CoreWeave, Inc. (CRWV) Stock Surge: Reasons Behind Last Week's Rise

Table of Contents

Strong Financial Performance and Earnings Reports

CoreWeave's recent earnings report played a pivotal role in the CRWV stock surge. The report showcased impressive financial indicators, exceeding market expectations and demonstrating the company's robust growth trajectory. This positive financial performance significantly boosted investor confidence and fueled buying pressure.

- Revenue Growth: CoreWeave reported substantial year-over-year revenue growth, exceeding analyst predictions. This indicates strong demand for its cloud computing and AI infrastructure services.

- Increased Profitability: Improvements in profitability metrics, such as gross margin and operating income, signaled CoreWeave's efficiency and ability to translate growth into profits. The CRWV earnings call provided further details on cost management strategies and operational improvements.

- Impressive Subscriber Acquisition: The number of subscribers to CoreWeave's services increased significantly, demonstrating the appeal of its offerings in the competitive cloud computing market. This rapid subscriber growth is a key indicator of market acceptance and future potential.

The market reacted positively to these strong CRWV earnings, driving the CoreWeave stock price higher. The clear evidence of financial health and strong growth prospects solidified investor confidence in the company's future.

Increasing Demand for AI Infrastructure and Cloud Computing

The surge in CoreWeave stock price is also a reflection of the broader growth in the AI infrastructure and cloud computing markets. The demand for powerful computing resources to support AI applications is exploding, and CoreWeave is well-positioned to capitalize on this trend.

- Booming AI Market: The rapid advancement of artificial intelligence is driving an insatiable demand for high-performance computing resources. CoreWeave's specialized infrastructure is perfectly suited to meet this demand.

- Strategic Partnerships: CoreWeave's recent partnerships with key players in the AI and cloud computing sectors have significantly enhanced its market reach and capabilities. These partnerships have provided access to new markets and technologies, further strengthening its competitive position.

- Competitive Advantage: CoreWeave differentiates itself through its specialized infrastructure and commitment to sustainability. This competitive advantage helps attract clients seeking high-performance, environmentally conscious solutions. This contrasts with some competitors who haven't prioritized sustainability as heavily in their infrastructure development.

The company's strategic position within this expanding market makes it an attractive investment for those seeking exposure to the growth of AI cloud computing.

Positive Analyst Ratings and Upgrades

Several prominent financial analysts upgraded their ratings on CRWV stock following the strong earnings report and positive market reaction. These upgrades contributed significantly to the increased investor sentiment and buying pressure.

- Upgraded Ratings: Several investment firms raised their ratings on CoreWeave stock, citing strong financial performance and future growth prospects.

- Increased Price Targets: Analyst price targets for CRWV stock were also increased, reflecting the expectation of further price appreciation. These higher price targets encouraged investors to buy CoreWeave stock.

- Positive Investor Sentiment: The combination of positive analyst ratings and increased price targets created a positive feedback loop, reinforcing investor confidence and driving further buying pressure.

The collective positive analyst sentiment surrounding CRWV stock played a crucial role in amplifying the stock's upward momentum.

Strategic Initiatives and Future Outlook

CoreWeave's strategic initiatives and future outlook further contribute to the positive sentiment surrounding the stock. The company has outlined ambitious plans for expansion and innovation, setting the stage for sustained growth.

- New Product Development: CoreWeave is continuously developing new products and services to meet the evolving needs of its clients. These innovations will help to maintain its competitive edge.

- Expansion Plans: The company has outlined ambitious plans for geographic expansion and infrastructure upgrades, ensuring its ability to meet the growing demand for its services.

- Risk Assessment: While the outlook is positive, potential risks exist, including competition, technological disruption, and economic fluctuations. A thorough risk assessment is crucial for any investor.

The potential for future growth, driven by these strategic initiatives, further bolsters the case for CoreWeave stock.

Conclusion: Investing in CoreWeave (CRWV) – A Look Ahead

The recent surge in CoreWeave (CRWV) stock price is attributable to a confluence of positive factors: strong financial performance, increasing demand for AI infrastructure and cloud computing, positive analyst ratings, and a promising outlook for future growth. While the potential for continued growth in the cloud computing and AI infrastructure sectors is significant, investors should always conduct thorough research and consider potential risks before making investment decisions.

