Competitiveness: Maintaining global competitiveness necessitates proactive measures to overcome trade barriers and adapt to changing consumer preferences.

Conclusion: Brexit's Lasting Impact on UK Luxury Exports to the EU

This case study has highlighted the significant negative impact of Brexit on UK luxury exports to the EU. Increased trade barriers, complex customs procedures, and shifting consumer demand have presented formidable challenges for the sector. While UK luxury businesses have shown resilience in adapting to these changes, the long-term consequences remain uncertain. Understanding Brexit's continued impact on UK luxury exports to the EU requires ongoing monitoring and informed policy decisions. Further research and analysis are crucial to developing effective strategies for supporting the sector's recovery and ensuring its long-term competitiveness within the global luxury market. The need for tailored government support and proactive business adaptation is clear to maintain the UK's position as a leading player in the global luxury goods market.

Featured Posts

-

Beklenen An Juergen Klopp Tekrar Sahada

May 21, 2025

Beklenen An Juergen Klopp Tekrar Sahada

May 21, 2025 -

Where To Watch The Goldbergs Streaming Options And More

May 21, 2025

Where To Watch The Goldbergs Streaming Options And More

May 21, 2025 -

Snehit Suravajjula Upsets Sharath Kamal In Wtt Contender Chennai 2025

May 21, 2025

Snehit Suravajjula Upsets Sharath Kamal In Wtt Contender Chennai 2025

May 21, 2025 -

Chinas Space Based Supercomputer A New Era Of Computation

May 21, 2025

Chinas Space Based Supercomputer A New Era Of Computation

May 21, 2025 -

Klopp To Real Madrid Agent Comments On Ancelotti Replacement

May 21, 2025

Klopp To Real Madrid Agent Comments On Ancelotti Replacement

May 21, 2025

Latest Posts

-

Uefa Nations League Germany Advances Past Italy With 5 4 Aggregate Win

May 21, 2025

Uefa Nations League Germany Advances Past Italy With 5 4 Aggregate Win

May 21, 2025 -

Beiers Two Goals Secure Borussia Dortmund Win Over Mainz

May 21, 2025

Beiers Two Goals Secure Borussia Dortmund Win Over Mainz

May 21, 2025 -

Germanys 5 4 Aggregate Victory Sends Them To Uefa Nations League Final Four

May 21, 2025

Germanys 5 4 Aggregate Victory Sends Them To Uefa Nations League Final Four

May 21, 2025 -

Borussia Dortmunds Victory Fueled By Beiers Double Against Mainz

May 21, 2025

Borussia Dortmunds Victory Fueled By Beiers Double Against Mainz

May 21, 2025 -

Schock Fuer Leipzig Kein Champions League Bochum Und Kiel Abgestiegen

May 21, 2025

Schock Fuer Leipzig Kein Champions League Bochum Und Kiel Abgestiegen

May 21, 2025