CoreWeave, CRWV, stock market, stock performance, cloud computing, GPU cloud, stock price, market volatility.

CoreWeave, CRWV, stock market, stock performance, cloud computing, GPU cloud, stock price, market volatility.

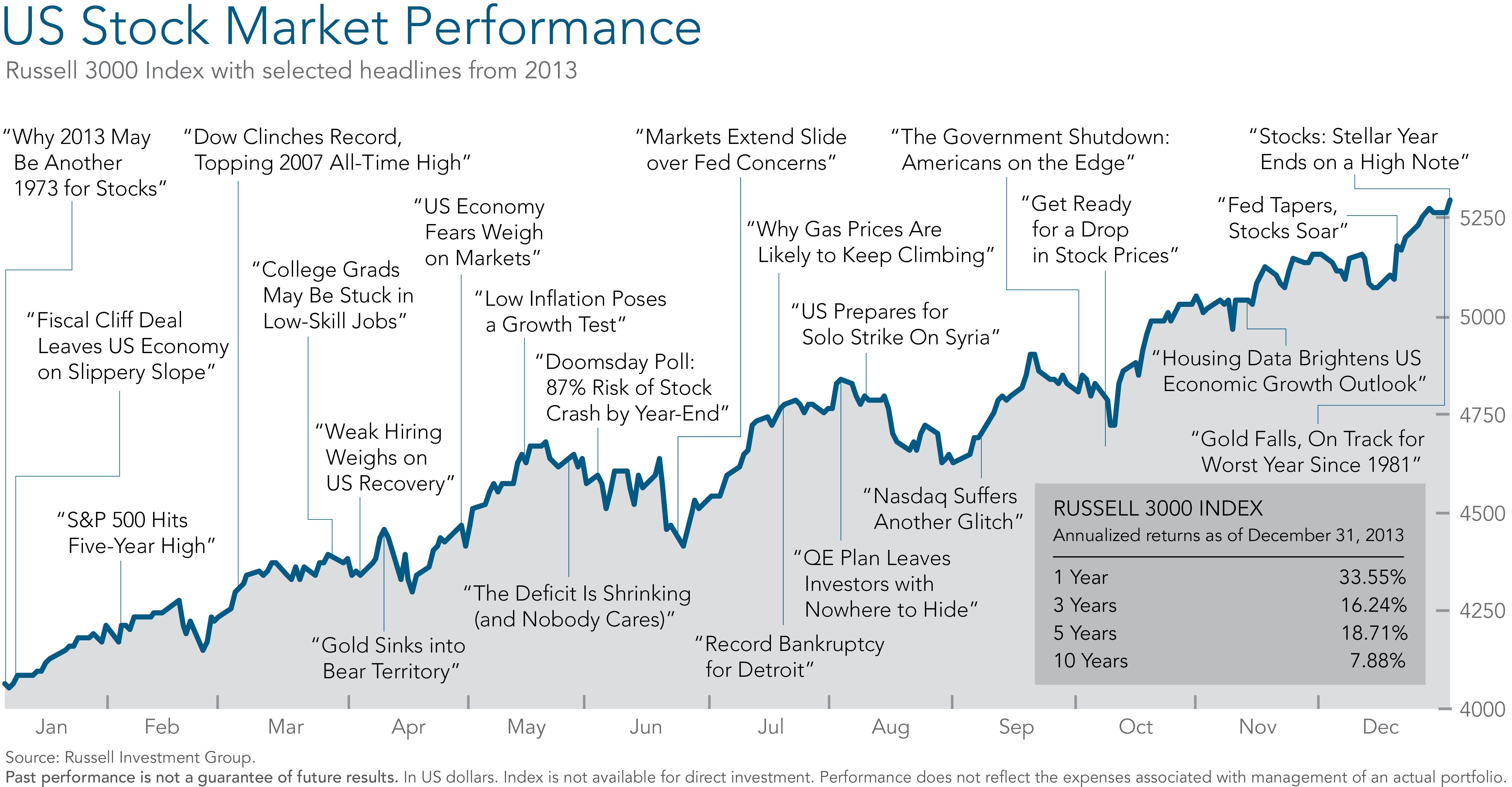

CoreWeave (CRWV) experienced a rollercoaster week, with its stock price exhibiting considerable volatility. To illustrate this, let's examine the data:

(Insert a clear chart or graph here visually representing CRWV's stock price movement throughout the week. This is crucial for SEO and engagement.)

