Corporate Earnings: A Deep Dive Into Current Strength And Future Risks

Table of Contents

The current state of corporate earnings presents a complex picture. While many companies are reporting robust results, driven by factors such as the post-pandemic recovery and sustained growth in specific sectors, significant headwinds loom on the horizon. Understanding both the current strengths and potential future risks in corporate earnings is crucial for investors, analysts, and business leaders alike. This article delves into these key aspects, providing insights to navigate the evolving economic landscape.

Current Strengths in Corporate Earnings

Robust Revenue Growth in Key Sectors

Several key sectors are exhibiting strong revenue growth, painting a positive, albeit potentially temporary, picture of corporate financial performance. The technology sector, fueled by advancements in artificial intelligence, cloud computing, and software-as-a-service (SaaS), continues to see robust expansion. Similarly, the healthcare sector benefits from an aging global population and ongoing investment in pharmaceutical research and development.

- Increased consumer spending in discretionary goods and services is driving growth in the retail and hospitality sectors.

- Technological advancements are fueling innovation and profitability in the technology and communication sectors, leading to strong earnings reports.

- Government stimulus packages, while tapering off, continue to positively impact specific industries such as infrastructure and renewable energy.

For example, companies like Microsoft and Amazon have reported significant revenue growth, exceeding market expectations, demonstrating the strength of the tech sector. In the healthcare sector, pharmaceutical giants are experiencing robust earnings due to the successful launch of new drugs and therapies. Analyzing these earnings reports provides valuable insights into the overall health of the market and specific sectors.

Improved Profit Margins and Efficiency

Many companies are demonstrating improved profitability through strategic cost-cutting measures and supply chain optimization. This improvement in profit margins reflects increased operational efficiency and a focus on maximizing returns. This trend is crucial for understanding overall corporate financial strength and potential for future growth.

- Supply chain improvements, including diversification and improved inventory management, are leading to reduced costs and higher margins.

- Strategic cost-cutting initiatives, such as streamlining operations and reducing administrative expenses, are yielding significant savings.

- Increased automation is boosting productivity and profitability in various industries, enhancing efficiency and reducing labor costs.

Companies are actively implementing lean manufacturing principles and utilizing data analytics to optimize their operations, resulting in stronger profit margins. This data-driven approach to efficiency improvements contributes significantly to the positive corporate earnings picture.

Strong Cash Flows and Balance Sheets

Many companies are reporting strong cash flows and healthy balance sheets, providing a significant buffer against economic downturns and enabling further investment and expansion. This financial stability is a key indicator of resilience and long-term growth potential.

- High cash reserves provide a buffer against economic downturns and uncertainties.

- Increased dividend payouts reflect strong financial performance and investor confidence.

- Capacity for strategic acquisitions and investments allows companies to capitalize on growth opportunities and expand their market share.

The availability of strong cash flows allows companies to invest in research and development, acquire complementary businesses, and weather periods of economic instability. Analyzing the cash flow statements of different companies provides essential information regarding their financial health and resilience.

Future Risks to Corporate Earnings

Inflationary Pressures and Rising Interest Rates

Inflationary pressures and rising interest rates represent significant headwinds for corporate earnings. Increased costs for raw materials, labor, and borrowing significantly impact profitability and constrain investment opportunities.

- Rising raw material costs impact production expenses and reduce profit margins.

- Increased borrowing costs affect capital expenditure and limit expansion plans.

- Reduced consumer spending due to decreased purchasing power dampens revenue growth.

The impact of inflation on corporate profitability is a critical factor for investors to consider when assessing the financial performance of different businesses. Analyzing earnings reports with an eye towards inflation's effect is essential for making sound investment decisions.

Geopolitical Uncertainty and Supply Chain Disruptions

Geopolitical uncertainty and ongoing supply chain disruptions pose substantial challenges to corporate earnings. Global events like wars, political instability, and trade disputes can disrupt supply chains and increase costs.

- Supply chain bottlenecks lead to production delays and increased costs.

- Geopolitical instability affects international trade and investment, creating uncertainty.

- Increased reliance on reshoring and diversification of supply chains is becoming a crucial strategy for mitigation.

Companies are actively seeking to mitigate these risks by diversifying their supply chains, investing in local production, and building more resilient operations. Understanding these geopolitical factors and supply chain vulnerabilities is vital for accurately forecasting corporate earnings.

