Canadian Housing Market Correction: Is Posthaste The New Normal?

Table of Contents

Signs of a Canadian Housing Market Correction

Several key indicators point to a significant correction underway in the Canadian housing market. These signs, while varying regionally, collectively paint a picture of a market transition.

Declining Sales

Across Canada, housing sales are demonstrably declining. The Canadian Real Estate Association (CREA) reports a substantial drop in transactions compared to the peak years.

- Vancouver: Experienced a significant decrease in sales volume in Q3 2023 compared to the same period in 2022.

- Toronto: Similar trends are evident in Toronto, with sales figures consistently below previous year's levels.

- Montreal: While still active, the Montreal market has also seen a slowdown in sales activity.

These declines are largely attributed to rising interest rates and increasing affordability concerns, making homeownership less accessible to many potential buyers.

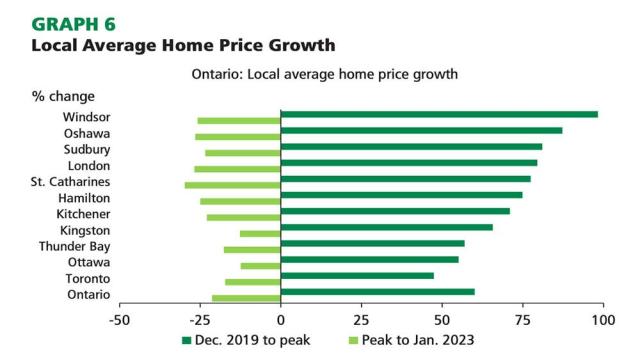

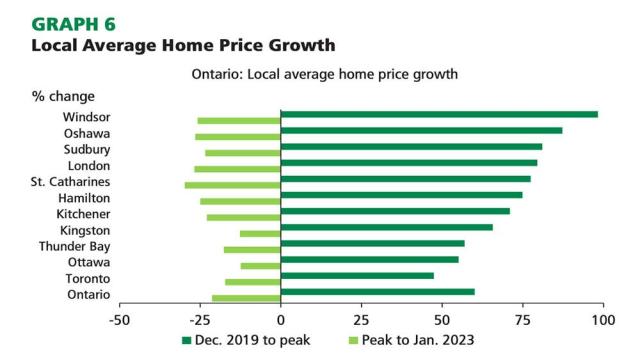

Price Adjustments

The once relentless climb in average home prices is slowing, and in some areas, prices are actively decreasing. This price adjustment is impacting various market segments.

- Detached Homes: While still commanding high prices, the rate of price growth for detached homes has significantly slowed.

- Condos: Certain condo markets are experiencing more noticeable price drops, especially in areas with higher inventory levels.

- Regional Variations: Price adjustments are not uniform across the country. Some regions, particularly those previously experiencing rapid price growth, are witnessing sharper corrections than others.

This shift signifies a transition from a seller's market to a more balanced environment, giving buyers more negotiating power.

Increased Inventory

The number of homes available for sale is steadily increasing, a stark contrast to the low inventory levels that characterized the market in recent years.

- Major Cities: Many major Canadian cities are reporting a noticeable increase in the number of homes listed for sale.

- Implications for Buyers: Increased inventory empowers buyers, enabling them to be more selective and potentially negotiate better prices.

This surge in inventory is a clear signal that the market is shifting towards a more balanced state, offering buyers more options and potentially influencing pricing.

Factors Contributing to the Canadian Housing Market Correction

Several interconnected factors have converged to contribute to this ongoing correction in the Canadian housing market.

Rising Interest Rates

The Bank of Canada's series of interest rate hikes to combat inflation has significantly impacted mortgage affordability.

- Higher Monthly Payments: Increased interest rates translate directly into higher monthly mortgage payments, making homeownership less attainable for many.

- Reduced Purchasing Power: Higher interest rates effectively reduce potential homebuyers’ purchasing power, limiting the price range they can afford.

These rate increases have played a pivotal role in cooling buyer demand and influencing the overall market correction.

Economic Uncertainty

Broader economic headwinds are also affecting the housing market.

- Inflation & Recessionary Fears: High inflation and the threat of a recession are eroding consumer confidence, leading to increased caution among potential homebuyers.

