Chime IPO Filing: A Deep Dive Into Revenue And Digital Banking Disruption

Table of Contents

Chime's Revenue Model: Unveiling the Numbers

Understanding Chime's financial strength is crucial for assessing the Chime IPO filing. Its revenue model is multifaceted, relying on a combination of strategies to generate income.

Subscription and Fee Revenue

Chime offers various subscription tiers—Chime Basic, Chime Plus, and potentially others—each with different features and pricing. Revenue from these subscriptions forms a cornerstone of Chime's income. While Chime is known for its no-overdraft-fee model for basic accounts, the higher-tiered services might incorporate different fee structures. This contrasts sharply with traditional banks, which often rely heavily on overdraft fees and other charges. Analyzing the specific revenue breakdown from these subscription tiers within the Chime IPO filing will be critical for investors.

- Chime Basic: Free checking account, offering core functionalities.

- Chime Plus: Paid subscription with additional features such as early direct deposit, overdraft protection, and potentially other premium services.

- Future tiers: The IPO filing might reveal plans for additional subscription tiers catering to different customer needs.

The Chime IPO filing should offer detailed data on the contribution of each subscription level to overall revenue, providing crucial insights into the company's financial health.

Interchange Fees and Payment Processing

A significant portion of Chime's revenue stems from interchange fees earned on debit card transactions. These fees are paid by merchants to payment processors every time a Chime debit card is used. Chime's strategic partnerships with payment processors are essential for this revenue stream's success. The profitability of this revenue stream compared to subscription fees will be a key data point to watch in the Chime IPO filing.

- Debit card usage: The volume and frequency of debit card transactions directly impact this revenue stream.

- Payment processor relationships: The terms and conditions of Chime's partnerships with payment processors will influence its profitability.

Other Revenue Streams (if applicable)

The Chime IPO filing might reveal other revenue streams, such as investment products or lending services. Diversification into these areas could significantly impact future growth and financial stability. The inclusion (or lack thereof) of these additional revenue sources in the filing will be an important factor in assessing the long-term viability of the company.

Chime's Disruptive Impact on the Digital Banking Landscape

Chime's success isn't just about its revenue model; it's about its disruptive impact on the digital banking landscape.

Challenging Traditional Banks

Chime's no-fee model (for basic services) and user-friendly mobile app directly challenge the practices of traditional banks. By targeting a demographic often underserved by traditional institutions, particularly younger generations and those with limited banking access, Chime has carved a significant niche for itself. Innovative features such as early direct deposit and budgeting tools further enhance the customer experience, driving user loyalty and growth.

- No-fee structure: A key differentiator attracting customers frustrated with traditional bank fees.

- Mobile-first approach: A seamless and intuitive mobile app enhances accessibility and convenience.

- Targeted marketing: Focuses on reaching underserved demographics.

Technological Innovation

Chime leverages technology to improve efficiency and reduce operational costs. Its mobile-first strategy is paramount, enabling cost-effective customer service and efficient transaction processing. The use of AI or machine learning could further enhance their operations, potentially optimizing fraud detection and personalized financial advice. The Chime IPO filing might detail the specific technologies and their impact on operational efficiency.

- Mobile-first banking: Cost-effective and accessible to a broad range of users.

- AI and Machine Learning: Potential applications in fraud detection, risk assessment, and personalized financial advice.

The Future of Fintech and Competition

Chime's success is not without challenges. The competitive landscape of fintech is dynamic, with numerous other digital banking platforms vying for market share. The Chime IPO filing will shed light on its competitive advantages and strategies for maintaining its leading position. Understanding this competitive landscape is essential for investors assessing the potential risks and rewards.

- Competitive landscape: Analyzing other fintech companies and their market strategies.

- Market trends: Understanding evolving consumer preferences and technological advancements.

Analyzing the Chime IPO Filing: Key Takeaways for Investors

The Chime IPO filing will be a crucial document for investors assessing the company's valuation, growth potential, and associated risks.

Valuation and Market Expectations

The valuation of Chime, as disclosed in the IPO filing, will be a critical benchmark. Analyzing investor sentiment and understanding the market expectations will be vital for prospective investors. Comparing Chime's valuation to similar fintech companies will provide context and inform investment decisions. The IPO filing will provide essential financial data enabling these comparisons.

- Valuation metrics: Examining key metrics such as Price-to-Earnings (P/E) ratio and other relevant financial ratios.

- Market comparison: Benchmarking Chime's valuation against competitors.

Growth Potential and Future Outlook

The Chime IPO filing will outline the company's long-term strategy and growth projections. Assessing the sustainability of its competitive advantages and identifying potential risks to future growth will be essential for investors. This includes considering factors like regulatory changes, competition, and macroeconomic conditions.

- Long-term strategy: Analyzing Chime's plans for expansion and diversification.

- Risk assessment: Identifying potential challenges and threats to future growth.

Conclusion: Chime IPO Filing – The Future of Banking is Here

The Chime IPO filing represents a significant moment for the fintech industry. Chime's innovative approach to digital banking, its robust revenue model, and its disruptive impact on the traditional banking sector have all contributed to its meteoric rise. Understanding the details within the Chime IPO filing – from its revenue streams and competitive landscape to its valuation and future prospects – is crucial for investors and industry observers alike. Stay informed about the Chime IPO filing and the future of digital banking by subscribing to our newsletter! Dive deeper into the implications of this momentous event and the ever-evolving landscape of fintech with our comprehensive resources.

