Celtics Sale To Private Equity: A $6.1 Billion Deal And Fan Uncertainty

Table of Contents

The $6.1 Billion Deal: A Record-Breaking Transaction

The sale of the Boston Celtics represents the highest price ever paid for an NBA franchise, shattering previous records and highlighting the immense value of established sports teams. The buyer is [Insert Name of Private Equity Firm], a prominent player in the investment world known for its strategic acquisitions and portfolio management. The seller was [Insert Name of Previous Ownership Group], who had overseen a period of significant success for the team, both on and off the court.

The $6.1 billion valuation speaks volumes about the Celtics' enduring brand strength, their consistent on-court performance, their lucrative location in Boston, and their significant potential for future revenue generation through various avenues like merchandise sales, media rights, and sponsorships. This massive price tag underscores the Celtics' place as one of the most valuable sports franchises globally.

- Exact sale price: $6.1 billion

- Sale date: [Insert Date]

- Key individuals involved: [List key individuals from both buyer and seller sides]

- Comparison to other sales: Compared to the [previous highest sale price] for the [previous highest selling team], this sale represents a significant leap in NBA franchise valuations.

The Private Equity Firm: Understanding the New Ownership

[Insert Name of Private Equity Firm]'s acquisition of the Celtics marks a significant shift in ownership structure. Understanding their investment strategy is crucial to gauging the potential impact on the team. The firm has a history of [briefly describe their investment strategy and past successes, including any relevant experience in sports or entertainment]. Their stated goals for the Celtics franchise will likely be crucial in determining the direction the team takes in the coming years.

The transition to private equity ownership often brings with it potential changes in team management, player acquisition strategies, and operational efficiency. Private equity firms are known for their focus on maximizing returns on investment, which can sometimes lead to shifts in priorities. This could mean a more aggressive approach to player trades or a greater emphasis on revenue generation.

- Private equity firm background: [Expand on their investment history and expertise]

- Stated goals for the Celtics: [Include any publicly available statements or inferred goals]

- Potential changes: Increased focus on analytics-driven decision-making, potential changes in coaching staff, or a more aggressive approach to free agency.

Fan Concerns and the Future of the Celtics

The "Celtics sale to private equity" has understandably generated a range of emotions among Celtics fans. Many are concerned about the potential impact on ticket prices, the team's player roster, and the overall direction of the franchise. Concerns expressed online range from fears of increased ticket costs pricing out loyal fans to anxieties about player trades driven by financial considerations rather than on-court success.

However, it's crucial to also consider potential positive aspects. A private equity firm with deep pockets could significantly increase investment in team infrastructure, player development programs, and marketing initiatives. Open communication between the new owners and the fanbase will be essential in alleviating anxieties.

- Common fan concerns: Increased ticket prices, potential star player trades, a shift in team culture.

- Potential positive aspects: Increased investment in facilities, enhanced player development, improved marketing campaigns.

- Potential negative aspects: Prioritization of short-term profits over long-term team success, increased ticket prices, decreased community engagement.

Impact on Ticket Prices and Season Ticket Holders

One of the most pressing concerns for Celtics fans revolves around ticket pricing. Private equity firms often employ sophisticated pricing strategies to maximize revenue. Their past track records with ticket pricing in other ventures will be closely scrutinized. Season ticket holders, in particular, will be watching closely to see whether their long-term commitment is valued and whether prices reflect the overall investment made in the team's future.

Conclusion: The Celtics Sale: What's Next?

The $6.1 billion "Celtics sale to private equity" represents a significant moment in NBA history. While the sale has sparked uncertainty amongst fans, the enormous price tag reflects the Celtics' enduring legacy and potential for future growth. The success of this new chapter will depend heavily on the new owners' management style, their commitment to fan engagement, and their ability to balance financial goals with the long-term success of the team on the court. Transparency and open communication will be paramount in building and maintaining trust with the passionate Celtics fanbase. Share your thoughts on the Celtics sale to private equity and stay tuned for further updates on this significant development!

