Can Palantir Reach A Trillion-Dollar Valuation By 2030?

Table of Contents

H2: Palantir's Current Market Position and Growth Trajectory

H3: Analyzing Palantir's Revenue Growth and Profitability:

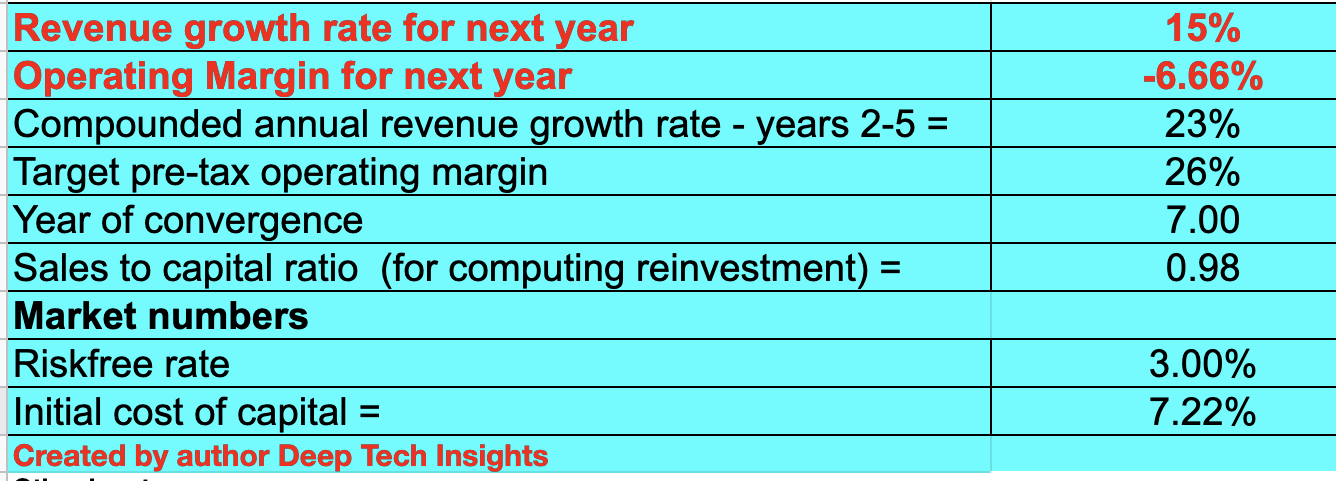

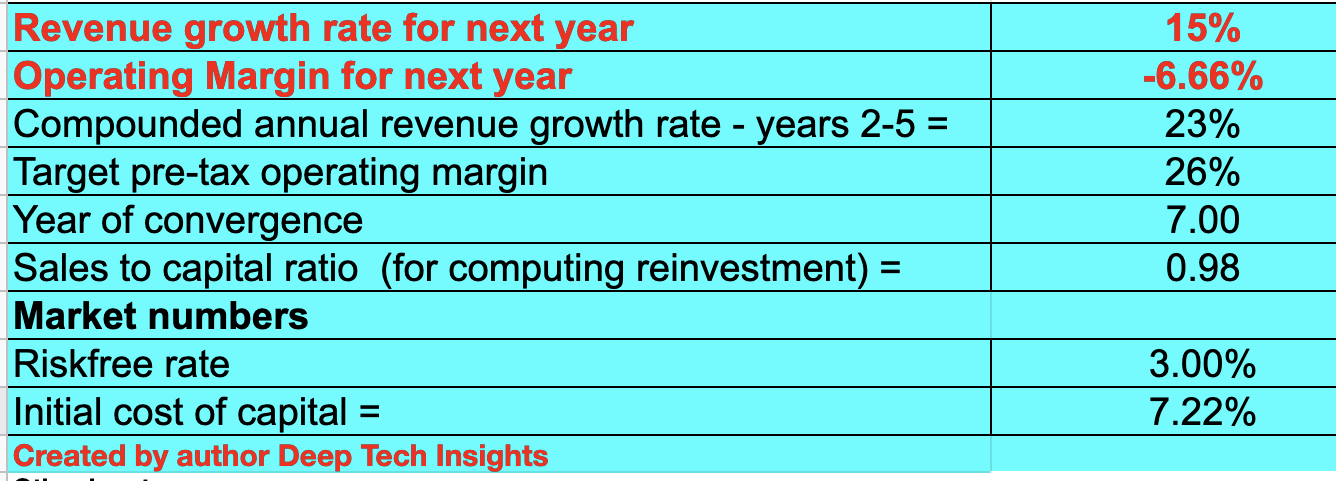

Palantir's revenue growth has been impressive, but achieving a trillion-dollar valuation requires sustained, exponential growth. Analyzing Palantir's financial performance reveals a mixed picture. While revenue has increased steadily, profitability margins remain a key area of focus.

- Historical Revenue Growth: Examine Palantir's historical revenue figures, showcasing year-over-year growth percentages. Include visual aids like charts to demonstrate trends.

- Profitability Margins: Discuss Palantir's operating margins and net income margins, highlighting areas for improvement. Compare these margins to competitors in the data analytics space.

- Future Revenue Projections: Analyze analyst forecasts for Palantir's future revenue growth and discuss the assumptions underlying these projections. Consider factors like market penetration and pricing strategies. Keywords: Palantir revenue, Palantir profitability, Palantir financial performance, Palantir stock price.

H3: Assessing Palantir's Competitive Landscape:

Palantir operates in a fiercely competitive big data analytics market. Its key competitors include established players like IBM, Microsoft, and smaller, more agile startups.

