Commodities Teams Refocus: Walleye Cuts Credit Impact On Core Groups

Table of Contents

The Impact of Credit Restrictions on Commodities Trading

The tightening of credit markets has directly impacted commodities trading activities, creating a cascade of challenges. The availability of financing, a cornerstone of large-scale commodity purchases, has significantly diminished. This credit crunch has made it harder for businesses to operate effectively within the commodities market. This difficulty manifests in several key areas:

- Reduced access to financing for large-scale commodity purchases: Teams are finding it increasingly difficult to secure loans and lines of credit for major acquisitions, limiting their trading volume and potential profits.

- Increased difficulty in securing letters of credit: Letters of credit, crucial for international trade, are now harder to obtain, creating significant hurdles for global commodities transactions.

- Higher borrowing costs impacting profitability: The increased cost of borrowing directly eats into profit margins, making previously viable trades unprofitable.

- Increased scrutiny from lenders: Lenders are conducting more rigorous due diligence, demanding greater transparency and stronger financial guarantees before extending credit.

This ripple effect extends across various commodities markets, from energy and metals to agricultural products, highlighting the systemic nature of the credit crisis. The consequences are felt across the supply chain, affecting producers, processors, and consumers alike.

Walleye Market Specifically Affected

The walleye market is particularly vulnerable to credit constraints, showcasing the unique vulnerabilities of niche commodities. Its susceptibility stems from several factors:

- Seasonality and reliance on short-term financing: The walleye fishing season is concentrated, requiring substantial short-term financing for operations and purchases. The tightening of credit markets directly impacts this crucial seasonal funding.

- Perishable nature of the product requiring prompt payment cycles: Walleye is a perishable good, demanding quick sales and swift payment cycles. Delays in payment can lead to significant losses due to spoilage.

- Concentration of buyers and sellers, making the market less resilient: A less diversified market structure means that a credit crunch impacts a smaller number of key players, magnifying the negative consequences.

These vulnerabilities translate into significant challenges for fishing communities and businesses dependent on the walleye industry. Reduced trading activity and financial difficulties can lead to job losses and economic hardship in these already fragile ecosystems. The economic stability of these communities is directly linked to the health of the walleye market.

New Strategies and Refocused Approaches by Commodities Teams

In response to the credit crunch, commodities teams are adopting new strategies and refocusing their approaches. The emphasis is now on resilience, adaptability, and efficient risk management. Key strategies include:

- Increased reliance on shorter-term contracts and reduced inventory: This minimizes exposure to price fluctuations and reduces the need for extensive financing.

- Exploring alternative financing sources like factoring or supply chain finance: These options offer alternative routes to secure capital and manage cash flow.

- Strengthening relationships with key suppliers to secure favorable payment terms: Negotiating extended payment periods and other beneficial terms can alleviate immediate financial pressure.

- Diversification into less credit-sensitive commodities: Spreading risk across different commodities can help mitigate the impact of credit constraints on a single market.

- Implementing robust risk management strategies: Sophisticated risk management models are critical for navigating the uncertain economic climate.

Increased transparency and improved communication between buyers and sellers are also crucial for building trust and ensuring efficient transactions. Open communication can help mitigate some of the risks and uncertainties inherent in the current market.

Technological Advancements & Data Analytics

Technology plays a crucial role in mitigating credit risks and improving operational efficiency. The strategic use of data and technological tools is becoming increasingly vital in this challenging environment. Key technological advancements include:

- Using data analytics to predict market volatility and manage risk: Sophisticated data analytics can help predict market trends and optimize trading strategies to minimize potential losses.

- Implementing blockchain technology for secure and transparent transactions: Blockchain can streamline transactions, enhance security, and improve transparency, boosting trust among trading partners.

- Leveraging AI-powered credit scoring systems for improved lender evaluation: AI-driven systems can provide more accurate assessments of creditworthiness, helping lenders make more informed decisions.

Conclusion

The credit crunch has presented significant challenges for commodities teams, with the walleye market experiencing a particularly sharp impact. However, by adopting innovative strategies, exploring alternative financing, and leveraging technological advancements, commodities teams can successfully navigate this difficult period. A commodities team refocus that incorporates robust risk management, diversification, and technological innovation is vital for long-term success. To learn more about effective strategies for commodities teams to adapt to credit market fluctuations and navigate the complexities of the walleye market and other affected sectors, explore further resources on [link to relevant resources]. Successfully navigating these challenges is crucial for the long-term health of your commodities team refocus strategy.

