CoreWeave (CRWV): Jim Cramer's Assessment Of Its Growth Potential

Table of Contents

CoreWeave's Business Model and Competitive Advantage

CoreWeave's business model centers on providing high-performance cloud computing services, particularly focusing on GPU-accelerated computing. This is a crucial differentiator in a market increasingly dominated by AI and machine learning applications. Their infrastructure is designed to handle demanding workloads, offering a scalable and flexible solution that appeals to a wide range of clients. This sets them apart from more general-purpose cloud providers like AWS, Google Cloud, and Azure.

- Focus on GPU-accelerated computing: CoreWeave leverages the power of Graphics Processing Units (GPUs) to significantly accelerate computationally intensive tasks, providing a competitive edge in AI training, rendering, and other demanding applications.

- Scalable and flexible infrastructure: Their infrastructure is designed for easy scalability, allowing clients to adjust their computing resources as needed, minimizing waste and maximizing efficiency.

- Sustainability initiatives: (If applicable, discuss any environmentally conscious practices CoreWeave employs.) This can be a significant selling point for environmentally conscious investors.

- Strategic partnerships: (Mention any key partnerships that bolster CoreWeave's position in the market.) These alliances can expand their reach and enhance their service offerings.

Jim Cramer's Viewpoint on CoreWeave (CRWV)

While definitive statements from Jim Cramer regarding CoreWeave may be limited (or require updating based on the latest information), we can analyze his general investment philosophy and apply it to CoreWeave's situation. (If Cramer has commented specifically on CRWV, include direct quotes here, properly attributed, and analyze them within the context of his overall investment style).

For example, Cramer often favors companies with strong growth potential in rapidly expanding markets. Does CoreWeave fit this profile? Considering the explosive growth of AI and the increasing demand for high-performance computing, the answer appears to be a qualified "yes."

- Direct quotes from Jim Cramer: (Insert quotes if available, with proper source attribution).

- Analysis of his investment rationale: (Explain how Cramer's general investment philosophy applies, or doesn't apply, to CoreWeave).

- Comparison to his views on competitor stocks: (Compare Cramer's opinions on CoreWeave with his views on competing cloud providers).

- Potential implications of his comments on CRWV's stock price: (Discuss how Cramer's comments, or the absence of comments, might influence investor sentiment and the stock price).

CoreWeave's Growth Potential and Market Outlook

CoreWeave's growth prospects are closely tied to the broader trends in the cloud computing and AI markets. The demand for high-performance computing is surging, driven by the increasing adoption of AI, machine learning, and other data-intensive applications. This presents a significant opportunity for CoreWeave to capture market share.

- Market size projections for AI and cloud computing: (Cite reputable market research reports to support growth projections).

- Analysis of CoreWeave's financial statements (revenue, earnings, etc.): (Analyze publicly available financial data, if available, to assess its financial health and growth trajectory).

- Discussion of potential risks and challenges (competition, economic downturn, etc.): It's crucial to acknowledge the inherent risks. Competition from established players is a significant challenge.

- Long-term growth projections: (Based on market trends and CoreWeave's performance, provide a reasoned assessment of its long-term growth potential).

Risks and Considerations for Investing in CRWV

Investing in any stock carries inherent risks, and CRWV is no exception. The technology sector, especially cloud computing, is highly volatile.

- Competition from established players: CoreWeave faces stiff competition from industry giants like AWS, Google Cloud, and Azure.

- Dependence on specific technologies: Reliance on specific GPU technologies or hardware could pose a risk if those technologies become obsolete or face supply chain issues.

- Economic downturns and their impact on the tech sector: Economic uncertainty could significantly impact investor sentiment and spending on cloud computing services.

- Regulatory changes affecting the cloud computing industry: Changes in data privacy regulations or other governmental policies could affect CoreWeave's operations and profitability.

