Choppy Trade In Indian Markets: Sensex And Nifty 50 End Unchanged

Table of Contents

Intraday Volatility and its Drivers

The Sensex and Nifty 50 experienced substantial intraday fluctuations today. While closing near their opening levels, both indices saw significant upward and downward movements throughout the trading session. This volatility can be attributed to a confluence of global and domestic factors:

-

Global Market Uncertainty: Concerns surrounding further US interest rate hikes continue to weigh on investor confidence globally. Geopolitical tensions, particularly the ongoing conflict in Ukraine, add to this uncertainty, impacting risk appetite across emerging markets, including India.

-

Domestic Factors: Fluctuations in the Indian rupee against the US dollar introduce currency risk for investors. Lingering inflation concerns and anticipation of upcoming policy announcements from the Reserve Bank of India (RBI) also contribute to market nervousness.

-

Sector-Specific News: Negative news impacting specific companies within the Sensex and Nifty 50 contributed to intraday declines in certain sectors. For example, a disappointing earnings report from a major IT company might trigger a sell-off in that sector.

-

FII Activity: The activity of Foreign Institutional Investors (FIIs) plays a crucial role in shaping Indian market trends. Significant FII selling or buying pressure can cause sharp intraday movements in the indices. Today's trading saw a relatively balanced FII activity, preventing a drastic swing in either direction.

For example, the Sensex reached a high of X points and a low of Y points during the day, while the Nifty 50 saw a high of A points and a low of B points. (Replace X, Y, A, and B with actual data).

Sectoral Performance and Key Movers

The choppy trading impacted different sectors unevenly. While some sectors exhibited resilience, others faced significant headwinds.

-

Banking: The banking sector showed mixed performance, with some public sector banks outperforming their private counterparts. This could be attributed to specific announcements or policy-related news.

-

IT: The IT sector, heavily influenced by global economic conditions, experienced moderate losses due to continued concerns about global recessionary fears and reduced IT spending.

-

Pharma: The pharmaceutical sector displayed relative stability, showing less sensitivity to the overall market volatility.

-

Auto: The auto sector showed a slight upward trend, potentially driven by positive sales figures or government initiatives.

Among the Nifty 50 stocks, Company Z emerged as a top gainer, driven by positive earnings and strong future outlook while Company W was a major loser due to [reason for loss]. (Replace Company Z and Company W with actual company names.) This highlights the importance of fundamental analysis in navigating choppy market conditions.

Impact on Investor Sentiment

The choppy trading day reflected a cautious investor sentiment. While there were periods of increased buying activity, the overall trend indicated a degree of risk aversion. Trading volume was relatively high, suggesting significant market activity despite the lack of a clear directional trend. Analysts' comments pointed toward a "wait-and-see" approach by many investors, anticipating further clarity on both global and domestic economic factors. Increased volatility often leads to a rise in hedging activities which was reflected in the trading of options and futures.

