Can XRP Reach New Heights After A 400% Price Increase?

Table of Contents

Analyzing the Factors Behind XRP's 400% Price Surge

Several key factors have contributed to XRP's dramatic price appreciation. Understanding these elements is crucial for assessing its future trajectory.

The Ripple Lawsuit Settlement

The protracted legal battle between Ripple Labs and the SEC cast a long shadow over XRP's price. The partial settlement, while not a complete victory for Ripple, significantly reduced the legal uncertainty surrounding the cryptocurrency. This positive development boosted investor confidence and fueled a surge in buying pressure.

- Key aspects of the settlement: The settlement clarified the status of XRP in some jurisdictions, leading to increased trading volume on many exchanges.

- Impact on investor confidence: The reduced regulatory risk significantly improved investor sentiment, leading to greater confidence in XRP's long-term prospects.

- Market sentiment shift: The positive news surrounding the settlement triggered a wave of positive market sentiment, driving up demand and price.

Related keywords: Ripple lawsuit, SEC lawsuit, XRP price prediction, Ripple price, legal uncertainty, XRP legal status.

Increased Institutional Adoption and Trading Volume

The XRP price increase wasn't solely driven by retail investors. Increased institutional interest and trading volume played a pivotal role. Large financial institutions, seeking exposure to the cryptocurrency market, have begun to show interest in XRP, particularly for its utility in cross-border payments.

- Examples of institutional investment: While specific names may be difficult to disclose due to privacy concerns, several reports suggest increasing activity from institutional investors. This indirect evidence points to a growing belief in XRP's potential.

- Increased trading volume: Trading platforms across the globe reported substantial increases in XRP trading volume during the price surge, a clear indicator of heightened market activity.

- Market capitalization growth: The rise in price directly translated to a considerable increase in XRP's market capitalization, further highlighting the surge in demand.

Related keywords: Institutional investors, XRP trading volume, cryptocurrency adoption, market capitalization, institutional interest XRP.

Growing Use Cases for XRP

XRP's utility extends beyond simple speculation. Its use in cross-border payments, facilitated by RippleNet and On-Demand Liquidity (ODL), is gaining traction globally. These real-world applications contribute significantly to XRP's fundamental value and potential for future growth.

- Real-world examples: Numerous financial institutions are utilizing RippleNet and ODL to streamline cross-border transactions, demonstrating XRP's practical application.

- Partnerships and collaborations: Ripple continues to forge strategic partnerships with major financial players, expanding XRP's reach and solidifying its role in the global payments landscape.

- Technological advantages: XRP's speed and efficiency compared to traditional banking systems are key advantages driving its adoption.

Related keywords: Cross-border payments, RippleNet, On-Demand Liquidity (ODL), XRP utility, blockchain technology, XRP transactions.

Potential Challenges and Risks Facing XRP's Future Growth

Despite the recent surge, several challenges and risks could impact XRP's future price trajectory. A realistic assessment of these factors is essential for informed decision-making.

Market Volatility and Crypto Winter

The cryptocurrency market is notoriously volatile. A potential crypto winter, characterized by a prolonged period of price declines, could significantly impact XRP's price, regardless of its underlying fundamentals.

- Historical market trends: Analyzing past cryptocurrency market cycles reveals periods of intense volatility and sharp corrections.

- Risk assessment: Investors should be prepared for potential price fluctuations and develop a risk management strategy.

- Diversification: Diversifying investment portfolios across different asset classes is crucial to mitigate risk.

Related keywords: Cryptocurrency market volatility, bear market, crypto winter, risk assessment, investment strategy, XRP volatility.

Regulatory Uncertainty and Future Legal Challenges

While the Ripple lawsuit settlement provided some clarity, regulatory uncertainty remains a significant risk. Future regulatory changes in various jurisdictions could impact XRP's adoption and price.

- Potential regulatory changes: Different countries have varying regulatory frameworks for cryptocurrencies, and these frameworks could evolve, potentially impacting XRP.

- Compliance requirements: Navigating the complexities of global regulations will be crucial for Ripple and XRP's continued growth.

