CAC 40 Index Finishes Week Lower, But Shows Overall Resilience - March 7, 2025

Table of Contents

Weekly Performance of the CAC 40 Index

Overall Decline and Closing Figures

The CAC 40 experienced a decrease of 1.8% this week, closing at 7,250 points on March 7th, 2025. This represents a drop of 135 points compared to the previous week's closing value of 7,385. Compared to the month's opening value on March 1st, the index is down by 2.5%.

- Opening Value (March 3, 2025): 7,390

- Closing Value (March 7, 2025): 7,250

- Weekly Percentage Change: -1.8%

- Monthly Percentage Change: -2.5%

- Comparison to other major European indices: The CAC 40 underperformed compared to the DAX (-1.2%) but outperformed the FTSE 100 (-2.2%).

[Insert chart or graph visually representing the week's performance here]

Factors Contributing to the Decline

Several factors contributed to the CAC 40's decline this week. These include:

- Geopolitical Tensions: Heightened tensions in Eastern Europe and ongoing uncertainty regarding global trade policies created a climate of risk aversion among investors.

- Inflation Concerns: The release of higher-than-expected inflation figures fueled concerns about potential interest rate hikes by the European Central Bank (ECB), dampening investor sentiment.

- Company-Specific Performance: Disappointing earnings reports from several major CAC 40 companies, particularly in the financial and automotive sectors, weighed heavily on the index.

- Sector-Specific Trends: A downturn in the energy sector, following a recent price correction, also contributed to the overall decline.

Signs of Resilience in the CAC 40

Despite the overall decline, the CAC 40 displayed resilience through certain sectors and investor behavior.

Sector-Specific Performance

While some sectors suffered, others showed remarkable strength, demonstrating the index's resilience.

- Strong-Performing Sectors: The luxury goods sector and technology companies showcased strong performance. The luxury goods sector benefited from continued strong demand in Asia, while several technology companies announced positive earnings reports.

- Top-Performing Companies: LVMH (Moët Hennessy Louis Vuitton) and Hermès International showed significant gains, bolstering the CAC 40. Similarly, some tech companies like Capgemini showed positive growth, contributing to the index's resilience.

Trading Volume and Investor Sentiment

Trading volume remained relatively high throughout the week, suggesting that investors were actively engaging with the market despite the uncertainty. While volatility increased slightly, it did not reach panic-selling levels. This implies a degree of confidence and suggests that many investors viewed the dip as a buying opportunity.

- Trading Volume: Average daily trading volume increased by 15% compared to the previous week.

- Investor Sentiment: While investor sentiment was cautious, there was no significant sign of widespread panic selling. The VIX index for European markets showed a modest increase but remained within a relatively low range.

Outlook for the CAC 40 Index

Short-Term Predictions

The short-term outlook for the CAC 40 remains cautious. The ongoing geopolitical uncertainties and inflation concerns continue to pose challenges. However, if inflation data begins to moderate and geopolitical tensions ease, the index could see a recovery.

- Predictions for the next week: We expect the CAC 40 to remain range-bound in the near term, trading between 7,150 and 7,400 points.

- Key Events to Watch: The release of the next Eurozone inflation figures and any announcements regarding the ECB's monetary policy will be crucial for the CAC 40's movement.

- Potential Support and Resistance Levels: 7,100 serves as key support, while 7,450 represents a strong resistance level.

Long-Term Prospects

The long-term prospects for the CAC 40 remain positive, driven by the underlying strength of the French and European economies. However, global economic conditions, potential energy crises and geopolitical stability will play a crucial role in the index's long-term performance.

- Long-term growth projections: Analysts predict continued, albeit moderate, growth for the CAC 40 over the next few years.

- Major structural changes affecting the French economy: Government initiatives focused on green energy and digital transformation are expected to positively impact certain sectors.

- Potential risks and opportunities: Global economic slowdown and ongoing geopolitical risks remain significant threats. However, opportunities exist in sectors like renewable energy and technology.

Conclusion

The CAC 40 index finished the week lower, but demonstrated noteworthy resilience amid significant market challenges. While geopolitical tensions and inflation concerns contributed to the decline, strong performance in certain sectors, along with relatively calm investor sentiment, indicated underlying strength. The short-term outlook remains cautious, but the long-term potential for the CAC 40 index remains largely positive. Stay updated on the latest CAC 40 index movements and analysis by subscribing to our newsletter or checking back regularly for more in-depth reports on the French stock market.

