Commodity Market Shifts: The Walleye Cuts Credit Effect On Core Businesses

Table of Contents

Understanding the Walleye Cuts Credit Effect

The "Walleye Cuts Credit Effect" describes the situation where a downturn in commodity markets leads to a contraction in credit availability for businesses operating within those markets. This is a cascading effect: falling commodity prices increase lender risk aversion, resulting in reduced lending and impacting the ability of businesses to operate effectively. Imagine a fishing company heavily reliant on walleye sales; a sudden drop in walleye prices makes it harder for them to repay loans, causing lenders to be less willing to provide future credit. This reduced access to credit then hampers their ability to buy equipment, hire staff, or even purchase supplies for the next fishing season.

- Defines the term "Walleye Cuts Credit Effect": The term illustrates how a decline in a key commodity (like walleye in the example) leads to a "cut" in credit access, impacting businesses' operational capacity.

- Connection between commodity price drops and lender risk aversion: When commodity prices fall, businesses’ revenue decreases, increasing the likelihood of loan defaults. This heightened risk prompts lenders to tighten their lending criteria or reduce their exposure to the affected sector.

- Impact on businesses dependent on commodity trade: Reduced access to credit directly impacts businesses' ability to fund operations, purchase inventory, invest in upgrades, and manage day-to-day expenses. This can lead to production cuts, layoffs, and potentially business failures.

Impact on Core Businesses Across Sectors

The Walleye Cuts Credit Effect impacts various sectors reliant on commodity markets. Let's examine key industries:

Agriculture

Farmers and agricultural businesses are significantly vulnerable to the Walleye Cuts Credit Effect. Reduced credit availability makes it challenging to finance planting, harvesting, and purchasing essential equipment.

- Examples of specific crops affected: Soybeans, corn, wheat, and other crops whose prices are subject to global market fluctuations are particularly vulnerable.

- Impact on supply chains: Credit constraints can disrupt the entire agricultural supply chain, from input suppliers to food processors and distributors.

- Potential government intervention: Governments often implement support programs like subsidies or loan guarantees to mitigate the impact on farmers during commodity price downturns.

Energy

The energy sector, particularly oil and gas companies, is highly susceptible to the Walleye Cuts Credit Effect. Securing financing for exploration, production, and infrastructure projects becomes significantly harder when commodity prices are low or uncertain.

- Impact on oil and gas companies: Reduced credit availability can delay or cancel exploration projects, impacting future energy production and supply.

- Renewable energy sector vulnerability: Although less directly tied to volatile fossil fuel prices, renewable energy companies can also be affected by overall credit market tightening during periods of economic uncertainty.

- Potential effects on energy prices for consumers: Reduced investment in energy production due to credit constraints can contribute to increased energy prices for consumers.

Manufacturing

Manufacturers relying on volatile raw materials face substantial challenges during the Walleye Cuts Credit Effect. Fluctuations in raw material costs directly affect production costs and profitability.

- Impact on production costs and profitability: Rising input costs, combined with reduced access to credit, squeeze profit margins, potentially leading to production cuts.

- Challenges in securing working capital: Manufacturers may struggle to secure short-term financing for day-to-day operations, including paying suppliers and meeting payroll obligations.

- Potential for factory closures or layoffs: In severe cases, the Walleye Cuts Credit Effect can force manufacturers to reduce production, leading to factory closures and job losses.

Mitigation Strategies for Businesses

Businesses can adopt several strategies to mitigate the impact of the Walleye Cuts Credit Effect:

- Diversification of suppliers and markets: Reducing reliance on a single supplier or market minimizes vulnerability to price shocks in a specific commodity.

- Implementing robust hedging strategies: Hedging through financial instruments like futures contracts can help mitigate price risk and protect against losses due to commodity price volatility.

- Strengthening relationships with existing lenders: Maintaining a strong financial track record and open communication with lenders can improve the chances of securing credit during challenging times.

- Exploring alternative financing options: Crowdfunding, government loan programs, and invoice financing can provide alternative sources of capital when traditional lending is restricted.

- Improving financial forecasting and risk management: Accurate financial planning and robust risk management strategies are crucial for anticipating and mitigating the effects of commodity price fluctuations.