- Legal risks: Ongoing legal challenges or future regulatory actions could still impact XRP's price.

Related keywords: Regulatory landscape, cryptocurrency regulation, compliance, legal risks, XRP regulation, regulatory uncertainty.

Competition from other Cryptocurrencies

XRP faces competition from other cryptocurrencies with similar functionalities. The competitive landscape is dynamic, and XRP must maintain its competitive edge to sustain its growth.

- Competitor analysis: Several altcoins offer similar functionalities to XRP, necessitating a thorough competitive analysis.

- Technological advancements: The cryptocurrency landscape is constantly evolving, with new technologies and innovations emerging regularly.

- Maintaining market share: XRP needs to continue innovating and adapting to maintain its market share.

Related keywords: Competitor analysis, altcoins, blockchain technology comparison, XRP competitors, blockchain competition.

Predicting XRP's Future Price: Can it Reach New Heights?

Predicting XRP's future price is inherently challenging. While technical analysis and expert opinions can offer insights, no one can definitively predict its future trajectory.

Technical Analysis and Price Predictions

Technical analysis can provide some guidance, but it's essential to avoid relying solely on predictions. Different analysts offer varying price targets, highlighting the inherent uncertainty.

- Chart patterns and indicators: Technical analysis tools can identify potential trends and support/resistance levels.

- Market sentiment analysis: Gauging overall market sentiment towards XRP can provide valuable insights.

- Disclaimer: No price prediction should be considered financial advice.

Related keywords: XRP price prediction, technical analysis, chart patterns, market sentiment, future outlook, XRP price forecast.

Fundamental Analysis and Long-Term Potential

Fundamental analysis focuses on XRP's underlying value proposition and its potential for long-term growth. The expanding use cases for XRP in cross-border payments and other applications suggest a strong fundamental basis for future growth.

- Adoption rate: The rate at which XRP is adopted by financial institutions and businesses will significantly impact its future price.

- Scalability and efficiency: XRP's scalability and efficiency relative to other cryptocurrencies are key factors in its long-term potential.

- Technological advancements: Continued innovation and development within the Ripple ecosystem could enhance XRP's utility and adoption.

Related keywords: Fundamental analysis, long-term investment, XRP adoption rate, scalability, XRP technology, long-term XRP price.

Conclusion: The Future of XRP After its Significant Price Increase

XRP's recent 400% price increase is a testament to its growing utility and reduced regulatory uncertainty. However, the cryptocurrency market remains inherently volatile, and several challenges lie ahead. While the settlement of the Ripple lawsuit was a positive development, navigating future regulatory hurdles and maintaining competitiveness will be crucial. The potential for XRP to reach new heights depends on various factors, including continued adoption, technological advancements, and the overall state of the cryptocurrency market.

Key Takeaways:

- The Ripple lawsuit settlement significantly impacted XRP's price, but regulatory uncertainty remains a factor.

- Institutional adoption and growing use cases contribute to XRP's value proposition.

- Market volatility and competition from other cryptocurrencies pose significant challenges.

- Predicting XRP's future price is complex and requires careful consideration of multiple factors.

Call to Action: Before making any investment decisions related to XRP, thoroughly research the cryptocurrency, understand the associated risks, and consider consulting with a qualified financial advisor. Learn more about XRP's potential, analyze the XRP price increase in detail, and always prioritize responsible investment strategies. Remember, cryptocurrency investments are inherently speculative.

