Climate-Related Risks And Their Effect On Your Home Loan Application

Table of Contents

Increased Flood Risk and Home Loan Approvals

Climate change is intensifying the frequency and severity of floods worldwide. This increased flood risk directly impacts your ability to secure a home loan. Lenders are acutely aware of this escalating threat and are incorporating climate risk assessments into their underwriting processes.

- Lenders assess flood risk using flood maps and historical data. They utilize resources like FEMA's flood maps to determine the likelihood of flooding in a specific area. Properties located in high-risk flood zones, designated as Special Flood Hazard Areas (SFHAs), face significantly increased scrutiny.

- Properties in high-risk flood zones may face higher interest rates or loan denial. The perceived risk translates to higher premiums for lenders, often passed on to the borrower through increased interest rates. In severe cases, loan applications may be outright denied.

- Flood insurance requirements can significantly impact affordability. Lenders often mandate flood insurance for properties in high-risk areas, adding a substantial recurring cost to homeownership. This can make the overall cost prohibitive for some buyers.

- Obtaining a pre-flood risk assessment is crucial. Before even applying for a mortgage, it's wise to conduct your own pre-flood risk assessment. This will give you a clearer picture of the potential flood risk and allow you to make informed decisions.

Coastal areas like Miami, Florida, and parts of the Gulf Coast are significantly affected by rising sea levels and increased flooding, resulting in stricter lending criteria for properties in those regions. Lenders meticulously examine FEMA flood maps to evaluate the likelihood of future flood damage.

Wildfire Risk and its Impact on Mortgage Applications

The increasing frequency and intensity of wildfires, fueled by climate change and prolonged drought, present another significant challenge for homebuyers. Lenders are factoring wildfire risk into their assessment of mortgage applications.

- Lenders consider proximity to wildfire-prone areas. Properties located near forests or other combustible vegetation face increased risk and scrutiny from lenders. The distance from the property to the nearest wildland-urban interface (WUI) significantly influences the assessment.

- Home insurance premiums can skyrocket in high-risk zones, affecting loan approval. High wildfire risk leads to exponentially higher home insurance premiums, sometimes making the property unaffordable even if the mortgage is approved. Lenders are sensitive to this and may factor the insurance cost into their lending decisions.

- Defensible space around homes in wildfire-prone areas is crucial. Creating and maintaining a defensible space, by clearing flammable vegetation and implementing fire-resistant landscaping, can significantly reduce risk and positively influence lender perception.

- Specific building materials and fire-resistant landscaping act as mitigating factors. Using fire-resistant building materials and implementing fire-resistant landscaping can demonstrate a commitment to mitigating risk and may improve your chances of loan approval.

Resources like CalFire (California) and the National Fire Protection Association (NFPA) provide valuable information on wildfire risk assessment and mitigation strategies.

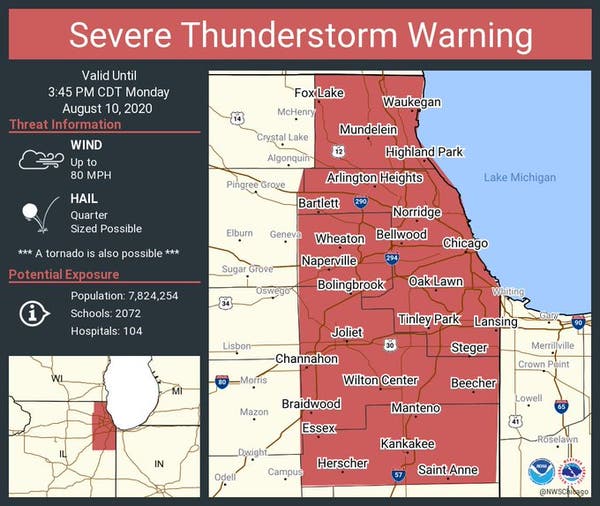

Extreme Weather Events and Home Loan Applications

Beyond floods and wildfires, various extreme weather events – hurricanes, heatwaves, severe thunderstorms, and tornadoes – impact property values and insurance costs, consequently affecting home loan applications.

- Damage from extreme weather can lead to loan defaults. The potential for significant damage increases the lender's risk, making them more cautious in their lending decisions.

- Lenders may require stricter underwriting for homes in vulnerable areas. Homes in areas prone to extreme weather events often face more stringent underwriting standards, including higher down payments or stricter credit requirements.

- Thorough property inspections and appraisals are vital. A comprehensive appraisal accurately assessing the property's condition and vulnerability to extreme weather is crucial for a successful application.

- Climate resilience features can positively influence loan approval. Incorporating climate-resilient design features in new construction or renovations, such as reinforced roofs or elevated foundations, can reduce risk and improve the chances of loan approval.

Hurricane-prone regions like the Gulf Coast and Atlantic seaboard experience increased scrutiny in mortgage applications, while areas susceptible to heatwaves may see assessments of potential energy-related costs influencing lending decisions.

Disclosure Requirements and Your Responsibility

Transparency is paramount. Failing to disclose known climate-related risks can have severe consequences.

- Lenders may require disclosure of known risks related to the property. It's your responsibility to disclose any information about past flood damage, wildfire proximity, or other climate-related issues affecting the property.

