Buffett's Apple Stake: Impact Of Trump-Era Tariffs

Table of Contents

Apple's Supply Chain and Tariff Vulnerability

Apple's global supply chain, heavily reliant on manufacturing in China, made it particularly vulnerable to the Trump administration's tariffs. The trade war initiated a series of tariffs on various goods, including components and finished products relevant to Apple. This significantly impacted Apple's cost structure and profitability.

- Specific tariffs: Tariffs were levied on various Apple products and components, including iPhones, iPads, and other electronics.

- Increased costs: The tariffs resulted in a percentage increase in the cost of manufacturing and importing these products, impacting Apple's margins. Precise figures vary depending on the specific product and tariff schedule.

- Geographic impact: The tariffs primarily affected manufacturing and assembly in China, creating ripple effects throughout Apple's extensive supply chain.

- Pricing strategy: Apple faced the difficult decision of absorbing these increased costs or passing them on to consumers, potentially affecting sales volumes and market share.

Berkshire Hathaway's Response to Tariff Impacts

Berkshire Hathaway, known for its long-term value investment strategy, maintained its significant holding in Apple stock despite the tariff challenges. While there were no public announcements of significant shifts in their Apple investment strategy in direct response to the tariffs, their actions speak volumes.

- Investment strategy: Berkshire Hathaway's generally conservative approach suggests that while they acknowledged the risks associated with the trade war, they held confidence in Apple's long-term prospects.

- Investment adjustments: While the exact details of any adjustments to their Apple holdings during this period are not publicly available, analysis of Berkshire Hathaway's financial reports shows a continued, strong holding of Apple shares.

- Public statements: Although Warren Buffett didn't make extensive public comments directly addressing the tariffs' impact on Apple, his general views on trade and the resilience of strong companies likely influenced the decision to maintain the investment.

- Financial reports analysis: Detailed examination of Berkshire Hathaway's quarterly and annual reports reveals that while the trade war created uncertainty, Apple remained a core holding, reflecting long-term confidence in the company.

The Wider Economic Impact and its Ripple Effect on Apple and Buffett

The Trump-era tariffs had a far-reaching impact on the global economy, extending beyond Apple and influencing consumer spending and global trade dynamics. This broader economic environment directly affected Apple's performance and, consequently, Berkshire Hathaway's investment.

- Consumer spending: Tariffs contributed to increased prices for various goods, impacting consumer confidence and potentially reducing discretionary spending on electronics like Apple products.

- Global supply chains: The trade war disrupted global supply chains, creating delays and uncertainties for many companies beyond Apple. This increased complexity added costs and risks.

- Alternative sourcing: Apple, along with many other companies, started exploring alternative manufacturing locations to reduce their dependence on China. This process takes time and resources.

- Long-term effects: The long-term impact of the tariffs on Apple's growth is still being assessed, though the company adapted successfully and continues to be a market leader.

Assessing the Long-Term Effects on Buffett's Apple Investment

Despite the trade war's challenges, Berkshire Hathaway's Apple investment ultimately performed well. Analyzing the long-term performance reveals the resilience of Apple and the effectiveness of Berkshire's long-term investment strategy.

- Apple stock performance: Apple's stock price experienced fluctuations during the tariff period, but it ultimately showed strong growth over the long term, benefiting Berkshire's significant investment.

- Berkshire Hathaway's return: The overall return on Berkshire Hathaway's Apple investment during and after the tariff period remains extremely profitable, proving the soundness of their investment thesis.

- Comparison to other tech companies: A comparative analysis of Apple's performance against other tech companies during the same period shows that Apple weathered the trade war better than many competitors.

- Long-term implications for investors: The episode highlights the importance of considering geopolitical factors alongside fundamental analysis when making long-term investment decisions.

Conclusion: Understanding the Interplay of Geopolitics and Investment – Buffett's Apple Stake and Tariffs

The Trump-era tariffs presented a significant challenge to Apple and, indirectly, to Berkshire Hathaway's Apple investment. However, this case study demonstrates the complexities of global trade and its influence on individual investments. While the tariffs created short-term uncertainties, Apple's resilience and Berkshire Hathaway's long-term investment strategy ultimately mitigated many of the potential negative impacts. Understanding the interplay between geopolitics and investment is crucial. This analysis of Buffett's Apple stake and the impact of tariffs emphasizes the importance of considering geopolitical risk when making investment decisions. We encourage further research into the impact of trade policies on investment strategies, including investigating how understanding global trade dynamics can inform your own investment decisions related to Buffett's Apple stake and similar situations. Use resources focusing on investment analysis, global trade, geopolitical risk, and Warren Buffett's investment strategy to strengthen your understanding.

