Canadian Economic Forecast: OECD Sees Flat Growth For 2025, Recession Unlikely

Table of Contents

Factors Contributing to Flat Growth in the Canadian Economy in 2025

The OECD's prediction of flat economic growth for Canada in 2025 is a result of several interconnected factors. A significant contributor is the ongoing global economic slowdown, impacting Canadian exports, particularly in resource-dependent sectors. Persistent inflation and subsequent interest rate hikes by the Bank of Canada are further dampening consumer spending and business investment. This economic environment creates a challenging climate for growth. The lingering effects of supply chain disruptions and ongoing geopolitical instability add further complexity to the economic outlook.

- Decreased demand for Canadian resources globally: Lower global demand directly impacts Canada's resource-based economy, leading to reduced export revenue and slowing growth.

- High borrowing costs deterring business investment: Increased interest rates make borrowing more expensive, discouraging businesses from investing in expansion or new projects.

- Ongoing uncertainty in global markets: Geopolitical tensions and economic volatility worldwide create uncertainty, making businesses hesitant to commit to long-term investments.

- Potential for labor shortages impacting productivity: While unemployment remains relatively low, potential labor shortages in specific sectors could hamper productivity gains.

Key Sectors to Watch in the Canadian Economic Forecast for 2025

The Canadian economic forecast for 2025 presents a mixed bag for various sectors. Understanding the projected performance of key sectors is crucial for informed decision-making.

- Energy sector: The energy sector faces significant volatility due to fluctuating global oil prices. While potential for growth exists, price swings pose a considerable challenge.

- Real estate: The real estate market is particularly sensitive to interest rate changes. High borrowing costs are expected to continue impacting housing market activity and prices.

- Manufacturing: The manufacturing sector's performance will depend on supply chain resilience and the adoption of automation technologies. Increased automation could boost productivity, while supply chain disruptions could hinder growth.

Why a Recession Remains Unlikely According to the OECD's Canadian Economic Forecast

Despite the prediction of flat economic growth, the OECD believes a recession in Canada remains unlikely in 2025. This assessment is based on several factors. The Canadian labor market demonstrates remarkable resilience, with strong employment numbers suggesting a robust economy. Furthermore, government fiscal measures aimed at supporting economic growth, such as targeted spending programs, may help mitigate a potential downturn. Certain economic sectors continue to show strength, creating a buffer against a more severe economic contraction.

- Strong employment numbers: The sustained strength in the job market signals underlying economic resilience.

- Government fiscal measures to support the economy: Government interventions can help cushion the impact of economic headwinds.

- Resilience of certain economic sectors: The strength in specific sectors helps offset weakness in others.

- Potential for positive surprises: Unforeseen positive developments could improve the economic outlook.

Potential Upside Surprises and Risks to the Canadian Economic Forecast

While the OECD's forecast points to flat growth, several factors could influence the actual outcome. Positive surprises, such as a faster-than-expected decline in inflation or increased global demand for Canadian goods, could lead to better-than-expected economic performance. Conversely, risks such as an escalation of geopolitical tensions or unexpected economic shocks could negatively impact the forecast.

- Stronger-than-expected consumer spending: A surge in consumer confidence could boost economic activity.

- Technological innovation driving productivity growth: Technological advancements can enhance efficiency and lead to stronger economic expansion.

- Risks of further inflation surges: Unexpected increases in inflation could lead to further interest rate hikes, dampening economic growth.

- Potential for increased global uncertainty: Escalating geopolitical issues or unexpected economic shocks abroad could negatively impact Canada.

Conclusion: Navigating the Canadian Economic Forecast for 2025

The OECD's Canadian economic forecast for 2025 anticipates flat growth, but it suggests a recession remains unlikely. This outlook is shaped by a complex interplay of global economic slowdown, inflation, interest rate hikes, and geopolitical uncertainty. While the outlook suggests a period of stagnation, monitoring key sectors like energy, real estate, and manufacturing is crucial. Businesses and investors should understand the potential risks and upside surprises to make informed decisions. Stay informed about the Canadian economic forecast by following our publications for updates and further analysis of the OECD's predictions. Conducting further research into specific sectors is recommended to effectively navigate the 2025 economic outlook. Understanding the nuances of this forecast is key to navigating the Canadian economic landscape successfully.

