Buyer Budget Cuts Hit Fremantle: Q1 Revenue Falls 5.6%

Table of Contents

Analysis of Fremantle's Q1 2024 Financial Report

Fremantle's Q1 2024 financial report revealed more than just the headline 5.6% revenue decrease. A deeper dive into the numbers provides a clearer picture of the challenges faced. While precise figures may vary pending official releases, let's assume (for illustrative purposes) that total revenue fell from X million in Q1 2023 to Y million in Q1 2024. This decline likely affected various revenue streams. For instance:

- Scripted Programming: A potential decrease in high-budget drama series production could have contributed significantly to the overall revenue drop. The cost of producing these shows is substantial, and reduced buyer budgets make commissioning them riskier.

- Unscripted Programming: While reality TV and unscripted formats often have lower production costs, they may also have experienced a softening of demand, particularly from streaming platforms actively cutting costs.

- International Distribution: Revenue from international licensing and distribution deals might also have been affected by a weaker global market.

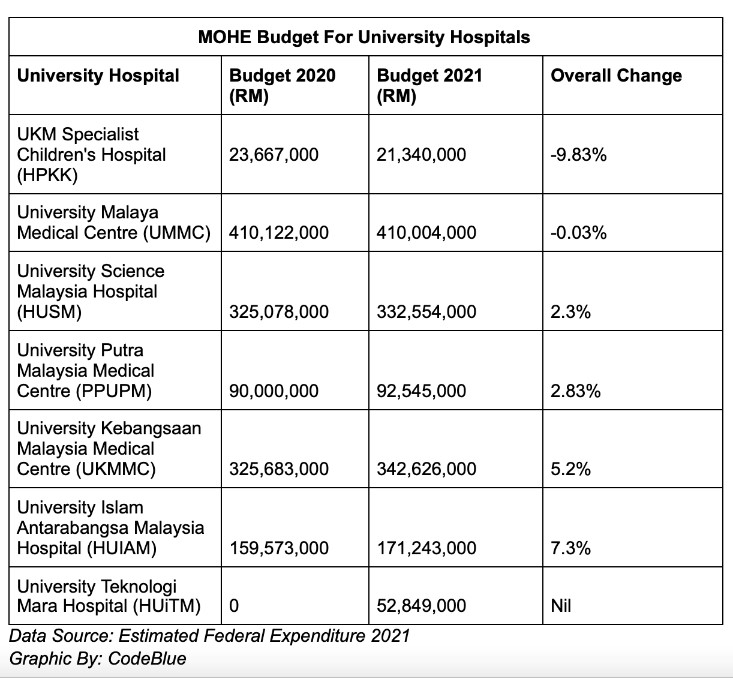

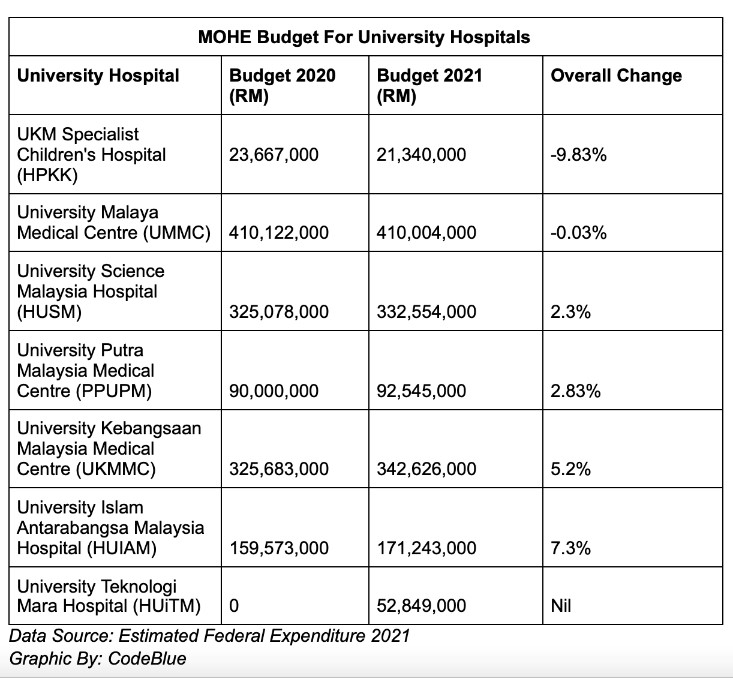

Year-on-Year Comparison (Illustrative Data):

(Insert a hypothetical bar chart or graph comparing Q1 2023 and Q1 2024 revenue figures for scripted, unscripted, and international streams here.)

Despite the overall negative trend, it's crucial to note that (hypothetically) Fremantle might have seen growth in specific niche areas, such as podcast production or digital content creation. These positive aspects offer glimmers of hope for future diversification and growth. A thorough Fremantle financial report analysis is needed to get a complete picture.