Featured Posts

-

Disney S Snow White 2025 Digital Release Date Prediction

May 14, 2025

Disney S Snow White 2025 Digital Release Date Prediction

May 14, 2025 -

Walmart Great Value Recalls 14 Significant Product Withdrawals

May 14, 2025

Walmart Great Value Recalls 14 Significant Product Withdrawals

May 14, 2025 -

Staten Island Nonna Restaurants A Taste Of Tradition

May 14, 2025

Staten Island Nonna Restaurants A Taste Of Tradition

May 14, 2025 -

Joaquin Caparros Nuevo Entrenador Del Sevilla Fc Tras El Despido De Garcia Pimienta

May 14, 2025

Joaquin Caparros Nuevo Entrenador Del Sevilla Fc Tras El Despido De Garcia Pimienta

May 14, 2025 -

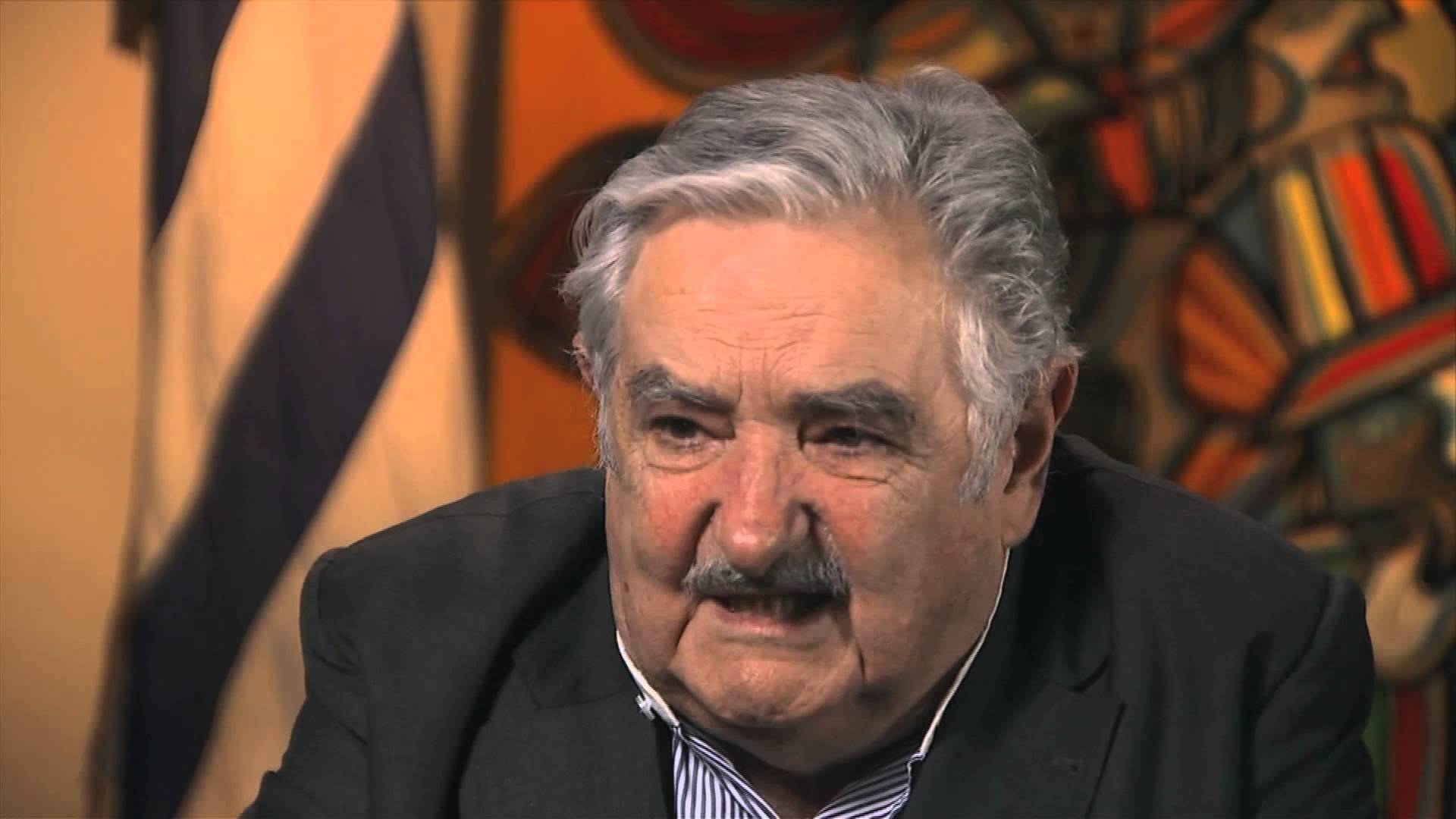

Murio Jose Mujica Expresidente De Uruguay A Los 89

May 14, 2025

Murio Jose Mujica Expresidente De Uruguay A Los 89

May 14, 2025