Climate Change And Your Home Loan: Understanding The Credit Risk

Table of Contents

Rising Flood Risks and Your Mortgage

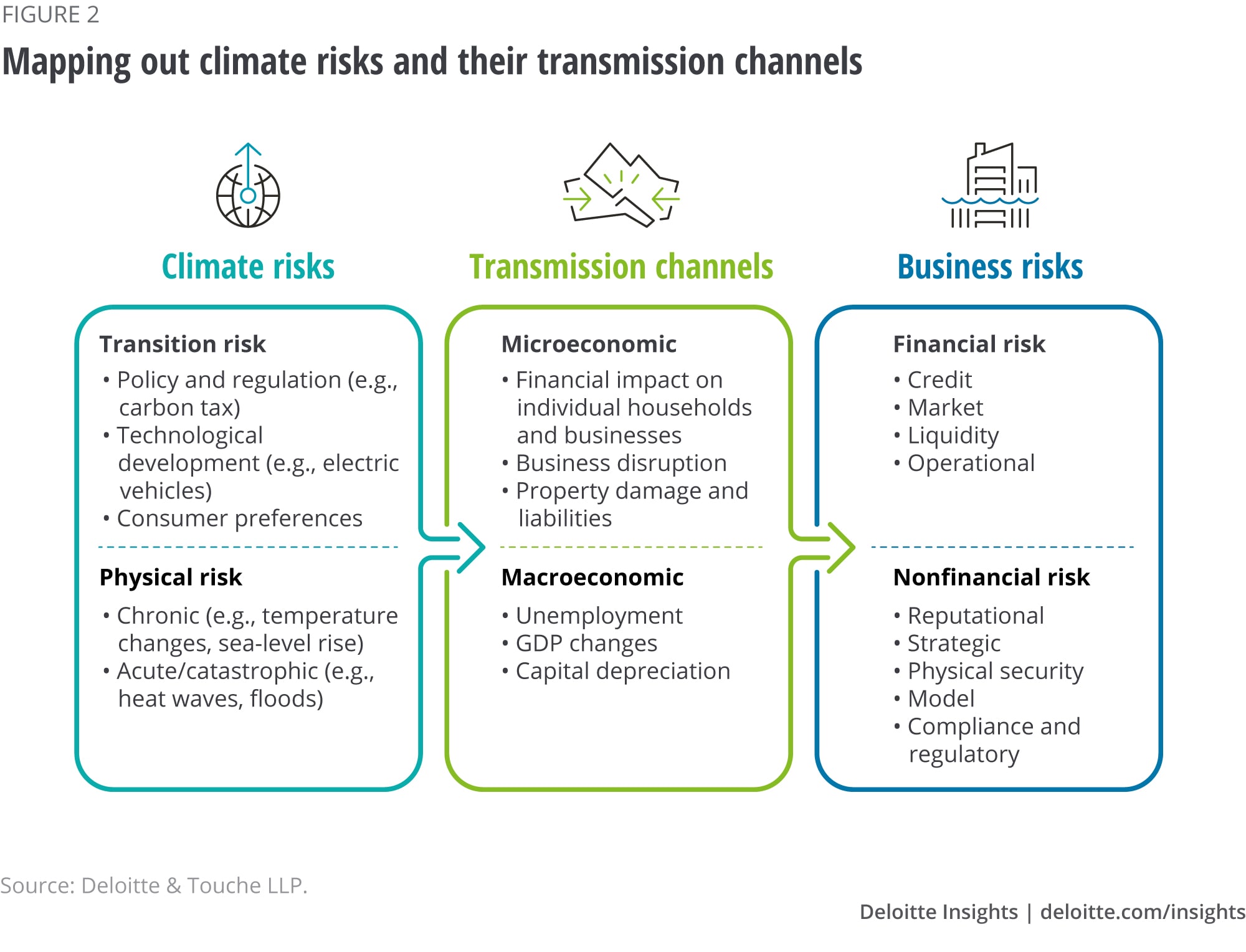

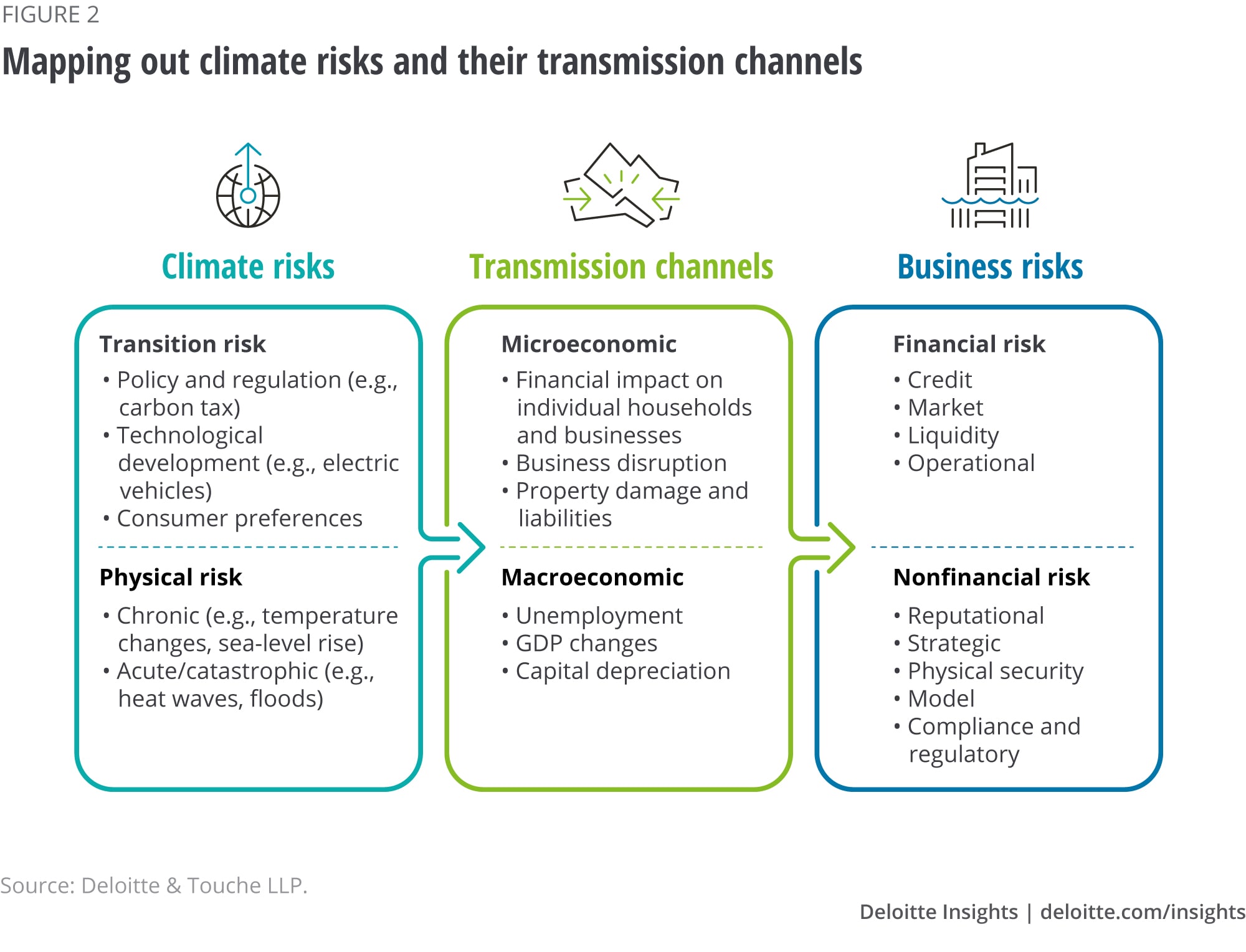

The escalating threat of floods, a direct consequence of climate change, poses a significant challenge to the stability of the housing market and the mortgage lending industry. Increased rainfall, melting glaciers, and rising sea levels contribute to more frequent and severe flooding events, dramatically impacting property values and insurance premiums. Lenders are finding it increasingly difficult to accurately assess flood risk, leading to several challenges:

- Increased likelihood of flood damage leading to defaults: Properties in flood-prone areas face a higher risk of damage, potentially leading to borrowers defaulting on their mortgages. This increases the financial burden on lenders.

- Higher insurance costs making properties less attractive to lenders: The rising cost of flood insurance, a necessity in many high-risk areas, makes properties less attractive to both buyers and lenders. Lenders may be less willing to offer loans or may demand higher interest rates to compensate for increased risk.

- Difficulty in obtaining accurate flood risk data for all properties: Accurate and up-to-date flood risk data isn't always readily available for every property, making it challenging for lenders to conduct comprehensive climate risk assessments.

- Potential for stricter lending criteria in high-risk flood zones: In response to increased risk, lenders are likely to implement stricter lending criteria in areas identified as high-risk flood zones, making it harder for homeowners to secure mortgages.

Extreme Weather Events and Home Loan Vulnerability

Beyond flooding, other extreme weather events like wildfires, hurricanes, and heatwaves significantly impact property values and mortgage risk. The increased frequency and intensity of these events directly affect a lender's assessment of a borrower's creditworthiness:

- Damage from extreme weather causing significant repair costs: The damage caused by extreme weather events can lead to substantial repair costs, potentially exceeding a homeowner's financial capacity.