Featured Posts

-

Ducks Carlsson Scores Twice But Stars Win In Overtime Thriller

May 15, 2025

Ducks Carlsson Scores Twice But Stars Win In Overtime Thriller

May 15, 2025 -

Proposed Nets Celtics Kevin Durant Trade A Potential Nba Earthquake

May 15, 2025

Proposed Nets Celtics Kevin Durant Trade A Potential Nba Earthquake

May 15, 2025 -

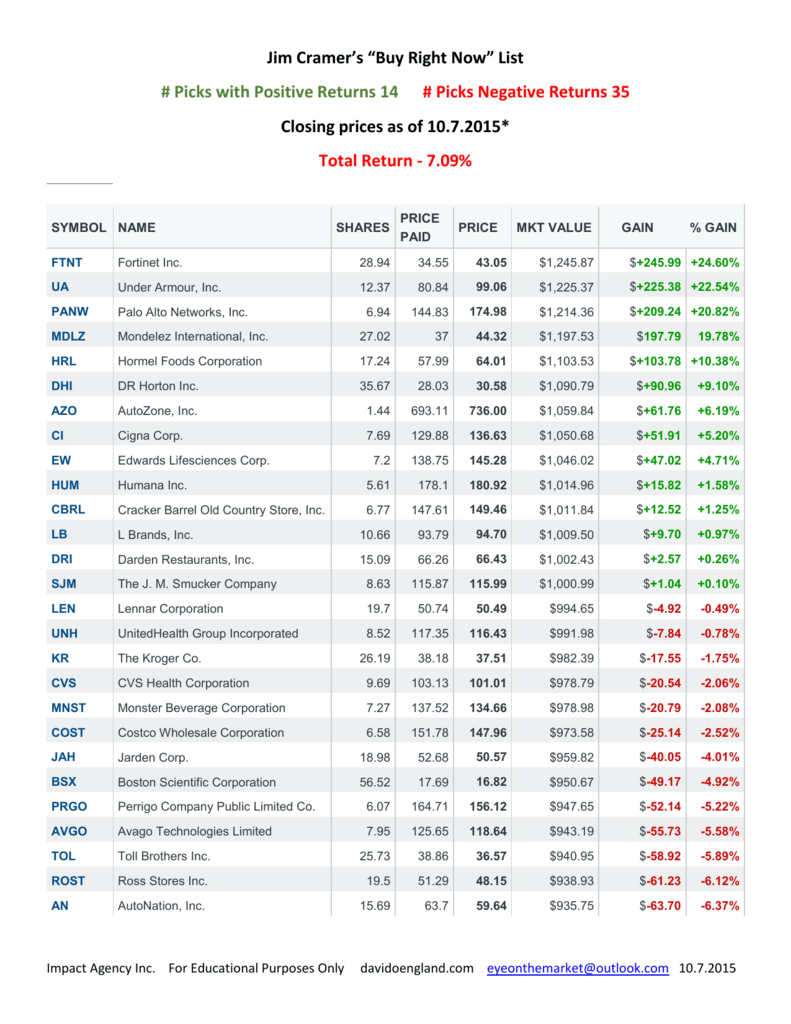

Foot Locker Fl Jim Cramers Analysis And Investment Recommendation

May 15, 2025

Foot Locker Fl Jim Cramers Analysis And Investment Recommendation

May 15, 2025 -

Top Baby Names Of 2024 Familiar Favorites And Fresh Picks

May 15, 2025

Top Baby Names Of 2024 Familiar Favorites And Fresh Picks

May 15, 2025 -

Chandler Simpsons Breakout Game Fuels Rays Sweep Of Padres

May 15, 2025

Chandler Simpsons Breakout Game Fuels Rays Sweep Of Padres

