Canada Tariffs: Full Removal Still In Question

Table of Contents

The Current State of Canada Tariffs

Canada's tariff landscape is a complex mix of existing and recently adjusted import and export tariffs. While many tariffs have been lowered through various trade agreements, significant barriers remain for specific goods and sectors. This impacts both Canadian businesses involved in international trade and Canadian consumers who face higher prices on certain imported goods.

-

Specific Examples of Remaining Tariffs: Tariffs remain in place on goods such as lumber, dairy products, and certain agricultural products. These sectors often face significant protectionist measures, even within the framework of agreements like the USMCA. The ongoing debate around supply management in the dairy sector highlights the political complexities involved in tariff removal.

-

Recent Tariff Adjustments: The Canadian government periodically adjusts tariffs based on various factors including international trade negotiations, domestic economic conditions, and anti-dumping measures. These adjustments can lead to both increases and decreases in specific tariff rates, creating uncertainty for businesses.

-

Impact on Canadian Businesses and Consumers: Tariffs increase the cost of imported goods, impacting businesses' input costs and consumers' purchasing power. Higher prices on imported goods can lead to reduced competitiveness for Canadian businesses reliant on imported materials. This also affects consumer spending and overall economic growth.

-

Volume of Goods Affected: While precise data fluctuates, a significant volume of goods traded internationally by Canada is still subject to tariffs, although the overall level has decreased in recent years. Further reduction in tariffs would likely increase trade volumes and benefit the Canadian economy.

The Role of USMCA in Tariff Removal

The United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA, has played a crucial role in reducing some Canada tariffs. However, the agreement hasn't resulted in the complete elimination of all tariffs.

-

USMCA Successes: USMCA successfully lowered or eliminated tariffs on numerous goods, facilitating increased trade between Canada, the US, and Mexico. This led to increased efficiency and reduced costs for many industries.

-

Areas Where USMCA Fell Short: Despite progress, certain sectors remain protected by tariffs. These often involve politically sensitive areas like agriculture and dairy, where protectionist measures are strongly defended.

-

Ongoing Disputes and Challenges: The implementation of USMCA has faced some challenges and ongoing disputes, particularly regarding rules of origin and dispute resolution mechanisms. These disputes can affect the pace of tariff reductions and create uncertainty for businesses.

-

Potential for Future Revisions: The USMCA is not static. Future negotiations could lead to revisions or amendments that further reduce tariffs and streamline trade between the three countries. This would require political will and consensus among the participating nations.

Obstacles to Full Tariff Removal

Several factors hinder the complete removal of Canada tariffs, creating a complex landscape for international trade.

-

Political Obstacles: Domestic political considerations, particularly concerning the protection of specific industries, often pose a significant barrier to tariff removal. Balancing the benefits of free trade with the need to safeguard domestic jobs and businesses is a continuous challenge. International political relations also play a role, as demonstrated by past trade disputes.

-

Lobbying Groups and Industry Interests: Powerful lobbying groups representing specific industries often advocate for maintaining or even increasing tariffs to protect their domestic markets from foreign competition. These groups exert considerable influence on policymakers.

-

Economic Considerations: Concerns about the potential negative economic impact on specific industries – particularly those with limited global competitiveness – often lead to hesitation in fully removing tariffs. The potential for job losses in these sectors is a major concern for policymakers.

-

Environmental Concerns: In some cases, environmental considerations may factor into the decision-making process regarding tariff removal. Concerns about the environmental impact of increased imports or exports of certain goods can lead to restrictions or delays.

The Economic Impact of Canada Tariffs

The existence of, and potential full removal of, Canada tariffs has significant repercussions for the Canadian economy.

-

Impact on GDP Growth: Lower tariffs generally stimulate economic growth by increasing trade, boosting productivity, and lowering consumer prices. The extent of this impact depends on the specific tariffs removed and the responsiveness of the economy.

-

Effects on Inflation and Consumer Prices: The removal of tariffs can lead to lower prices for consumers on imported goods, reducing inflation. Conversely, removing tariffs on certain goods could impact domestic producers and potentially lead to price increases for some goods.

-

Influence on Employment and Job Creation: The impact on employment is complex. While tariff removal may lead to job losses in protected industries, it can also create jobs in export-oriented sectors and industries that benefit from lower input costs.

-

Data and Statistics: Economic modeling and empirical studies are crucial for assessing the specific impacts of tariff changes on the Canadian economy. Data from Statistics Canada and other reputable sources provide valuable insights into these complex relationships.

Conclusion

The complete removal of Canada tariffs remains uncertain despite progress made through agreements like USMCA. Significant economic and political factors continue to influence the pace and extent of tariff reductions. Navigating this complex landscape requires a nuanced understanding of the interplay between domestic policy, international trade agreements, and the interests of various stakeholders. Understanding the nuances of Canada tariffs is crucial for businesses engaging in international trade.

Call to Action: Stay informed about the evolving landscape of Canada tariffs and their impact on various sectors. Follow reputable sources like Statistics Canada, the Department of Finance Canada, and international trade organizations for updates on trade agreements and their potential implications for Canadian businesses. Proactive monitoring of Canada tariffs is essential for strategic planning and successful navigation of the international trade environment.

Featured Posts

-

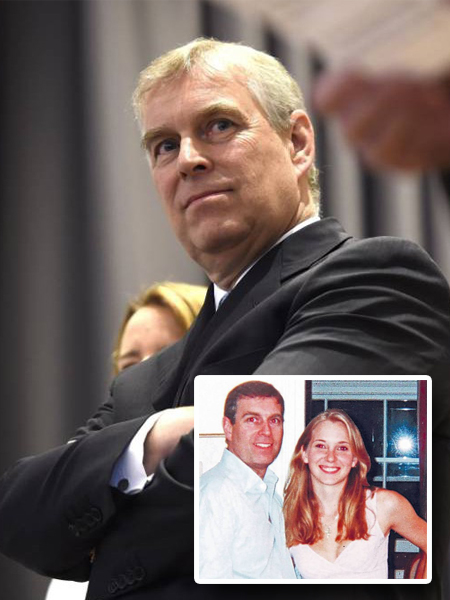

New Footage Surfaces Prince Andrew Facing Serious Accusations Of Underage Relations

May 12, 2025

New Footage Surfaces Prince Andrew Facing Serious Accusations Of Underage Relations

May 12, 2025 -

Santorinis Seismic Shift Scientists Analyze Decreasing Earthquake Frequency

May 12, 2025

Santorinis Seismic Shift Scientists Analyze Decreasing Earthquake Frequency

May 12, 2025 -

Nba Sixth Man Of The Year Is It Payton Pritchard

May 12, 2025

Nba Sixth Man Of The Year Is It Payton Pritchard

May 12, 2025 -

Optimiser Son Budget 12 Astuces Pour Faire Des Economies Significatives

May 12, 2025

Optimiser Son Budget 12 Astuces Pour Faire Des Economies Significatives

May 12, 2025 -

La Vie Amoureuse D Eric Antoine Un Acteur Celebre Implique

May 12, 2025

La Vie Amoureuse D Eric Antoine Un Acteur Celebre Implique

May 12, 2025