Featured Posts

-

San Francisco Giants Vs Arizona Diamondbacks Hicks Pitching And The Defeat

May 28, 2025

San Francisco Giants Vs Arizona Diamondbacks Hicks Pitching And The Defeat

May 28, 2025 -

Ronaldo Ya Fenerbahce Teklifi Danimarka Dan Bir Tuerk Taraftarin Cagrisi

May 28, 2025

Ronaldo Ya Fenerbahce Teklifi Danimarka Dan Bir Tuerk Taraftarin Cagrisi

May 28, 2025 -

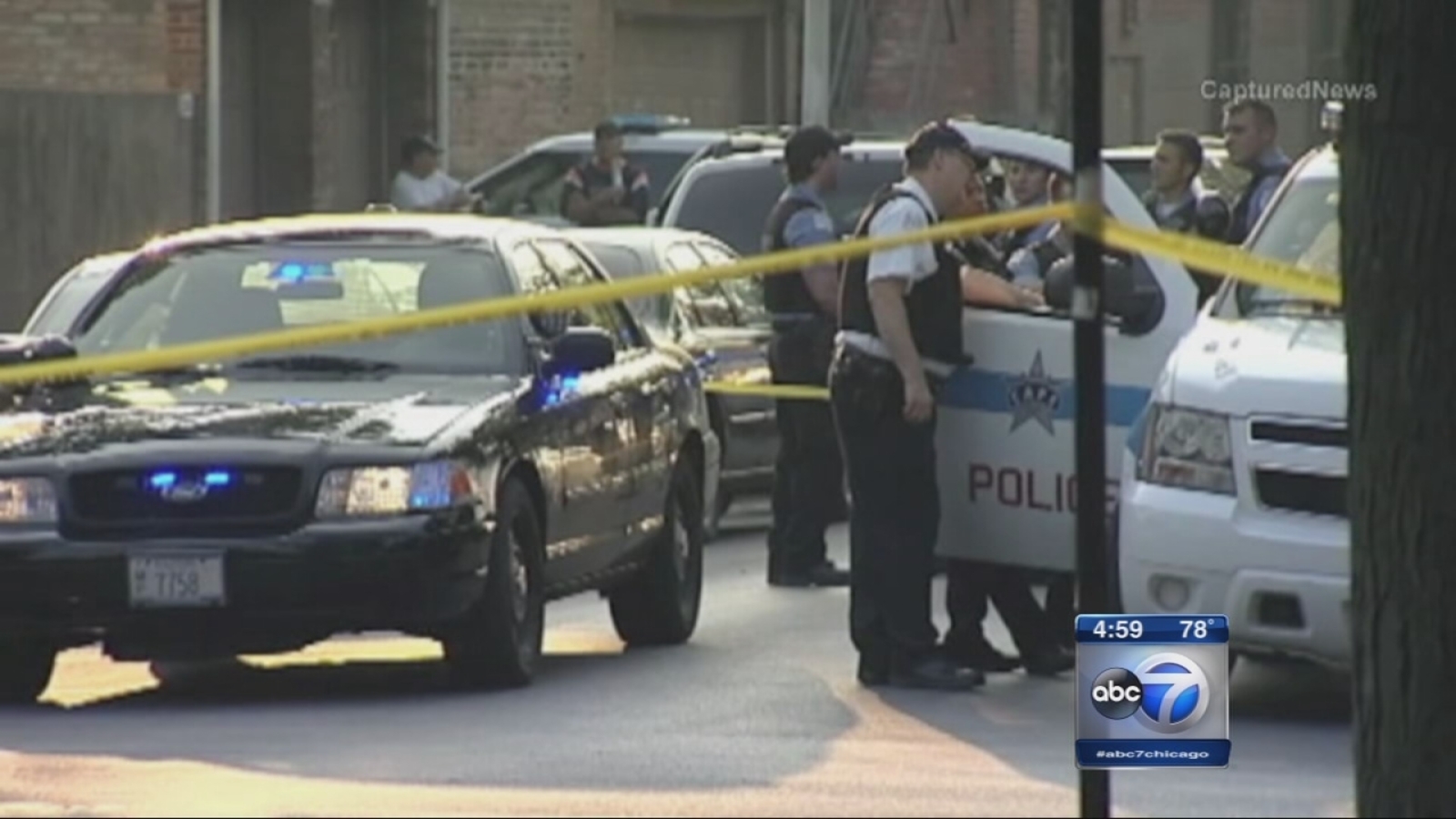

What Caused The Recent Decrease In Crime In Chicago

May 28, 2025

What Caused The Recent Decrease In Crime In Chicago

May 28, 2025 -

Avrupa Yi Sarsacak Transfer Ingiliz Devi Anlasmaya Cok Yakin

May 28, 2025

Avrupa Yi Sarsacak Transfer Ingiliz Devi Anlasmaya Cok Yakin

May 28, 2025 -

Palisades Fire A List Of Celebrities Affected By Home Losses

May 28, 2025

Palisades Fire A List Of Celebrities Affected By Home Losses

May 28, 2025

Latest Posts

-

Malaga Hosts Mein Schiff Relax Christening With Robbie Williams

May 29, 2025

Malaga Hosts Mein Schiff Relax Christening With Robbie Williams

May 29, 2025 -

Starboards Retail Expansion On Tui Cruises Mein Schiff Relax

May 29, 2025

Starboards Retail Expansion On Tui Cruises Mein Schiff Relax

May 29, 2025 -

Mein Schiff Relax Christening Robbie Williams Star Performance

May 29, 2025

Mein Schiff Relax Christening Robbie Williams Star Performance

May 29, 2025 -

Starboard Group Expands Partnership With Tui Cruises Mein Schiff Relax Retail Launch

May 29, 2025

Starboard Group Expands Partnership With Tui Cruises Mein Schiff Relax Retail Launch

May 29, 2025 -

Record Breaking E360m Cruise Ship Visits Liverpool

May 29, 2025

Record Breaking E360m Cruise Ship Visits Liverpool

May 29, 2025