- Job Security Concerns: Concerns about job security and potential income reductions further dampen buyer enthusiasm and purchasing power.

Economic uncertainty is contributing to a more conservative approach towards significant investments like homeownership.

Government Policies

Government policies, such as stress tests and foreign buyer taxes, have also played a role in shaping market dynamics.

- Stress Tests: Mortgage stress tests aim to ensure buyers can handle potential interest rate increases, impacting borrowing capacity.

- Foreign Buyer Taxes: These taxes aim to curb foreign investment and help cool certain overheated markets.

Government interventions, while intended to promote market stability, have also influenced buyer behavior and overall market activity.

Is "Posthaste" the New Normal for the Canadian Housing Market?

Predicting the future of the Canadian housing market requires considering various perspectives and regional nuances.

Forecasting Future Trends

Experts offer varying forecasts, ranging from predictions of continued correction to those anticipating market stabilization or even a rebound.

- Short-Term Outlook: Many analysts predict a continued period of adjustment and price stabilization in the short term.

- Long-Term Outlook: The long-term outlook remains uncertain, dependent on factors like inflation control, economic growth, and government policy adjustments.

Regional Differences

Market conditions vary significantly across Canada.

- Major Urban Centers: Major cities like Toronto and Vancouver are likely to experience different trends compared to smaller urban areas or rural regions.

- Provincial Variations: Provincial-level economic conditions and housing policies also influence market dynamics.

Advice for Buyers and Sellers

Navigating the current market requires strategic planning.

- Buyers: Thorough research, securing pre-approval, and patient negotiation are crucial for successful home buying.

- Sellers: Realistic pricing, effective marketing, and professional guidance can help optimize sale outcomes.

Conclusion

The Canadian housing market correction is a multifaceted phenomenon driven by rising interest rates, economic uncertainty, and government policies. Whether this correction proceeds "posthaste" or unfolds more gradually remains to be seen. However, the current trends suggest a significant shift away from the rapid price escalation of previous years. Understanding these dynamics is crucial for navigating the evolving landscape. Stay informed about Canadian housing market trends and seek professional advice before making any significant Canadian real estate market correction related decisions. Successfully navigating the Canadian housing market correction requires informed decision-making and a clear understanding of the current market conditions.

