Brookfield Targets Distressed Assets: An Opportunistic Investment Strategy

Table of Contents

Brookfield's Opportunistic Investment Strategy

Brookfield's success in the distressed asset market stems from a sophisticated, multi-faceted strategy. This strategy encompasses identifying undervalued assets, strategically acquiring them, and implementing effective risk management practices.

Identifying Distressed Assets

Brookfield employs a rigorous due diligence process, leveraging its extensive network and expertise to pinpoint undervalued assets across various sectors. This process involves:

- Utilizing proprietary data and analytics: Brookfield uses advanced data analysis to identify market inefficiencies and undervalued properties that might be overlooked by less sophisticated investors. This includes sophisticated modeling techniques to predict future market trends and asset performance.

- Focusing on sectors experiencing temporary distress: Brookfield differentiates between temporary market downturns and long-term structural problems. They strategically target assets facing short-term challenges with strong long-term potential, avoiding investments in fundamentally flawed assets.

- Leveraging its global reach: Brookfield's extensive international network provides access to a vast range of opportunities across diverse geographical markets, allowing them to diversify their portfolio and capitalize on regional market fluctuations.

Strategic Asset Acquisition

Brookfield's approach goes beyond simply purchasing distressed assets. It involves actively managing and improving them to maximize their value. This includes:

- Employing experienced asset management teams: Brookfield boasts specialized teams with deep sector expertise, ensuring effective management and operational improvements across various asset classes.

- Focusing on operational improvements and cost reductions: They actively seek opportunities for operational efficiencies, cost reductions, and value-add strategies to enhance the profitability of their acquisitions. This might involve renovations, restructuring, or implementing new technologies.

- Negotiating favorable terms: Brookfield’s financial strength and reputation allow them to negotiate advantageous terms with sellers, securing favorable purchase prices and maximizing their potential return on investment.

Risk Management and Due Diligence

Mitigation of risk is a cornerstone of Brookfield's distressed asset investment strategy. They achieve this through:

- Thorough due diligence: Every potential acquisition undergoes comprehensive legal, environmental, and financial reviews to minimize unforeseen risks and liabilities.

- Portfolio diversification: Brookfield diversifies its portfolio across different asset classes (real estate, private equity, infrastructure) and geographic regions to reduce exposure to single-point failures.

- Maintaining strong liquidity: This ensures that they can weather market fluctuations and capitalize on unexpected opportunities that may arise during periods of market instability.

Types of Distressed Assets Targeted by Brookfield

Brookfield’s opportunistic strategy targets a diverse range of distressed assets, primarily focusing on real estate, private equity, and infrastructure.

Real Estate

A significant portion of Brookfield’s portfolio comprises distressed real estate assets. This includes:

- Properties with repositioning or redevelopment potential: Brookfield seeks properties that can be enhanced through renovations, repurposing, or redevelopment to increase their value.

- Portfolios of underperforming assets: They often acquire large portfolios of underperforming assets at a bulk discount, leveraging their expertise to improve the performance of the entire portfolio.

- Urban core properties: Brookfield favors properties in prime urban locations with strong long-term growth potential, even if they are currently underperforming.

Private Equity Investments

Brookfield actively invests in distressed private equity assets, assisting struggling businesses or acquiring stakes in financially troubled companies. This involves:

- Investing in fundamentally sound companies: They seek companies with strong underlying fundamentals that are experiencing temporary liquidity challenges rather than long-term structural issues.

- Providing restructuring expertise and operational support: Brookfield provides the necessary expertise to restructure operations, improve efficiency, and ultimately enhance profitability.

- Acquiring majority or minority stakes: Depending on the specific investment opportunity, Brookfield may acquire either a controlling stake or a minority interest.

Infrastructure

Increasingly, Brookfield focuses on infrastructure assets facing financial difficulties or operational challenges. This includes:

- Underperforming infrastructure projects: They seek projects with strong long-term cash flow potential that are currently underperforming due to operational inefficiencies or financial constraints.

- Projects with long-term cash flow potential: Brookfield focuses on infrastructure projects with stable, predictable cash flows over the long term, even if facing short-term challenges.

- Leveraging infrastructure management expertise: Brookfield utilizes its deep expertise in infrastructure management and operations to improve efficiency, reduce costs, and enhance returns.

The Benefits of Brookfield's Distressed Asset Strategy

Brookfield’s approach to distressed assets offers several key advantages:

High Potential Returns

Acquiring assets at a discount offers the potential for significantly higher returns than investments in traditional markets. This is a core driver of Brookfield’s investment strategy.

Long-Term Value Creation

Brookfield's active management approach focuses on long-term value creation through operational improvements, asset repositioning, and strategic enhancements.

Diversification and Risk Mitigation

Investment in distressed assets, when managed effectively as Brookfield does, can provide portfolio diversification and potentially lower overall risk compared to other asset classes.

Conclusion

Brookfield's success in targeting distressed assets is a testament to their strategic foresight, rigorous due diligence, expert asset management, and profound understanding of market dynamics. Their opportunistic investment strategy, focusing on undervalued assets across diverse sectors like real estate, private equity, and infrastructure, offers the potential for substantial returns. By meticulously identifying and acquiring distressed assets, implementing effective operational strategies, and expertly managing risk, Brookfield consistently demonstrates its mastery in this challenging yet rewarding investment niche. To learn more about the opportunities within distressed asset investing and how to potentially benefit from Brookfield’s strategies, explore our resources on [link to relevant resources]. Consider exploring [link to Brookfield's investor relations page] to learn more about their investment opportunities in distressed assets.