The overall weekly change shows a relatively small net positive gain, masking the significant daily fluctuations. This CRWV stock chart clearly highlights the weekly stock trends and the substantial stock market fluctuations experienced by CRWV last week. Understanding this CRWV price history is essential for assessing the reasons behind these changes.

Several factors likely contributed to CRWV's fluctuating stock price:

Last week saw a general downturn in the broader tech sector, likely impacting investor sentiment toward growth stocks like CRWV. Negative economic news regarding inflation and interest rates potentially contributed to this overall market pessimism. This broader market analysis is crucial to understand the context of CRWV's performance.

Several news items impacted the cloud computing market and, by extension, CRWV. A competitor's announcement of a new GPU offering might have influenced investor perception of CRWV's competitive positioning in the GPU cloud computing market. Understanding these industry trends is essential.

No significant company-specific news directly influenced CRWV's stock price last week. However, the absence of positive announcements in a volatile market could have contributed to the downward pressure on the stock. Monitoring company news is vital for any investor.

Some analysts slightly lowered their ratings for CRWV last week, citing concerns about the broader market conditions and increased competition within the cloud computing market. These analyst ratings and their reasoning should be considered when evaluating the stock's performance.

CoreWeave operates in a highly competitive market dominated by giants such as AWS, Google Cloud, and Azure. These cloud computing competitors constantly innovate, impacting the competitive landscape and influencing market share dynamics. CRWV's competitive advantage lies in its specialization in GPU cloud computing, but maintaining its position requires continuous innovation and strategic partnerships. Analyzing this competitive landscape is critical to understanding CRWV's future potential.

The future outlook for CRWV remains mixed. While the company enjoys a strong position in a growing market segment, the increased competition and overall economic uncertainty present significant risks. However, its specialized focus on GPU cloud computing offers considerable growth opportunities in various sectors like AI and machine learning. Potential partnerships and strategic acquisitions could also significantly impact CRWV's growth prospects. A thorough risk assessment is essential when considering long-term investment options. Predicting the future is challenging, and any stock prediction should be approached with caution.

CoreWeave's stock performance last week was influenced by a complex interplay of market conditions, industry trends, and its position within the competitive cloud computing landscape. Understanding these factors is crucial for any investor looking to analyze CRWV's stock. While the long-term prospects for CoreWeave remain promising given its focus on the high-growth GPU cloud computing sector, it’s essential to remember that market volatility is inherent in the stock market. Therefore, before making any investment decisions related to CoreWeave (CRWV) stock, thoroughly research the company, monitor its market performance, and consider seeking advice from a qualified financial advisor. Stay informed about CRWV stock and make informed decisions.

