CoreWeave (CRWV) Stock Soars: Analyzing Thursday's Market Performance

Table of Contents

Understanding CoreWeave's Business Model and Recent Developments

CoreWeave's Position in the Cloud Computing Market

CoreWeave specializes in high-performance computing (HPC), providing robust cloud infrastructure tailored for demanding applications like AI and machine learning. Its competitive advantage stems from its unique approach to leveraging GPU-accelerated computing, offering unparalleled scalability and performance to its clientele. This focus on a rapidly growing market segment, combined with its cutting-edge technology, positions CoreWeave for significant future growth.

- Clients and Projects: CoreWeave boasts a diverse client base, including prominent names in the AI, machine learning, and high-performance computing sectors. They've successfully completed large-scale projects requiring immense processing power, demonstrating their platform's capabilities. Specific examples (although confidential information may limit this) could include contributions to large-scale AI model training or scientific research projects.

- Strategic Partnerships: CoreWeave's strategic partnerships with leading technology providers further solidify its position in the market. These collaborations enhance its technological offerings and expand its reach to a broader customer base. Details on these partnerships (if publicly available) should be included here.

- Innovation and Scalability: CoreWeave's commitment to innovation is evident in its continuous development of advanced technologies. The company's ability to scale its infrastructure to meet the ever-increasing demands of its clients is a critical factor in its success. Mentioning specific technological advancements would strengthen this point.

Analyzing the News and Events Leading to the Stock Surge

Thursday's stock surge wasn't a random event. Several factors likely converged to create this positive market reaction. Identifying and analyzing these events is crucial to understanding the driving forces behind CRWV's price increase.

- Positive News and Announcements: Any press releases, partnerships announcements, or successful project deployments should be explicitly mentioned here. For example, a new strategic partnership with a major technology company, or the successful completion of a significant project that showcases CoreWeave's capabilities, could substantially boost investor confidence.

- Analyst Upgrades and Ratings Changes: Positive ratings from reputable financial analysts can significantly influence investor sentiment. Mentioning any upgrades or positive rating changes related to CRWV's stock on or before Thursday is crucial. These ratings often cite underlying reasons, further explaining the market's response.

- Market Sentiment and Overall Economic Factors: It's also crucial to assess the overall market sentiment and broader economic factors that may have indirectly contributed to the positive performance of CRWV. Positive economic indicators or overall bullish market trends could amplify the effect of specific company news.

Assessing Market Sentiment and Investor Reactions

Investor Confidence and Market Reaction

The sharp increase in CRWV's stock price on Thursday reflects a significant shift in investor confidence. Understanding this change requires examining investor sentiment before, during, and after the surge.

- Trading Volume and Price Fluctuations: Analyze the trading volume on Thursday compared to previous days. A significant increase in volume alongside a price surge confirms strong investor interest. Detailing price fluctuations throughout the day paints a clearer picture of market dynamics.

- Social Media Sentiment and Investor Forums: Monitoring social media conversations and investor forum discussions provides valuable insight into the collective sentiment towards CRWV. Positive sentiment can act as a self-fulfilling prophecy, driving further price increases.

- Analyst Predictions and Recommendations: Review analyst comments and predictions surrounding the stock. Positive comments and upward revisions of price targets contribute to increased investor confidence.

Comparing CoreWeave's Performance to Competitors

Analyzing CoreWeave's performance relative to its competitors provides valuable context. This comparison highlights its unique strengths and competitive advantages.

- Competitor Stock Performance: Compare CRWV's performance on Thursday to that of its main competitors in the cloud computing and AI infrastructure markets. This contextualizes its performance and helps determine whether the surge is specific to CoreWeave or a broader market trend.

- CoreWeave's Unique Strengths: Highlight the aspects that differentiate CoreWeave from its competitors. This could include superior technology, stronger client relationships, or a more focused market strategy.

Risk Factors and Future Outlook for CRWV Stock

Potential Risks and Challenges

Despite the positive market reaction, investing in CRWV carries inherent risks. Understanding these potential challenges is crucial for informed decision-making.

- Dependence on Large Clients: A concentration of revenue from a limited number of large clients exposes CoreWeave to significant risk if these relationships deteriorate.

- Technological Disruptions: The rapid pace of technological change in the cloud computing sector poses a continuous threat. CoreWeave must constantly innovate to maintain its competitive edge.

- Regulatory Changes: Changes in regulations, particularly those related to data privacy and security, could impact CoreWeave's operations and profitability.

- Economic Downturn: A general economic downturn could reduce demand for cloud computing services, affecting CoreWeave's revenue and stock price.