Featured Posts

-

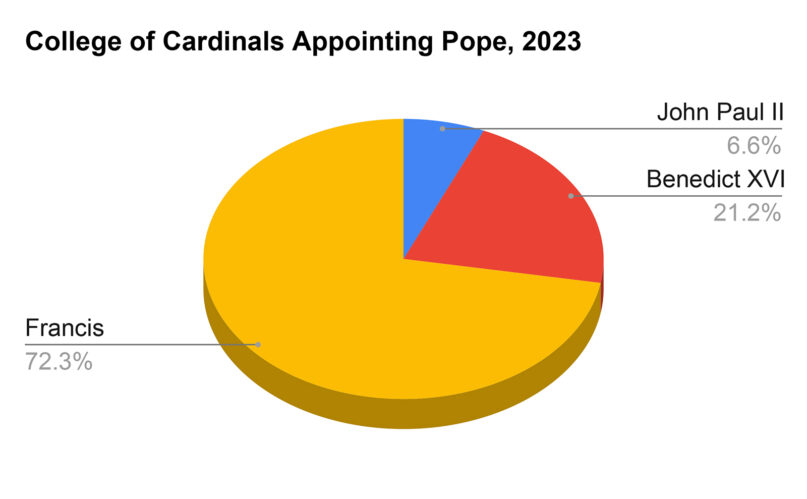

Cardinal Voters Receive Candidate Dossiers For Upcoming Conclave

May 08, 2025

Cardinal Voters Receive Candidate Dossiers For Upcoming Conclave

May 08, 2025 -

Lotto 6aus49 Mittwoch 9 4 2025 Ueberpruefen Sie Ihre Zahlen

May 08, 2025

Lotto 6aus49 Mittwoch 9 4 2025 Ueberpruefen Sie Ihre Zahlen

May 08, 2025 -

Extradition Case Malaysias Pursuit Of Former Goldman Partner In 1 Mdb Probe

May 08, 2025

