Buffett's Retirement: What Happens To Berkshire Hathaway's Apple Investment?

Table of Contents

Warren Buffett's impending retirement, or rather, the eventual succession of leadership at Berkshire Hathaway, casts a long shadow over the future of the company's massive Apple investment. This colossal stake represents a significant portion of Berkshire's portfolio and its fate is a key concern for investors worldwide. This article explores the potential scenarios, analyzing the implications for Berkshire Hathaway, Apple, and the broader investment landscape. We'll examine the succession plans, the investment philosophies of potential successors, and the overall impact on the market, focusing on the future of this monumental investment.

<h2>Berkshire Hathaway's Succession Plan and Apple</h2>

The question of who will manage Berkshire Hathaway's vast holdings, especially its Apple investment, after Warren Buffett's departure is paramount. The answer lies partly in understanding the roles of key individuals within the company and their potential approaches to such a significant asset.

<h3>The Role of Greg Abel and Ajit Jain</h3>

Two prominent figures stand out: Greg Abel, currently Vice Chairman of non-insurance operations, and Ajit Jain, Vice Chairman of insurance operations. Their differing backgrounds might lead to contrasting investment strategies.

- Abel's operational focus: Abel's experience managing Berkshire's diverse operational businesses suggests a potentially more active and analytical approach to investments. He might favor a data-driven strategy, carefully evaluating Apple's performance metrics and future prospects.

- Jain's insurance expertise: Jain's background in insurance emphasizes risk assessment and long-term stability. His approach to Apple's stock might prioritize minimizing risk and maintaining a secure, long-term position.

- Alignment with Buffett's strategy: Both Abel and Jain have publicly expressed admiration for Buffett's investment philosophy, suggesting a likely continuation of the long-term buy-and-hold strategy for Apple. However, subtle shifts in approach are possible. Past statements and actions by both individuals will be scrutinized to predict their future investment decisions concerning Apple.

<h3>The Berkshire Hathaway Investment Committee</h3>

The influence of Berkshire Hathaway's investment committee cannot be overlooked. This group plays a crucial role in investment decisions, particularly in the post-Buffett era.

- Committee composition and power: The committee's exact composition and the level of its authority remain partly opaque, adding to the uncertainty surrounding future investment decisions.

- Historical precedent: Examining the committee's past influence on investment choices can offer clues to its potential approach to Apple.

- Potential approach to Apple: Given Apple's size and importance within Berkshire's portfolio, the committee's input on future decisions will be critical. Their collective expertise and risk tolerance will shape the future of the Berkshire Hathaway Apple investment.

<h2>Potential Scenarios for Berkshire Hathaway's Apple Holding</h2>

Several scenarios could unfold regarding Berkshire Hathaway's Apple holding post-Buffett. These range from maintaining the status quo to significant changes in the investment strategy.

<h3>Maintaining the Status Quo</h3>

The simplest scenario involves continuing the current substantial holding in Apple. This path reflects a belief in Apple's continued success and a commitment to Buffett's long-term investment strategy.

- Arguments for continuation: Apple's consistent profitability, strong brand recognition, and dominance in key markets support the argument for maintaining the existing investment.

- Potential risks and rewards: While this offers stability, it also carries risks; market fluctuations could significantly impact the value of the holding. Conversely, continued Apple growth could yield substantial returns.

<h3>Gradual Reduction of Apple Stock</h3>

A more moderate approach would involve a gradual reduction of Berkshire's Apple holdings. This might be driven by several factors.

- Reasons for reduction: Market diversification, the emergence of more attractive investment opportunities, or a perceived overvaluation of Apple's stock might lead to a phased divestment.

- Impact on Apple and Berkshire: A gradual reduction would likely have a less disruptive impact on Apple's stock price than a sudden, large-scale sale. However, it could still signal a shift in Berkshire's investment strategy.

<h3>Significant Changes to the Apple Investment</h3>

The most dramatic scenario would involve a significant alteration to the Apple investment, possibly including a complete sale of Berkshire's shares.

- Factors leading to change: Major shifts in Apple's performance, the emergence of disruptive technologies, or a fundamental change in Berkshire's investment philosophy could trigger such a move.

- Market reaction: A large-scale sale of Apple shares by Berkshire would undoubtedly cause significant market volatility, impacting both Apple's stock price and the broader technology sector.

<h2>Impact on Apple and the Market</h2>

Berkshire Hathaway's actions, or lack thereof, will have significant implications for Apple and the broader financial market.

<h3>Apple's Stock Price Volatility</h3>

Any change in Berkshire's Apple investment strategy will likely influence Apple's stock price.

