Choppy Trading On Indian Markets: Sensex And Nifty 50 End Unchanged

Table of Contents

Factors Contributing to Choppy Trading

Several factors contributed to the choppy trading witnessed in Indian markets today. These can be broadly categorized into global market influences, domestic economic concerns, and sector-specific performance.

Global Market Influences

Global market trends significantly impacted the Indian stock market's performance. The ongoing uncertainty in the global economy played a major role in the day's volatility.

-

Impact of US Fed rate decisions on FII investments: The recent interest rate hike by the US Federal Reserve continues to impact Foreign Institutional Investor (FII) investment decisions. Higher interest rates in the US make dollar-denominated assets more attractive, potentially leading to capital outflow from emerging markets like India. This outflow can increase market volatility and contribute to choppy trading.

-

Influence of global commodity prices on Indian indices: Fluctuations in global commodity prices, particularly crude oil, exert considerable pressure on the Indian economy. Rising crude oil prices increase inflation and impact the current account deficit, potentially affecting investor sentiment and leading to choppy trading days.

-

Geopolitical risks and their effect on investor sentiment: Geopolitical tensions and uncertainties across the globe invariably influence investor sentiment. Concerns about global stability and potential conflicts often translate into risk-aversion, resulting in increased market volatility and choppy trading sessions.

Domestic Economic Concerns

Domestic factors also played a significant role in today's market volatility. Concerns about inflation and the upcoming policy announcements added to the uncertainty.

-

Impact of recent inflation figures on market behavior: The recent release of inflation data, showing persistent inflationary pressure, likely influenced investor sentiment. High inflation erodes purchasing power and can lead to investor hesitancy, contributing to choppy trading.

-

Rupee volatility and its effect on import-export businesses: Fluctuations in the Indian Rupee's value against the US dollar affect import-export businesses and overall economic stability. A weakening rupee can increase import costs and negatively impact investor confidence, adding to market volatility.

-

Anticipation of upcoming government policy decisions: The anticipation of upcoming government policy announcements, particularly regarding fiscal measures and economic reforms, creates uncertainty in the market. Investors often adopt a wait-and-see approach before making significant investment decisions, which can contribute to choppy trading.

Sector-Specific Performance

The performance of individual sectors also contributed to the overall market volatility.

-

Performance analysis of IT sector amidst global tech slowdown: The IT sector, a significant contributor to the Indian stock market, experienced some downward pressure due to concerns about a global tech slowdown and reduced demand. This sector's performance directly impacts overall market sentiment.

-

Banking sector performance influenced by credit growth and NPA concerns: The banking sector's performance is closely linked to credit growth and Non-Performing Asset (NPA) levels. Concerns about increasing NPAs or slower credit growth can negatively affect investor confidence in this sector, influencing the broader market's volatility.

-

Pharma sector's reaction to regulatory changes and global demand: The pharmaceutical sector's performance is often influenced by regulatory changes and global demand fluctuations. Changes in drug pricing policies or shifts in global demand can create uncertainty and impact market sentiment.

Sensex and Nifty 50 Performance Analysis

Both the Sensex and Nifty 50 experienced significant intraday fluctuations. While they ultimately closed unchanged, the journey throughout the day was marked by considerable volatility. (Insert chart/graph illustrating the daily price movements of Sensex and Nifty 50 here).

-

Opening prices and closing prices for both indices: (Insert opening and closing prices for both indices).

-

High and low points reached during the trading session: (Insert high and low points for both indices).

-

Trading volume and its implications: (Discuss the trading volume and its implications for market sentiment). High trading volume during periods of choppy trading often suggests increased investor activity and uncertainty.

Investor Sentiment and Market Outlook

The overall investor sentiment today was cautious, reflecting the day's choppy trading. Experts expressed mixed opinions regarding the short-term market outlook.

-

Expert opinions on the causes of the choppy trading: (Include quotes or summaries of expert opinions regarding the causes of the volatility).

-

Short-term market outlook and predictions: (Summarize short-term market predictions from experts). Many analysts are suggesting a period of continued volatility in the coming days.

-

Potential implications for long-term investment strategies: (Discuss the potential implications for long-term investment strategies in light of the choppy trading). Long-term investors are advised to maintain a balanced portfolio and carefully assess their risk tolerance.

