Could XRP ETF Approval Generate $800 Million In Initial Investment?

Table of Contents

The Potential Demand for an XRP ETF

Current market sentiment towards XRP is cautiously optimistic. While the ongoing legal battle between Ripple and the SEC has created uncertainty, many believe that a positive resolution could significantly boost XRP's price and adoption. An XRP ETF would capitalize on this potential, offering several key advantages to investors:

-

Increased Accessibility and Diversification: An XRP ETF would allow investors to gain exposure to XRP through traditional brokerage accounts, simplifying investment and broadening diversification strategies beyond Bitcoin and Ethereum. This is particularly appealing to those wary of directly holding cryptocurrencies due to security concerns or lack of familiarity with cryptocurrency exchanges.

-

Regulatory Compliance and Institutional Appeal: The structured nature of an ETF, operating under regulatory oversight, makes it far more attractive to institutional investors – hedge funds, pension funds, and other large players – who often face stricter investment guidelines than individual investors. This institutional interest is a crucial factor in driving substantial initial investment.

-

Liquidity and Price Stability: The increased liquidity offered by an XRP ETF, through exchange trading, could help stabilize XRP's price and reduce volatility, further enticing institutional and retail investors alike.

-

Key Advantages of XRP ETF Investment:

- Increased liquidity through ETF trading.

- Easier access for institutional investors (XRP investment for institutions).

- Reduced regulatory hurdles for large-scale investment in XRP.

- Potential for significant price appreciation following ETF approval.

Factors Influencing Initial Investment in an XRP ETF

Several factors will significantly influence the level of initial investment in an XRP ETF, particularly the crucial $800 million figure.

-

SEC Approval and Investor Confidence: The SEC's decision on whether to approve an XRP ETF is paramount. A favorable ruling would dramatically boost investor confidence, unlocking significant investment. Conversely, rejection could severely dampen enthusiasm and reduce the potential investment influx.

-

Regulatory Hurdles and Market Conditions: Even with SEC approval, potential regulatory hurdles remain. The overall crypto market sentiment, along with broader economic factors, will also play a critical role. A bearish market or economic downturn could reduce investor risk appetite, impacting investment in any new crypto ETF, including an XRP ETF.

-

Competition and Public Perception: The success of an XRP ETF will depend on how it competes with other existing or future crypto ETFs. Media coverage and public perception of XRP will shape investor sentiment and influence investment decisions, affecting the potential inflow of funds into an XRP ETF.

-

Key Factors Affecting XRP ETF Investment:

- SEC approval timeline and its impact on investor anticipation.

- Market volatility and its influence on investment risk appetite.

- Competition from other crypto ETFs and their impact on XRP ETF demand.

- The role of media coverage and public perception in shaping investor sentiment.

Estimating the $800 Million Figure: Methodology and Assumptions

The $800 million estimate is based on a model that considers several factors, including projected investor participation rates across different investor categories (retail, institutional, high-net-worth individuals), anticipated ETF pricing, and expected market conditions at launch.

-

Calculation Breakdown: The model breaks down the estimated investment into segments based on predicted investor participation and average investment sizes per category.

-

Sensitivity Analysis: A sensitivity analysis reveals how changes in key assumptions (e.g., a more conservative estimate of investor participation or a lower ETF price) would affect the overall investment projection.

-

Comparison to other Crypto ETFs: The projection is also compared against the initial investment figures seen in successful launches of other crypto ETFs to assess its plausibility.

-

Potential Inaccuracies: It's crucial to acknowledge the inherent limitations of such a projection. Market conditions are dynamic, and unforeseen events could significantly alter the actual investment levels.

Potential Ripple Effects of XRP ETF Approval

The approval of an XRP ETF could have far-reaching consequences, extending beyond the initial investment.