Labor Shortages and Rising Wages

Labor shortages and rising wages present a significant challenge for many businesses. The competition for talent is driving up labor costs and putting pressure on profit margins.

- Difficulty attracting and retaining skilled labor impacts productivity and operational efficiency.

- Increased labor costs impact profit margins and constrain expansion plans.

- Potential for automation to address labor shortages and improve productivity.

Companies are increasingly exploring automation and other technological solutions to address labor shortages and mitigate rising wage pressures. Understanding these labor market trends is crucial for evaluating the long-term profitability of businesses.

Conclusion

Analyzing corporate earnings requires a nuanced understanding of both current strengths and emerging risks. While robust revenue growth and improved profitability are currently evident in many sectors, inflationary pressures, geopolitical uncertainty, and supply chain disruptions pose significant challenges. Investors and business leaders must carefully assess these factors when developing their investment strategies and business plans. Staying informed about the latest trends in corporate earnings, and proactively adapting to evolving economic conditions, is crucial for long-term success. Continue monitoring corporate earnings reports and market analysis to make informed decisions regarding your investment strategy and business operations.

Featured Posts

-

Awstabynkw Njmt Almlaeb Altrabyt Alsaedt

May 30, 2025

Awstabynkw Njmt Almlaeb Altrabyt Alsaedt

May 30, 2025 -

Virginia Health Officials Address Second Measles Case Of 2025

May 30, 2025

Virginia Health Officials Address Second Measles Case Of 2025

May 30, 2025 -

Kawasaki Ninja 650 Krt Edition 2025 Unveiling The New Model

May 30, 2025

Kawasaki Ninja 650 Krt Edition 2025 Unveiling The New Model

May 30, 2025 -

Alcarazs Sixth Masters 1000 Victory Monte Carlo Conquest

May 30, 2025

Alcarazs Sixth Masters 1000 Victory Monte Carlo Conquest

May 30, 2025 -

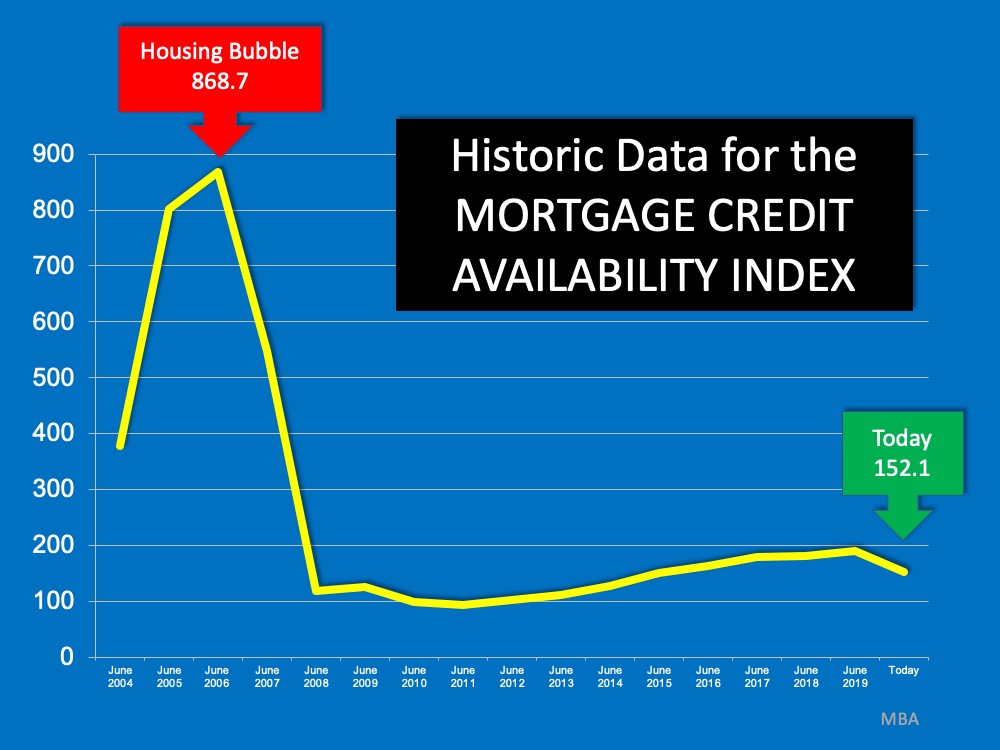

Are We Facing A Housing Crisis The State Of Home Sales

May 30, 2025

Are We Facing A Housing Crisis The State Of Home Sales

May 30, 2025