Broadcom's VMware Acquisition: AT&T Exposes A Potential 1,050% Cost Increase

Table of Contents

AT&T's Potential 1,050% Cost Increase: A Deep Dive

Reports suggest AT&T could face a dramatic 1,050% surge in VMware licensing costs after Broadcom's takeover. While the exact figures remain subject to negotiation and haven't been officially confirmed by AT&T, the sheer magnitude of the potential increase underscores the significant power shift in the virtualization market. This isn't simply a matter of inflation; it represents a fundamental change in the cost structure of a crucial technology for many businesses.

Several factors contribute to this alarming potential price hike:

- Increased VMware licensing costs post-acquisition: Broadcom, known for its aggressive pricing strategies, is expected to significantly raise VMware's licensing fees. This directly translates into higher costs for existing customers like AT&T.

- Potential for reduced competition and less negotiation power: With Broadcom controlling a significant market share in networking and software infrastructure, the potential for robust competition and negotiation leverage diminishes for large enterprises.

- Impact of Broadcom's strategies on pricing and licensing: Broadcom’s historical track record indicates a preference for higher margins, suggesting that VMware's pricing model may undergo a substantial transformation, impacting clients globally.

This potential cost increase has major implications for AT&T's operational costs and profitability, potentially impacting its bottom line and strategic investments. The company may need to absorb these costs, raise prices for its services, or explore alternative technologies to offset the burden.

Broadcom's VMware Acquisition: Market Dominance and Anti-Competitive Concerns

Broadcom's acquisition of VMware raises serious concerns regarding market dominance and anti-competitive practices. The merger combines two industry giants, creating a behemoth with significant influence over the virtualization market. This consolidated power could stifle innovation and lead to a range of negative consequences.

- Increased prices for VMware products and services: As seen with the potential AT&T case, this acquisition paves the way for higher prices across the board.

- Reduced innovation due to less competition: Reduced competition could lead to slower innovation and fewer choices for businesses.

- Potential impact on smaller businesses reliant on VMware: Smaller businesses may find themselves facing disproportionately high price increases, potentially impacting their competitiveness.

Regulatory bodies are scrutinizing the deal, investigating potential antitrust concerns and the implications for fair market competition. The outcome of these investigations could significantly impact the future direction of the virtualization market and the pricing power of Broadcom.

The Ripple Effect: How Broadcom's Acquisition Impacts Other Businesses

The impact of Broadcom's VMware acquisition isn't limited to AT&T. Businesses of all sizes, across various industries, rely on VMware technologies for their critical infrastructure. The potential for similar price increases is real and widespread. The ripple effect could be substantial:

- Increased IT costs across various sectors: From finance and healthcare to education and government, businesses will likely face increased IT costs.

- Need for businesses to explore alternative virtualization solutions: Many businesses will need to actively search for alternatives to avoid excessively high VMware licensing fees.

- Potential for increased cloud computing adoption: The increase in VMware costs could accelerate the migration towards cloud-based virtualization solutions.

Strategies for Mitigating the Impact of Broadcom's VMware Acquisition

Facing the potential for substantially higher VMware costs, businesses must proactively implement strategies to mitigate the impact:

- Negotiating volume discounts and long-term contracts: Leveraging purchasing power and negotiating favorable long-term agreements can help offset some cost increases.

- Exploring open-source virtualization alternatives: Open-source solutions like Proxmox VE and oVirt offer viable alternatives to VMware, although they might require a transition period and additional expertise.

- Transitioning to cloud-based solutions: Cloud providers offer virtualization services that could be a cost-effective alternative, depending on specific business needs and existing infrastructure.

Broadcom's VMware Acquisition: Preparing for the Future

Broadcom's VMware acquisition has far-reaching consequences, potentially leading to significant cost increases for businesses reliant on VMware technologies. AT&T's potential 1,050% cost hike serves as a stark warning of what lies ahead. The acquisition raises concerns about market dominance, competition, and the long-term health of the virtualization market. To mitigate the impact, businesses must proactively evaluate their VMware licensing agreements, explore alternative solutions, and prepare for potential price increases. Don't wait for the impact to hit your bottom line. Start researching the implications of Broadcom's VMware acquisition for your specific business needs today.

Featured Posts

-

West Broad Street Foot Locker Homicide Investigation Following Argument

May 16, 2025

West Broad Street Foot Locker Homicide Investigation Following Argument

May 16, 2025 -

How To Watch The Nhl Playoffs Your Guide To Stanley Cup Glory

May 16, 2025

How To Watch The Nhl Playoffs Your Guide To Stanley Cup Glory

May 16, 2025 -

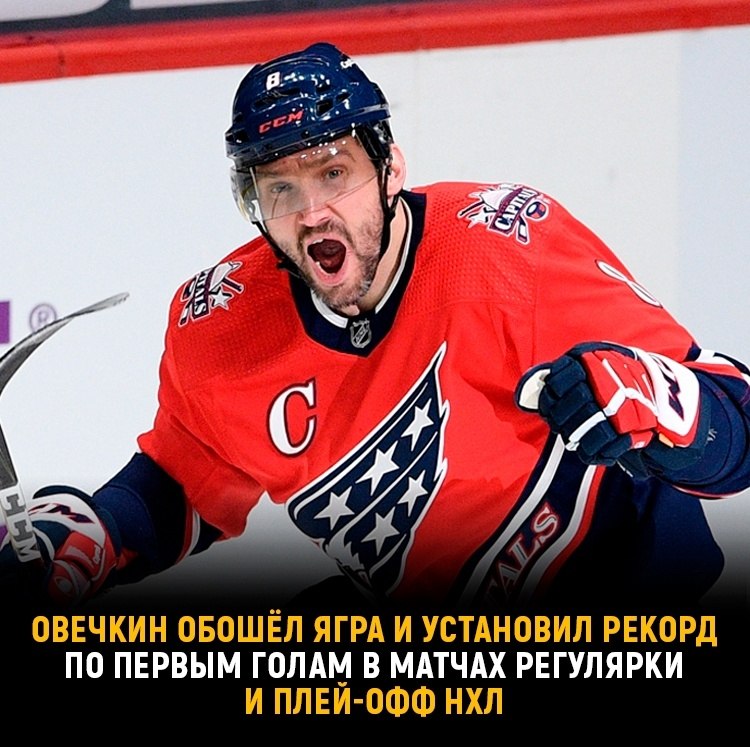

Ovechkin Obnovil Rekord Leme V Pley Off N Kh L

May 16, 2025

Ovechkin Obnovil Rekord Leme V Pley Off N Kh L

May 16, 2025 -

Neal Pionk News Trade Rumors Injury Reports And Game Highlights

May 16, 2025

Neal Pionk News Trade Rumors Injury Reports And Game Highlights

May 16, 2025 -

Finding Stability Microsoft Among Software Stocks In A Turbulent Market

May 16, 2025

Finding Stability Microsoft Among Software Stocks In A Turbulent Market

May 16, 2025