Canada Significantly Reduces Tariffs On US Imports: Exemptions Explained

Table of Contents

Key Tariff Reductions Announced by Canada

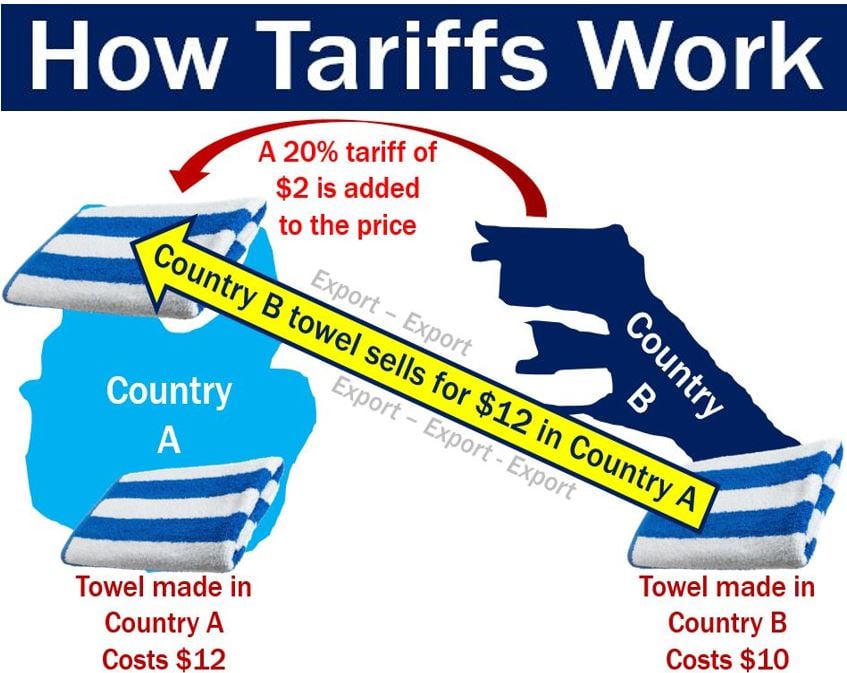

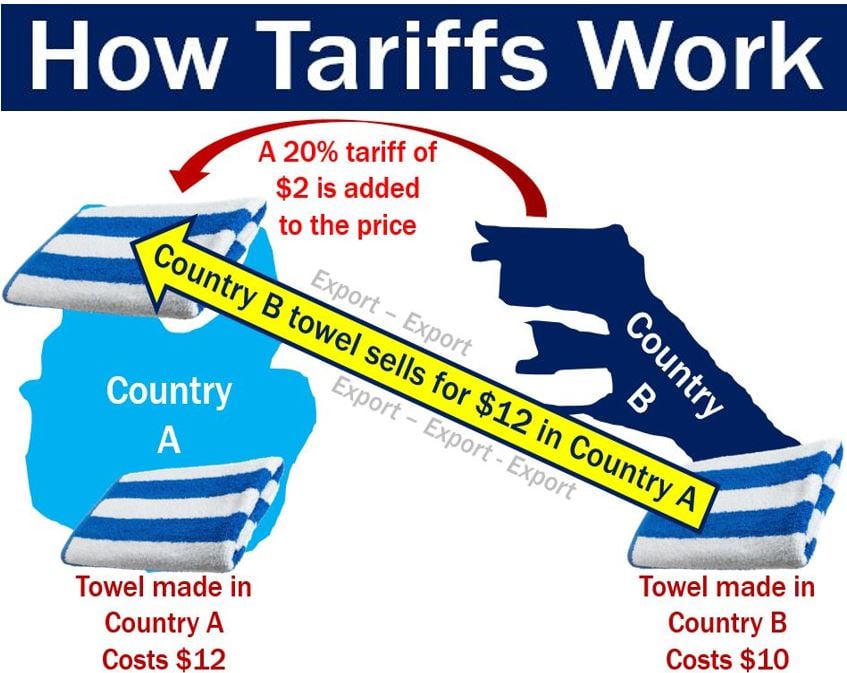

Canada has announced a significant reduction in tariffs on various US imports, aiming to boost bilateral trade and strengthen the economic relationship between the two countries. While the overall percentage reduction varies depending on the product category, many goods will see a substantial decrease in import duties. This Canada-US trade deal represents a considerable shift in the trade landscape.

Specific examples of products experiencing tariff reductions include:

- Dairy products: Previously facing a 25% tariff, the new rate is now 10%, signifying a major shift in the dairy market and opening opportunities for US dairy exporters.

- Lumber: The tariff on lumber has been slashed from 15% to 5%, potentially leading to increased lumber imports from the US and impacting the Canadian construction industry.

