Court Rejects Bid To Halt Paramount-Skydance Merger; Shareholder Case Moves Forward

Table of Contents

Court Rejects Motion to Halt Paramount-Skydance Merger

A group of shareholders filed a motion to halt the Paramount-Skydance merger, arguing that the deal undervalued the company and didn't adequately represent shareholder interests. Their arguments centered on claims of inadequate due diligence and a potential conflict of interest within the negotiation process.

The court, however, rejected the motion to issue a preliminary injunction. The judge's reasoning, based on precedent set in similar merger cases (citation needed), stated that the plaintiffs had not presented sufficient evidence to demonstrate irreparable harm if the merger were to proceed. The court deemed the arguments regarding undervaluation insufficient to justify halting the merger at this stage.

- Plaintiff arguments: The merger undervalued the company's assets and future potential; the due diligence process was insufficient; key information was withheld from shareholders.

- Defendant arguments: The merger price was fair and represented a reasonable valuation; the due diligence was thorough and appropriate; all necessary information was disclosed to shareholders.

- "The court finds that the plaintiffs have not met their burden of demonstrating a likelihood of success on the merits, nor have they shown irreparable harm," stated the judge in the ruling (paraphrased for illustrative purposes. Actual quote needed).

Shareholder Lawsuit Proceeds: What's Next?

Despite the rejection of the motion to halt the Paramount-Skydance merger, the shareholder lawsuit continues. The lawsuit alleges breach of fiduciary duty, claiming that the company's board of directors failed to act in the best interests of shareholders when negotiating the merger terms. This ongoing litigation focuses on the fairness of the deal and seeks compensation for shareholders.

Potential outcomes of the lawsuit include:

- Financial penalties: Paramount and/or Skydance could face substantial financial penalties if found liable.

- Restructuring of the merger agreement: The court could order changes to the terms of the merger.

- Dismissal of the lawsuit: The court could rule in favor of Paramount and Skydance, ending the case.

The next steps in the legal process include discovery, where both sides will gather and exchange evidence, followed by further court hearings and potentially a trial. The timeline for these proceedings is uncertain, but investors should expect volatility in the stock prices of both companies.

- Impact on Investors: Share prices may fluctuate significantly depending on the progress and outcome of the lawsuit. Investors should carefully monitor the case's development.

Implications of the Ruling on the Entertainment Industry

The court's decision in the Paramount-Skydance merger case carries significant implications for the entertainment industry. This ruling sets a precedent that may influence future merger and acquisition (M&A) activity. It also raises questions about shareholder rights and corporate governance in the sector.

The decision could lead to:

- Increased scrutiny of M&A deals in the entertainment industry.

- Greater emphasis on ensuring fair valuations in merger agreements.

- A rise in shareholder activism and litigation regarding mergers.

This case shares similarities with previous legal challenges to major media mergers, highlighting ongoing debates regarding the balance between corporate efficiency and shareholder protections. The long-term effects on Paramount and Skydance, regardless of the lawsuit’s outcome, could influence their individual strategic directions and growth trajectories.

Conclusion: Paramount-Skydance Merger: The Legal Battle Continues

The court's rejection of the bid to halt the Paramount-Skydance merger does not signify an end to the legal battle. The shareholder lawsuit proceeds, carrying significant implications for both companies and the broader entertainment industry. This case underscores the importance of due diligence, fair valuation, and robust corporate governance in major M&A transactions.

Follow the developments of the Paramount-Skydance merger case for updates on the ongoing legal proceedings. Stay tuned for further analysis and insights as this important legal battle unfolds. For access to court documents and relevant news articles, please refer to [link to relevant resource 1] and [link to relevant resource 2].

Featured Posts

-

E11 Mlrd Germaniya Usilivaet Voennuyu Podderzhku Ukrainy

May 27, 2025

E11 Mlrd Germaniya Usilivaet Voennuyu Podderzhku Ukrainy

May 27, 2025 -

Security Forces Eliminate Top Bandit In Zamfara Following Attack

May 27, 2025

Security Forces Eliminate Top Bandit In Zamfara Following Attack

May 27, 2025 -

Louisiana Native Enrolls In Kai Cenats Groundbreaking Streamer University

May 27, 2025

Louisiana Native Enrolls In Kai Cenats Groundbreaking Streamer University

May 27, 2025 -

Novas Oportunidades De Emprego 111 Vagas Em Petrolina 02 Ago

May 27, 2025

Novas Oportunidades De Emprego 111 Vagas Em Petrolina 02 Ago

May 27, 2025 -

Analysis Trumps Role In The Nippon Steel Deal

May 27, 2025

Analysis Trumps Role In The Nippon Steel Deal

May 27, 2025

Latest Posts

-

Revenirea Lui Andre Agassi Primul Meci De Pickleball

May 30, 2025

Revenirea Lui Andre Agassi Primul Meci De Pickleball

May 30, 2025 -

Andre Agassi O Noua Era In Cariera Sa Pickleball

May 30, 2025

Andre Agassi O Noua Era In Cariera Sa Pickleball

May 30, 2025 -

Legenda Tenisului Andre Agassi Joaca Pickleball

May 30, 2025

Legenda Tenisului Andre Agassi Joaca Pickleball

May 30, 2025 -

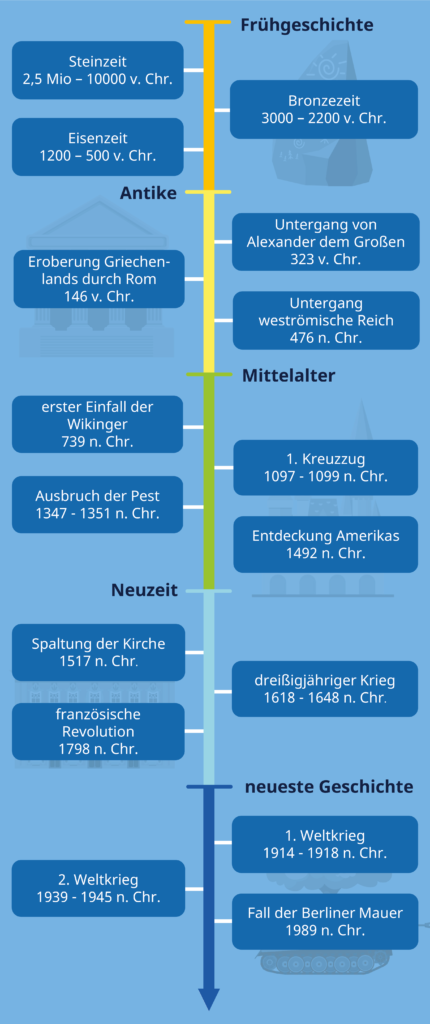

Der 10 April In Der Geschichte Daten Fakten Und Ereignisse

May 30, 2025

Der 10 April In Der Geschichte Daten Fakten Und Ereignisse

May 30, 2025 -

Andre Agassi Prima Partida Profesionala De Pickleball

May 30, 2025

Andre Agassi Prima Partida Profesionala De Pickleball

May 30, 2025