Featured Posts

-

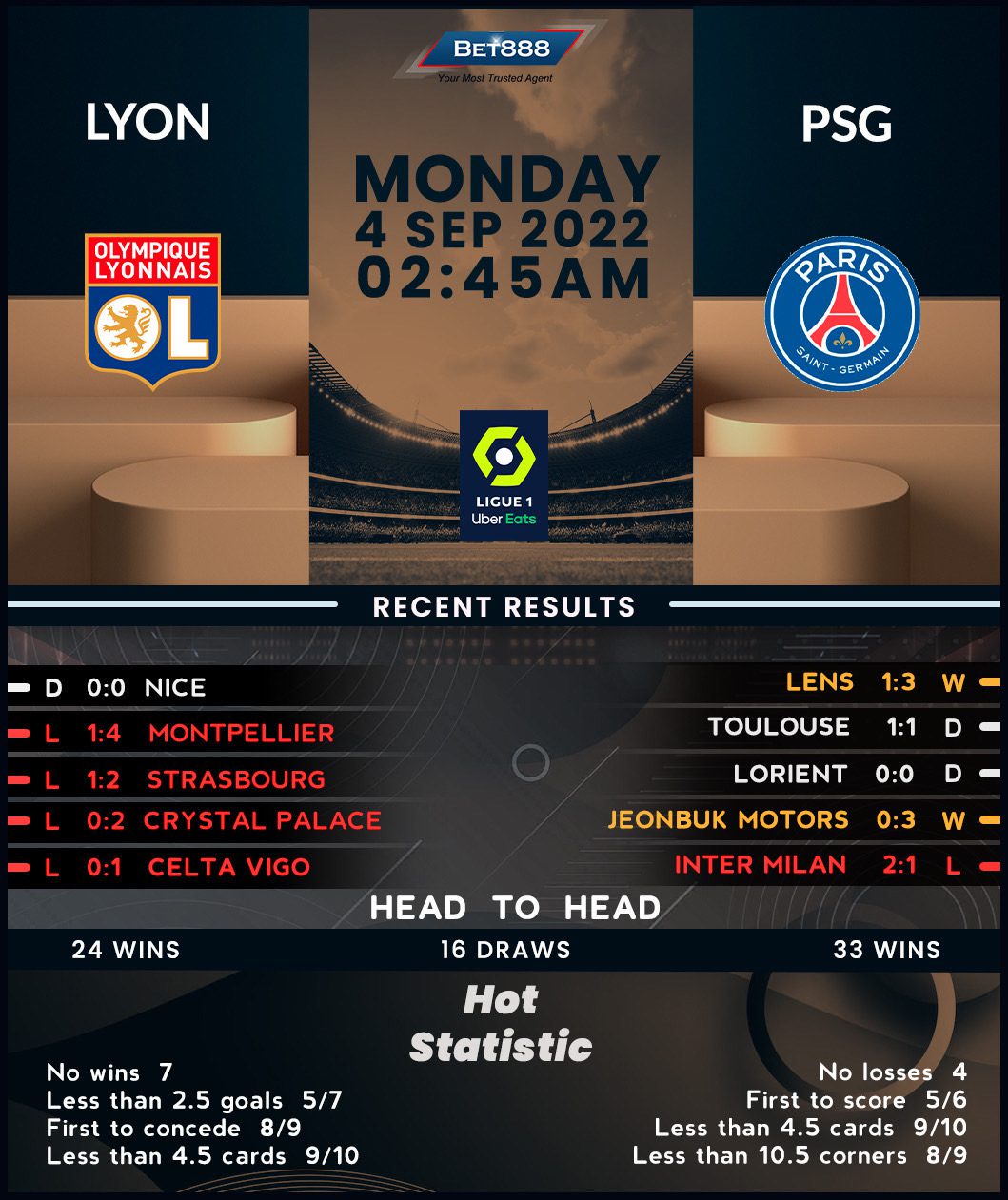

El Psg Vence Al Lyon En Francia

May 08, 2025

El Psg Vence Al Lyon En Francia

May 08, 2025 -

Inter Milan Eliminate Feyenoord Last Eight Awaits

May 08, 2025

Inter Milan Eliminate Feyenoord Last Eight Awaits

May 08, 2025 -

Dojs Proposed Google Changes A Threat To User Trust

May 08, 2025

Dojs Proposed Google Changes A Threat To User Trust

May 08, 2025 -

Leveraging Technology Ahsans Vision For Made In Pakistan On The World Stage

May 08, 2025

Leveraging Technology Ahsans Vision For Made In Pakistan On The World Stage

May 08, 2025 -

Lahwr Ky Ahtsab Edaltyn 5 Ka Khatmh Nzam Ansaf Pr Kya Athr

May 08, 2025

Lahwr Ky Ahtsab Edaltyn 5 Ka Khatmh Nzam Ansaf Pr Kya Athr

May 08, 2025