- Automotive parts: While the exact percentages vary depending on the specific part, many automotive components will see a noticeable decrease in import duties, streamlining the automotive supply chain between the two nations.

Here's a more detailed breakdown of specific tariff rates:

- Dairy products: Previous tariff rate 25%, New tariff rate 10%.

- Lumber: Previous tariff rate 15%, New tariff rate 5%.

- Automotive parts: Previous tariff rates varied widely (10-20%), New tariff rates reduced by an average of 15%.

These tariff cuts and reductions in import duties are expected to have a significant positive economic impact on both countries. For the US, it opens up access to the Canadian market, potentially boosting exports and creating jobs. For Canada, it could lead to lower prices for consumers and increased competition, fostering innovation and efficiency.

Understanding the Exemptions to the Tariff Reductions

While many US imports will benefit from the reduced tariffs, some product categories remain exempt. These tariff exceptions are primarily due to concerns about protecting domestic industries and maintaining existing trade agreements.

Specific product categories or industries excluded from the tariff reductions include:

- Certain agricultural products: Some agricultural products remain subject to higher tariffs to protect Canadian farmers and maintain food security. This reflects the sensitivity around agricultural trade in both countries.

- Specific manufactured goods: Certain manufactured goods may be exempt due to pre-existing bilateral or multilateral trade agreements. These exceptions are carefully defined to ensure compliance with international trade obligations.

Reasons for exemption:

- Domestic production concerns: Protecting vulnerable domestic industries is a key driver behind these exemptions.

- Existing trade agreements: Maintaining commitments under pre-existing trade agreements is crucial for international trade stability.

For a complete list of exemptions and detailed explanations, refer to the official government documentation: [Link to Official Government Documentation]. This resource provides crucial information regarding Canada import exemptions and their implications.

Navigating the New Trade Landscape: Practical Implications for Businesses

The Canada US tariff reduction presents both challenges and opportunities for businesses on both sides of the border.

Implications for US businesses exporting to Canada:

- Lower tariffs mean increased competitiveness in the Canadian market.

- Businesses need to adjust pricing strategies to reflect the reduced import duties.

- Increased demand for US goods is anticipated.

Implications for Canadian businesses importing from the US:

- Lower costs for imported goods from the US.

- Increased competition from US businesses.

- Need to adapt to the new market dynamics.

Practical steps businesses should take:

- Review existing import/export contracts to assess the impact of the tariff changes.

- Update pricing strategies based on the new tariff rates to remain competitive.

- Seek legal counsel to ensure compliance with all relevant regulations and agreements.

- Utilize resources provided by government agencies like the US Department of Commerce and Global Affairs Canada to understand the changes fully. These resources are invaluable for navigating this new trade compliance landscape.

Resources and Further Information

- Government of Canada: [Link to relevant Canadian government website]

- Government of the United States: [Link to relevant US government website]

- Relevant Trade Organizations: [Links to relevant trade organizations]

- Contact Information for Relevant Government Agencies: [Contact information]

Conclusion

Canada's significant reduction in tariffs on US imports represents a major shift in the Canada US tariff reduction landscape. While offering considerable opportunities, understanding the exemptions and their implications is crucial for businesses. By reviewing contracts, adjusting pricing, and seeking expert advice, businesses can effectively navigate this new trade environment and capitalize on the enhanced opportunities. Stay informed about the latest updates on Canada US tariff reduction to optimize your trade strategy and take advantage of these new opportunities. Explore the resources provided and contact the relevant agencies for more detailed information to develop a successful import/export strategy in this evolving market.

Featured Posts

-

Reddit Service Disruption Us Users Encountering Page Not Found

May 17, 2025

Reddit Service Disruption Us Users Encountering Page Not Found

May 17, 2025 -

Watch Ny Knicks Vs Brooklyn Nets Live Free Stream Tv Schedule And Game Details April 13th 2025

May 17, 2025

Watch Ny Knicks Vs Brooklyn Nets Live Free Stream Tv Schedule And Game Details April 13th 2025

May 17, 2025 -

50 000 Ultraviolette

May 17, 2025

50 000 Ultraviolette

May 17, 2025 -

Angel Reeses Dpoy Award A Triumph Marred By Injury

May 17, 2025

Angel Reeses Dpoy Award A Triumph Marred By Injury

May 17, 2025 -

Photos Cassie Venturas Stunning Red Carpet Look At Mob Land Premiere With Husband Alex Fine

May 17, 2025

Photos Cassie Venturas Stunning Red Carpet Look At Mob Land Premiere With Husband Alex Fine

May 17, 2025