-

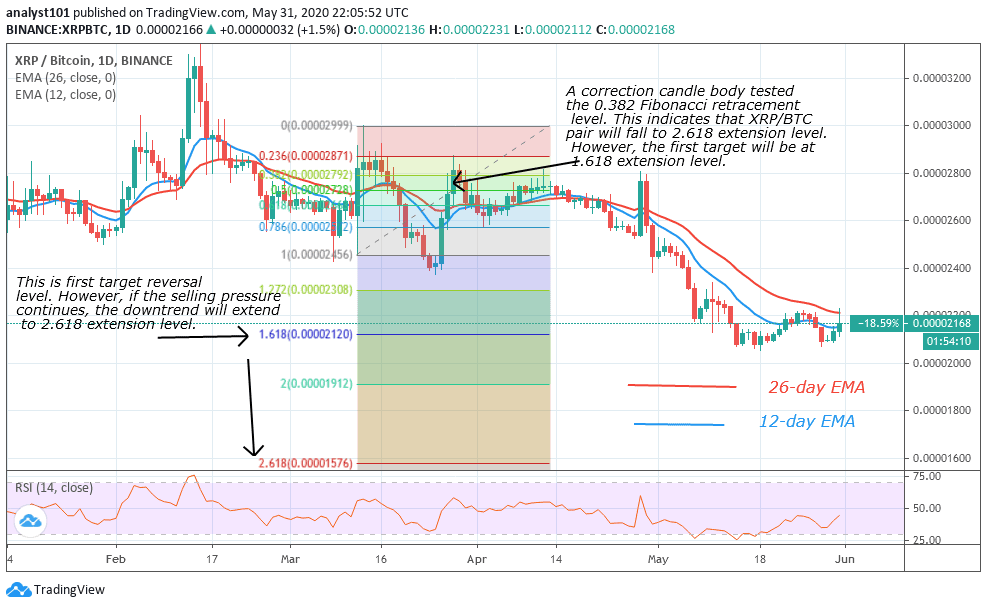

XRP Price Volatility: The listing of an XRP ETF is likely to lead to increased price volatility in the short term, but could potentially drive long-term price appreciation due to increased demand.

-

Wider Cryptocurrency Market Impact: The success of an XRP ETF could act as a catalyst for the wider adoption of other cryptocurrencies and potentially lead to the launch of more crypto ETFs.

-

Ripple Labs and XRP Development: A successful XRP ETF launch would undoubtedly benefit Ripple Labs, providing increased legitimacy and funding for further development and adoption of XRP as a payment solution.

-

Regulatory Scrutiny: The increased visibility and institutional involvement following ETF approval might bring renewed regulatory scrutiny, impacting both XRP and the broader cryptocurrency space.

-

Ripple Effects of XRP ETF Approval:

- Price volatility following ETF listing.

- Increased adoption of XRP as a payment asset.

- Impact on other cryptocurrencies and their market capitalization.

- Potential for further regulatory scrutiny of cryptocurrencies.

Conclusion: The Future of XRP and the $800 Million Question

The potential for an XRP ETF to generate $800 million in initial investment is significant, driven by the increased accessibility, regulatory compliance, and institutional interest it offers. However, the actual outcome will hinge on several crucial factors, including SEC approval, market conditions, and competition from other crypto ETFs. While the $800 million figure is a projection based on certain assumptions, it highlights the substantial potential of XRP within the evolving cryptocurrency landscape.

Stay tuned for further updates on the potential of XRP ETFs and the possibility of seeing $800 million in initial investment – the future of XRP is unfolding. Keep an eye on XRP investment news and the broader crypto market for the latest developments in XRP and crypto ETF trading.

Featured Posts

-

Sharpest Hkd Usd Rate Fall Since 2008 Following Monetary Intervention

May 08, 2025

Sharpest Hkd Usd Rate Fall Since 2008 Following Monetary Intervention

May 08, 2025 -

The Unexpected Rise Of Counting Crows Thanks To Saturday Night Live

May 08, 2025

The Unexpected Rise Of Counting Crows Thanks To Saturday Night Live

May 08, 2025 -

Xrp Ripple Price Prediction And Its Impact On Your Investment Strategy

May 08, 2025

Xrp Ripple Price Prediction And Its Impact On Your Investment Strategy

May 08, 2025 -

New Uber Pet Service Easier Pet Travel In Delhi And Mumbai

May 08, 2025

New Uber Pet Service Easier Pet Travel In Delhi And Mumbai

May 08, 2025 -

Pivfinali Ligi Chempioniv 2024 2025 Prognoz Ta Analiz Matchiv Arsenal Ps Zh Ta Barselona Inter

May 08, 2025

Pivfinali Ligi Chempioniv 2024 2025 Prognoz Ta Analiz Matchiv Arsenal Ps Zh Ta Barselona Inter

May 08, 2025