Featured Posts

-

The Ftc And Meta Antitrust Lawsuit And The Future Of Social Media

May 13, 2025

The Ftc And Meta Antitrust Lawsuit And The Future Of Social Media

May 13, 2025 -

South African Refugees Granted Us Asylum Under Trump Administration Arrive

May 13, 2025

South African Refugees Granted Us Asylum Under Trump Administration Arrive

May 13, 2025 -

Zontanes Athlitikes Metadoseis Serie A Odigos Gia To 2024

May 13, 2025

Zontanes Athlitikes Metadoseis Serie A Odigos Gia To 2024

May 13, 2025 -

Columbus Crew Defeats San Jose Earthquakes 2 1 After Initial Setback

May 13, 2025

Columbus Crew Defeats San Jose Earthquakes 2 1 After Initial Setback

May 13, 2025 -

Philippine Capital Schools Shut Down Due To Extreme Heat

May 13, 2025

Philippine Capital Schools Shut Down Due To Extreme Heat

May 13, 2025

Latest Posts

-

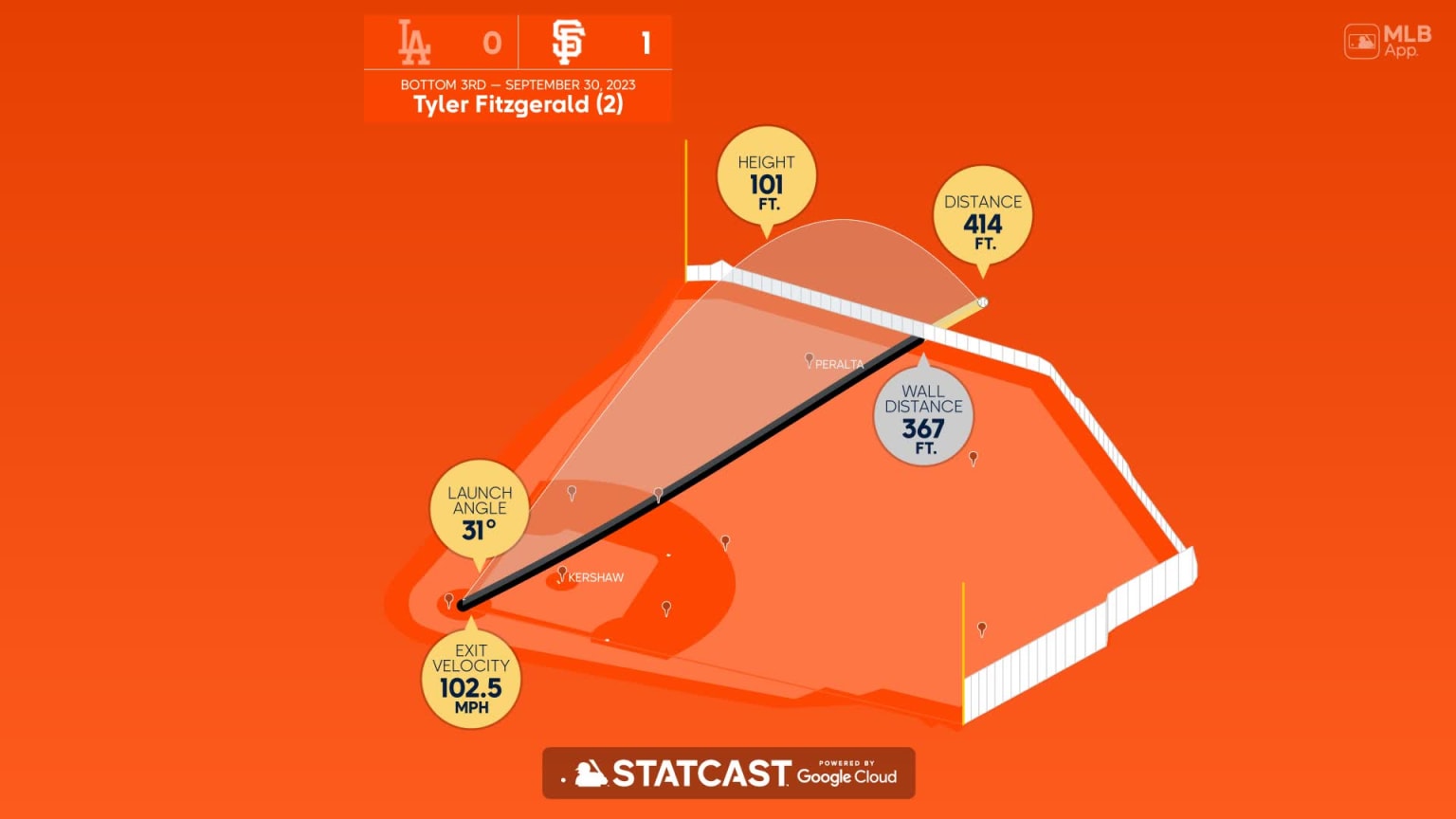

Fitzgeralds Dominant Performance Fuels Giants Victory

May 14, 2025

Fitzgeralds Dominant Performance Fuels Giants Victory

May 14, 2025 -

Tyler Fitzgeralds Strong Stretch Continues In Giants Win

May 14, 2025

Tyler Fitzgeralds Strong Stretch Continues In Giants Win

May 14, 2025 -

Dodgers Vs Angels Ohtanis Epic 6 Run 9th Inning

May 14, 2025

Dodgers Vs Angels Ohtanis Epic 6 Run 9th Inning

May 14, 2025 -

6 Run 9th Ohtanis Power Drives Dodgers Comeback Win

May 14, 2025

6 Run 9th Ohtanis Power Drives Dodgers Comeback Win

May 14, 2025 -

14 11 Thriller Ohtanis Late Homer Secures Dodgers Victory Over Diamondbacks

May 14, 2025

14 11 Thriller Ohtanis Late Homer Secures Dodgers Victory Over Diamondbacks

May 14, 2025