Celtics Sale To Private Equity: A $6.1 Billion Deal And Fan Concerns

Table of Contents

The $6.1 Billion Deal: A Deep Dive into the Acquisition

The Boston Celtics' sale marks a significant moment in sports history. The buyer, [Insert Private Equity Firm Name Here], a prominent player in the private equity landscape known for its investments in [mention relevant sectors, e.g., sports and entertainment, media], successfully closed the deal after [mention duration of the sale process]. The $6.1 billion valuation is unprecedented in basketball, highlighting the increasing financial power driving professional sports acquisitions. This valuation surpasses previous records for NBA team sales, setting a new benchmark for the industry.

- Key figures involved: [List key individuals from both the selling and buying sides, including names and titles].

- Strategic rationale: For [Insert Private Equity Firm Name Here], the acquisition likely represents a strategic move to diversify their portfolio into a high-growth, high-profile asset with significant long-term value. The Celtics' strong brand, passionate fanbase, and potential for future revenue growth make it an attractive investment.

- Comparison to other sales: Compared to other high-profile sports team sales, such as [mention examples, e.g., the sale of the Brooklyn Nets or the Los Angeles Dodgers], the Celtics' sale price signifies the escalating value of established franchises in major leagues.

Impact on Celtics Fans: Ticket Prices, Team Culture, and Ownership

The most pressing concern for Celtics fans revolves around potential ticket price increases following this "Celtics Sale to Private Equity." Private equity firms often seek to maximize returns on investment, and this can translate to higher operational costs, including ticket prices, concessions, and merchandise. Further, changes to the team's overall culture and operational structure under new ownership are also a significant worry. Will the emphasis shift from winning championships to maximizing profits?

- Examples of past team changes: Examining similar acquisitions in other sports leagues, we can see varied outcomes. Some teams maintained their winning culture, while others faced significant shifts in management and playing styles. [Cite specific examples].

- Fan reaction: Social media and online fan forums are buzzing with discussion. Many fans express concern about the potential loss of the team's unique identity and traditions. Others are cautiously optimistic, hoping for increased investment in infrastructure and player recruitment.

- Potential benefits: While price increases are a legitimate concern, the influx of capital could lead to stadium upgrades, improved fan experience, and potentially increased investment in player acquisitions, ultimately benefiting the team's on-court performance.

The Role of Private Equity in Sports: Advantages and Disadvantages

The increasing involvement of private equity firms in professional sports presents both opportunities and challenges. This trend is driven by the potential for significant returns on investment in established franchises with strong brands and loyal fan bases.

- Advantages: Private equity can bring increased financial resources, leading to improved infrastructure, enhanced player recruitment strategies, and improved overall financial performance.

- Disadvantages: The focus on short-term returns can lead to neglecting long-term team building, increased pressure on management to meet financial targets, and potentially impacting the team's overall culture.

- Examples: [Provide specific examples of successful and unsuccessful private equity involvement in professional sports, citing specific outcomes].

- Regulatory environment: The regulatory landscape surrounding such acquisitions is crucial to ensure fair play and protect the interests of both the teams and their fans.

Addressing Fan Concerns and Future Outlook

Many fans worry about the potential loss of the team's unique identity and traditions after the "Celtics Sale to Private Equity." These concerns are valid and must be addressed. Open communication between the new ownership and the fans will be crucial to build trust and manage expectations. Transparency regarding financial decisions, commitment to community engagement, and a focus on maintaining the team’s winning legacy could help mitigate these fears. The future outlook remains uncertain, but a balanced approach focusing on both financial success and the team's identity is crucial.

Conclusion: The Future of the Celtics After the Private Equity Sale

The $6.1 billion Celtics sale to private equity represents a watershed moment for the franchise. While the potential for increased investment and improved financial performance exists, valid concerns regarding ticket prices, team culture, and long-term stability remain. The success of this acquisition will depend on the new ownership's ability to balance financial goals with the preservation of the team’s unique identity and commitment to its loyal fans. We encourage you to share your thoughts and opinions on the Celtics Sale to Private Equity in the comments section below. [Link to relevant articles or resources]. Let's continue the conversation!