- Historical precedents: Berkshire's investment decisions have historically had a notable impact on the stocks of companies it invests in, creating market ripples.

- Investor sentiment: Investor sentiment towards Apple will be heavily influenced by Berkshire's actions. A sale of shares, for example, could cause negative sentiment and pressure the stock price.

<h3>Wider Market Implications</h3>

The ramifications extend beyond Apple, impacting the broader technology sector and investor confidence.

- Berkshire's market influence: Berkshire Hathaway's considerable influence as a major investor cannot be understated. Its decisions carry significant weight in the market.

- Investor confidence and market stability: Berkshire's moves will impact investor confidence, potentially affecting market stability and investment flows within the technology sector and beyond.

<h2>Conclusion</h2>

Buffett's retirement and the future of Berkshire Hathaway's Apple investment are inextricably linked, with substantial implications for both companies and the global financial market. While predicting the precise outcome is impossible, understanding the succession plans, potential investment strategies of successors, and likely market reactions is crucial. Continuous monitoring of Berkshire Hathaway's actions and diligent market analysis are essential for investors seeking to navigate the complexities surrounding this monumental investment. Stay informed on the future of Berkshire Hathaway's Apple investment and its implications to make sound investment decisions.

Featured Posts

-

Joy Crookes Unveils New Single Carmen

May 24, 2025

Joy Crookes Unveils New Single Carmen

May 24, 2025 -

