China's Soybean Supply Crunch: Sinograin's Auction Response

Table of Contents

The Severity of China's Soybean Supply Crunch

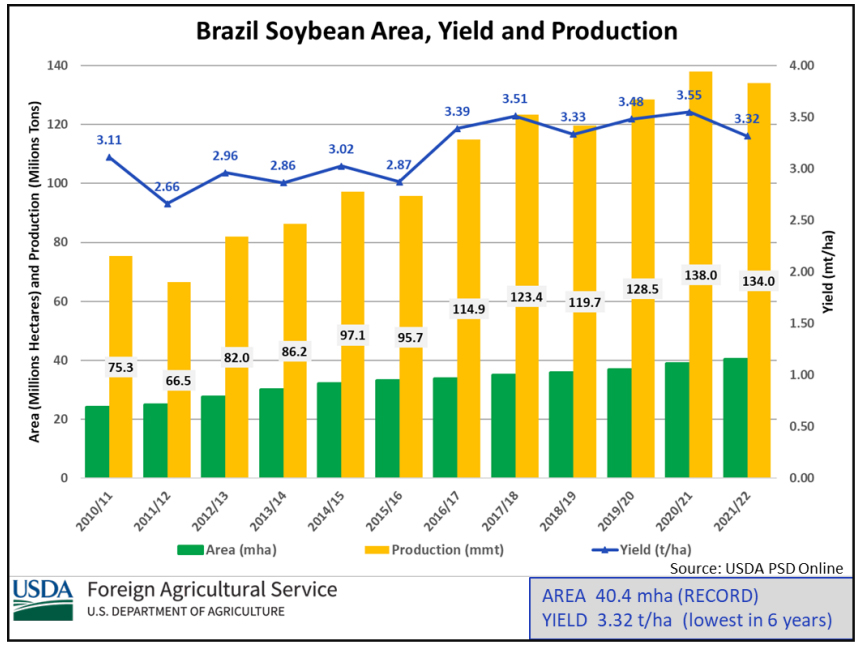

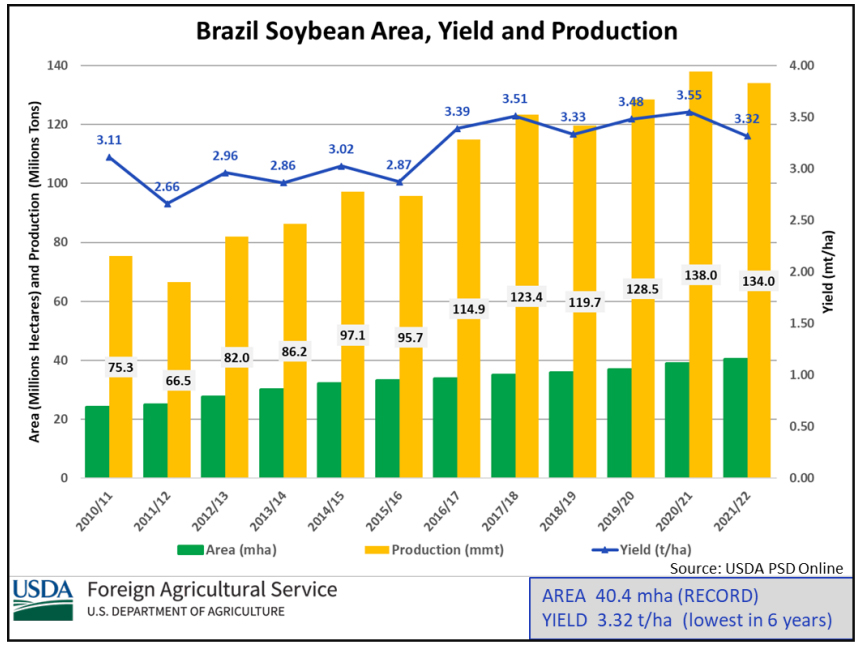

Reduced Domestic Production

Unfavorable weather patterns, including droughts and floods in key soybean-producing regions, have significantly hampered domestic production. Disease outbreaks have further reduced yields, compounding the problem. Government policies, while aiming for sustainable agriculture, have also inadvertently impacted soybean cultivation in some areas.

- Yield reductions of up to 20% reported in Heilongjiang and Jilin provinces in 2023.

- Increased incidence of soybean cyst nematode impacting harvests.

- Shift towards other crops due to government subsidies impacting overall soybean acreage.

Data indicates a sharp decline in domestic soybean production compared to previous years. While official figures vary, estimates suggest a shortfall of millions of tons, exacerbating reliance on imports to meet the burgeoning demand.

Increased Global Demand

The global demand for soybeans continues to rise, driven primarily by the increasing consumption of animal protein in developing countries and the growing biofuel industry. This increased global demand puts upward pressure on international soybean prices, making imports more expensive for China.

- Rising demand from livestock feed industries in Asia and Latin America.

- Expansion of biodiesel production using soybeans as a feedstock.