- Failure to disclose can lead to loan denial or future complications. Omitting critical information can result in loan denial or even legal repercussions later.

- The ethical implications of not disclosing relevant information are significant. Open communication and transparency are essential for building trust with your lender.

Diligent due diligence on your part is crucial. Thoroughly research the property's history and potential climate-related risks before submitting your application.

Finding a Lender Who Understands Climate Risk

Not all lenders assess climate risk equally. Some are more proactive than others in incorporating climate data into their underwriting.

- Research lenders with strong sustainability initiatives. Many lenders are increasingly incorporating Environmental, Social, and Governance (ESG) factors into their decision-making.

- Look for lenders who actively assess climate-related risks in their underwriting process. Seek lenders who openly demonstrate their consideration of climate change impacts in their loan approval process.

- Consider working with a mortgage broker who specializes in climate-conscious lending. A specialized broker can guide you towards lenders who understand and prioritize climate risk assessment.

Conclusion

Climate-related risks are increasingly impacting the home loan application process. Understanding the potential challenges related to flood risk, wildfires, and extreme weather events is vital for securing a mortgage. By proactively addressing these risks and choosing a lender who understands climate change implications, you can significantly improve your chances of getting your dream home loan approved. Don't let climate change derail your homeownership dreams; take the necessary steps to mitigate climate-related risks in your home loan application today. Learn more about minimizing the impact of climate risks on your home loan application by researching lenders and educating yourself on local hazards.

Featured Posts

-

Abn Group Victoria Appoints Half Dome As Its Media Agency

May 21, 2025

Abn Group Victoria Appoints Half Dome As Its Media Agency

May 21, 2025 -

First Space Based Supercomputer Chinas Groundbreaking Achievement

May 21, 2025

First Space Based Supercomputer Chinas Groundbreaking Achievement

May 21, 2025 -

T And T Minister Restricts Vybz Kartels Movement

May 21, 2025

T And T Minister Restricts Vybz Kartels Movement

May 21, 2025 -

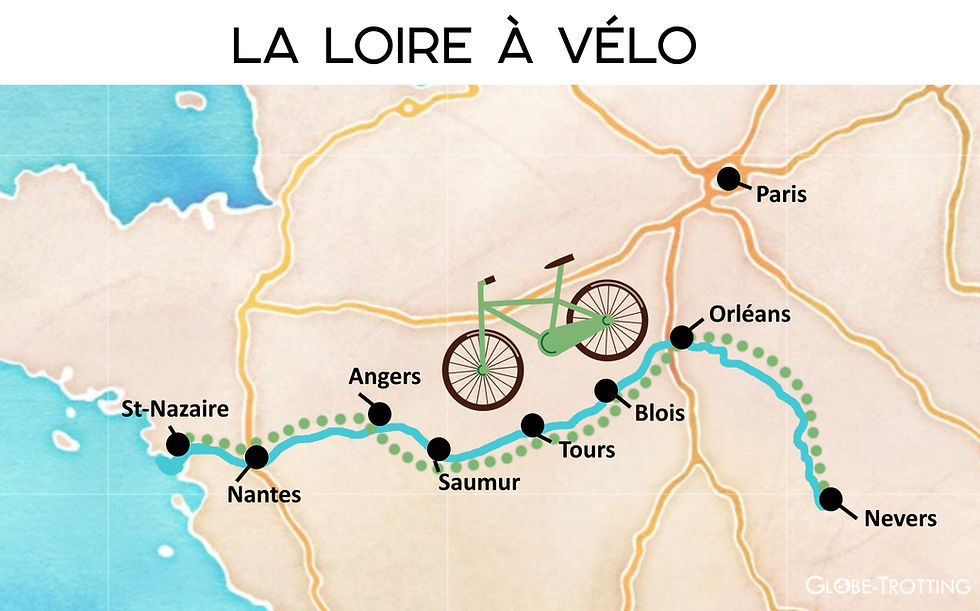

Parcourir La Loire A Velo Guide Des Vignobles Et De L Estuaire Nantais

May 21, 2025

Parcourir La Loire A Velo Guide Des Vignobles Et De L Estuaire Nantais

May 21, 2025 -

The Goldbergs Exploring The Shows Enduring Popularity

May 21, 2025

The Goldbergs Exploring The Shows Enduring Popularity

May 21, 2025

Latest Posts

-

Mainzs Impressive Win At Gladbach Strengthens Top Four Bid

May 21, 2025

Mainzs Impressive Win At Gladbach Strengthens Top Four Bid

May 21, 2025 -

Damaging Winds And Fast Moving Storms What To Watch For

May 21, 2025

Damaging Winds And Fast Moving Storms What To Watch For

May 21, 2025 -

Ftv Lives A Hell Of A Run Facts Figures And Fallout

May 21, 2025

Ftv Lives A Hell Of A Run Facts Figures And Fallout

May 21, 2025 -

Mainz Secure Top Four Spot With Dominant Gladbach Victory

May 21, 2025

Mainz Secure Top Four Spot With Dominant Gladbach Victory

May 21, 2025 -

Watch Out For Damaging Winds Fast Moving Storms

May 21, 2025

Watch Out For Damaging Winds Fast Moving Storms

May 21, 2025