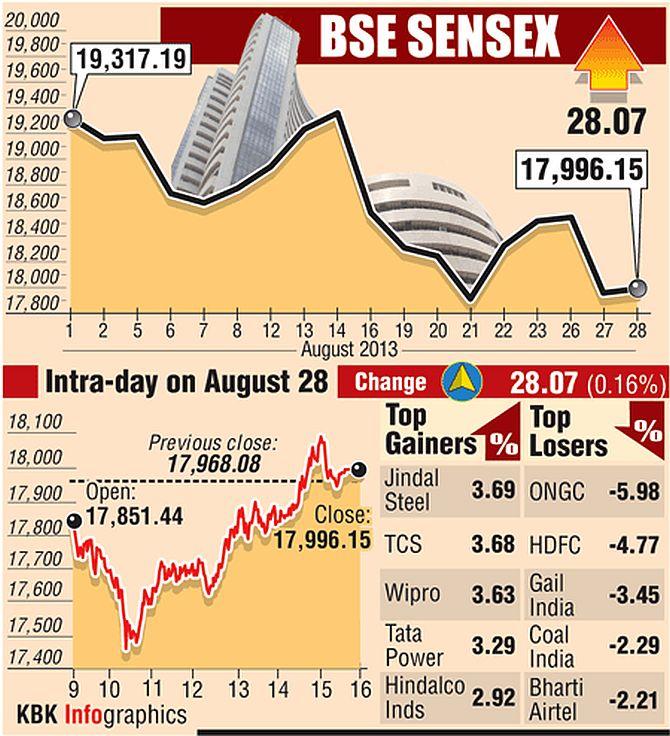

BSE Stocks Surge: Sensex's Rise And Top 10%+ Gainers

Table of Contents

Sensex's Impressive Rise: Factors Contributing to the Surge

The significant increase in the Sensex wasn't a spontaneous event; several interconnected factors contributed to this robust rally in the BSE stock market.

Global Market Influences

The global economic climate significantly impacts the Indian stock market. Positive developments on the international stage often ripple through to the BSE.

- Positive global economic news: Reports of strong economic growth in major economies, such as the US and Europe, can boost investor confidence, leading to increased investment in emerging markets like India.

- Foreign investment inflows: Increased foreign institutional investor (FII) participation often fuels market rallies. Positive global sentiment can attract significant foreign investment into the Indian stock market, driving up the Sensex.

- Performance of global indices: The performance of major global indices, such as the Dow Jones Industrial Average and the Nasdaq Composite, often correlates with the BSE Sensex's movement. Strong performance in these indices typically translates to a positive sentiment in the Indian stock market.

The interconnectedness of global markets means that positive trends abroad often translate into gains for the BSE Sensex and individual BSE stocks.

Domestic Economic Factors

Domestic economic performance and government policies play a crucial role in driving the BSE stock market's direction. Positive domestic indicators contribute significantly to investor sentiment.

- Positive GDP growth: Strong GDP growth figures signal a healthy economy, attracting investors and boosting stock prices. Higher GDP growth often translates into increased corporate profits, benefiting BSE stocks.

- Government initiatives: Favorable government policies, such as tax cuts or infrastructure spending, can inject confidence into the market and stimulate economic activity, leading to a rise in the Sensex.

- Positive industry reports: Positive reports from key sectors, indicating strong performance and future growth prospects, positively influence investor sentiment and contribute to the overall market rally.

Domestic investor sentiment, influenced by these factors, acts as a powerful force shaping the BSE's trajectory.

Sector-Specific Performance

The recent surge wasn't uniform across all sectors. Certain sectors significantly outperformed others, contributing disproportionately to the Sensex's rise.

- Strong performance in IT: The Information Technology sector often shows strong correlation with global market trends. Positive global economic indicators and increased tech spending can boost the performance of IT stocks listed on the BSE.

- Pharmaceutical sector strength: Positive regulatory developments or successful new drug launches in the pharmaceutical sector can trigger significant gains for BSE-listed pharmaceutical companies.

- Other key sectors: Other sectors, such as banking, finance, and consumer goods, might also experience periods of strong performance, depending on various macroeconomic and industry-specific factors.

Analyzing sector-specific performance is crucial to understanding the nuances of the market rally and identifying potentially lucrative investment opportunities.

Top 10%+ Gainers: Analyzing the Leading Stocks

Several BSE stocks significantly outperformed the market today, showcasing exceptional growth. This section highlights some of the top performers. (Note: Specific stock names and percentages would be inserted here based on the day's actual market data. This is a template.)

Individual Stock Performance Analysis

- Company A (Symbol: ABC): +15% gain. (Reason: Strong quarterly earnings report exceeding expectations.)

- Company B (Symbol: XYZ): +12% gain. (Reason: Successful product launch and positive market reception.)

- Company C (Symbol: DEF): +11% gain. (Reason: Acquisition announcement boosting investor confidence.)

(This list would continue with 7 more companies and their respective data.)

Investment Implications

This surge presents both opportunities and risks for investors.

- Opportunities for long-term investment: While short-term gains are exciting, long-term investment strategies remain crucial. The current surge may present opportunities to acquire fundamentally strong stocks at potentially attractive valuations.

- Potential risks: Market volatility remains a significant factor. Chasing high-performing stocks without thorough due diligence can be risky.

- Need for diversified portfolios: Diversification is key to mitigating risk. Investing across various sectors and asset classes can help cushion against market fluctuations.

Caution is advised against solely focusing on short-term gains. Thorough research and a well-diversified portfolio are essential for long-term success.