Extradition Case Malaysias Pursuit Of Former Goldman Partner In 1 Mdb Probe

May 08, 2025 -

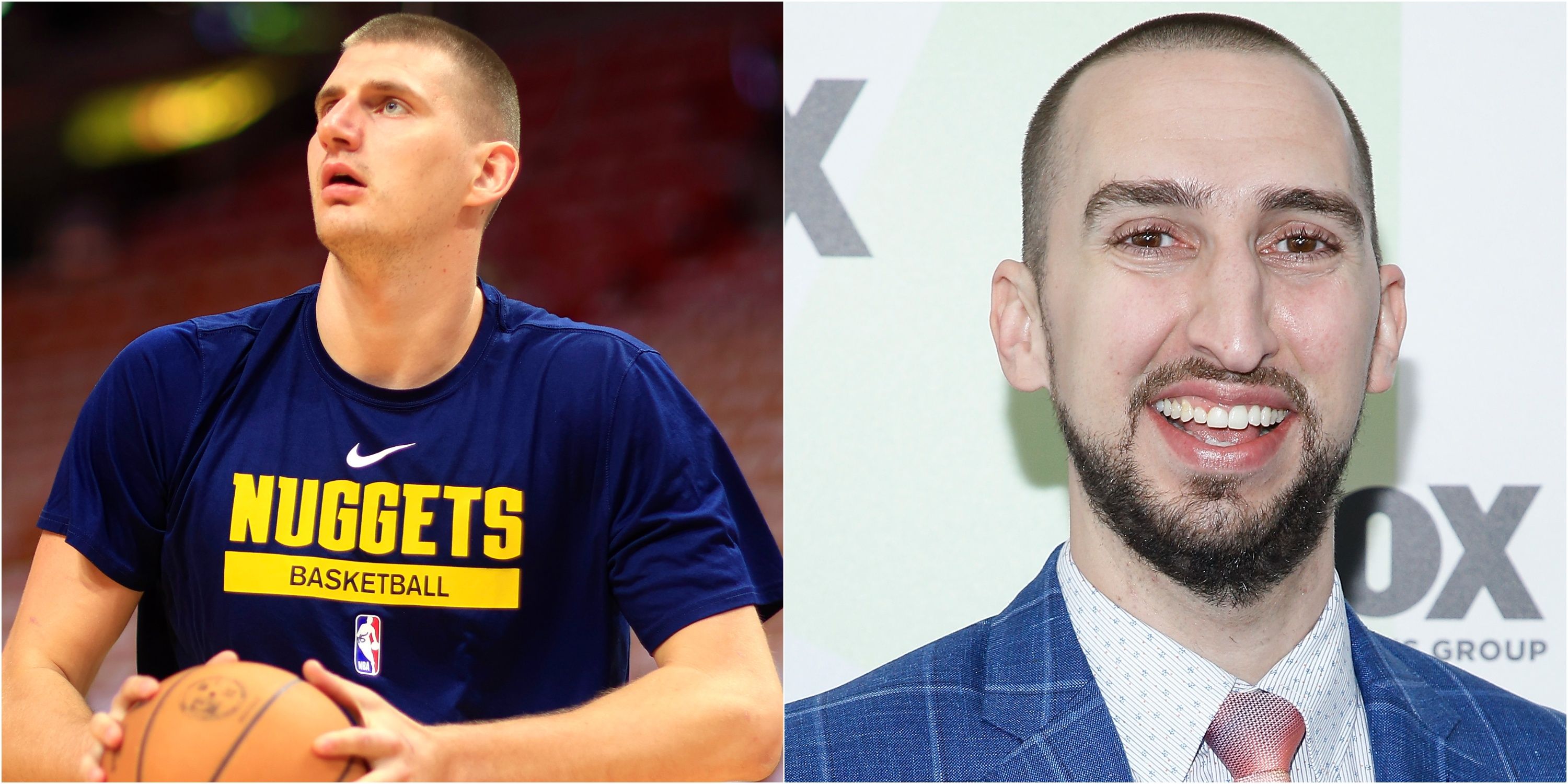

Jokic To Sit Nuggets Give Starters Rest Following Tough Defeat

May 08, 2025

Jokic To Sit Nuggets Give Starters Rest Following Tough Defeat

May 08, 2025 -

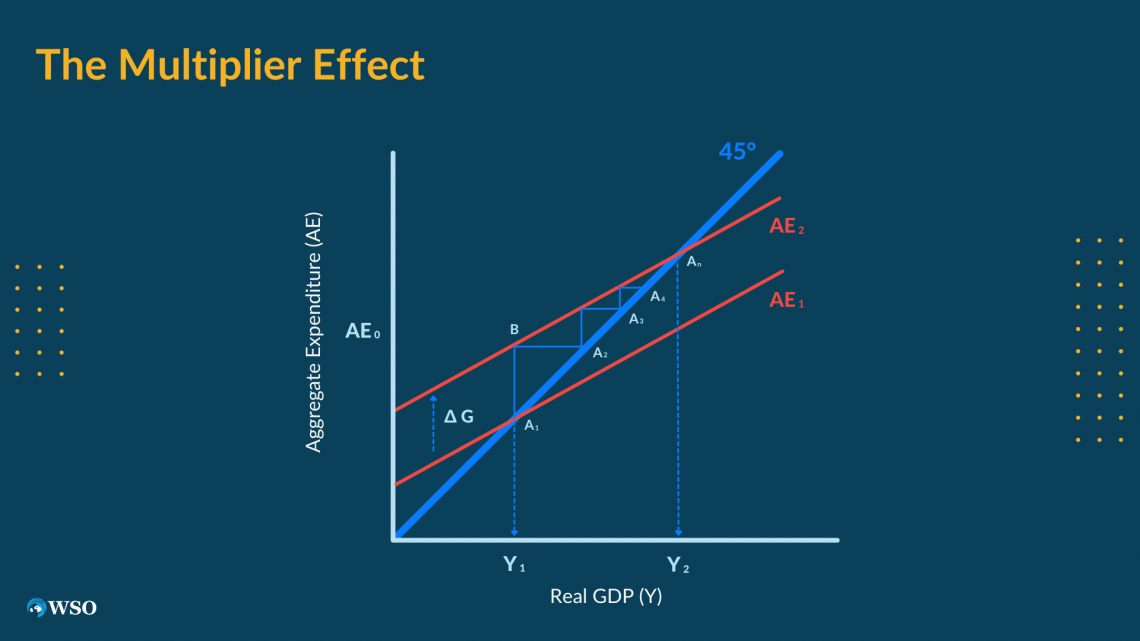

Bitcoins 10x Multiplier Could It Storm Wall Street

May 08, 2025

Bitcoins 10x Multiplier Could It Storm Wall Street

May 08, 2025