- Increased competition from other major soybean importers like the EU and India.

Global soybean production, while increasing, hasn't kept pace with the rapidly expanding global consumption, resulting in tighter supply and higher prices in the international market.

Geopolitical Factors

Trade tensions and geopolitical instability further complicate China's soybean imports. Trade disputes and sanctions can disrupt supply chains, limiting access to major soybean suppliers and increasing reliance on less reliable sources.

- Trade tariffs and restrictions impacting soybean imports from the US.

- Supply chain disruptions due to global political instability affecting shipping and logistics.

- Increased reliance on South American suppliers leading to price volatility based on weather patterns and currency fluctuations.

These factors have collectively contributed to the severity of China's soybean supply crunch, creating a challenging environment for the country's food security and agricultural sector.

Sinograin's Auction Intervention as a Response

The Role of Sinograin

Sinograin, China's state-owned grain trader, plays a crucial role in managing the country's national grain reserves and ensuring food security. It holds significant market influence and is responsible for stabilizing grain prices and ensuring sufficient supplies.

- Monopoly-like control of major grain imports and distribution channels.

- Strategic reserve management to mitigate market volatility and ensure domestic needs.

- Significant influence on soybean pricing through its purchasing and auctioning activities.

Details of the Auctions

In response to China's soybean supply crunch, Sinograin has implemented a series of soybean auctions to release reserves into the market. These auctions have varied in scale and frequency, aiming to inject sufficient quantities to alleviate price pressures. Pricing strategies have been carefully managed to balance market stabilization with maintaining the integrity of national reserves.

- Auctions held regularly throughout 2023, releasing millions of tons of soybeans.

- Prices offered generally slightly below prevailing market prices to encourage market participation.

- Auction volume strategically managed to avoid flooding the market and triggering unintended price drops.

Impact of the Auctions on the Market

Sinograin's auction interventions have had a measurable impact on the soybean market, although the effectiveness remains a subject of ongoing debate. While the auctions have provided some relief to soaring prices, the overall impact on completely alleviating the supply crunch has been limited. Short-term stabilization has been observed, but long-term effects are still developing.

- Temporary price decreases following major auction events.

- Price volatility continues despite Sinograin's intervention, indicating the persistence of underlying supply issues.

- Long-term impact requires further analysis and is dependent on future harvests and import dynamics.

Long-Term Implications and Future Outlook for China's Soybean Market

Strategies for Improving Domestic Production

Improving domestic soybean production is crucial for long-term food security. This necessitates a multi-pronged approach including technological advancements in soybean cultivation, promoting better farming practices, and strengthening government support for domestic soybean farmers.

- Investing in research and development of high-yield, disease-resistant soybean varieties.

- Implementing precision agriculture techniques to optimize resource utilization and maximize yields.

- Providing financial incentives and subsidies to encourage domestic soybean cultivation.

Diversification of Soybean Imports

Reducing reliance on a limited number of soybean suppliers is critical to mitigate risks associated with geopolitical instability and trade disputes. China needs to actively explore and cultivate relationships with diverse soybean-producing nations.

- Strengthening trade ties with countries in Africa and other regions to diversify import sources.

- Investing in infrastructure development to support imports from multiple origins.

- Negotiating long-term supply contracts to secure stable access to soybeans.

The Continued Role of Sinograin

Sinograin's role in managing future soybean supply challenges will remain critical. Its capacity to effectively manage national reserves, strategically intervene in the market, and promote a balanced approach to domestic production and imports will be vital in mitigating future crises.

Conclusion: Addressing China's Soybean Supply Crunch Moving Forward

China's soybean supply crunch highlights the vulnerability of relying heavily on imports for a crucial commodity. Sinograin's auction interventions have provided some short-term relief but haven't fully addressed the underlying issues. Long-term solutions require a comprehensive strategy focused on boosting domestic production, diversifying import sources, and ensuring the continued effective management of national reserves by Sinograin. Stay updated on the evolving dynamics of China's soybean supply crunch and Sinograin's continued efforts to ensure food security.

