Buying A Home: Managing Student Loan Debt Effectively

Table of Contents

Assessing Your Financial Situation

Before you even start browsing properties, you need a clear understanding of your financial landscape. This involves a thorough assessment of your student loan debt and your overall affordability.

Understanding Your Student Loan Payments

The first step is to meticulously analyze your student loan situation. This includes understanding your current repayment plan (standard, income-driven repayment (IDR), graduated, etc.), interest rates, and the total amount you owe.

- List all student loans: For each loan, note the lender, interest rate, minimum payment, and remaining balance.

- Calculate your total monthly student loan payment: Add up all your monthly payments to get a clear picture of your debt servicing burden.

- Explore refinancing options: Refinancing could potentially lower your monthly payments and interest rate over the life of the loan. However, carefully compare offers and ensure it aligns with your long-term financial goals. Consider whether a longer repayment period is worth the potential increased interest paid over time.

Calculating Your Affordability

Determining your affordability is crucial to avoid financial strain. You need to realistically assess how much you can comfortably afford for a mortgage while still managing your student loan payments and other essential expenses.

- Use online mortgage affordability calculators: Many reputable websites offer free calculators that factor in your income, debt, and down payment to estimate your potential mortgage amount.

- Create a detailed monthly budget: Include all expenses – rent, utilities, groceries, transportation, entertainment, and of course, your student loan payments. This will give you a realistic view of your disposable income.

- Consider the 28/36 rule: A common guideline is that your total housing costs (mortgage, property taxes, insurance, HOA fees) shouldn't exceed 28% of your gross monthly income, and your total debt payments shouldn't exceed 36% of your gross monthly income.

Strategies for Managing Student Loan Debt

Effectively managing your student loan debt is key to improving your chances of homeownership. Several strategies can help you achieve this.

Exploring Repayment Options

Different repayment plans can significantly impact your monthly expenses. Explore the options available to find the best fit for your financial situation.

- Research Income-Driven Repayment (IDR) plans: These plans base your monthly payments on your income and family size, potentially resulting in lower monthly payments. However, be aware that you may end up paying more interest over the long term.

- Explore student loan refinancing: If your credit score has improved since you took out your loans, refinancing could help you secure a lower interest rate, potentially saving you money in the long run. Shop around and compare offers from multiple lenders.

- Consider deferment or forbearance (use cautiously): Deferment or forbearance temporarily suspends your payments, but interest usually continues to accrue, increasing your total debt. Only consider these as a last resort if you face a temporary financial hardship.

Improving Your Credit Score

A good credit score is essential for obtaining a favorable mortgage interest rate. Working on improving your credit score is a crucial step in the home-buying process.

- Monitor your credit report regularly: Check for errors and report any discrepancies to the credit bureaus immediately.

- Pay all bills on time: Consistent on-time payments are a major factor in credit score calculation.

- Keep credit utilization below 30%: Your credit utilization ratio (the amount of credit you use compared to your total available credit) significantly impacts your score. Aim to keep it below 30%.

Saving for a Down Payment

Accumulating a down payment is a significant hurdle for many aspiring homeowners. Strategic planning and resourcefulness can make this achievable.

Developing a Savings Plan

Create a realistic savings plan tailored to your income and expenses, focusing on maximizing your savings rate.

- Set a realistic savings goal: Determine the down payment amount required for your desired home and create a timeline for achieving it.

- Automate savings transfers: Set up automatic transfers from your checking account to a high-yield savings account to make saving consistent and effortless.

- Explore alternative investment options: While less liquid, investments may provide higher returns than savings accounts over the long term, contributing more substantially to your down payment. Consult a financial advisor.

Exploring Down Payment Assistance Programs

Several government and private programs offer down payment assistance to first-time homebuyers, potentially easing the financial burden.

- Check local and state housing authority websites: Many state and local governments offer down payment assistance programs.

- Inquire with lenders about available programs: Mortgage lenders often have partnerships with organizations offering down payment assistance.

- Explore programs specifically for student loan borrowers: Some programs prioritize borrowers struggling with student loan debt.

Conclusion

Buying a home while managing student loan debt is achievable with careful planning and strategic debt management. By assessing your financial situation, exploring repayment options, improving your credit score, and diligently saving for a down payment, you can work towards achieving your homeownership goals. Remember to consult with a financial advisor and mortgage lender to create a personalized plan tailored to your specific circumstances. Don't let student loan debt delay your dream of buying a home – take control of your finances and start planning today!

