Brexit's Grip: How It Slows UK Luxury Exports To The EU

Table of Contents

Increased Bureaucracy and Customs Delays

Brexit has introduced significant administrative hurdles for UK businesses exporting luxury goods to the EU. The increased bureaucracy and customs delays are major contributing factors to the decline in exports.

New Customs Procedures

Navigating the new customs procedures has become a significant challenge. Exporters now face a complex web of paperwork and declarations, increasing the administrative burden and the potential for costly errors.

- Increased paperwork: Companies must complete numerous customs declarations, including the new Entry Summary Declaration (ENS) and various export declarations, significantly increasing processing time.

- Longer processing times: Customs authorities in both the UK and the EU are experiencing backlogs, leading to significant delays in the clearance of goods. This can range from days to weeks, delaying delivery and impacting customer satisfaction.

- Higher error rate: The complexity of the new procedures has resulted in a higher error rate in documentation, leading to further delays and potential penalties.

Increased Transportation Costs

The added complexity translates into substantial increases in transportation and logistics costs. Longer border crossing times and increased inspections contribute to higher expenses for UK exporters.

- Increased fuel costs: Longer wait times at borders translate to higher fuel consumption for hauliers.

- Driver wait times: Drivers often spend hours waiting for customs checks, leading to increased labor costs and reduced efficiency.

- Storage fees: Delays in customs clearance often necessitate the use of expensive storage facilities, adding further costs to the supply chain. This directly impacts the profitability of exporting luxury goods.

Tariff and Non-Tariff Barriers

Beyond the increased bureaucracy, Brexit has introduced both tariff and non-tariff barriers, impacting the competitiveness and profitability of UK luxury exports to the EU.

Tariff Implications

New tariffs on specific luxury goods have increased prices for consumers in the EU, reducing demand for UK products and impacting the competitiveness of UK luxury brands.

- Higher import duties: Products like high-end clothing, Scotch whisky, and luxury jewelry now face higher import duties when entering the EU market.

- Price increases: These tariffs are often passed onto consumers, making UK luxury goods less price-competitive compared to those originating within the EU.

- Reduced consumer demand: The increased prices have undeniably impacted consumer demand for UK luxury goods within the EU market.

Non-Tariff Barriers

Beyond tariffs, a range of non-tariff barriers hinder UK luxury exports. These regulatory differences create additional complexities and costs for businesses.

- Regulatory hurdles: Discrepancies in product labeling, certification requirements, and other regulations add to the complexity and cost of exporting.

- Sanitary and Phytosanitary (SPS) measures: These measures, designed to protect human, animal, and plant health, can be particularly challenging for luxury food and beverage exports.

- Conformity assessment: Ensuring products meet EU standards and obtaining necessary certifications adds time and cost to the export process.

Impact on UK Luxury Brands and Businesses

The combined effect of increased bureaucracy, tariffs, and non-tariff barriers has significantly impacted UK luxury brands and the wider economy.

Reduced Market Access

Brexit has severely limited market access for UK luxury brands in the EU, directly affecting their sales and profitability.

- Loss of market share: UK luxury brands have lost market share to competitors within the EU who no longer face the same export barriers.

- Reduced consumer demand: The combination of higher prices and reduced availability has led to a decline in consumer demand for UK luxury products.

- Damage to brand reputation: Delays and disruptions to the supply chain can also damage brand reputation and customer loyalty.

Job Losses and Economic Consequences

The decline in luxury exports has had broader economic consequences, with potential job losses across various sectors.

- Job losses in manufacturing, retail, and logistics: The reduced demand for UK luxury goods has led to job losses across the entire supply chain.

- Economic output decline: The decline in exports contributes to a decrease in overall economic output and investment in the UK.

- Business uncertainty: The ongoing uncertainty surrounding trade relations with the EU continues to negatively impact business investment and decision-making.

