Chime's IPO Plans: Examining The Rise Of The Digital Banking Challenger

Table of Contents

Chime's Disruptive Business Model and Rapid Growth

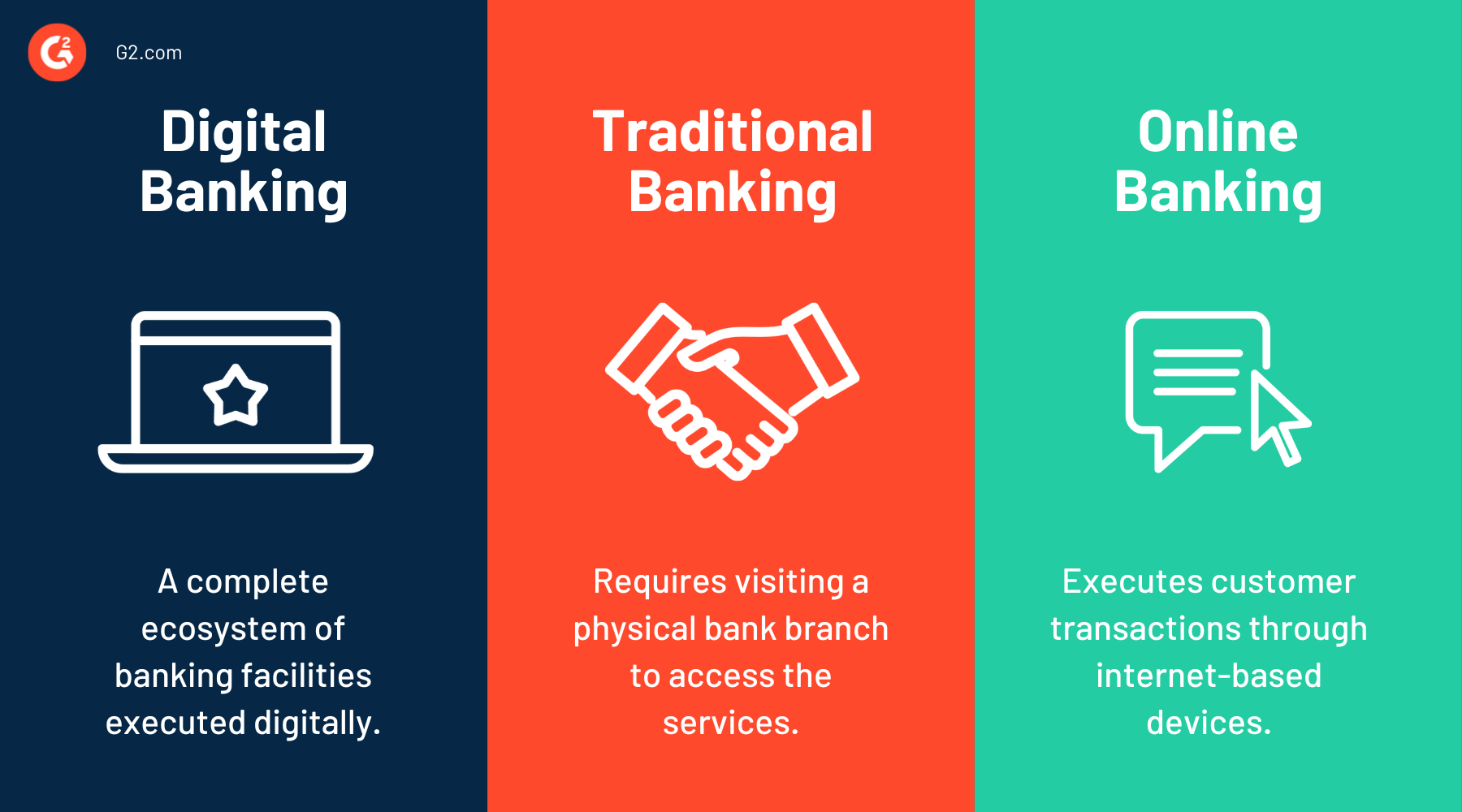

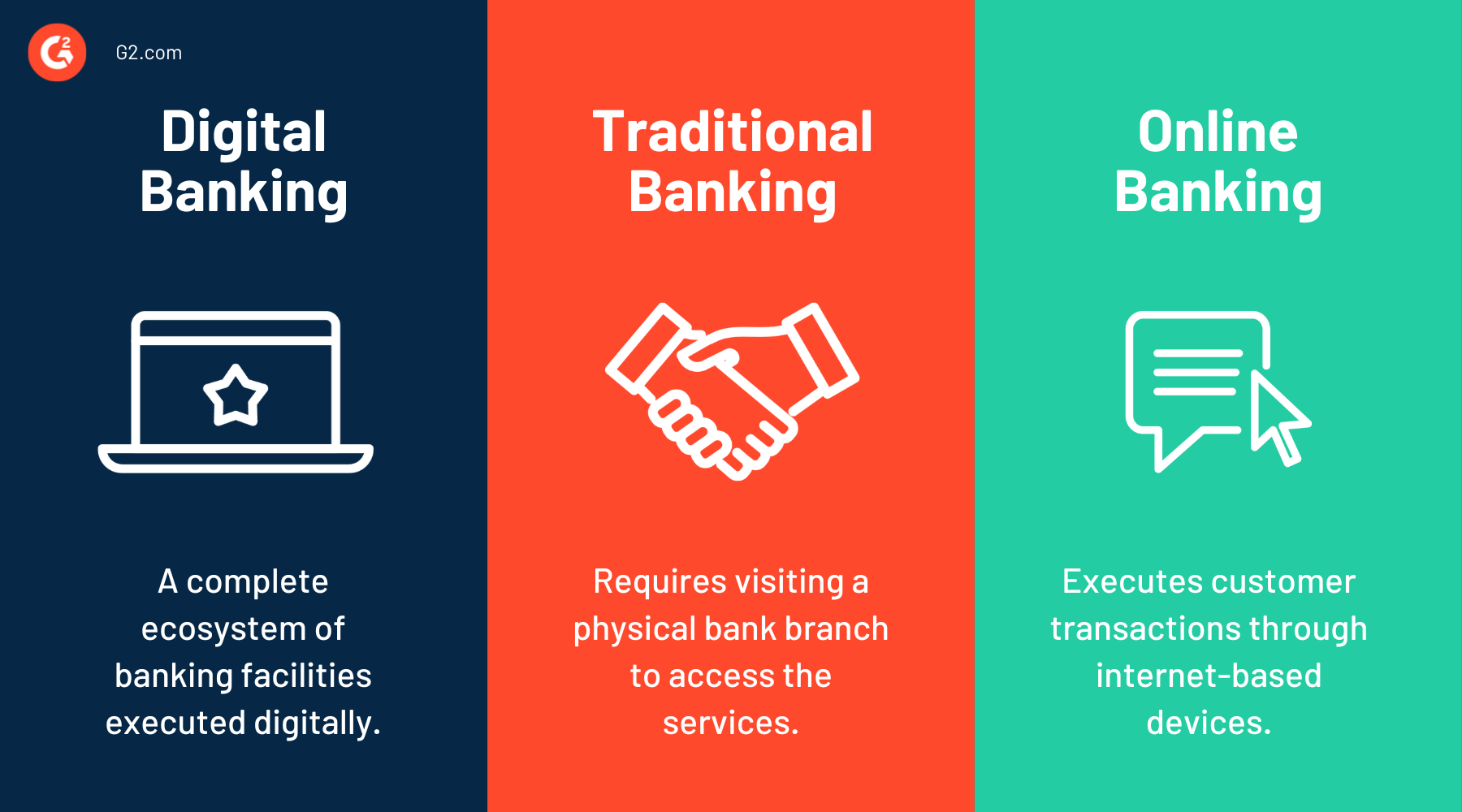

Chime's success stems from its unique value proposition: fee-free banking accessible through a seamless mobile-first experience. Unlike traditional banks burdened by fees and complex processes, Chime offers a refreshing alternative. Its core features, including early access to paychecks through direct deposit and its overdraft safety net, SpotMe, resonate strongly with its target demographic. This has fueled its impressive growth trajectory, positioning it as a major player in the digital banking space.

- Number of customers: Chime boasts millions of customers, a testament to its widespread appeal and effective marketing strategies. Specific numbers are subject to change, but publicly available data reveals phenomenal growth year over year.

- Growth rate compared to traditional banks: Chime's growth rate significantly outpaces that of many established banks, highlighting the shift towards digital financial services. This rapid expansion underscores the market's appetite for innovative, user-friendly banking solutions.