Juergen Klopp Bir Duenya Devine Doenues Hikayesi

Juergen Klopp Bir Duenya Devine Doenues Hikayesi

Trans Australia Run Record On The Brink Of Being Broken

Trans Australia Run Record On The Brink Of Being Broken

Wordle Hints April 3 2025 Clues And Solution For Wordle 1384

Wordle Hints April 3 2025 Clues And Solution For Wordle 1384

National Average Gas Price Jumps Almost 20 Cents

National Average Gas Price Jumps Almost 20 Cents

Fake Ai Experts And Books The Chicago Sun Times Controversy

Fake Ai Experts And Books The Chicago Sun Times Controversy

Wordle Solution And Clues For April 26 2025 Puzzle 1407

Wordle Solution And Clues For April 26 2025 Puzzle 1407

Wordle Answer And Hints Today April 26 2025 Puzzle 1407

Wordle Answer And Hints Today April 26 2025 Puzzle 1407

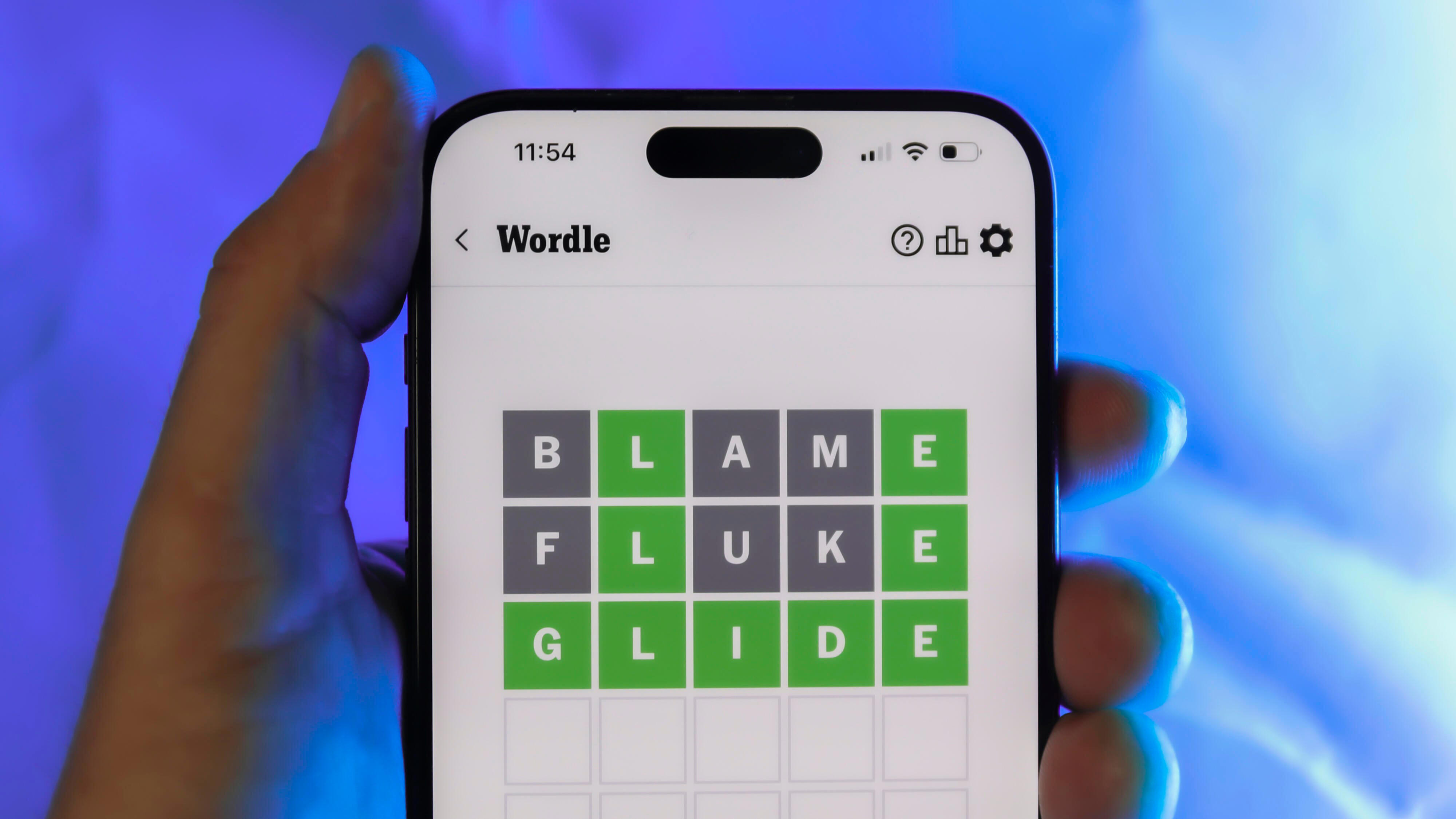

Wordle Puzzle 1356 March 6th Clues And Solution

Wordle Puzzle 1356 March 6th Clues And Solution

Solve Wordle 1356 Hints Clues And The Answer For Thursday March 6th

Solve Wordle 1356 Hints Clues And The Answer For Thursday March 6th

Wordle 1356 March 6th Solve Todays Puzzle With Our Hints And Answer

Wordle 1356 March 6th Solve Todays Puzzle With Our Hints And Answer