Open Ai Facing Ftc Investigation A Deep Dive Into The Concerns

May 24, 2025

Open Ai Facing Ftc Investigation A Deep Dive Into The Concerns

May 24, 2025 -

The Kyle Walker Scandal Examining Annie Kilners Poisoning Allegations

May 24, 2025

The Kyle Walker Scandal Examining Annie Kilners Poisoning Allegations

May 24, 2025 -

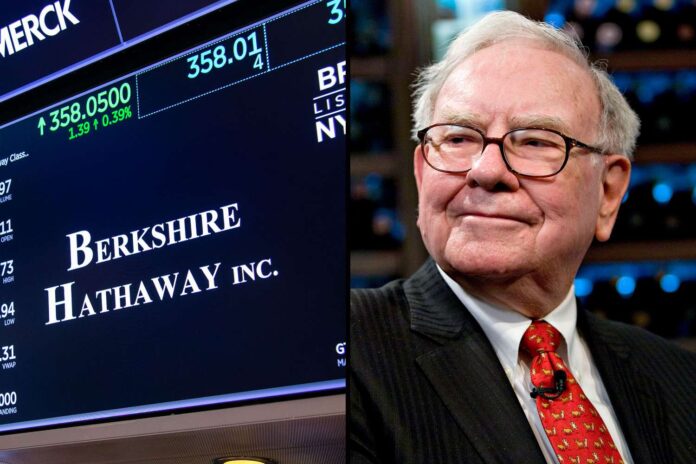

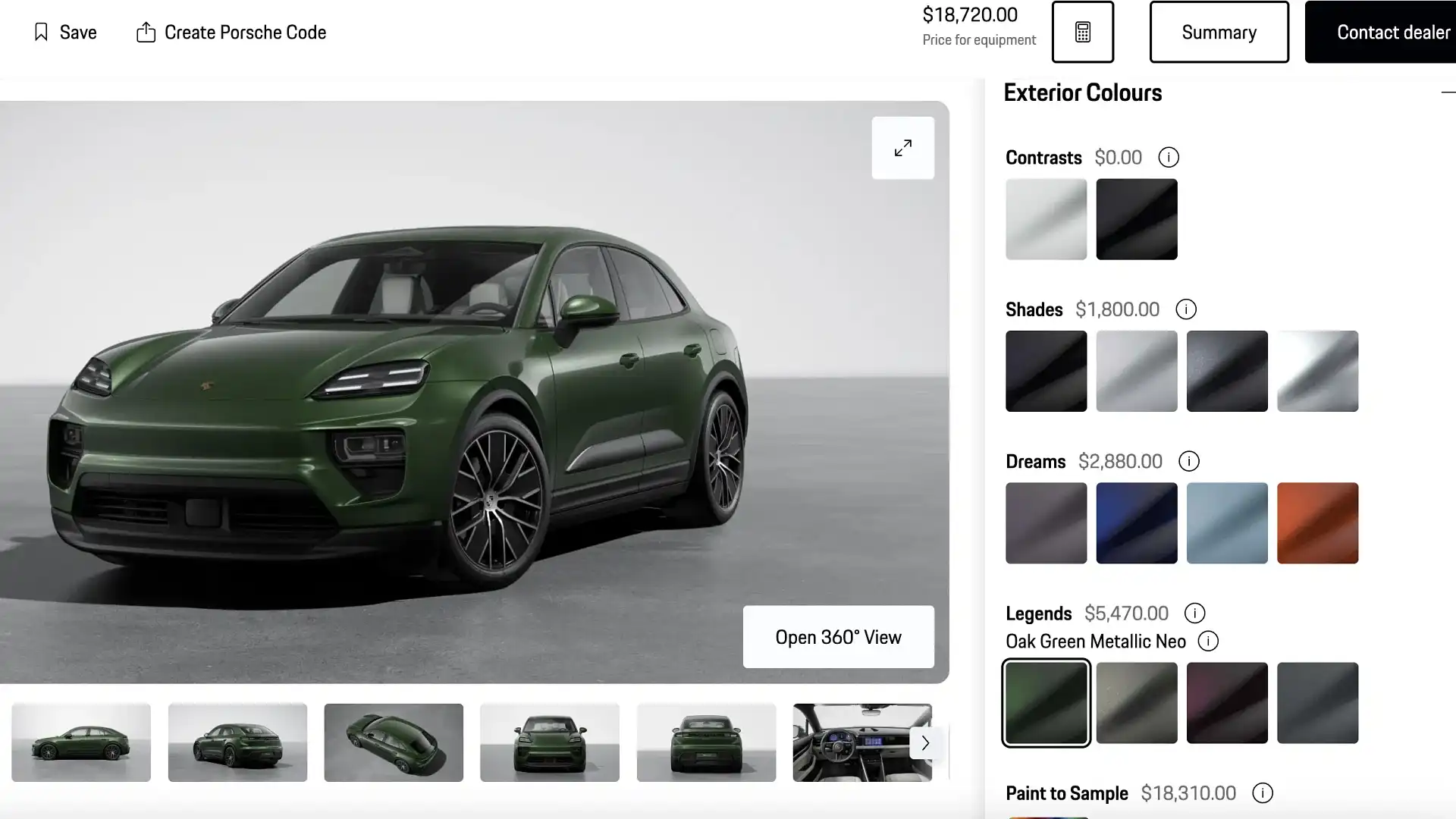

Porsche Macan Buyers Guide Everything You Need To Know

May 24, 2025

Porsche Macan Buyers Guide Everything You Need To Know

May 24, 2025 -

Musk Zuckerberg Bezos La Lotta Per Il Titolo Di Uomo Piu Ricco Del Mondo Forbes 2025

May 24, 2025

Musk Zuckerberg Bezos La Lotta Per Il Titolo Di Uomo Piu Ricco Del Mondo Forbes 2025

May 24, 2025

Latest Posts

-

A Deep Dive Into Data How Ai Creates A Poop Podcast From Repetitive Documents

May 24, 2025

A Deep Dive Into Data How Ai Creates A Poop Podcast From Repetitive Documents

May 24, 2025 -

Ai Generated Poop Podcast Extracting Meaning From Repetitive Scatological Documents

May 24, 2025

Ai Generated Poop Podcast Extracting Meaning From Repetitive Scatological Documents

May 24, 2025 -

Turning Trash To Treasure An Ai Powered Poop Podcast From Repetitive Documents

May 24, 2025

Turning Trash To Treasure An Ai Powered Poop Podcast From Repetitive Documents

May 24, 2025 -

Covid 19 Pandemic Lab Owner Convicted Of Faking Test Results

May 24, 2025

Covid 19 Pandemic Lab Owner Convicted Of Faking Test Results

May 24, 2025 -

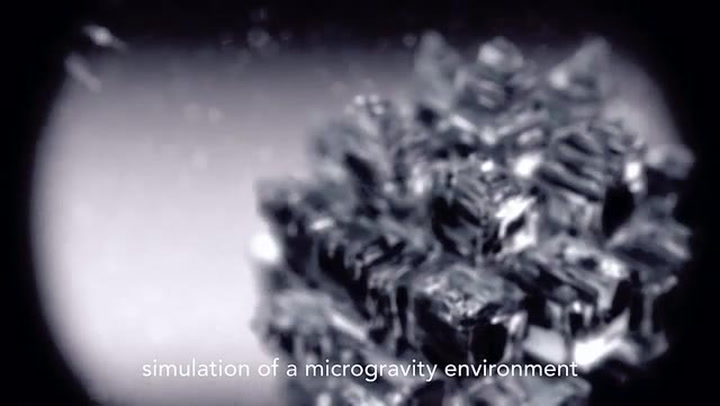

Improving Drug Development Through Space Grown Crystals

May 24, 2025

Improving Drug Development Through Space Grown Crystals

May 24, 2025