The Future of Commodity Markets and Credit Access

Predicting the future of commodity markets and credit access is complex, but several trends are worth considering:

- Predictions about commodity price volatility: Commodity prices are likely to remain volatile due to factors like geopolitical instability, climate change, and evolving consumer demand.

- The role of technological advancements: Technological innovations in areas like precision agriculture and energy efficiency could potentially reduce the impact of price volatility.

- Potential policy changes influencing credit availability: Government policies aimed at supporting specific industries or improving access to credit could play a significant role in mitigating the Walleye Cuts Credit Effect.

- Discussion about the long-term sustainability of businesses in volatile commodity markets: Businesses must adapt to the realities of commodity market volatility by diversifying their operations and strengthening their financial resilience.

Conclusion

The Walleye Cuts Credit Effect presents significant challenges for core businesses reliant on commodity markets. Understanding the intricacies of this phenomenon is crucial for navigating the volatile landscape. By implementing the mitigation strategies outlined above and staying informed about market trends, businesses can better manage risk and ensure their long-term sustainability. Proactive planning and adaptation are key to weathering the storm of the Walleye Cuts Credit Effect and ensuring continued success in the face of commodity market shifts. Stay informed and prepare for future fluctuations in the commodity markets to minimize the impact of the Walleye Cuts Credit Effect on your business.

Featured Posts

-

Gaza Hostage Crisis A Lingering Nightmare For Families

May 13, 2025

Gaza Hostage Crisis A Lingering Nightmare For Families

May 13, 2025 -

Mosque In Major Muslim City Issues Statement Following Police Inquiry

May 13, 2025

Mosque In Major Muslim City Issues Statement Following Police Inquiry

May 13, 2025 -

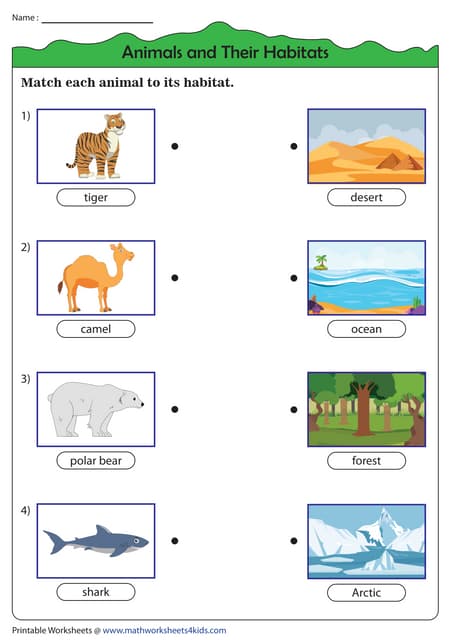

Understanding The Wonder Of Animals Their Habitats And Behaviors

May 13, 2025

Understanding The Wonder Of Animals Their Habitats And Behaviors

May 13, 2025 -

Bbcs Chris Packham And The Hug A Slug Campaign Promoting Wildlife Appreciation

May 13, 2025

Bbcs Chris Packham And The Hug A Slug Campaign Promoting Wildlife Appreciation

May 13, 2025 -

Urgent Tory Lanez Suffers Stab Wounds In Prison Hospitalized

May 13, 2025

Urgent Tory Lanez Suffers Stab Wounds In Prison Hospitalized

May 13, 2025

Latest Posts

-

Scotty Mc Creerys Sons Sweet George Strait Tribute Goes Viral

May 14, 2025

Scotty Mc Creerys Sons Sweet George Strait Tribute Goes Viral

May 14, 2025 -

Adorable Video Scotty Mc Creerys Son Honors George Strait

May 14, 2025

Adorable Video Scotty Mc Creerys Son Honors George Strait

May 14, 2025 -

Watch Scotty Mc Creerys Son Pay Heartfelt Tribute To George Strait

May 14, 2025

Watch Scotty Mc Creerys Son Pay Heartfelt Tribute To George Strait

May 14, 2025 -

Country Music Scotty Mc Creerys Sons Adorable George Strait Tribute

May 14, 2025

Country Music Scotty Mc Creerys Sons Adorable George Strait Tribute

May 14, 2025 -

Cute Video Scotty Mc Creerys Sons George Strait Tribute

May 14, 2025

Cute Video Scotty Mc Creerys Sons George Strait Tribute

May 14, 2025