CoreWeave (CRWV): Jim Cramer's Assessment And The Future Of AI Infrastructure

Table of Contents

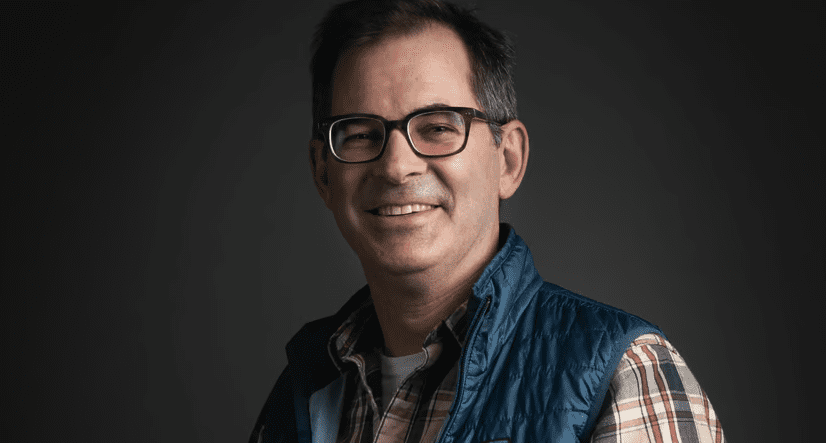

Jim Cramer's Stance on CoreWeave (CRWV)

Jim Cramer, known for his outspoken views on the stock market, has frequently commented on the potential of AI infrastructure companies. While specific quotes require referencing his recent shows and publications (due to the dynamic nature of financial commentary), his general sentiment towards CoreWeave can often be characterized as cautiously optimistic. He typically highlights the massive growth potential within the AI sector and recognizes CoreWeave's strategic positioning to capitalize on this trend.

- Cramer's overall sentiment towards CRWV: Generally positive, emphasizing its potential but acknowledging inherent market risks.

- Specific aspects highlighted: Cramer often focuses on CoreWeave's focus on sustainable practices, a significant differentiating factor in an environmentally conscious investor landscape. He also seems to appreciate the company’s specialized hardware and its ability to compete against larger cloud providers.

- Comparison to competitors: Cramer frequently draws comparisons to major players like AWS, Azure, and GCP, emphasizing CoreWeave's niche focus as a potential competitive advantage.

His investment strategy aligns with CoreWeave's business model in that it focuses on companies poised for significant growth in emerging technology sectors. However, it’s crucial to remember that even Cramer's endorsements should be considered alongside broader market analysis.

CoreWeave's Business Model and Competitive Advantage

CoreWeave offers GPU cloud computing services specifically designed to handle the demanding workloads associated with artificial intelligence and machine learning. This specialization is a core component of its competitive advantage. Unlike general-purpose cloud providers, CoreWeave focuses on providing optimized solutions for AI developers and researchers.

- Key features and benefits: CoreWeave's services prioritize speed, scalability, and cost-effectiveness. They offer various GPU options, enabling users to choose the hardware best suited for their specific needs. Their focus on sustainability, achieved through efficient power usage and responsible sourcing, attracts environmentally conscious clients.

- Comparison to other cloud computing providers: While AWS, Azure, and GCP offer GPU-based cloud computing, CoreWeave's specialization and targeted approach give it a unique edge. It can provide more specialized solutions for AI applications than the broader offerings of the large players.

- Market share and growth trajectory: Although precise market share data fluctuates, CoreWeave is experiencing rapid growth as AI adoption accelerates, suggesting a promising trajectory.

The Future of AI Infrastructure and CoreWeave's Role

The future of AI infrastructure looks bright. The market is poised for explosive growth, driven by increasing adoption of AI across various industries. This expansion presents significant opportunities for CoreWeave.

- Projected market size and growth rate: Industry analysts predict substantial growth for the AI infrastructure market over the coming years, a positive outlook for companies like CoreWeave.

- Key technological advancements: Advancements in GPU technology, networking, and AI algorithms will continue to shape the landscape, and CoreWeave’s ability to adapt to these changes will be vital.

- CoreWeave's strategies for long-term success: CoreWeave's strategic focus on sustainability, specialized hardware, and customer service positions it well for long-term success. Continuous innovation and expansion into new markets are key to maintaining its competitive edge.

- Potential risks: Competition from larger cloud providers, technological disruptions, and regulatory changes pose potential risks to CoreWeave's growth.

Investing in CoreWeave (CRWV): A Risk/Reward Assessment

Investing in CRWV, like any investment in a growth stock, presents both substantial risks and potential rewards. It's crucial to perform thorough due diligence before making any investment decisions.

- Key financial metrics: Closely examine revenue growth, profitability margins, and debt levels to gauge the company's financial health.

