Core Inflation Surge: The Bank Of Canada's Policy Predicament

Table of Contents

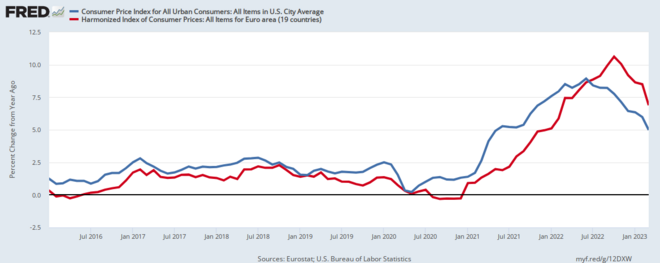

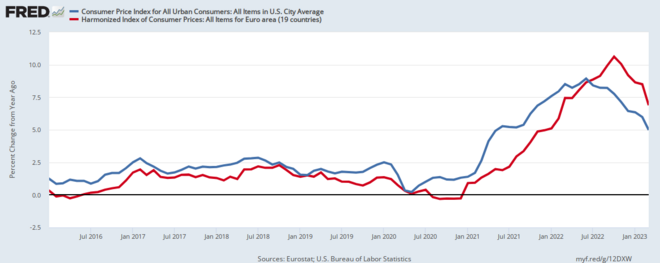

Understanding the Core Inflation Surge

Defining Core Inflation and its Significance

Core inflation represents the underlying rate of price increases in an economy, excluding the more volatile components of headline inflation, such as food and energy prices. Understanding core inflation is crucial because it provides a clearer picture of persistent price pressures within the economy. Unlike headline inflation, which can fluctuate dramatically due to short-term shocks, core inflation offers a more stable measure of underlying inflationary trends. This makes it a better predictor of future inflation and a key indicator for monetary policy decisions.

- Measures of Core Inflation: Several measures exist, including the trimmed mean Consumer Price Index (CPI), which removes the highest and lowest price changes, and the median CPI, which focuses on the middle value. These alternative measures help to smooth out the impact of outliers and provide a more accurate reflection of underlying price pressures.

- Predictive Power: Core inflation is a more reliable indicator of future inflation than headline inflation. This is because it filters out temporary price shocks, allowing policymakers to focus on the more persistent inflationary pressures driving long-term price changes.

- Recent Canadian Data: Recent statistics show a concerning rise in Canadian core inflation, exceeding the Bank of Canada's target range, signaling persistent upward pressure on prices across the economy. (Specific data should be inserted here, referencing reliable sources like Statistics Canada).

Key Drivers of the Current Core Inflation Surge

Several factors contribute to the current core inflation surge in Canada. These are interconnected and reinforce each other, creating a complex challenge for policymakers.

- Supply Chain Disruptions: The lingering effects of the global pandemic continue to disrupt supply chains, leading to shortages and increased production costs. This directly impacts the prices of many goods and services.

- Strong Consumer Demand: Robust consumer spending, fueled by pent-up demand and government stimulus measures, has outpaced the capacity of many industries to meet the increased demand, adding to inflationary pressure.

- Wage Growth: Increased wages, while positive for workers, contribute to inflationary pressure if they outpace productivity gains. This can create a wage-price spiral, where higher wages lead to higher prices, which in turn lead to demands for even higher wages.

- Housing Costs: The rapid rise in Canadian housing prices, driven by both strong demand and limited supply, significantly impacts core inflation measures, as housing costs constitute a large share of consumer spending.

- Imported Inflation: Global inflationary pressures, stemming from factors like rising energy prices and supply chain disruptions worldwide, are imported into Canada, adding to domestic inflationary trends. This highlights the interconnectedness of global and domestic economies.

The Bank of Canada's Policy Response

Interest Rate Hikes and Their Effectiveness

The Bank of Canada has responded to the core inflation surge by raising interest rates. This monetary policy tool aims to curb inflation by reducing borrowing costs and slowing down economic activity. However, the effectiveness of these rate hikes is not immediate.

- Lags in Policy Effects: There's a significant time lag between interest rate changes and their full impact on the economy and inflation. This lag makes monetary policy a challenging tool to manage inflation in real-time.

- Risk of Recession: Aggressive interest rate hikes carry the risk of triggering a recession, as higher borrowing costs can dampen business investment and consumer spending, potentially leading to job losses. The Bank of Canada must carefully balance the need to control inflation with the risk of causing an economic downturn.

- Inflation Target: The Bank of Canada has a mandate to maintain inflation at 2%, and the current levels significantly exceed this target, necessitating proactive policy measures.

Alternative Policy Tools and Considerations

Beyond interest rate adjustments, the Bank of Canada has other tools at its disposal, although each carries its own limitations.

