China Slowdown Impacts Nvidia, But Forecast Remains Positive

Table of Contents

The Impact of China's Economic Slowdown on Nvidia's Revenue

China's economic slowdown is undeniably impacting Nvidia's revenue streams. The reduced consumer spending and cautious investment climate are affecting several key sectors where Nvidia's products play a crucial role. This translates into decreased demand across several product lines. Specifically:

- Decreased sales of gaming GPUs: Lower consumer spending in China has led to a noticeable drop in the sales of Nvidia's gaming GPUs, a significant portion of their revenue historically. Reports suggest a double-digit percentage decline in this segment compared to previous quarters. (Source needed - Replace with actual source and percentage).

- Reduced demand for high-performance computing (HPC) GPUs from Chinese data centers: The slowdown has led to decreased investment in data center infrastructure, reducing demand for Nvidia's high-end GPUs crucial for AI and machine learning applications. (Source needed - Replace with actual source and data).

- Slower adoption of AI solutions: Economic uncertainty has caused many Chinese businesses to delay or postpone investments in AI solutions, impacting the demand for Nvidia's AI-focused hardware and software. (Source needed - Replace with actual source and data).

These factors combined have resulted in a measurable percentage decrease in Nvidia's overall revenue attributed to the Chinese market. (Source needed - Replace with actual source and percentage). It's important to note that while this impact is significant, it doesn't overshadow the broader picture of Nvidia's global performance.

Nvidia's Diversification Strategy and Mitigation Efforts

Nvidia's proactive diversification strategy is crucial in mitigating the impact of the Chinese economic slowdown. The company has wisely avoided over-reliance on any single market, establishing a strong presence globally. This geographic diversification, combined with other strategic initiatives, significantly reduces the risk associated with economic fluctuations in any particular region.

Key elements of Nvidia's mitigation efforts include:

- Increased focus on other high-growth markets: Nvidia is actively expanding its presence in the US, Europe, and other regions showing strong growth potential for their products, bolstering their global market share.

- Expansion into new product segments: Nvidia continues to innovate and expand into new markets like automotive, healthcare, and robotics, diversifying its revenue streams beyond the traditional gaming and data center sectors. This strategic move reduces dependence on any single industry's economic health.

- Strengthening partnerships with key players in other regions: Nvidia is actively building and strengthening strategic partnerships with leading companies in various sectors and geographic locations to expand market access and distribution channels.

These combined efforts showcase Nvidia's commitment to long-term growth and resilience, effectively mitigating the risks associated with regional economic downturns.

Positive Forecast for Nvidia Despite China's Challenges

Despite the short-term headwinds from the Chinese economic slowdown, the long-term forecast for Nvidia remains remarkably positive. Several key factors contribute to this optimistic outlook:

- Strong global demand for AI and high-performance computing: The global demand for AI and HPC solutions continues to grow exponentially, driving demand for Nvidia's high-performance GPUs. This strong, global demand is less susceptible to regional economic fluctuations.

- Continued technological advancements and innovation: Nvidia's consistent leadership in technological innovation ensures that its products remain at the forefront of the industry, maintaining a competitive advantage and attracting customers globally.

- Successful expansion into new markets and sectors: Nvidia's strategic expansion into new and emerging markets, like autonomous vehicles and healthcare, ensures long-term growth even in the face of short-term challenges in existing markets.

The continued growth in AI, coupled with Nvidia's market leadership and innovative approach, positions the company for sustained success.

Analyzing Investor Sentiment and Stock Performance

Investor sentiment towards Nvidia remains largely positive despite the challenges posed by the Chinese economic slowdown. While there have been some short-term fluctuations in Nvidia stock price, the long-term outlook remains optimistic. (Include relevant chart/graph here showing Nvidia stock performance).

- Analyst ratings: Many analysts maintain a positive outlook on Nvidia stock, citing the company's strong fundamentals and long-term growth potential. (Source needed - Replace with actual analyst ratings and predictions).

- Market analysis: Market analysis suggests that the impact of the China slowdown is considered a temporary setback, with the overall long-term growth trajectory remaining largely unaffected. (Source needed - Replace with market analysis data).

Conclusion: China Slowdown Impacts Nvidia, But Forecast Remains Positive

In conclusion, while the Chinese economic slowdown presents a short-term challenge for Nvidia, the company's diversification strategy, technological leadership, and strong global demand mitigate its impact significantly. The overall positive outlook for Nvidia's future remains strong, underpinned by its long-term growth potential in AI and other high-growth sectors. To stay informed about Nvidia's progress and the evolving dynamics of the global semiconductor industry, subscribe to our newsletter [link to newsletter] or follow us on social media [links to social media]. Further research into Nvidia stock and the China tech market is highly encouraged.

Featured Posts

-

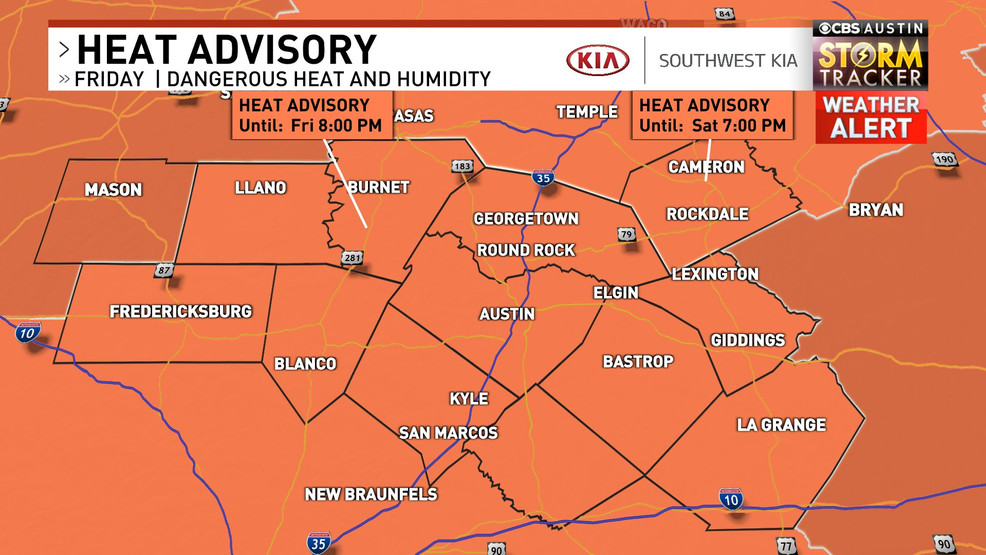

Texas Heat Advisory Temperatures To Reach A Dangerous 111 Degrees

May 30, 2025

Texas Heat Advisory Temperatures To Reach A Dangerous 111 Degrees

May 30, 2025 -

The Jon Jones Hasbulla Daily Fight Story A Kick To The Mouth

May 30, 2025

The Jon Jones Hasbulla Daily Fight Story A Kick To The Mouth

May 30, 2025 -

Kasper Dolberg Stigende Interesse Og Fremtidig Karriere

May 30, 2025

Kasper Dolberg Stigende Interesse Og Fremtidig Karriere

May 30, 2025 -

Analysis Us Solar Tariffs And Their Impact On Malaysia

May 30, 2025

Analysis Us Solar Tariffs And Their Impact On Malaysia

May 30, 2025 -

All Air Jordans Dropping In June 2025 Release Dates And Where To Buy

May 30, 2025

All Air Jordans Dropping In June 2025 Release Dates And Where To Buy

May 30, 2025