Conclusion

Today's trading session in the Indian stock market was characterized by choppy trading, with both the Sensex and Nifty 50 ending the day unchanged despite significant intraday volatility. This volatility stemmed from a confluence of factors, including global market uncertainties, domestic economic concerns, and sector-specific performance. Understanding these influences is crucial for navigating the complexities of the Indian stock market. Key takeaways include the significant impact of global interest rates, domestic inflation concerns, and the fluctuating performance of key sectors like IT and banking on the overall market sentiment.

Key Takeaways: Global influences, domestic economic factors, and sector-specific performance all contributed to today's choppy trading. Investor sentiment remains cautious.

Call to Action: Stay informed about the daily fluctuations in the Indian stock market and monitor the performance of Sensex and Nifty 50 for informed investment decisions. Understanding choppy trading patterns is crucial for successfully navigating the Indian stock market. Continue to follow our daily market reports for insightful analysis on the Indian stock market and its future trends.

Featured Posts

-

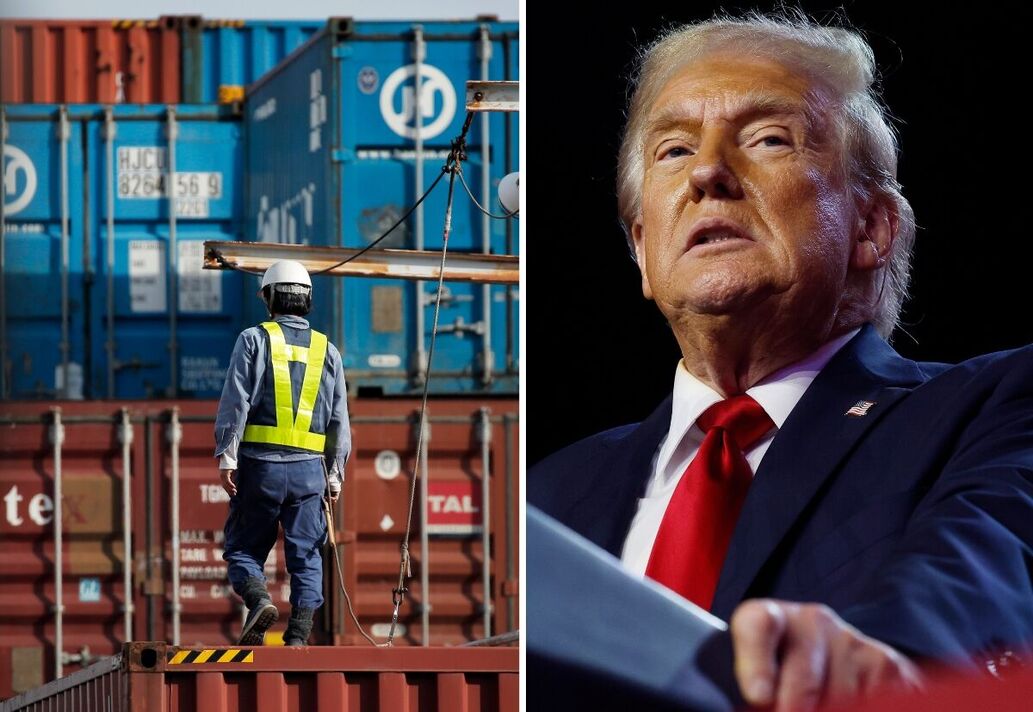

Details Of Trumps Planned Trade Agreement With The Uk

May 10, 2025

Details Of Trumps Planned Trade Agreement With The Uk

May 10, 2025 -

Sensex Live Market Update Sharp Gains Sectoral Analysis

May 10, 2025

Sensex Live Market Update Sharp Gains Sectoral Analysis

May 10, 2025 -

Wynne Evans Health Update A Nasty Illness And Showbiz Return Hints

May 10, 2025

Wynne Evans Health Update A Nasty Illness And Showbiz Return Hints

May 10, 2025 -

Rocket Launch Abort Blue Origin Cites Vehicle Subsystem Failure

May 10, 2025

Rocket Launch Abort Blue Origin Cites Vehicle Subsystem Failure

May 10, 2025 -

Nottingham Attack Survivor Speaks Out Heartbreaking Plea After Triple Killing

May 10, 2025

Nottingham Attack Survivor Speaks Out Heartbreaking Plea After Triple Killing

May 10, 2025