May 15, 2025

Latest Posts

-

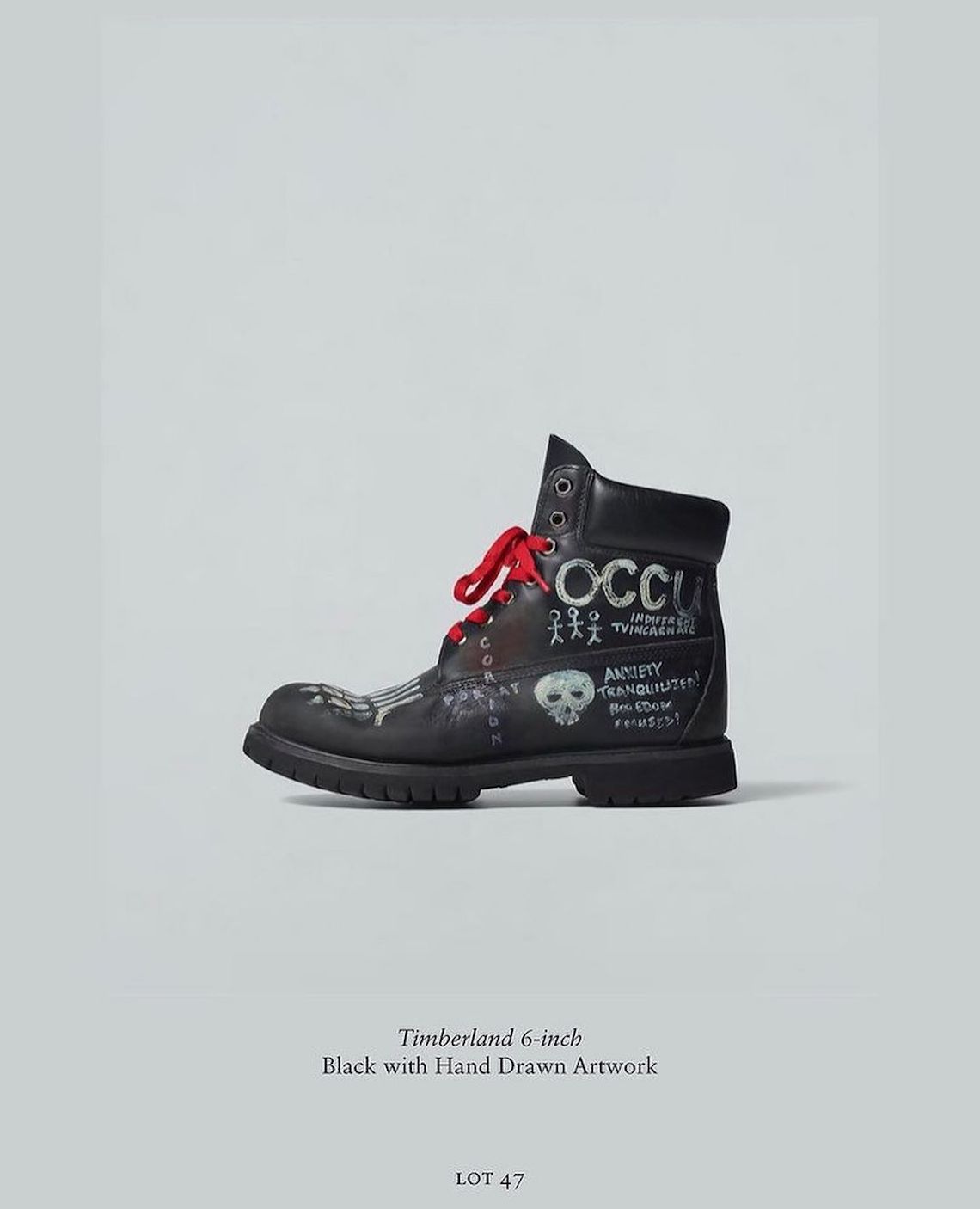

High Bids For Kid Cudis Personal Effects At Recent Auction

May 15, 2025

High Bids For Kid Cudis Personal Effects At Recent Auction

May 15, 2025 -

Kid Cudi Joopiter Auction Date Items And Bidding Information

May 15, 2025

Kid Cudi Joopiter Auction Date Items And Bidding Information

May 15, 2025 -

Kid Cudis Artwork Joopiter Auction Announcement

May 15, 2025

Kid Cudis Artwork Joopiter Auction Announcement

May 15, 2025 -

High Bids For Kid Cudis Jewelry And Sneakers At Recent Auction

May 15, 2025

High Bids For Kid Cudis Jewelry And Sneakers At Recent Auction

May 15, 2025 -

Kid Cudi Auction Jewelry And Sneakers Fetch High Prices

May 15, 2025

Kid Cudi Auction Jewelry And Sneakers Fetch High Prices

May 15, 2025