Predicting Future Growth and Potential Stock Price Movements

Predicting future stock price movements is inherently uncertain. However, analyzing CoreWeave's growth prospects allows for a reasoned outlook.

- Factors Contributing to Growth: Expanding market share, successful new product launches, and increasing demand for AI and machine learning services are all potential drivers of CoreWeave's future growth. The company's ability to capitalize on these opportunities will be key.

- Uncertainty and Cautious Outlook: It's crucial to acknowledge the inherent uncertainty in stock market predictions. Unexpected events, competitive pressures, and economic fluctuations can significantly impact CoreWeave's future performance.

Conclusion

CoreWeave (CRWV)'s impressive stock performance on Thursday stemmed from a confluence of factors, including positive news, strong investor sentiment, and a generally favorable market environment. While the company shows promise in the rapidly growing cloud computing and AI infrastructure sector, investors must carefully consider the inherent risks associated with this investment.

While this analysis provides insights into CoreWeave's (CRWV) market performance, further research is crucial before making any investment decisions. Conduct thorough due diligence and consider consulting a financial advisor before investing in CoreWeave (CRWV) or any other stock. Stay informed about CoreWeave's (CRWV) progress and market trends to make well-informed investment choices. Understanding the nuances of CRWV's business model and the competitive landscape is essential for navigating the complexities of the stock market.