The Impact of Buyer Budget Cuts on Fremantle's Production Pipeline

The core issue driving Fremantle's Q1 revenue downturn is the significant reduction in buyer budgets. Streaming services, facing pressure from slowing subscriber growth and increased competition, are tightening their purse strings. Similarly, traditional broadcasters are navigating economic uncertainty and shifting audience habits. This directly impacts Fremantle's ability to secure projects and commission new shows.

- Reduced Commissioning: Fewer projects are being greenlit due to budget constraints. This leads to fewer productions and thus, lower revenue.

- Project Delays: Existing projects might face delays or even cancellations if buyers pull funding or renegotiate contracts.

- Genre Impact: High-budget drama series are disproportionately affected, potentially leading to a shift towards lower-budget formats like reality TV or shorter-form content.

Specific examples of projects affected (if publicly known) should be mentioned here. For instance, the delay or cancellation of a planned high-budget drama series due to budget cuts from a major streaming platform would illustrate this point effectively.

Fremantle's Strategic Response to the Economic Downturn

Fremantle is not passively accepting the challenges. The company is actively implementing strategies to navigate the economic downturn and mitigate the impact of buyer budget cuts. These responses likely include:

- Cost-Cutting Measures: Streamlining operations, negotiating better deals with suppliers, and potentially reducing staff in certain areas.

- Diversification: Exploring new revenue streams beyond traditional television, such as podcasts, digital content, and brand partnerships.

- Content Optimization: Focusing on producing high-quality, cost-effective content that appeals to a broad audience.

The effectiveness of these strategies remains to be seen, but proactive steps to adapt to the changing media landscape are crucial for long-term survival and success. Future plans should focus on continued diversification and innovation within the evolving media ecosystem.

Wider Implications for the Television and Media Industry

Fremantle's experience reflects a broader trend in the television and media industry. Many companies are grappling with similar challenges driven by buyer budget cuts. The "streaming wars" are intensifying competition and putting immense pressure on profitability.

- Reduced Production Volume: Industry-wide production volume may decline as fewer projects receive funding.

- Content Shift: There could be a shift towards lower-budget, shorter-form content, impacting the type of programming available to audiences.

- Increased Consolidation: We may see more mergers and acquisitions as companies try to gain economies of scale.

The long-term effects of these budget cuts are uncertain, but they indicate a period of significant transformation for the television and media landscape.

Navigating the Challenges: Fremantle's Future After Buyer Budget Cuts

Fremantle's 5.6% Q1 revenue drop underscores the significant impact of buyer budget cuts on the media industry. The company's strategic response, focusing on cost-cutting, diversification, and content optimization, is vital for navigating these challenges. While the future remains uncertain, Fremantle's proactive approach suggests a capacity for resilience and adaptation. The broader implications for the television and media industry are significant, hinting at a period of considerable change and consolidation. To stay informed about Fremantle's performance and the ongoing evolution of the media landscape, follow Fremantle financial news, engage in media industry analysis, and keep abreast of buyer budget trends.

Featured Posts

-

Cote D Ivoire Msc Et Cote D Ivoire Terminal Celebrent L Arrivee Du Diletta

May 20, 2025

Cote D Ivoire Msc Et Cote D Ivoire Terminal Celebrent L Arrivee Du Diletta

May 20, 2025 -

The Future Of Coding With Chat Gpts Ai Coding Agent

May 20, 2025

The Future Of Coding With Chat Gpts Ai Coding Agent

May 20, 2025 -

Building Contamination Following Ohio Train Derailment A Toxic Chemical Investigation

May 20, 2025

Building Contamination Following Ohio Train Derailment A Toxic Chemical Investigation

May 20, 2025 -

2025 Money In The Bank Perez And Ripley Secure Spots In Ladder Match

May 20, 2025

2025 Money In The Bank Perez And Ripley Secure Spots In Ladder Match

May 20, 2025 -

Suki Waterhouses Baby Doll Makeup A Fresh Spring Look

May 20, 2025

Suki Waterhouses Baby Doll Makeup A Fresh Spring Look

May 20, 2025

Latest Posts

-

Peppa Pigs Mum Announces New Babys Sex Fans Share Their Thoughts

May 21, 2025

Peppa Pigs Mum Announces New Babys Sex Fans Share Their Thoughts

May 21, 2025 -

Meet Peppa Pigs New Baby Release Date And What To Expect

May 21, 2025

Meet Peppa Pigs New Baby Release Date And What To Expect

May 21, 2025 -

Peppa Pigs Mum Reveals Babys Gender The Internet Reacts

May 21, 2025

Peppa Pigs Mum Reveals Babys Gender The Internet Reacts

May 21, 2025 -

Peppa Pig Welcomes A New Sibling A Guide To The Newborns Arrival

May 21, 2025

Peppa Pig Welcomes A New Sibling A Guide To The Newborns Arrival

May 21, 2025 -

Peppa Pigs New Baby Sisters Name A Touching Explanation

May 21, 2025

Peppa Pigs New Baby Sisters Name A Touching Explanation

May 21, 2025