Understanding Market Volatility and Future Predictions

The stock market is inherently volatile. While today's surge is positive, it's essential to remember the unpredictable nature of market movements.

- Factors influencing market fluctuations: Numerous factors, including global events, domestic policies, and investor sentiment, influence market fluctuations.

- Risk management techniques: Investors should employ risk management strategies, such as stop-loss orders and diversification, to protect their investments.

- Importance of professional advice: Seeking advice from qualified financial advisors is crucial, especially for those new to investing or managing substantial portfolios.

Predicting future market trends with certainty is impossible. While today's surge is positive, investors should maintain a cautious outlook and develop robust long-term investment plans.

Conclusion

The BSE experienced a significant surge today, with the Sensex recording a substantial rally. Several BSE stocks achieved remarkable gains exceeding 10%, driven by a combination of global and domestic factors. Analyzing sector-specific performance and understanding the reasons behind individual stock movements is vital for making informed investment decisions. While this rally is positive, investors should remember the inherent volatility of the stock market and maintain a long-term perspective. Diversification and professional guidance are essential for mitigating risk and achieving long-term investment success.

Call to Action: Stay informed about the latest developments in the BSE stock market. Follow our updates for more insights on BSE stocks and Sensex performance. Understanding the dynamics of BSE stocks is crucial for making informed investment decisions. Continue to monitor market trends and consult with financial advisors for personalized guidance.

Featured Posts

-

Does The Us Really Need Canada Expert Analysis Of Trumps Claims

May 15, 2025

Does The Us Really Need Canada Expert Analysis Of Trumps Claims

May 15, 2025 -

Bruins En De Npo Gesprek Over Leeflang Na Hamer Aangifte

May 15, 2025

Bruins En De Npo Gesprek Over Leeflang Na Hamer Aangifte

May 15, 2025 -

The Carney Cabinet Who Business Leaders Are Watching Closely

May 15, 2025

The Carney Cabinet Who Business Leaders Are Watching Closely

May 15, 2025 -

U S Military Base Hidden Beneath Greenlands Ice Sheet Exploring The Evidence

May 15, 2025

U S Military Base Hidden Beneath Greenlands Ice Sheet Exploring The Evidence

May 15, 2025 -

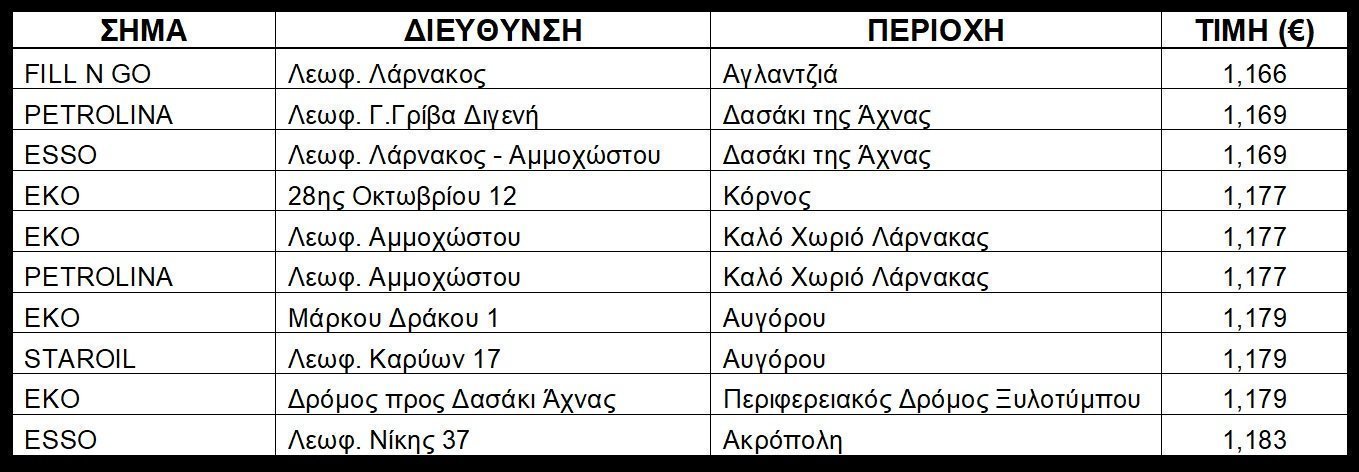

Times Kaysimon Kypros Breite Ta Fthinotera Pratiria

May 15, 2025

Times Kaysimon Kypros Breite Ta Fthinotera Pratiria

May 15, 2025

Latest Posts

-

The Case For Jimmy Butler A Better Fit For The Warriors Than Kevin Durant

May 15, 2025

The Case For Jimmy Butler A Better Fit For The Warriors Than Kevin Durant

May 15, 2025 -

Jimmy Butler Vs Kevin Durant What The Warriors Really Need

May 15, 2025

Jimmy Butler Vs Kevin Durant What The Warriors Really Need

May 15, 2025 -

Jimmy Butler The Missing Piece The Warriors Need Not Kevin Durant

May 15, 2025

Jimmy Butler The Missing Piece The Warriors Need Not Kevin Durant

May 15, 2025 -

The Warriors Need Jimmy Butler Not Kevin Durant A Statistical Analysis

May 15, 2025

The Warriors Need Jimmy Butler Not Kevin Durant A Statistical Analysis

May 15, 2025 -

Jimmy Butler Vs Kevin Durant A Case For Butler Joining The Warriors

May 15, 2025

Jimmy Butler Vs Kevin Durant A Case For Butler Joining The Warriors

May 15, 2025