- Potential risks: Competition from established players, technological obsolescence, and shifts in regulatory environments all present significant risk factors. Market volatility related to the overall technology sector is another critical consideration.

- Potential rewards: The high growth potential of the AI infrastructure market and CoreWeave's strategic positioning offer significant potential upside for investors with a higher risk tolerance.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.

CoreWeave (CRWV): Navigating the AI Infrastructure Landscape

Jim Cramer's generally positive view on CoreWeave reflects the significant potential within the AI infrastructure market. CoreWeave's competitive advantage lies in its specialized focus, sustainable practices, and its ability to provide optimized solutions for demanding AI workloads. While significant growth potential exists, investors should carefully consider the inherent risks associated with investing in a growth company within a rapidly evolving technological landscape. The future of CoreWeave will depend significantly on its ability to adapt to technological advancements, maintain its competitive edge, and successfully navigate the complexities of the rapidly expanding AI market. Further research into CoreWeave (CRWV) is recommended before making any investment decisions, considering your individual risk tolerance and financial goals. Consult with a qualified financial advisor for personalized guidance.

Featured Posts

-

Vybz Kartel Tour A Dream Realized For Nuphy

May 22, 2025

Vybz Kartel Tour A Dream Realized For Nuphy

May 22, 2025 -

Creating Your Own Love Monster A Diy Craft Project

May 22, 2025

Creating Your Own Love Monster A Diy Craft Project

May 22, 2025 -

Investigating The Reasons Behind Core Weave Inc Crwv S Thursday Stock Drop

May 22, 2025

Investigating The Reasons Behind Core Weave Inc Crwv S Thursday Stock Drop

May 22, 2025 -

Is Blake Lively Involved In This Alleged Incident A Look At The Controversy

May 22, 2025

Is Blake Lively Involved In This Alleged Incident A Look At The Controversy

May 22, 2025 -

Thursdays Drop In Core Weave Inc Crwv Stock A Comprehensive Look

May 22, 2025

Thursdays Drop In Core Weave Inc Crwv Stock A Comprehensive Look

May 22, 2025

Latest Posts

-

Lindsey Graham Calls For Crushing Sanctions Against Russia If Ceasefire Fails

May 22, 2025

Lindsey Graham Calls For Crushing Sanctions Against Russia If Ceasefire Fails

May 22, 2025 -

Siren 2024 Review A Stellar Cast Elevates This Beachside Thriller

May 22, 2025

Siren 2024 Review A Stellar Cast Elevates This Beachside Thriller

May 22, 2025 -

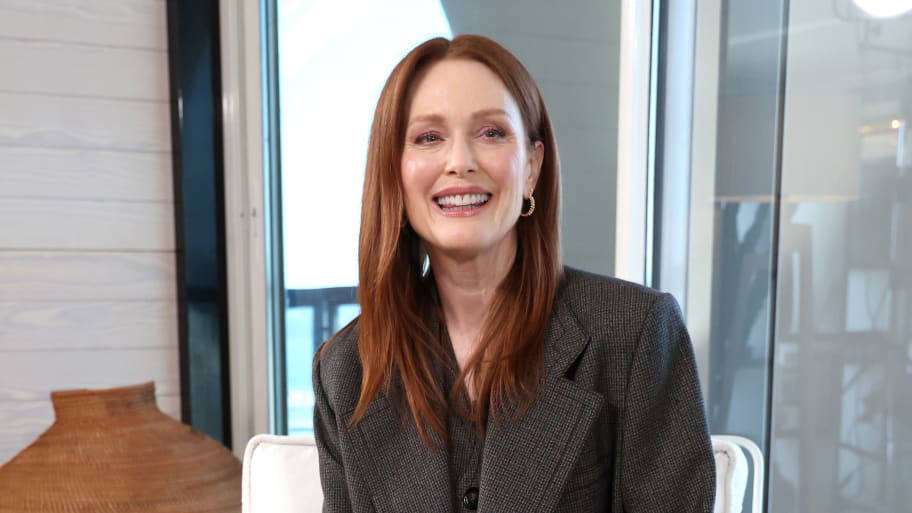

Siren Review Julianne Moore Meghann Fahy And Milly Alcock Deliver Beachy Thrills

May 22, 2025

Siren Review Julianne Moore Meghann Fahy And Milly Alcock Deliver Beachy Thrills

May 22, 2025 -

Siren Julianne Moore Meghann Fahy And Milly Alcock Lead Netflixs Dark Comedy

May 22, 2025

Siren Julianne Moore Meghann Fahy And Milly Alcock Lead Netflixs Dark Comedy

May 22, 2025 -

Netflix New Releases May 2025 Preview

May 22, 2025

Netflix New Releases May 2025 Preview

May 22, 2025