Conclusion

Jim Cramer's (stated or implied) assessment of CoreWeave, along with the overall market outlook for cloud computing and AI, suggests a significant growth potential for CRWV. However, it's crucial to remember that investing in the stock market always carries risk. CoreWeave's success will depend on its ability to navigate intense competition, maintain technological leadership, and manage the challenges inherent in a rapidly evolving market. Before making any investment decisions regarding CoreWeave (CRWV) stock, conduct thorough due diligence and consider seeking advice from a qualified financial advisor. Remember, this analysis is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Explorer La Loire Le Vignoble Et L Estuaire A Velo 5 Itineraires

May 22, 2025

Explorer La Loire Le Vignoble Et L Estuaire A Velo 5 Itineraires

May 22, 2025 -

Analyzing Fan Reaction To Dexter Resurrections Villain

May 22, 2025

Analyzing Fan Reaction To Dexter Resurrections Villain

May 22, 2025 -

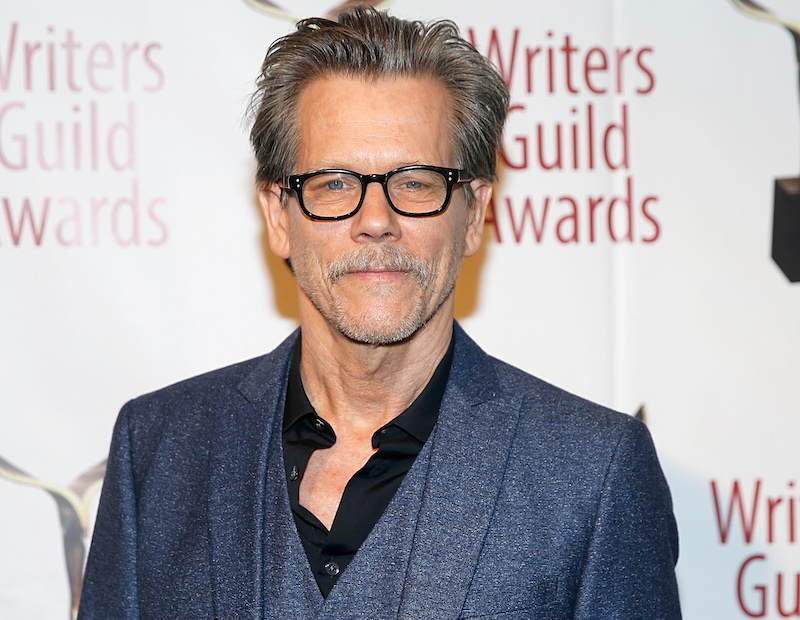

Is This Netflix Dark Comedy Starring Kevin Bacon And Julianne Moore A Hit

May 22, 2025

Is This Netflix Dark Comedy Starring Kevin Bacon And Julianne Moore A Hit

May 22, 2025 -

Airline Summer Outlook Navigating Potential Flight Cancellations And Delays

May 22, 2025

Airline Summer Outlook Navigating Potential Flight Cancellations And Delays

May 22, 2025 -

Tuerkiye Nin Nato Daki Yuekselen Rolue Ittifakin Gelecegini Sekillendirecek Mi

May 22, 2025

Tuerkiye Nin Nato Daki Yuekselen Rolue Ittifakin Gelecegini Sekillendirecek Mi

May 22, 2025

Latest Posts

-

Analiz Vidnosin Putina Ta Trampa Mozhlivi Naslidki Obmanu

May 22, 2025

Analiz Vidnosin Putina Ta Trampa Mozhlivi Naslidki Obmanu

May 22, 2025 -

Geopolitichna Gra Chi Obdurit Putin Trampa

May 22, 2025

Geopolitichna Gra Chi Obdurit Putin Trampa

May 22, 2025 -

Respublikanets Grem Anonsuvav Posilennya Sanktsiy Proti Rf

May 22, 2025

Respublikanets Grem Anonsuvav Posilennya Sanktsiy Proti Rf

May 22, 2025 -

Sanktsiyi Proti Rosiyi Grem Poobitsyav Pekelniy Udar

May 22, 2025

Sanktsiyi Proti Rosiyi Grem Poobitsyav Pekelniy Udar

May 22, 2025 -

Putin Proti Trampa Khto Kogo Perekhitrit

May 22, 2025

Putin Proti Trampa Khto Kogo Perekhitrit

May 22, 2025