Conclusion

Brexit's impact on UK luxury exports to the EU is multifaceted and significant. Increased bureaucracy, tariffs, and non-tariff barriers have created substantial challenges for UK businesses, leading to reduced market access, job losses, and a decline in economic output. Understanding Brexit's impact on UK luxury exports to the EU is crucial for the future of this vital sector. Explore further resources to understand the full implications and advocate for solutions that will revitalize this important market and strengthen the UK's position in the global luxury goods market.

Featured Posts

-

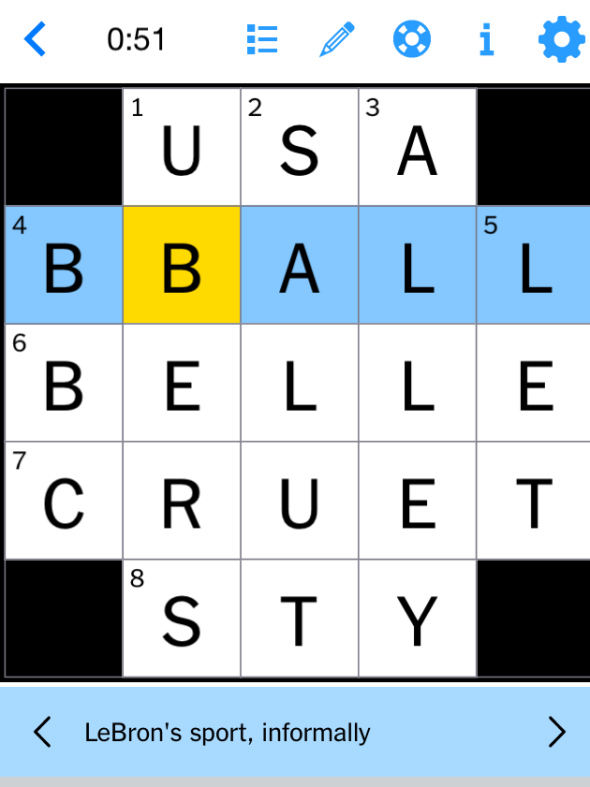

Complete Solutions Nyt Mini Crossword March 27 2024

May 20, 2025

Complete Solutions Nyt Mini Crossword March 27 2024

May 20, 2025 -

Impact Of Abc News Layoffs On Programming

May 20, 2025

Impact Of Abc News Layoffs On Programming

May 20, 2025 -

Chinas Demand Philippines Withdraw Typhon Missiles To Maintain Peace

May 20, 2025

Chinas Demand Philippines Withdraw Typhon Missiles To Maintain Peace

May 20, 2025 -

Avoid Scams How To Identify Genuine Hmrc Child Benefit Messages

May 20, 2025

Avoid Scams How To Identify Genuine Hmrc Child Benefit Messages

May 20, 2025 -

Los Angeles Wildfires A Societal Reflection In The Context Of Disaster Gambling

May 20, 2025

Los Angeles Wildfires A Societal Reflection In The Context Of Disaster Gambling

May 20, 2025

Latest Posts

-

Four Star Admirals Corruption Conviction A Deep Dive

May 20, 2025

Four Star Admirals Corruption Conviction A Deep Dive

May 20, 2025 -

Retired Four Star Admiral Convicted Corruption Scandal Details

May 20, 2025

Retired Four Star Admiral Convicted Corruption Scandal Details

May 20, 2025 -

Retired Admirals Bribery Conviction Details Of The Four Charges

May 20, 2025

Retired Admirals Bribery Conviction Details Of The Four Charges

May 20, 2025 -

Four Star Admirals Bribery Case Exposes Systemic Problems Within The Navy

May 20, 2025

Four Star Admirals Bribery Case Exposes Systemic Problems Within The Navy

May 20, 2025 -

High Ranking Admirals Corruption Trial Verdict And Implications

May 20, 2025

High Ranking Admirals Corruption Trial Verdict And Implications

May 20, 2025