- Main Competitors: List and briefly describe Palantir's major competitors, highlighting their strengths and weaknesses.

- Competitive Advantages: Analyze Palantir's unique selling propositions, such as its sophisticated algorithms, strong government relationships, and focus on complex data analysis.

- Market Share and Expansion: Discuss Palantir's current market share and its potential for expansion into new markets, both geographically and within different industries. Keywords: Palantir competitors, data analytics market, competitive landscape, market share.

H2: Factors Contributing to (or Hindering) a Trillion-Dollar Valuation

H3: Technological Innovation and Product Development:

Palantir's continued investment in R&D is crucial for its long-term growth. The development of new AI and machine learning capabilities could significantly enhance its offerings and drive future revenue.

- R&D Spending: Analyze Palantir's investment in research and development, comparing it to industry averages.

- New Product Launches: Discuss the impact of new product releases and features on revenue growth and market adoption.

- Technological Breakthroughs: Assess the potential for Palantir to achieve significant technological breakthroughs that could disrupt the market. Keywords: Palantir innovation, technology development, product roadmap, AI, machine learning.

H3: Government Contracts and Commercial Market Expansion:

Palantir's significant reliance on government contracts presents both opportunities and risks. Diversification into the commercial market is essential for long-term sustainability.

- Government Contracts: Analyze the proportion of Palantir's revenue derived from government contracts and the potential risks associated with this dependence.

- Commercial Market Penetration: Discuss Palantir's progress in expanding its client base in the commercial sector and the challenges associated with this market segment.

- Market Diversification: Evaluate the success of Palantir's strategy to diversify its revenue streams and reduce its reliance on any single customer or market segment. Keywords: government contracts, commercial market, Palantir clients, market diversification.

H3: Economic and Geopolitical Factors:

Global economic conditions and geopolitical events can significantly influence Palantir's growth trajectory.

- Economic Growth: Analyze the impact of global economic growth or recession on Palantir's revenue and profitability.

- Geopolitical Risks: Discuss the potential impact of geopolitical instability on Palantir's business, especially concerning government contracts and international operations.

- Market Volatility: Assess the influence of market volatility on Palantir's stock price and investor sentiment. Keywords: global economy, geopolitical risks, market volatility, economic growth.

H2: Challenges and Risks in Achieving a Trillion-Dollar Valuation

H3: High Valuation and Market Expectations:

Palantir's current market capitalization presents a challenge in justifying a trillion-dollar valuation. Meeting investor expectations will require sustained exceptional performance.

- Current Market Capitalization: State Palantir's current market cap and compare it to other companies in the tech sector.

- Investor Sentiment: Discuss the prevailing investor sentiment towards Palantir and the factors influencing it.

- Meeting Market Expectations: Analyze the realistic likelihood of Palantir meeting the high market expectations embedded in its current valuation. Keywords: market capitalization, stock valuation, investor sentiment, market expectations.

H3: Competition and Market Saturation:

Increased competition and potential market saturation pose significant risks to Palantir's future growth.

- Increased Competition: Discuss the potential for new entrants and existing competitors to increase competition in the data analytics market.

- Market Saturation: Analyze the risk of the data analytics market reaching saturation, limiting future growth opportunities.

- Maintaining a Competitive Edge: Discuss Palantir's strategies to maintain a competitive edge in a rapidly evolving market. Keywords: competition, market saturation, competitive advantage, innovation.

H3: Data Privacy and Security Concerns:

Data privacy and security are paramount in the data analytics industry. Breaches can severely damage reputation and business.

- Data Privacy Regulations: Analyze the impact of data privacy regulations like GDPR and CCPA on Palantir's operations.

- Cybersecurity Risks: Discuss the potential for data breaches and cyberattacks and their potential impact on Palantir's business.

- Reputation Management: Analyze how Palantir manages its reputation in relation to data privacy and security. Keywords: data privacy, data security, cybersecurity, regulatory compliance.

3. Conclusion: Palantir's Path to a Trillion-Dollar Valuation – A Realistic Assessment?

Reaching a trillion-dollar valuation by 2030 presents a significant challenge for Palantir. While the company possesses considerable strengths, including strong technology, a growing customer base, and a skilled workforce, significant hurdles remain, including intense competition, market saturation risks, and reliance on government contracts. Sustained revenue growth, increased profitability, and successful navigation of geopolitical and economic uncertainties are crucial. The likelihood of achieving this ambitious goal depends on continued innovation, effective market expansion, and the successful mitigation of various risks. What are your thoughts on Palantir reaching a trillion-dollar valuation? Share your predictions in the comments below!

Featured Posts

-

The High Cost Of Childcare One Mans 3 K To 3 6 K Experience

May 09, 2025

The High Cost Of Childcare One Mans 3 K To 3 6 K Experience

May 09, 2025 -

Rytsarskoe Zvanie Dlya Stivena Fraya Reaktsiya I Podrobnosti

May 09, 2025

Rytsarskoe Zvanie Dlya Stivena Fraya Reaktsiya I Podrobnosti

May 09, 2025 -

Potential Uk Visa Crackdown Pakistan Nigeria And Sri Lanka Affected

May 09, 2025

Potential Uk Visa Crackdown Pakistan Nigeria And Sri Lanka Affected

May 09, 2025 -

Find Live Music And Events In Lake Charles For Easter Weekend

May 09, 2025

Find Live Music And Events In Lake Charles For Easter Weekend

May 09, 2025 -

When To Watch The Next High Potential Episode On Abc

May 09, 2025

When To Watch The Next High Potential Episode On Abc

May 09, 2025