Featured Posts

-

Experience Report Googles Ai Smart Glasses Prototype

May 22, 2025

Experience Report Googles Ai Smart Glasses Prototype

May 22, 2025 -

Accentures 50 000 Promotions A Six Month Wait Ends

May 22, 2025

Accentures 50 000 Promotions A Six Month Wait Ends

May 22, 2025 -

Thames Water Executive Bonuses A Closer Look At The Controversy

May 22, 2025

Thames Water Executive Bonuses A Closer Look At The Controversy

May 22, 2025 -

Echo Valley Images Offer First Look At Sweeney And Moores Upcoming Film

May 22, 2025

Echo Valley Images Offer First Look At Sweeney And Moores Upcoming Film

May 22, 2025 -

600 Year Old Tower In China Partially Collapses Impact On Tourism

May 22, 2025

600 Year Old Tower In China Partially Collapses Impact On Tourism

May 22, 2025

Latest Posts

-

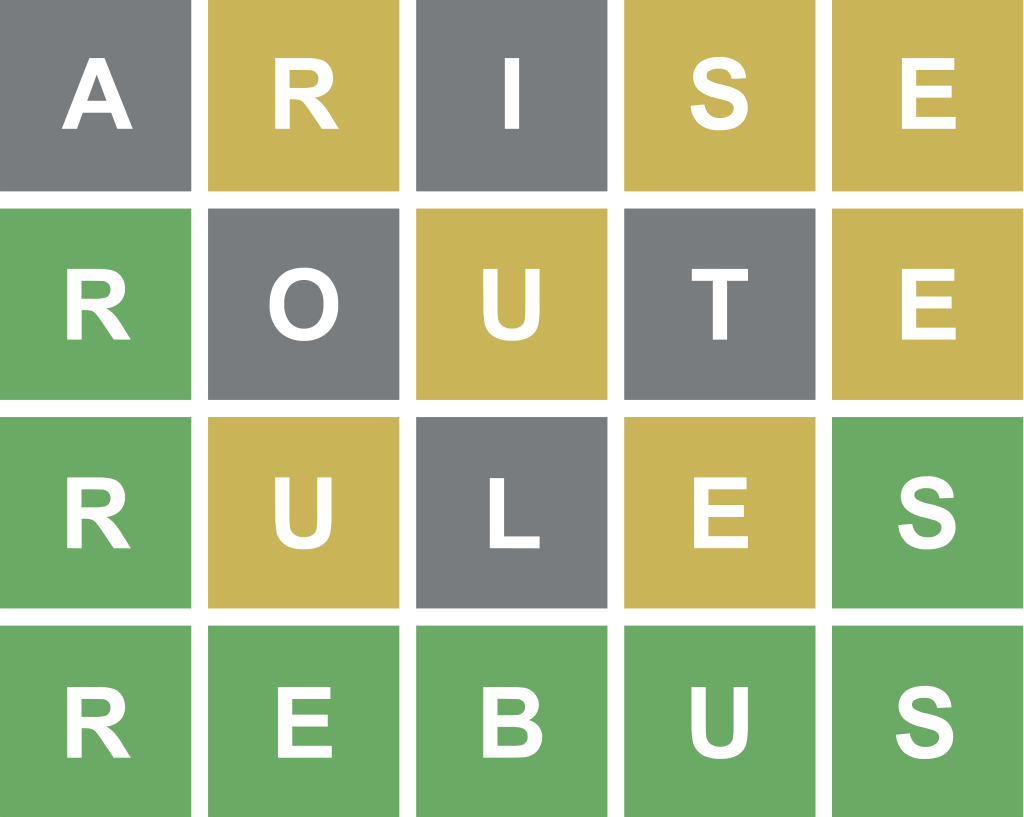

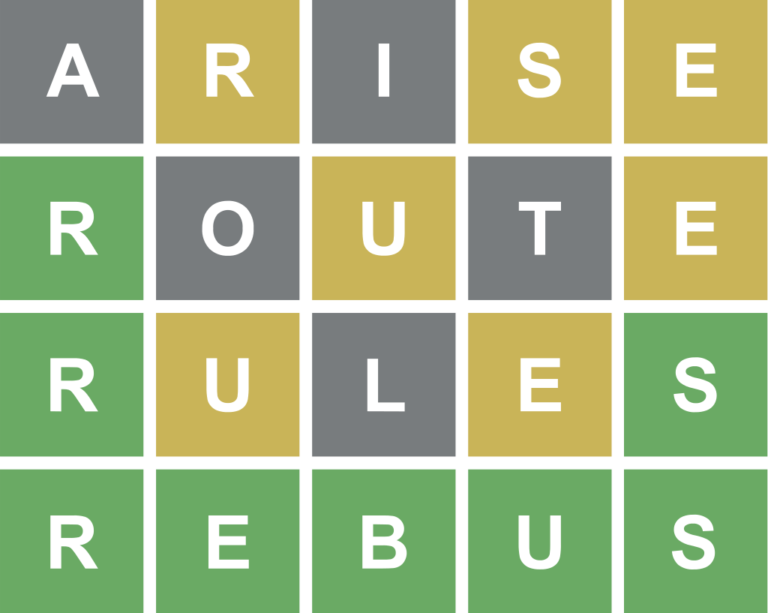

Wordle Help Nyt Answer For March 26

May 22, 2025

Wordle Help Nyt Answer For March 26

May 22, 2025 -

Wordle Answer Today March 16th Hints And Solution For Wordle 1366

May 22, 2025

Wordle Answer Today March 16th Hints And Solution For Wordle 1366

May 22, 2025 -

Nyt Wordle March 26 Help With Todays Challenging Puzzle

May 22, 2025

Nyt Wordle March 26 Help With Todays Challenging Puzzle

May 22, 2025 -

Wordle 1366 Solution March 16th Wordle Puzzle Solved

May 22, 2025

Wordle 1366 Solution March 16th Wordle Puzzle Solved

May 22, 2025 -

Tough Wordle Today March 26 Heres The Nyt Solution

May 22, 2025

Tough Wordle Today March 26 Heres The Nyt Solution

May 22, 2025