- Quantitative Tightening (QT): This involves reducing the Bank's balance sheet by allowing government bonds to mature without replacement. This reduces the money supply and can help curb inflation. However, QT can also negatively affect credit markets and economic growth.

- Forward Guidance: Clear communication about the Bank's intentions and future policy decisions can influence market expectations and help to anchor inflation expectations. Effective forward guidance requires credible communication and consistent policy actions.

- Communication Strategies: Transparency and clear communication about the economic outlook and policy decisions are crucial to build confidence and manage inflation expectations effectively.

Economic Outlook and Future Projections

Forecasting Core Inflation

Forecasting core inflation involves a high degree of uncertainty, with various economic institutions offering different projections.

- Institutional Forecasts: Predictions from institutions like the IMF and OECD offer valuable insights but should be considered with caution, as underlying assumptions and methodologies vary. (Include specific forecasts from reputable sources, referencing them properly)

- Uncertainty and Risks: Several factors, such as geopolitical events, energy price shocks, and unexpected shifts in consumer demand, can significantly impact future inflation outcomes.

- Upside and Downside Risks: There are both upside and downside risks to current core inflation forecasts. Persistent supply chain disruptions or a resurgence of strong consumer demand could lead to higher-than-expected inflation. Conversely, a sharper-than-anticipated economic slowdown could lead to lower inflation.

Implications for Businesses and Consumers

Persistent core inflation significantly impacts businesses and consumers.

- Increased Costs for Businesses: Businesses face rising input costs, including wages, raw materials, and energy, which can squeeze profit margins and impact investment decisions.

- Reduced Purchasing Power for Consumers: Higher prices reduce the purchasing power of consumers, potentially leading to reduced consumption and economic slowdown.

- Impact on Investment Decisions: Uncertainty about future inflation can discourage businesses from making long-term investments, impacting economic growth.

- Mitigation Strategies: Businesses can explore cost-cutting measures and price adjustments, while consumers can focus on budgeting, saving, and seeking out value-for-money products and services.

Conclusion

The surge in core inflation presents a formidable challenge for the Bank of Canada. Balancing the need to control inflation with the need to avoid a recession requires a delicate policy approach. The complexity is compounded by interconnected global factors that influence Canada's economic conditions. The effectiveness of interest rate hikes, alongside the potential implications of alternative policy tools, remains a significant area of ongoing analysis. The significant impact of global factors underscores the interconnectedness of the Canadian and global economies. Understanding core inflation is critical to navigate this uncertain landscape.

Call to Action: Stay informed about the evolving situation of core inflation in Canada and the Bank of Canada's policy responses. Regularly consult reliable economic news sources to understand the implications for your financial planning and business decisions. Understanding and monitoring core inflation is crucial for navigating this uncertain economic landscape.

Featured Posts

-

Hieu Ro Chuc Nang Hai Lo Vuong Tren Cong Usb Cua Ban

May 22, 2025

Hieu Ro Chuc Nang Hai Lo Vuong Tren Cong Usb Cua Ban

May 22, 2025 -

Core Weave Inc Crwv Stock Surge On Wednesday Reasons Behind The Rise

May 22, 2025

Core Weave Inc Crwv Stock Surge On Wednesday Reasons Behind The Rise

May 22, 2025 -

William Goodge Sets New Standard For Fastest Australian Foot Crossing

May 22, 2025

William Goodge Sets New Standard For Fastest Australian Foot Crossing

May 22, 2025 -

Thousands Of Zebra Mussels Discovered On Boat Lift In Casper

May 22, 2025

Thousands Of Zebra Mussels Discovered On Boat Lift In Casper

May 22, 2025 -

Home Depot Stock Despite Disappointing Results Tariff Impact Guidance Remains

May 22, 2025

Home Depot Stock Despite Disappointing Results Tariff Impact Guidance Remains

May 22, 2025

Latest Posts

-

Fed Ex Truck Blaze On Route 283 Lancaster County Emergency Response

May 22, 2025

Fed Ex Truck Blaze On Route 283 Lancaster County Emergency Response

May 22, 2025 -

Produce Hauling Truck Crash Interstate 83 Closure

May 22, 2025

Produce Hauling Truck Crash Interstate 83 Closure

May 22, 2025 -

Lancaster County Fed Ex Truck Catches Fire On Route 283

May 22, 2025

Lancaster County Fed Ex Truck Catches Fire On Route 283

May 22, 2025 -

I 83 Tractor Trailer Accident Involves Produce Shipment

May 22, 2025

I 83 Tractor Trailer Accident Involves Produce Shipment

May 22, 2025 -

Route 283 Fed Ex Truck Fire Lancaster County Incident

May 22, 2025

Route 283 Fed Ex Truck Fire Lancaster County Incident

May 22, 2025