Featured Posts

-

Is A Malcolm In The Middle Revival On The Cards Exploring The Chances

May 29, 2025

Is A Malcolm In The Middle Revival On The Cards Exploring The Chances

May 29, 2025 -

Limited Time Offer Nike Court Legacy Lift Sneakers At 58

May 29, 2025

Limited Time Offer Nike Court Legacy Lift Sneakers At 58

May 29, 2025 -

Who Are The Parents Of Actress Taylor Dearden

May 29, 2025

Who Are The Parents Of Actress Taylor Dearden

May 29, 2025 -

Starbase Le Futur De Space X Se Construit Au Texas

May 29, 2025

Starbase Le Futur De Space X Se Construit Au Texas

May 29, 2025 -

Weihong Liu The Billionaire Behind The Hudsons Bay Lease Buyouts

May 29, 2025

Weihong Liu The Billionaire Behind The Hudsons Bay Lease Buyouts

May 29, 2025

Latest Posts

-

Tsitsipas Defeats Berrettini Medvedev Moves On At Indian Wells

May 31, 2025

Tsitsipas Defeats Berrettini Medvedev Moves On At Indian Wells

May 31, 2025 -

Alcaraz Beats Davidovich Fokina To Secure Monte Carlo Masters Final Berth

May 31, 2025

Alcaraz Beats Davidovich Fokina To Secure Monte Carlo Masters Final Berth

May 31, 2025 -

Carlos Alcaraz Defeats Davidovich Fokina Reaches Monte Carlo Masters Final

May 31, 2025

Carlos Alcaraz Defeats Davidovich Fokina Reaches Monte Carlo Masters Final

May 31, 2025 -

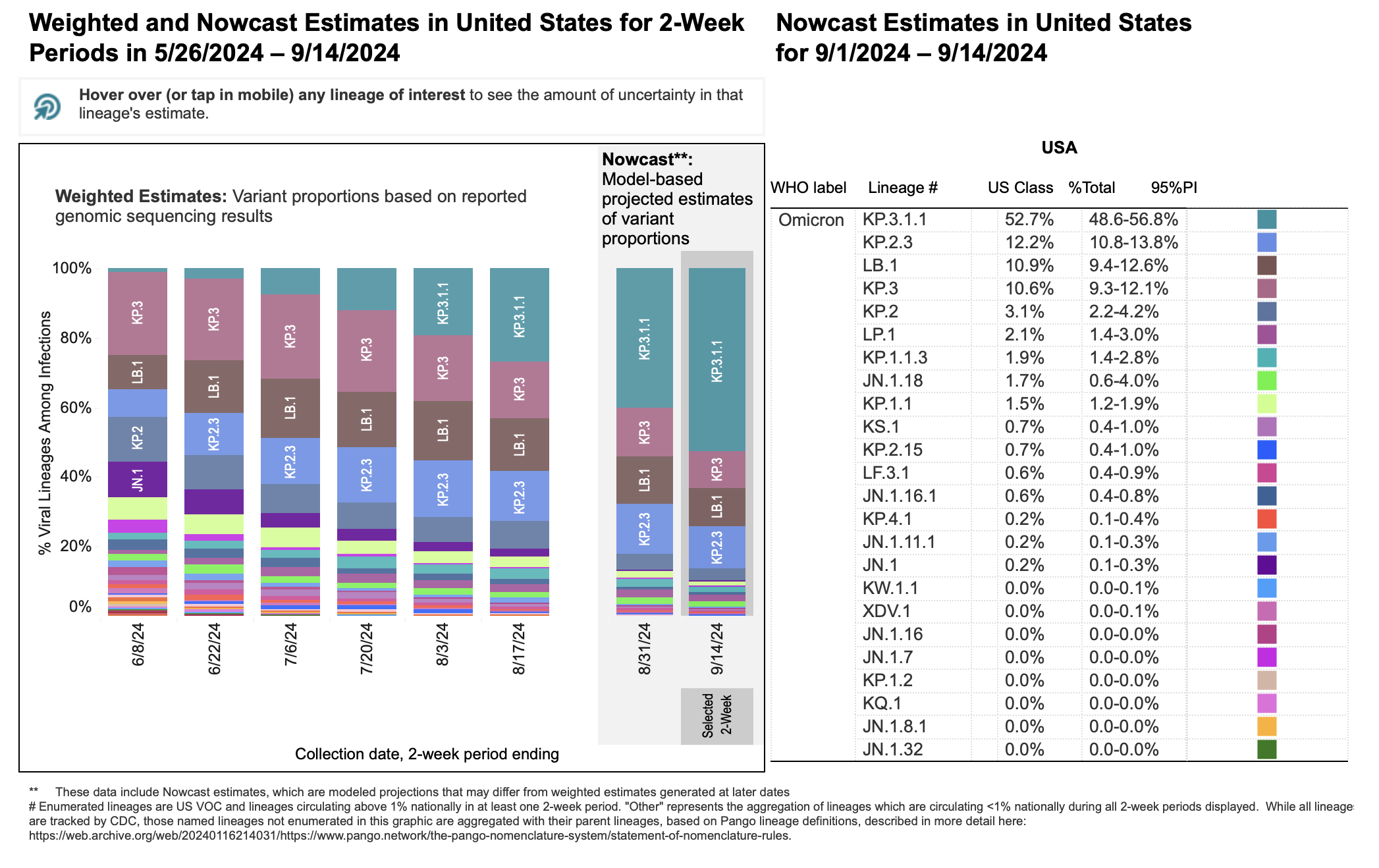

The Connection Between A New Covid 19 Variant And Rising Infection Rates

May 31, 2025

The Connection Between A New Covid 19 Variant And Rising Infection Rates

May 31, 2025 -

A New Covid 19 Variant Whats Driving The Increase In Cases

May 31, 2025

A New Covid 19 Variant Whats Driving The Increase In Cases

May 31, 2025