Broadcom's VMware Acquisition: AT&T Reports A Staggering 1,050% Price Increase

Table of Contents

Understanding the Broadcom-VMware Merger and its Implications

The $61 billion acquisition of VMware by Broadcom, finalized in late 2022, represents one of the largest tech mergers in history. Broadcom, a leading provider of semiconductor and infrastructure software solutions, acquired VMware, a dominant player in enterprise virtualization and cloud computing. The strategic rationale behind the merger centers on Broadcom's ambition to expand its software portfolio and create a more comprehensive offering for enterprise customers.

- Broadcom's Business Model: Broadcom operates on a model of acquiring and integrating companies, often leading to significant cost-cutting measures and consolidation. This business model, while effective in generating profits, also raises concerns about potential monopolistic practices and reduced competition.

- Market Consolidation: The merger significantly consolidates the market share in virtualization and networking technologies, potentially limiting choices for businesses and increasing dependence on a single vendor.

- Potential Benefits and Drawbacks: While the merger could lead to some synergies and cost efficiencies for Broadcom, critics express concerns about potential price increases, reduced innovation, and a less competitive market landscape.

AT&T's 1050% Price Increase: A Case Study

AT&T's reported 1,050% increase in VMware licensing costs post-acquisition has sent shockwaves through the industry. While precise figures and official statements remain limited, reports from various news sources (e.g., cite credible news articles here) indicate an unprecedented surge in pricing. This drastic price hike raises serious questions about the post-merger pricing strategies adopted by Broadcom.

- Reasons for the Price Surge: While the exact reasons remain unclear, several contributing factors are possible: the consolidation of market power allowing for increased pricing, Broadcom's cost-cutting measures being passed on to customers, and potentially even contract renegotiations. Further investigation is needed to fully understand the root cause.

- Lack of Transparency: The lack of detailed public explanations from Broadcom regarding these substantial price increases raises concerns about transparency and the potential for unfair business practices.

Impact on Other Businesses and the Broader Tech Industry

AT&T's situation is not an isolated incident. The Broadcom-VMware merger's impact is expected to ripple throughout the tech industry, affecting numerous businesses relying on VMware's products and services.

- Increased Costs for Businesses: Many businesses face the prospect of substantially increased IT budgets due to VMware's post-acquisition price adjustments.

- Reduced Competition: The merger reduces competition, potentially stifling innovation and limiting the choices available to businesses.

- Regulatory Scrutiny: The potential for antitrust concerns and regulatory intervention is high, given the significant market consolidation and the reported price hikes. Antitrust agencies worldwide are likely scrutinizing the impact of this merger.

- A Broader Trend?: This situation raises broader concerns about the potential for post-merger price gouging in other tech acquisitions.