Technical Analysis and Outlook

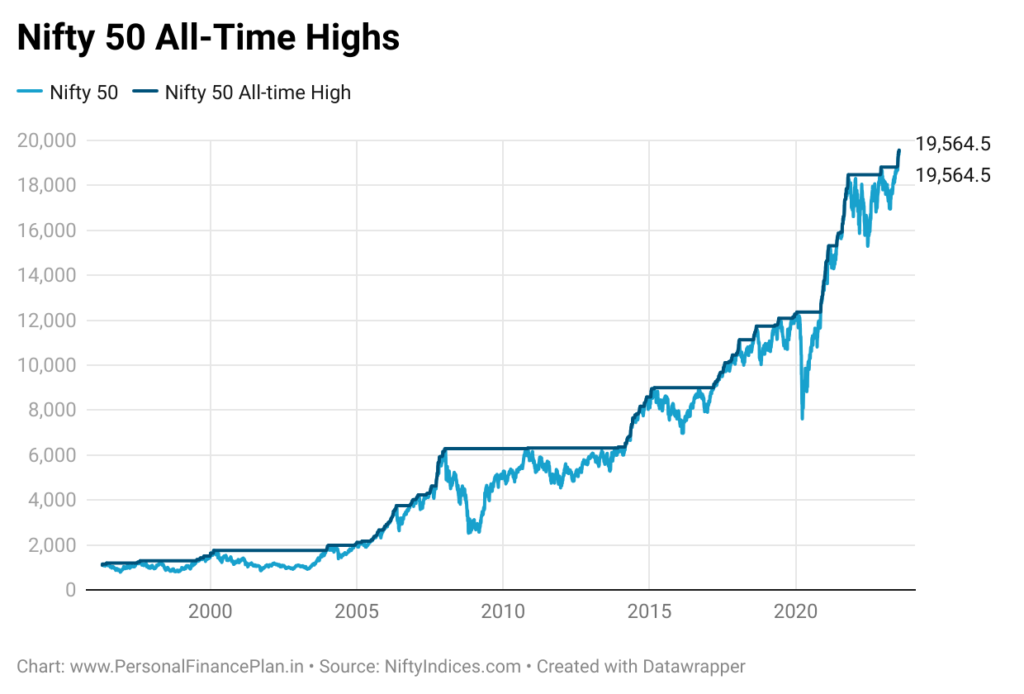

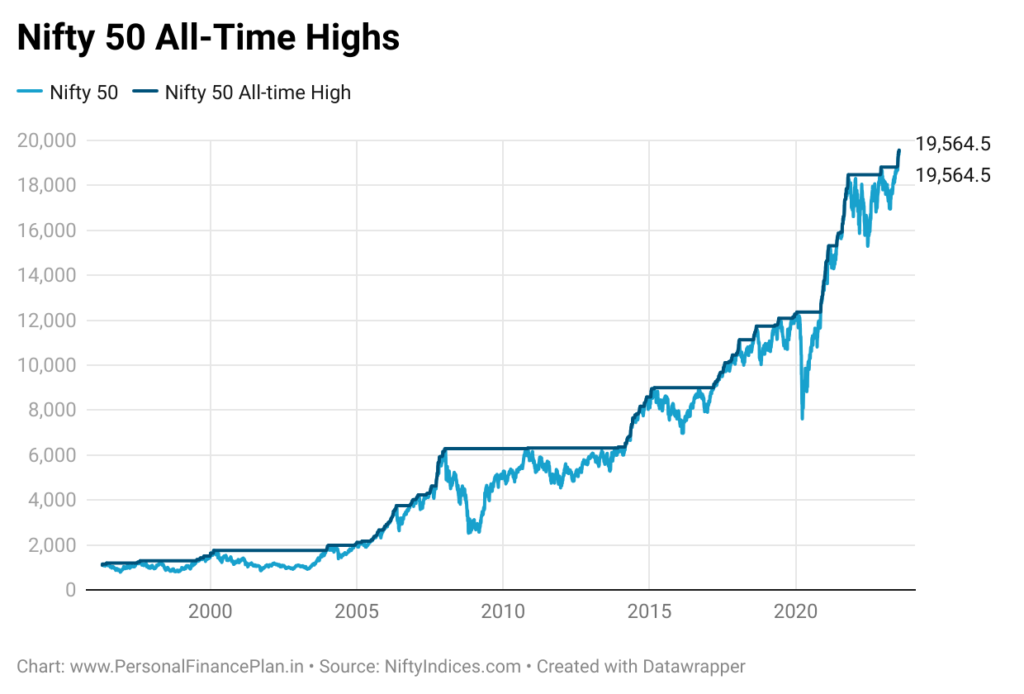

A technical analysis of the Sensex and Nifty 50 charts reveals that both indices are currently testing key support levels. Several technical indicators suggest a potential short-term consolidation phase. While there is no clear breakout signal, the prevailing choppy trading pattern warrants caution. Near-term market trends remain uncertain, making it crucial for investors to monitor key support and resistance levels closely. The lack of decisive bullish or bearish signals makes predicting short-term movements challenging.

Navigating Choppy Trade in Indian Markets: Sensex and Nifty 50's Uncertain Future

Today's trading session underscored the impact of both global and domestic factors on the Indian stock market. Despite significant intraday volatility, the Sensex and Nifty 50 indices closed relatively flat, highlighting the prevailing uncertainty in the market. The cautious investor sentiment and mixed sectoral performance further emphasize the need for a watchful approach. For the coming trading sessions, a continuation of choppy trading is likely.

Understanding choppy trading in Indian markets is crucial for successful investment strategies. Stay informed about future choppy trades affecting the Sensex and Nifty 50 by regularly checking our website for the latest market updates and in-depth analysis. Subscribe to our newsletter for expert insights and timely alerts.

Featured Posts

-

Man Learns Expensive Lesson After 3 K Babysitting Bill And 3 6 K Daycare Fee

May 09, 2025

Man Learns Expensive Lesson After 3 K Babysitting Bill And 3 6 K Daycare Fee

May 09, 2025 -

Mushers And Dogs Persevere Despite Shorter Fur Rondy Race

May 09, 2025

Mushers And Dogs Persevere Despite Shorter Fur Rondy Race

May 09, 2025 -

Daycare Debate Psychologist Sparks Outrage With Viral Podcast Claims

May 09, 2025

Daycare Debate Psychologist Sparks Outrage With Viral Podcast Claims

May 09, 2025 -

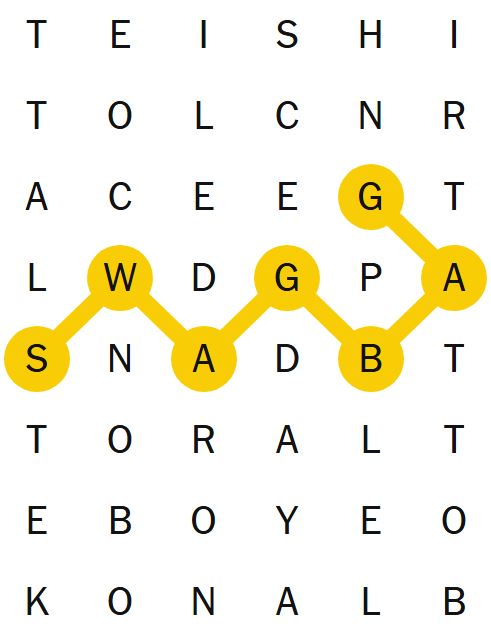

Strands Nyt Saturday March 15th Complete Solution Game 377

May 09, 2025

Strands Nyt Saturday March 15th Complete Solution Game 377

May 09, 2025 -

Edmonton School Projects 14 Initiatives To Proceed Quickly

May 09, 2025

Edmonton School Projects 14 Initiatives To Proceed Quickly

May 09, 2025