- Market share gains: Chime has steadily gained market share, chipping away at the dominance of traditional institutions. Its success demonstrates the potential for challenger banks to capture significant portions of the market.

- Key features driving customer acquisition: SpotMe, offering overdraft protection without traditional overdraft fees, and early access to direct deposit funds are crucial in attracting and retaining customers. These features address common pain points experienced by many traditional banking customers.

Competitive Landscape and Market Position

Chime operates within a fiercely competitive landscape populated by other neobanks and digital banking providers, including Robinhood, Current, and others. While facing strong competition, Chime maintains a strong position due to its established brand recognition and loyal customer base. However, challenges remain.

- Key competitors and their market share: While precise market share data is often proprietary, publicly available information illustrates the competitive intensity within the neobank sector. Chime’s market position relative to its competitors is a key factor in assessing its IPO potential.

- Chime's competitive advantages: Chime’s robust mobile app, commitment to fee-free services, and innovative features like SpotMe provide significant competitive advantages. Customer loyalty and strong brand recognition are equally crucial assets.

- Potential threats: Increased competition from both established banks and new entrants represents a significant threat. Regulatory changes and potential economic downturns could also impact Chime's growth and profitability.

Factors Influencing Chime's IPO Decision

Several factors influence Chime's decision regarding an IPO. While an IPO offers significant benefits, it also presents substantial risks.

- Potential benefits of an IPO: Access to substantial capital for expansion, increased brand visibility and recognition, and the opportunity to offer employee stock options are key advantages of going public.

- Potential risks associated with an IPO: Increased regulatory scrutiny, pressure to consistently meet investor expectations, and a potential loss of managerial control are significant considerations.

- Macroeconomic conditions and IPO timing: Favorable market conditions, including investor sentiment and overall economic stability, are crucial factors in determining the optimal timing for an IPO.

- Chime's financial performance and profitability: Chime's financial health, including revenue growth and profitability, directly impacts its IPO valuation and investor appeal.

Potential Valuation and Investor Interest

Predicting Chime's IPO valuation is challenging, but analysts offer estimates based on comparable company valuations and projected future growth. Several investor types are likely to show significant interest.

- Comparable company valuations: Analyzing valuations of similar fintech companies that have gone public provides a benchmark for estimating Chime's potential IPO price range.

- Potential price range for Chime's shares: While exact figures are speculative, analysts' estimates can provide a range for Chime's potential share price.

- Factors influencing investor interest: Chime's growth trajectory, market position, profitability, and the overall state of the stock market will heavily influence investor interest and demand.

Conclusion: The Future of Chime and its IPO Plans

Chime's rapid growth, innovative business model, and strong market position make its potential IPO a significant event in the digital banking sector. While several factors influence the timing and valuation of Chime's IPO, its disruptive approach to banking has undoubtedly attracted considerable investor interest. Understanding Chime's IPO plans and the dynamics of the digital banking industry is crucial for investors and financial market participants alike. Stay informed about Chime's IPO plans and the latest developments in the digital banking sector by regularly reviewing financial news sources and the company's financial reports. This will help you understand the evolution of this key player in the fintech space.

Featured Posts

-

Mission Impossible Dead Reckoning The Trailers Smart Approach To Marketing

May 14, 2025

Mission Impossible Dead Reckoning The Trailers Smart Approach To Marketing

May 14, 2025 -

Disney Quietly Fixes Snow Whites Biggest Problem For Future Live Action Films

May 14, 2025

Disney Quietly Fixes Snow Whites Biggest Problem For Future Live Action Films

May 14, 2025 -

Filming Euphoria Season 3 Jacob Elordi Shares Insights Into A Powerful Production

May 14, 2025

Filming Euphoria Season 3 Jacob Elordi Shares Insights Into A Powerful Production

May 14, 2025 -

Percorso Milano Sanremo 2025 Strade Chiuse In Lombardia E Deviazioni

May 14, 2025

Percorso Milano Sanremo 2025 Strade Chiuse In Lombardia E Deviazioni

May 14, 2025 -

Klarna Files For 1 Billion Ipo A Closer Look

May 14, 2025

Klarna Files For 1 Billion Ipo A Closer Look

May 14, 2025