CoreWeave (CRWV) Stock: Jim Cramer's Opinion And Market Analysis

Table of Contents

Jim Cramer's Stance on CoreWeave (CRWV)

While definitive public statements from Jim Cramer specifically addressing CoreWeave (CRWV) stock are currently limited (as of [Insert Current Date]), analyzing his general investment philosophy and pronouncements on similar companies in the cloud computing sector can offer valuable insights. Cramer's often-expressed preference for companies with strong growth potential and disruptive technologies suggests that, if he were to comment on CRWV, his stance might lean towards the positive, particularly if he perceived CoreWeave's technology as truly innovative and its market position as secure.

- Specific quotes from Jim Cramer (if available): [Insert any available quotes here; if none, replace with "At the time of writing, no direct quotes from Jim Cramer regarding CRWV stock were found."]

- Dates of his pronouncements on CRWV: [Insert dates if available; if none, state "N/A"]

- Analysis of his investment strategy as it relates to CRWV: [Analyze Cramer's general investment style – growth stocks, value stocks, etc. – and how CRWV might fit into that strategy. Speculate responsibly, avoiding definitive claims without evidence.]

CoreWeave (CRWV) Fundamental Analysis

CoreWeave's business model centers on providing scalable, high-performance cloud computing infrastructure, primarily targeting demanding applications like AI and machine learning. Its revenue streams stem from subscriptions and usage-based pricing for its cloud services. Analyzing CRWV's financial health requires a thorough examination of key metrics:

- Key financial metrics (e.g., revenue growth, profit margins): [Insert available financial data and analyze revenue growth rates, profit margins, and operating expenses. Source data appropriately.]

- Competitive landscape and market share: [Discuss CoreWeave's competitors (e.g., AWS, Google Cloud, Microsoft Azure) and estimate its current market share. Explain its competitive advantages.]

- Potential future growth opportunities: [Identify potential future growth drivers, such as expansion into new markets, partnerships, or technological advancements. Mention the growing demand for high-performance computing.]

CoreWeave (CRWV) Technical Analysis

Technical analysis of CRWV stock requires studying chart patterns and technical indicators to predict future price movements.

- Relevant chart patterns (e.g., head and shoulders, flags): [Analyze the stock's chart patterns using reputable charting tools. Identify any potential support or resistance levels.]

- Key technical indicators and their signals: [Examine key indicators like moving averages (e.g., 50-day, 200-day), Relative Strength Index (RSI), and MACD to gauge momentum and potential trend reversals.]

- Price targets based on technical analysis: [Based on the technical analysis, cautiously suggest potential price targets. Emphasize that these are only estimations and not financial advice.]

Market Sentiment and Investor Behavior Towards CRWV

Gauging market sentiment towards CRWV requires analyzing various sources:

- Summary of recent news impacting CRWV: [Summarize recent news articles, press releases, and announcements impacting CRWV's stock price and investor confidence.]

- Overview of analyst ratings and price targets: [Present a summary of analyst ratings and price targets from reputable financial institutions. Explain the range of opinions.]

- Social media sentiment analysis (if available): [If available, include insights from social media sentiment analysis tools. Mention the limitations of social media data as an indicator of overall market sentiment.]

Conclusion: Investing in CoreWeave (CRWV) Stock – A Balanced Perspective

While definitive information on Jim Cramer's specific view of CRWV remains limited, our analysis suggests that a positive assessment may align with his general investment approach. The fundamental analysis reveals a company with significant growth potential in a rapidly expanding market. However, technical analysis provides a more nuanced perspective, highlighting the need for careful consideration of potential volatility. Overall market sentiment seems positive, but investors should always remain cautious. Investing in CRWV stock, or any stock, carries inherent risk. Therefore, before making any investment decisions regarding CRWV investment opportunities or CRWV stock market analysis, conduct your own thorough due diligence. Consider consulting with a qualified financial advisor to determine if CoreWeave (CRWV) stock aligns with your personal investment goals and risk tolerance. Remember that this analysis is for informational purposes only and should not be considered financial advice. Conduct your own research and seek professional guidance before investing in CRWV investment.