Featured Posts

-

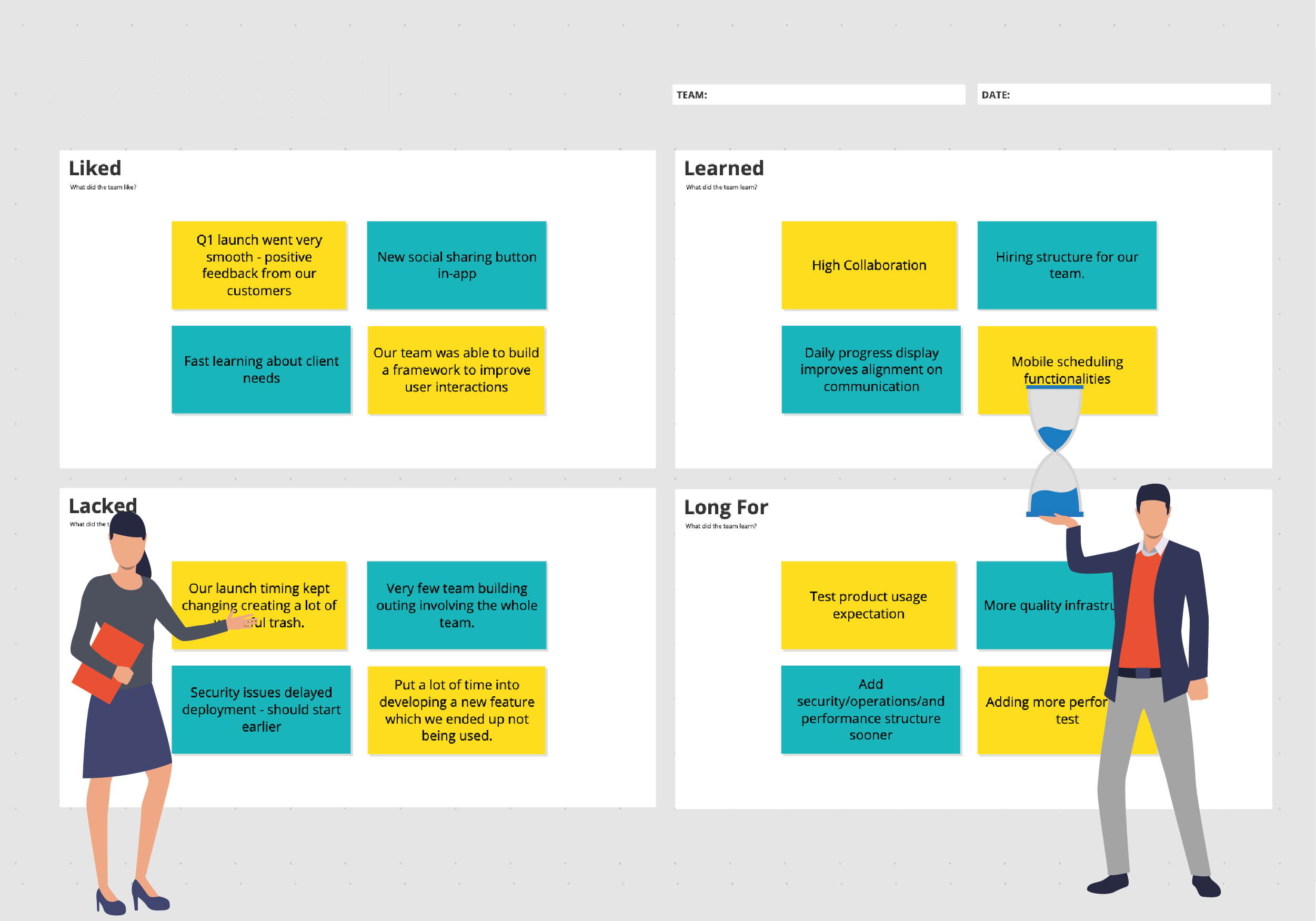

This Weeks Setbacks A Retrospective Analysis

May 17, 2025

This Weeks Setbacks A Retrospective Analysis

May 17, 2025 -

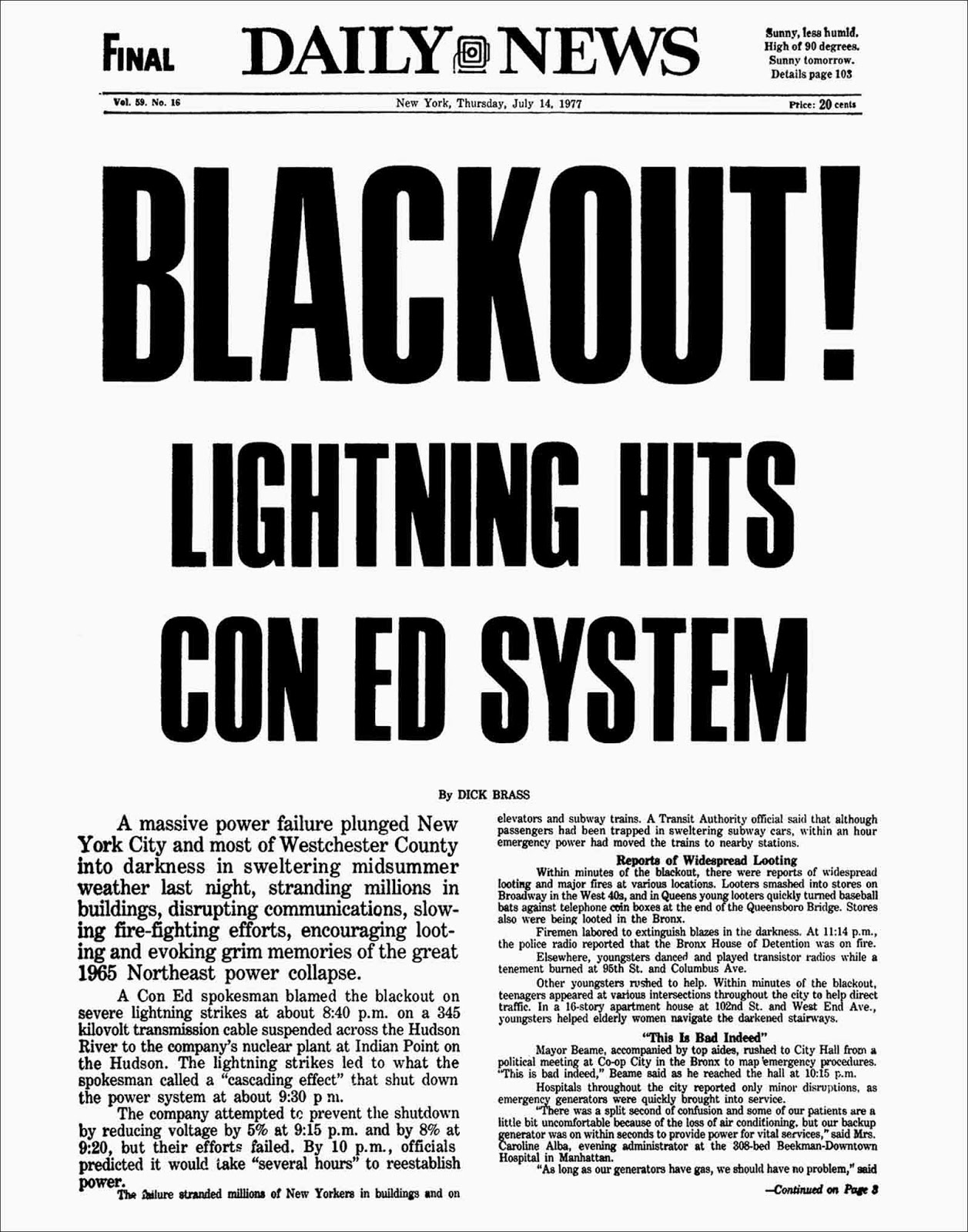

Accessing New York Daily News Archives May 2025 Edition

May 17, 2025

Accessing New York Daily News Archives May 2025 Edition

May 17, 2025 -

Popularne Lokacije Za Kupovinu Stanova Izbor Srba

May 17, 2025

Popularne Lokacije Za Kupovinu Stanova Izbor Srba

May 17, 2025 -

Severance Season 3 Will It Happen

May 17, 2025

Severance Season 3 Will It Happen

May 17, 2025 -

Peringatan Houthi Dubai Dan Abu Dhabi Dalam Bahaya Serangan Rudal

May 17, 2025

Peringatan Houthi Dubai Dan Abu Dhabi Dalam Bahaya Serangan Rudal

May 17, 2025