Could 3% Mortgage Rates Reignite Canada's Housing Market?

Table of Contents

H2: The Impact of Lower Mortgage Rates on Affordability

The most immediate impact of lower mortgage rates, particularly a dramatic drop to 3%, would be increased affordability. This translates into significantly reduced monthly mortgage payments, making homeownership more accessible to a wider range of buyers.

H3: Reduced Monthly Payments

A reduction in interest rates directly translates to lower monthly payments. Consider this:

- Example 1: A $500,000 mortgage amortized over 25 years at a 5% interest rate results in a monthly payment of approximately $2,866. The same mortgage at a 3% interest rate would cost around $2,108 – a savings of $758 per month!

- Example 2: A $750,000 mortgage at 5% would see monthly payments of approximately $4,299, while at 3% it drops to $3,162 – a saving of $1,137 monthly.

These savings are substantial, boosting mortgage affordability and potentially opening the door to homeownership for many who were previously priced out of the market. This increased affordable housing Canada would significantly impact lower mortgage payments.

H3: Increased Purchasing Power

Lower mortgage rates also increase buyers' purchasing power. With lower monthly payments, buyers can afford a more expensive property or a larger home within their budget.

- A buyer pre-approved for a $500,000 mortgage at 5% might find their borrowing power significantly increased at 3%, potentially allowing them to consider properties in the $600,000-$700,000 range. This increased home buying power significantly impacts the Canadian real estate market.

This increased purchasing power allows buyers to access a wider range of properties and potentially upgrade their living situation, driving further activity within the Canadian real estate market.

H2: Potential Market Reactions to 3% Mortgage Rates

A return to 3% mortgage rates would likely trigger significant shifts in the Canadian housing market.

H3: Increased Buyer Demand

A swift drop to 3% would almost certainly lead to a surge in housing market demand. We could see a significant increase in buyer activity, potentially reigniting bidding wars and pushing prices upward, especially in already competitive markets.

- Regional Variations: Markets like Toronto and Vancouver, historically known for high demand, might experience a more pronounced increase in buyer activity than smaller, less competitive markets. However, even in smaller cities, the increase in affordable housing Canada could stimulate local markets.

This increased housing market demand would likely put upward pressure on prices in many areas, making it essential to monitor real estate trends Canada.

H3: Impact on Housing Inventory

Increased buyer demand would place further pressure on existing housing supply Canada. With already low inventory levels in many areas, a sudden surge in demand could lead to a further tightening of the market, potentially driving prices even higher. However, if new construction accelerates in response to heightened demand, it might eventually lead to a loosening of the market, but this could take considerable time. The interplay between demand, supply, and price will be crucial to observe.

H3: Investor Activity

Lower rates could also stimulate real estate investment Canada. Lower borrowing costs make investment properties more attractive, potentially leading to increased investor activity and a heightened competition for properties. This increased investment could affect rental markets significantly, potentially driving up rents in areas with high investor activity. Analyzing rental market trends and the impact on property investment will be critical.

H2: Economic Factors Influencing the Possibility of 3% Mortgage Rates

The likelihood of a return to 3% mortgage rates hinges on several key economic factors.

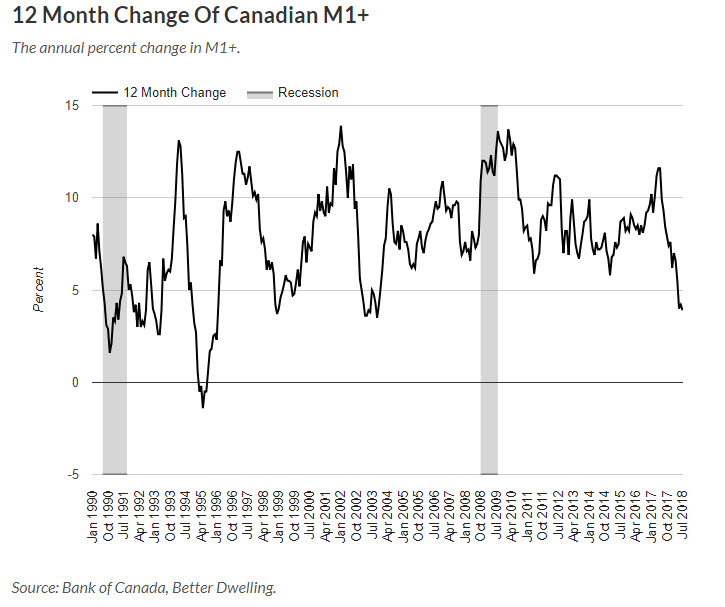

H3: Bank of Canada Policies

The Bank of Canada interest rates are set by the Bank of Canada, based on its assessment of economic conditions. Currently, the Bank of Canada's monetary policy is focused on managing inflation. Significant rate cuts are unlikely unless inflation falls substantially and economic growth shows sustained signs of slowing. The factors influencing the Bank of Canada's decisions are complex and constantly evolving. Understanding monetary policy is key to predicting future interest rate movements.

H3: Inflation and Economic Growth

The relationship between Canadian inflation rate, economic growth Canada, and interest rate predictions is complex. High inflation generally leads to higher interest rates to cool the economy, while lower inflation may create conditions for lower rates. The Bank of Canada balances these factors to ensure price stability and sustainable economic growth. Closely monitoring key economic indicators is essential for predicting the direction of interest rate changes.

3. Conclusion:

The potential return to 3% mortgage rates could significantly impact Canada's housing market. While it offers the promise of increased affordable housing Canada and renewed market activity, it also carries risks such as increased competition and potentially inflated prices. The reality depends heavily on the Bank of Canada interest rates and broader economic conditions. The interplay between housing market demand, housing supply Canada, and investor activity will shape the market’s future.

Call to Action: To stay informed about the potential impact of 3% mortgage rates on your financial future and the Canadian housing market forecast, it's crucial to monitor interest rates and follow economic news closely. Understanding these dynamics will help you make informed decisions, whether you're a prospective buyer, seller, or investor. Explore resources from reputable financial institutions and real estate agencies to access the latest data and analysis of affordable housing options in your area.

Featured Posts

-

Nine Month Space Mission Details From Cbs News Report

May 12, 2025

Nine Month Space Mission Details From Cbs News Report

May 12, 2025 -

Super Express Szokujaca Historia Ksiecia Andrzeja I Masazystki

May 12, 2025

Super Express Szokujaca Historia Ksiecia Andrzeja I Masazystki

May 12, 2025 -

Bayerns Bundesliga Triumph A Fitting Farewell For Thomas Mueller

May 12, 2025

Bayerns Bundesliga Triumph A Fitting Farewell For Thomas Mueller

May 12, 2025 -

Early Season Stats Chisholm Challenges Judges Dominance

May 12, 2025

Early Season Stats Chisholm Challenges Judges Dominance

May 12, 2025 -

Choosing The Next Pope A Look At Nine Prominent Cardinals

May 12, 2025

Choosing The Next Pope A Look At Nine Prominent Cardinals

May 12, 2025