Featured Posts

-

Glastonbury 2025 A Lineup Analysis Charli Xcx Neil Young And The Top Artists To Watch

May 25, 2025

Glastonbury 2025 A Lineup Analysis Charli Xcx Neil Young And The Top Artists To Watch

May 25, 2025 -

Amundi Msci World Ii Ucits Etf Dist A Guide To Net Asset Value Nav And Its Importance

May 25, 2025

Amundi Msci World Ii Ucits Etf Dist A Guide To Net Asset Value Nav And Its Importance

May 25, 2025 -

Analysis Former French Prime Ministers Views On Macron

May 25, 2025

Analysis Former French Prime Ministers Views On Macron

May 25, 2025 -

Ronan Farrows Role In Mia Farrows Potential Comeback

May 25, 2025

Ronan Farrows Role In Mia Farrows Potential Comeback

May 25, 2025 -

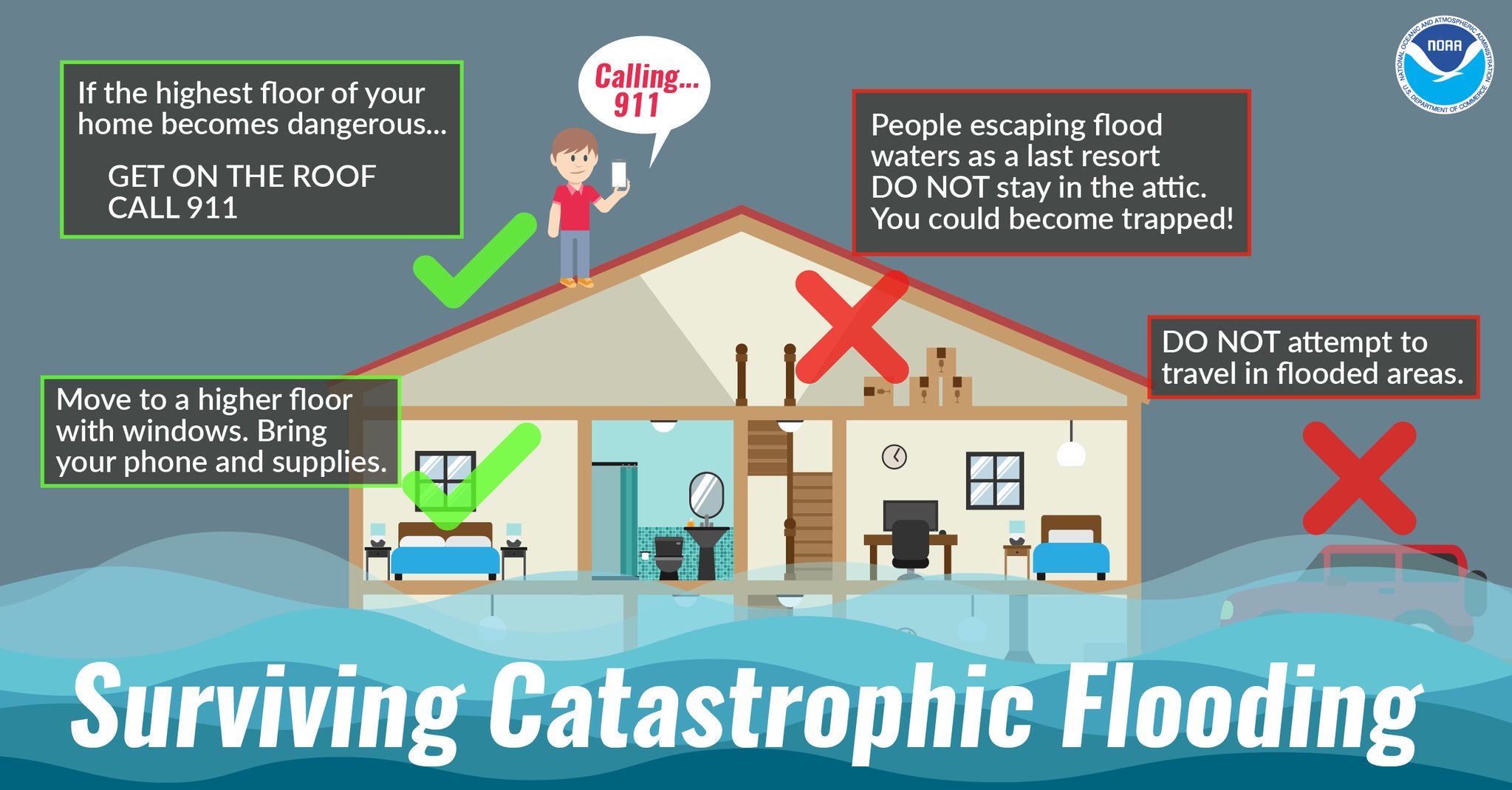

Staying Safe During Flash Floods A Comprehensive Guide To Flood Warnings

May 25, 2025

Staying Safe During Flash Floods A Comprehensive Guide To Flood Warnings

May 25, 2025

Latest Posts

-

Fatal Shooting In Myrtle Beach 1 Dead 11 Injured Sled Investigating Officer Involvement

May 25, 2025

Fatal Shooting In Myrtle Beach 1 Dead 11 Injured Sled Investigating Officer Involvement

May 25, 2025 -

Shooting Incident Prompts Safety Review At Popular Southern Vacation Spot

May 25, 2025

Shooting Incident Prompts Safety Review At Popular Southern Vacation Spot

May 25, 2025 -

Shooting At Popular Southern Vacation Spot Prompts Safety Review

May 25, 2025

Shooting At Popular Southern Vacation Spot Prompts Safety Review

May 25, 2025 -

Myrtle Beach Officer Involved Shooting Leaves 1 Dead 11 Injured Sled Investigation

May 25, 2025

Myrtle Beach Officer Involved Shooting Leaves 1 Dead 11 Injured Sled Investigation

May 25, 2025 -

Southern Vacation Destination Addresses Safety Concerns Following Shooting

May 25, 2025

Southern Vacation Destination Addresses Safety Concerns Following Shooting

May 25, 2025