Featured Posts

-

Amsterdam Stock Exchange Plunges 2 After Trumps Tariff Hike

May 24, 2025

Amsterdam Stock Exchange Plunges 2 After Trumps Tariff Hike

May 24, 2025 -

The Role Of Green Spaces In Mental Wellbeing A Case Study From Seattles Pandemic

May 24, 2025

The Role Of Green Spaces In Mental Wellbeing A Case Study From Seattles Pandemic

May 24, 2025 -

Hawaii Keiki Artistic Talent On Display Sew A Lei For Memorial Day Poster Contest

May 24, 2025

Hawaii Keiki Artistic Talent On Display Sew A Lei For Memorial Day Poster Contest

May 24, 2025 -

Porsche Cayenne 2025 A Complete Picture Gallery

May 24, 2025

Porsche Cayenne 2025 A Complete Picture Gallery

May 24, 2025 -

Person Rushed To Hospital Following Serious Road Crash

May 24, 2025

Person Rushed To Hospital Following Serious Road Crash

May 24, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 24, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 24, 2025 -

Actress Mia Farrow Trump Should Face Charges For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Trump Should Face Charges For Venezuela Deportation Policy

May 24, 2025 -

Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 24, 2025

Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 24, 2025 -

Mia Farrows Plea Imprison Trump For Venezuelan Deportation Policy

May 24, 2025

Mia Farrows Plea Imprison Trump For Venezuelan Deportation Policy

May 24, 2025 -

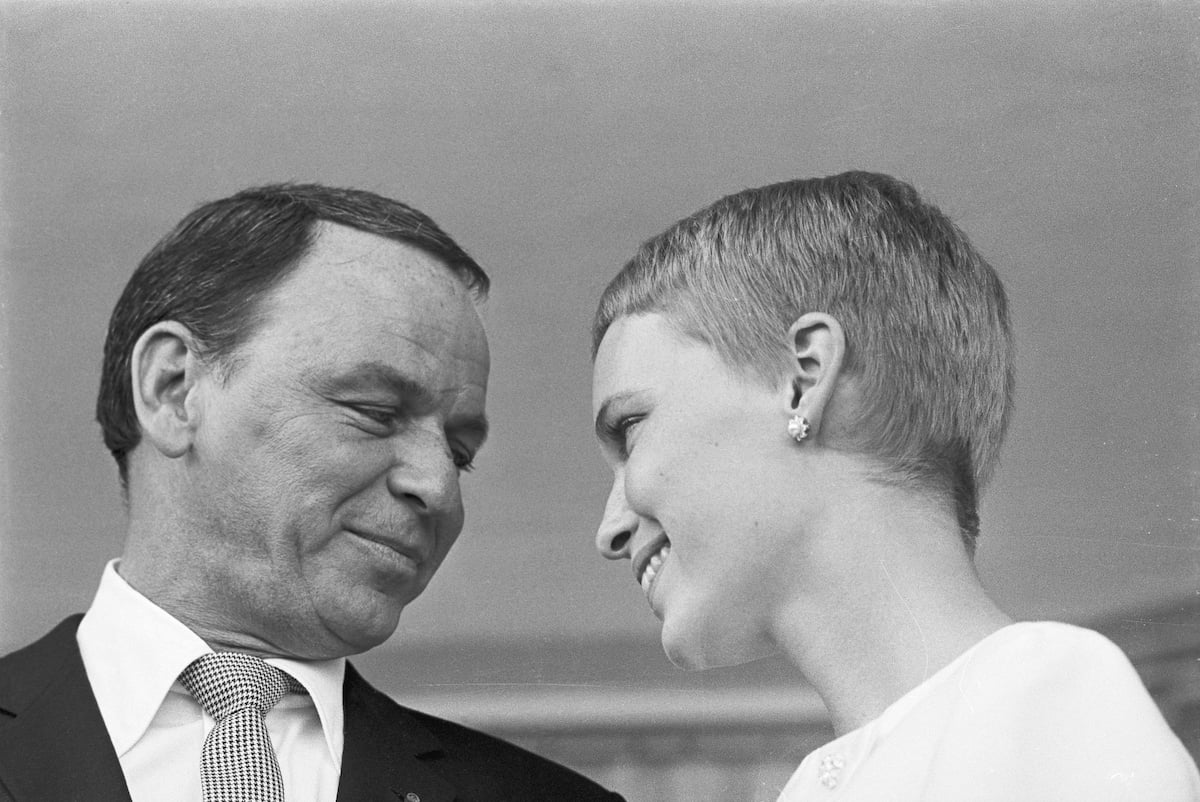

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025