Featured Posts

-

Understanding Core Weave Inc S Crwv Tuesday Stock Price Movement

May 22, 2025

Understanding Core Weave Inc S Crwv Tuesday Stock Price Movement

May 22, 2025 -

Middle Managers The Unsung Heroes Of Corporate Success

May 22, 2025

Middle Managers The Unsung Heroes Of Corporate Success

May 22, 2025 -

Jim Cramer And Core Weave Crwv A Deep Dive Into The Open Ai Partnership

May 22, 2025

Jim Cramer And Core Weave Crwv A Deep Dive Into The Open Ai Partnership

May 22, 2025 -

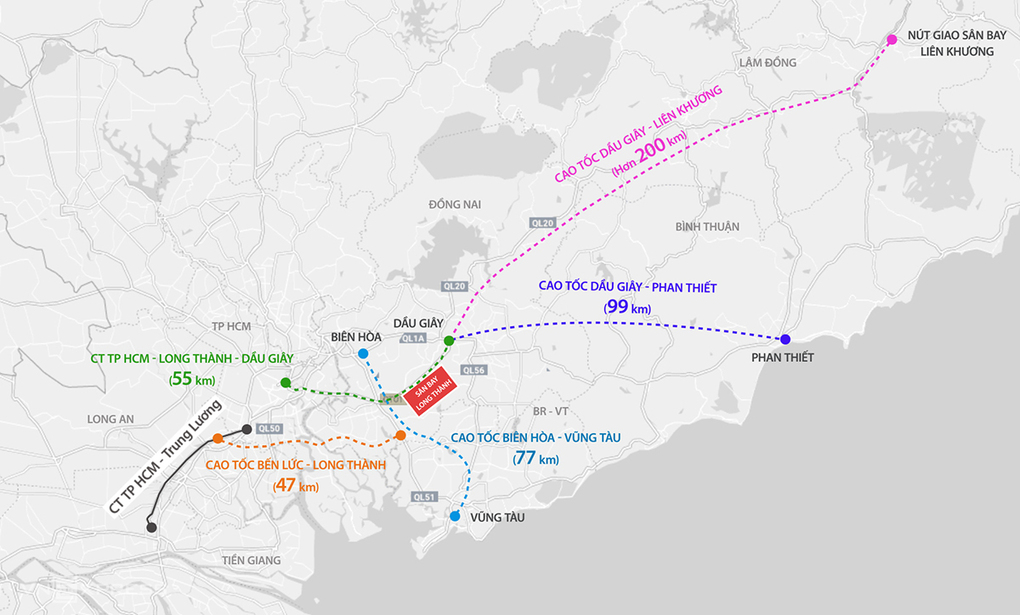

Thong Xe Cao Toc Dong Nai Vung Tau Chuan Bi Cho Ky Nghi Le 2 9

May 22, 2025

Thong Xe Cao Toc Dong Nai Vung Tau Chuan Bi Cho Ky Nghi Le 2 9

May 22, 2025 -

Vidmova Ukrayini Vid Nato Realni Zagrozi Ta Politichni Naslidki

May 22, 2025

Vidmova Ukrayini Vid Nato Realni Zagrozi Ta Politichni Naslidki

May 22, 2025

Latest Posts

-

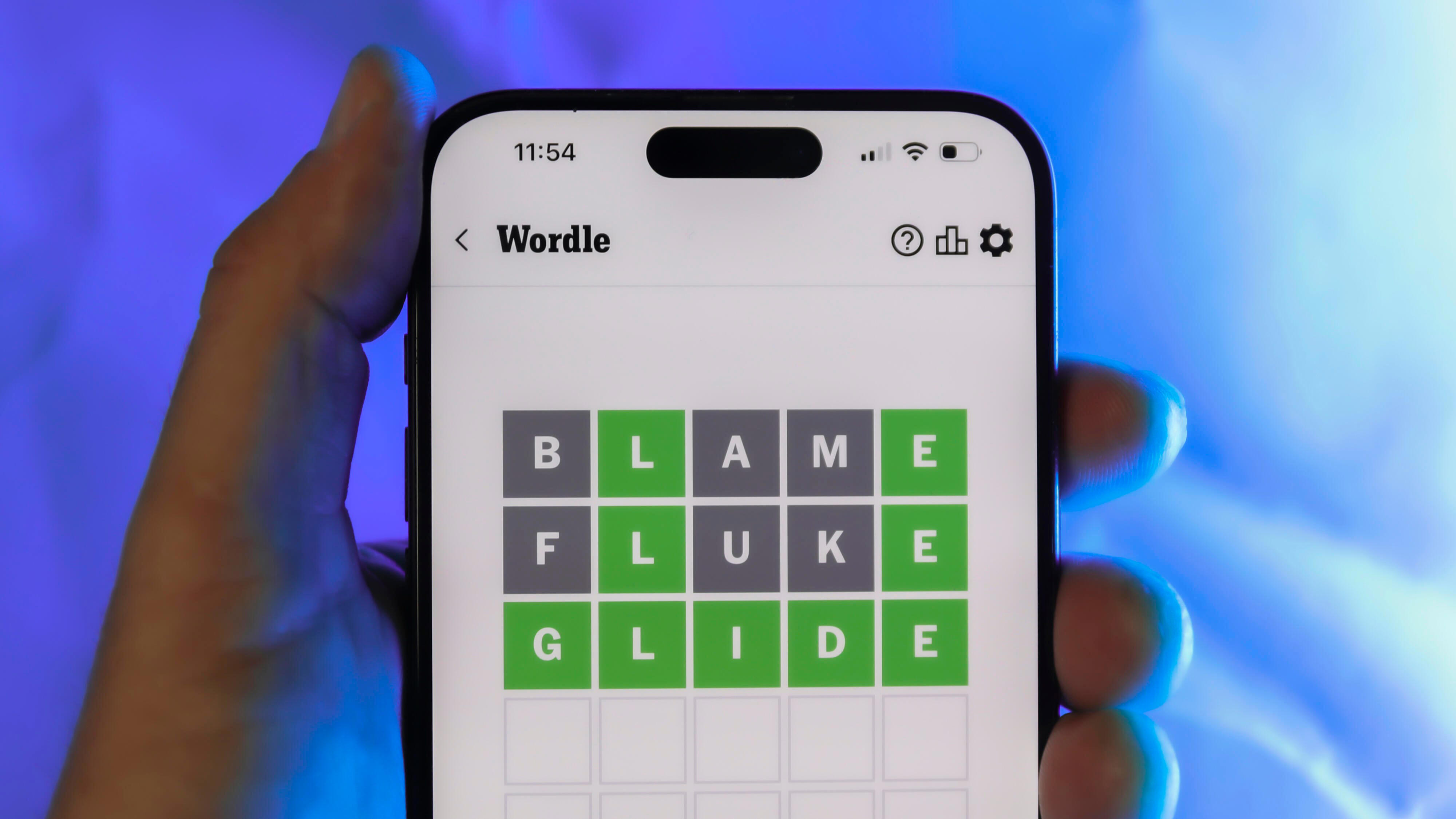

Wordle Solution And Clues For April 26 2025 Puzzle 1407

May 22, 2025

Wordle Solution And Clues For April 26 2025 Puzzle 1407

May 22, 2025 -

Wordle Answer And Hints Today April 26 2025 Puzzle 1407

May 22, 2025

Wordle Answer And Hints Today April 26 2025 Puzzle 1407

May 22, 2025 -

Wordle Puzzle 1356 March 6th Clues And Solution

May 22, 2025

Wordle Puzzle 1356 March 6th Clues And Solution

May 22, 2025 -

Solve Wordle 1356 Hints Clues And The Answer For Thursday March 6th

May 22, 2025

Solve Wordle 1356 Hints Clues And The Answer For Thursday March 6th

May 22, 2025 -

Wordle 1356 March 6th Solve Todays Puzzle With Our Hints And Answer

May 22, 2025

Wordle 1356 March 6th Solve Todays Puzzle With Our Hints And Answer

May 22, 2025