- Decreased property value due to damage and perceived risk: Properties damaged by extreme weather events often suffer a decrease in value, making it difficult for homeowners to refinance or sell their homes. The perceived risk associated with these areas further depresses property values.

- Increased difficulty in securing insurance coverage: Securing adequate insurance coverage after an extreme weather event can be incredibly challenging, leaving homeowners vulnerable to significant financial losses.

- Potential for lender foreclosure due to inability to repay: If a homeowner cannot afford the repairs or replacement costs after an extreme weather event, they may be unable to repay their mortgage, leading to foreclosure.

Climate Change and Property Valuation

Climate change is fundamentally altering how properties are valued. Lenders are adapting their appraisal methods to incorporate climate risk assessments more effectively. This involves:

- Reduced property values in climate-vulnerable areas: Properties located in areas vulnerable to climate change impacts, such as coastal erosion or wildfire risk, are experiencing reduced property values.

- Increased scrutiny of property appraisals considering climate risk: Appraisers are under increasing pressure to consider climate risks when determining property value, leading to a more thorough and nuanced evaluation process.

- Development of new appraisal methodologies that integrate climate data: New methodologies are being developed to integrate climate data, such as flood maps and wildfire risk assessments, into the property valuation process.

- Impact on loan-to-value ratios and loan approval processes: The incorporation of climate risk into property valuations directly impacts loan-to-value ratios (LTV) and can influence loan approval processes. Higher climate risk may lead to lower LTVs and stricter lending terms.

Protecting Yourself from Climate-Related Credit Risk

Understanding and mitigating climate-related risks to your home loan is crucial for responsible homeownership. Several proactive steps can significantly reduce your vulnerability:

- Researching the climate risk of your property before buying: Before purchasing a property, thoroughly research its vulnerability to various climate-related risks, including flooding, wildfires, and extreme heat.

- Obtaining adequate insurance coverage: Ensure you have adequate insurance coverage to protect your property against potential damage from extreme weather events. This includes flood insurance, even if you're not in a designated flood zone.

- Implementing home upgrades to improve resilience (e.g., flood barriers, fire-resistant materials): Invest in home improvements that enhance your property's resilience to climate-related hazards.

- Considering relocation to a less vulnerable area: If you live in a high-risk area, consider relocating to a less vulnerable location.

- Staying informed about climate change impacts on your area: Stay updated on climate change impacts in your area and adapt your strategies accordingly.

Conclusion: Understanding Climate Change and Your Home Loan’s Future

Climate change is undeniably a significant factor influencing home loan credit risk, impacting property values, insurance costs, and lender assessments. Understanding these risks and taking proactive steps to protect your home and your mortgage is crucial for responsible homeownership. Conduct thorough due diligence on the climate-related risks of properties before applying for a home loan, speak with your lender about climate risk, and research climate-resilient home improvements. By embracing responsible homeownership practices and advocating for climate-resilient mortgage options, you can secure your financial future in a changing climate. Take control and build a more secure and sustainable future with informed decisions concerning your home loan and climate change mitigation.

Featured Posts

-

Hamilton V Leclerc Chinese Gp Contact Sparks Ferrari Drama

May 20, 2025

Hamilton V Leclerc Chinese Gp Contact Sparks Ferrari Drama

May 20, 2025 -

Supreme Court Justices Alito And Roberts A Retrospective On Their Long Tenures

May 20, 2025

Supreme Court Justices Alito And Roberts A Retrospective On Their Long Tenures

May 20, 2025 -

Journalists Update Throws Spanner In Man Uniteds Cunha Transfer Plans

May 20, 2025

Journalists Update Throws Spanner In Man Uniteds Cunha Transfer Plans

May 20, 2025 -

Us Typhon Missile System In Philippines A Counter To Chinese Aggression

May 20, 2025

Us Typhon Missile System In Philippines A Counter To Chinese Aggression

May 20, 2025 -

Dzhenifr Lorns Potvrdeno Vtori Pt Mayka

May 20, 2025

Dzhenifr Lorns Potvrdeno Vtori Pt Mayka

May 20, 2025

Latest Posts

-

Planning For A Period Of Drier Weather

May 20, 2025

Planning For A Period Of Drier Weather

May 20, 2025 -

Understanding The Drier Weather Forecast For Your Area

May 20, 2025

Understanding The Drier Weather Forecast For Your Area

May 20, 2025 -

Get Ready Drier Weather Conditions Approaching Soon

May 20, 2025

Get Ready Drier Weather Conditions Approaching Soon

May 20, 2025 -

Looking Ahead Coping With The Incoming Drier Weather

May 20, 2025

Looking Ahead Coping With The Incoming Drier Weather

May 20, 2025 -

Drier Weather On The Horizon Impacts And Adaptations

May 20, 2025

Drier Weather On The Horizon Impacts And Adaptations

May 20, 2025