CoreWeave stock (CRWV) presents an interesting opportunity for investors interested in the rapidly expanding cloud computing and AI infrastructure markets. However, remember that all stock market investments carry inherent risk. Further research into CoreWeave's financials, competitive landscape, and strategic initiatives is strongly recommended before investing in CRWV stock. Consider consulting with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Architecture Toscane En Petite Italie De L Ouest Guide De Voyage

May 22, 2025

Architecture Toscane En Petite Italie De L Ouest Guide De Voyage

May 22, 2025 -

Kevin Bacon And Julianne Moore Team Up For Netflixs Dark Comedy

May 22, 2025

Kevin Bacon And Julianne Moore Team Up For Netflixs Dark Comedy

May 22, 2025 -

Antalya Da Nato Parlamenter Asamblesi Teroerizm Ve Deniz Guevenligi Odak Noktasi

May 22, 2025

Antalya Da Nato Parlamenter Asamblesi Teroerizm Ve Deniz Guevenligi Odak Noktasi

May 22, 2025 -

The Most Refreshing Hot Weather Drink You Ve Never Heard Of

May 22, 2025

The Most Refreshing Hot Weather Drink You Ve Never Heard Of

May 22, 2025 -

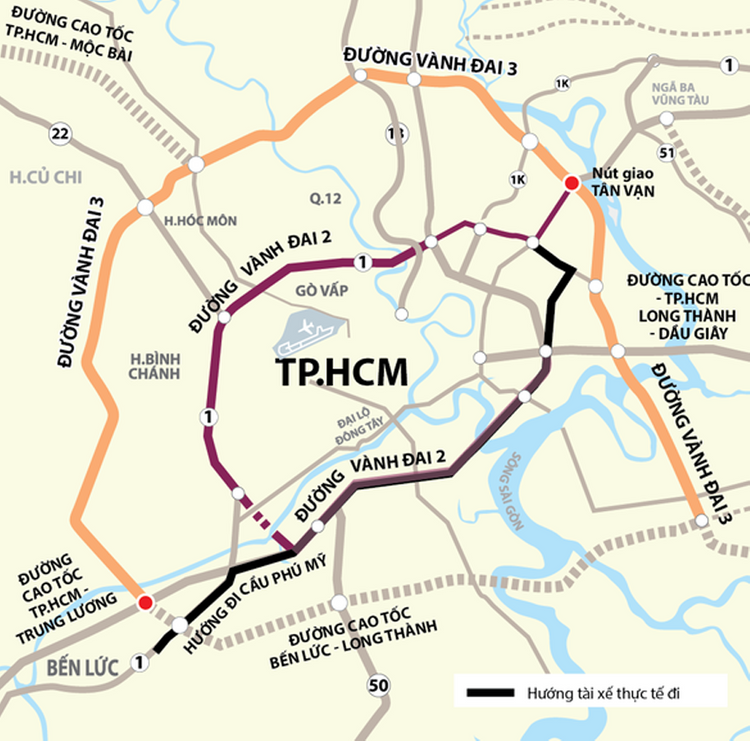

7 Tuyen Ket Noi Quan Trong Tp Hcm Long An Dau Tu Uu Tien

May 22, 2025

7 Tuyen Ket Noi Quan Trong Tp Hcm Long An Dau Tu Uu Tien

May 22, 2025

Latest Posts

-

Los Mejores Memes Canada Vs Mexico Liga De Naciones Concacaf

May 22, 2025

Los Mejores Memes Canada Vs Mexico Liga De Naciones Concacaf

May 22, 2025 -

Georgia Domina Armenia Cu 6 1 In Meciul Din Liga Natiunilor

May 22, 2025

Georgia Domina Armenia Cu 6 1 In Meciul Din Liga Natiunilor

May 22, 2025 -

Liga Natiunilor Victorie Clara Pentru Georgia Impotriva Armeniei 6 1

May 22, 2025

Liga Natiunilor Victorie Clara Pentru Georgia Impotriva Armeniei 6 1

May 22, 2025 -

Rezultat Categoric Georgia Invinge Armenia Cu 6 1 In Liga Natiunilor

May 22, 2025

Rezultat Categoric Georgia Invinge Armenia Cu 6 1 In Liga Natiunilor

May 22, 2025 -

Liga Natiunilor Georgia Zdrobeste Armenia Cu 6 1

May 22, 2025

Liga Natiunilor Georgia Zdrobeste Armenia Cu 6 1

May 22, 2025