Featured Posts

-

Maple Leafs Vs Blue Jackets Nhl Game Prediction Betting Odds And Analysis

May 15, 2025

Maple Leafs Vs Blue Jackets Nhl Game Prediction Betting Odds And Analysis

May 15, 2025 -

Giants Vs Padres Game Prediction Analyzing A Potential Upset

May 15, 2025

Giants Vs Padres Game Prediction Analyzing A Potential Upset

May 15, 2025 -

Opposition Analysis Preparing To Face The San Jose Earthquakes

May 15, 2025

Opposition Analysis Preparing To Face The San Jose Earthquakes

May 15, 2025 -

Filtrer L Eau Du Robinet Est Ce Vraiment Possible

May 15, 2025

Filtrer L Eau Du Robinet Est Ce Vraiment Possible

May 15, 2025 -

Boil Water Advisory In Effect Anderson County Rural Water District 4 Kdhe

May 15, 2025

Boil Water Advisory In Effect Anderson County Rural Water District 4 Kdhe

May 15, 2025

Latest Posts

-

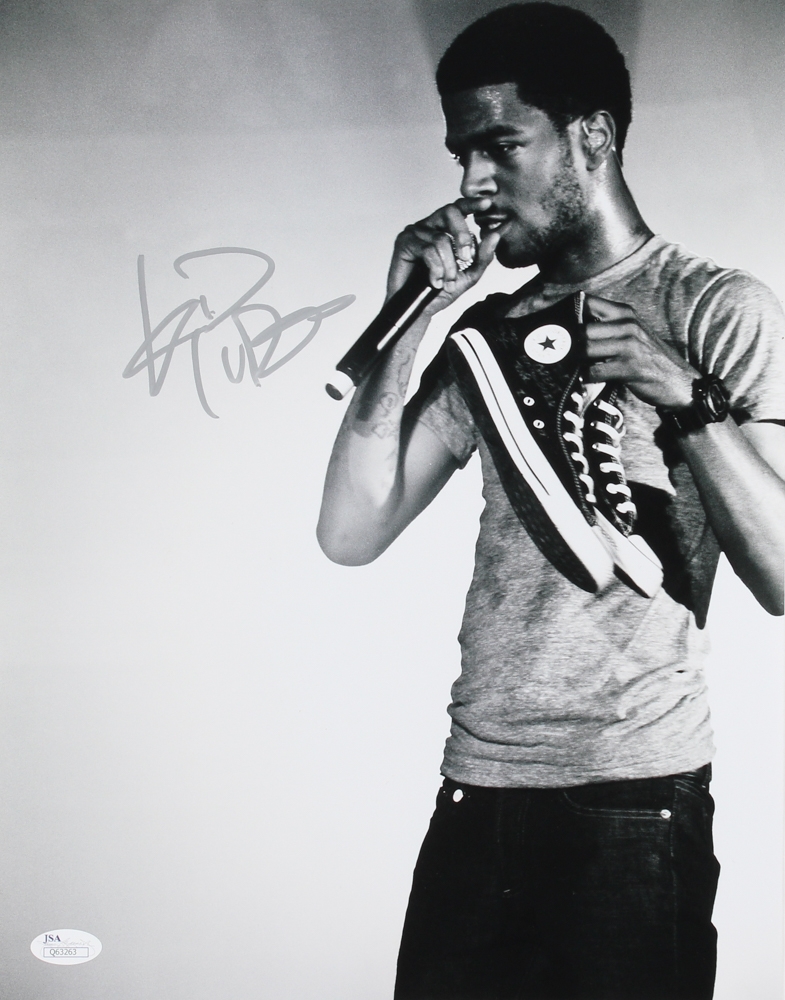

High Bids Mark Kid Cudis Personal Items Auction Success

May 15, 2025

High Bids Mark Kid Cudis Personal Items Auction Success

May 15, 2025 -

Kid Cudi Memorabilia Fetches Record Prices At Auction

May 15, 2025

Kid Cudi Memorabilia Fetches Record Prices At Auction

May 15, 2025 -

Kid Cudis Personal Belongings Sell For Record Breaking Amounts

May 15, 2025

Kid Cudis Personal Belongings Sell For Record Breaking Amounts

May 15, 2025 -

Kid Cudi Memorabilia Fetches High Price At Auction

May 15, 2025

Kid Cudi Memorabilia Fetches High Price At Auction

May 15, 2025 -

Auction Of Kid Cudis Personal Items Yields Unexpectedly High Prices

May 15, 2025

Auction Of Kid Cudis Personal Items Yields Unexpectedly High Prices

May 15, 2025