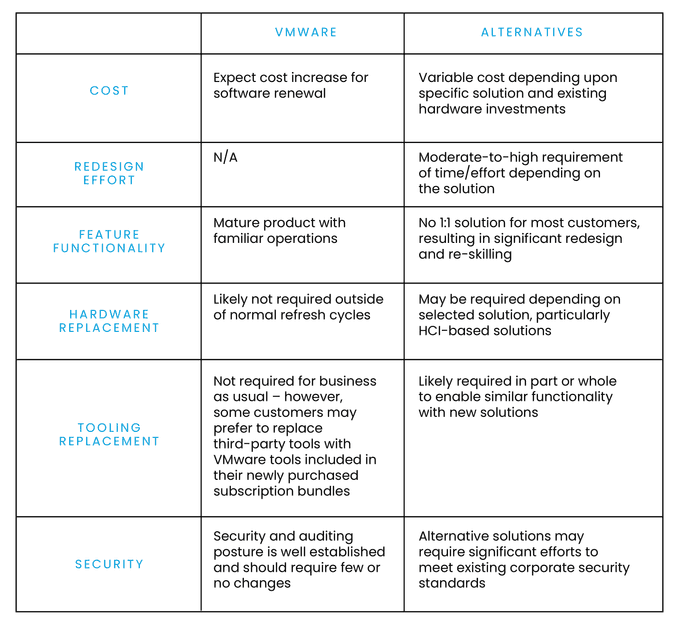

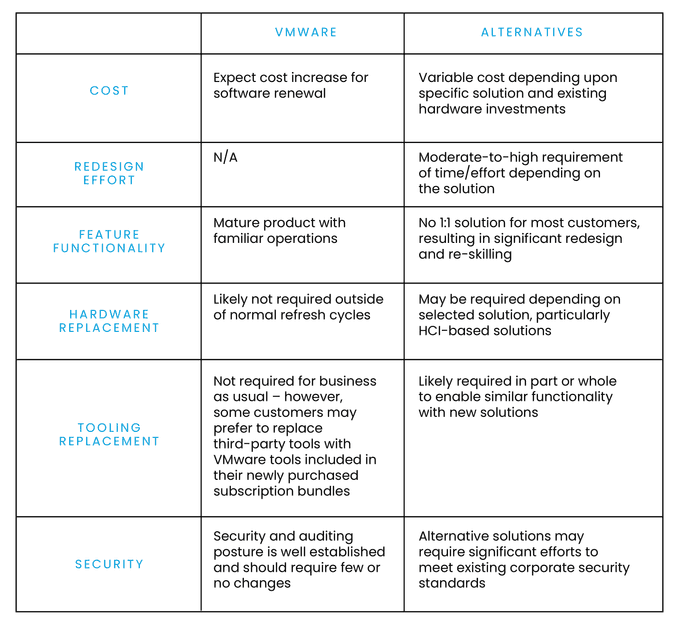

Strategies for Businesses Facing VMware Price Increases

Facing unexpectedly high VMware pricing, businesses need proactive strategies to mitigate the impact.

- Explore Alternative Virtualization Solutions: Consider switching to alternative virtualization platforms, such as open-source solutions like Proxmox VE or open-source cloud solutions like OpenStack.

- Negotiate with VMware: Engage in contract renegotiations with VMware, leveraging market dynamics and the potential for regulatory scrutiny.

- Long-Term Budget Management: Implement robust long-term budget planning to account for unpredictable price fluctuations and potentially high renewal costs.

- Cloud Migration: Consider migrating to alternative cloud providers to reduce reliance on VMware products.

Conclusion: Navigating the Post-Acquisition Landscape of VMware Pricing

The Broadcom-VMware merger's impact on pricing is undeniably significant, as evidenced by AT&T's reported 1,050% price increase. This case study highlights the potential for substantial cost increases across the industry and underscores the need for proactive measures. Businesses must carefully evaluate their VMware contracts, explore alternative solutions, and remain vigilant about industry developments. Monitor VMware pricing post-acquisition, manage your Broadcom-VMware costs effectively, and learn more about the VMware price increase to protect your bottom line. Failing to do so could lead to severely strained IT budgets and operational challenges.

Featured Posts

-

Bailed Teen Rearrested Shop Owners Fatal Stabbing

May 24, 2025

Bailed Teen Rearrested Shop Owners Fatal Stabbing

May 24, 2025 -

Annie Kilner Runs Errands After Kyle Walkers Night Out

May 24, 2025

Annie Kilner Runs Errands After Kyle Walkers Night Out

May 24, 2025 -

Concerns Addressed Today Show Co Hosts Discuss Missing Anchor

May 24, 2025

Concerns Addressed Today Show Co Hosts Discuss Missing Anchor

May 24, 2025 -

The Today Show Dylan Dreyers Unexpected Hosting Challenge

May 24, 2025

The Today Show Dylan Dreyers Unexpected Hosting Challenge

May 24, 2025 -

Philips Concludes Annual General Meeting Results And Outlook

May 24, 2025

Philips Concludes Annual General Meeting Results And Outlook

May 24, 2025

Latest Posts

-

Record Low Gas Prices Possible For Memorial Day Weekend

May 24, 2025

Record Low Gas Prices Possible For Memorial Day Weekend

May 24, 2025 -

Sandy Point Rehoboth Ocean City Beaches Memorial Day 2025 Weather Prediction

May 24, 2025

Sandy Point Rehoboth Ocean City Beaches Memorial Day 2025 Weather Prediction

May 24, 2025 -

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025 -

Ocean City Rehoboth Sandy Point Beach Weather Memorial Day Weekend 2025 Forecast

May 24, 2025

Ocean City Rehoboth Sandy Point Beach Weather Memorial Day Weekend 2025 Forecast

May 24, 2025 -

Memorial Day Weekend 2025 Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025

Memorial Day Weekend 2025 Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025