Featured Posts

-

Abn Amro Analyse Van De Stijgende Vraag Naar Occasions

May 22, 2025

Abn Amro Analyse Van De Stijgende Vraag Naar Occasions

May 22, 2025 -

Blake Lively And Taylor Swift Did A Subpoena Damage Their Friendship

May 22, 2025

Blake Lively And Taylor Swift Did A Subpoena Damage Their Friendship

May 22, 2025 -

Wtt Star Contender Chennai 2025 Suravajjula Upsets Kamal In Emotional Farewell Match

May 22, 2025

Wtt Star Contender Chennai 2025 Suravajjula Upsets Kamal In Emotional Farewell Match

May 22, 2025 -

New Looney Tunes Animated Short Featuring Cartoon Network Stars 2025

May 22, 2025

New Looney Tunes Animated Short Featuring Cartoon Network Stars 2025

May 22, 2025 -

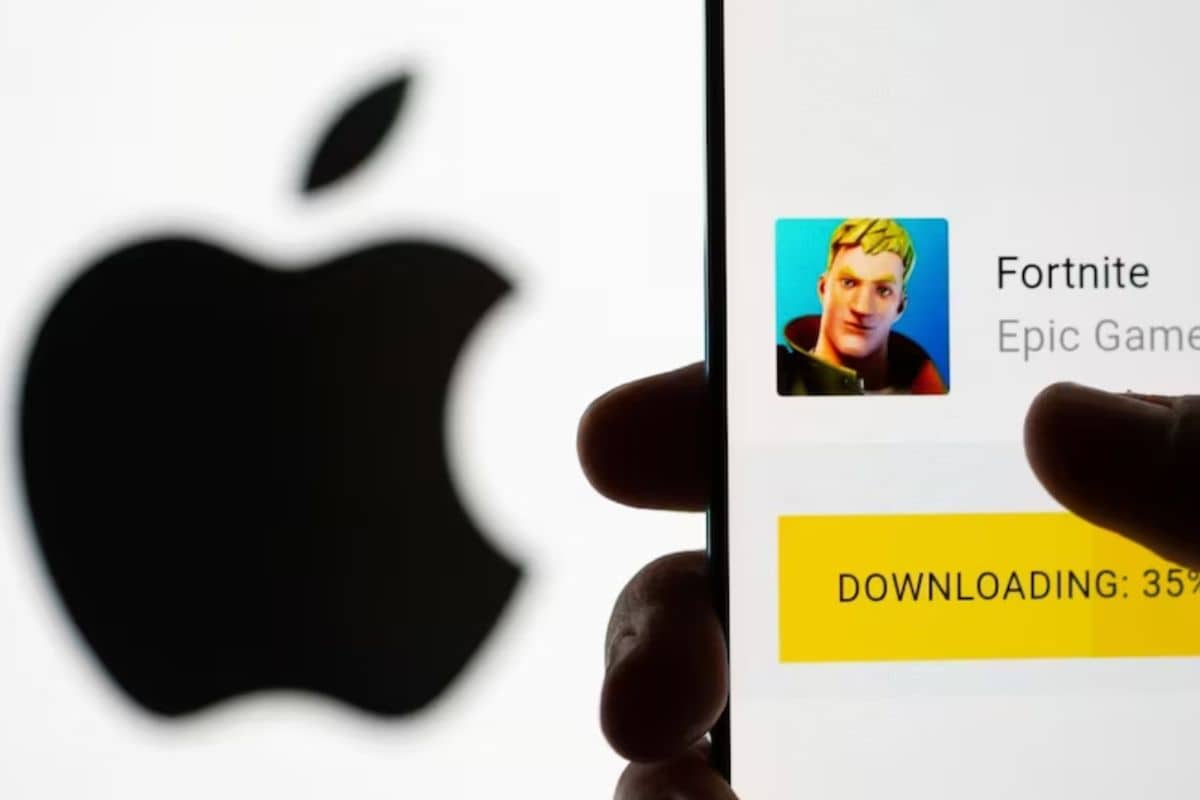

Apple And Epic Games Settle Fortnite Back On Us I Phones

May 22, 2025

Apple And Epic Games Settle Fortnite Back On Us I Phones

May 22, 2025

Latest Posts

-

Death Of Adam Ramey Dropout Kings Singer Passes

May 22, 2025

Death Of Adam Ramey Dropout Kings Singer Passes

May 22, 2025 -

Remembering Adam Ramey Dropout Kings Vocalist Dies

May 22, 2025

Remembering Adam Ramey Dropout Kings Vocalist Dies

May 22, 2025 -

Adam Ramey Of Dropout Kings Passes Away

May 22, 2025

Adam Ramey Of Dropout Kings Passes Away

May 22, 2025 -

Dropout Kings Vocalist Adam Ramey Dead At Age

May 22, 2025

Dropout Kings Vocalist Adam Ramey Dead At Age

May 22, 2025 -

Music World Mourns The Loss Of Dropout Kings Adam Ramey

May 22, 2025

Music World Mourns The Loss Of Dropout Kings Adam Ramey

May 22, 2025