D-Wave Quantum (QBTS): A Top Quantum Computing Stock In 2024?

Table of Contents

D-Wave's Technology and Market Position

D-Wave's Quantum Annealing Advantage

D-Wave employs a unique approach to quantum computing: quantum annealing. Unlike gate-based quantum computing, which aims to build universal quantum computers capable of executing any quantum algorithm, quantum annealing excels at solving specific optimization problems.

- Strengths: Quantum annealing is particularly adept at tackling complex optimization tasks found in various industries, such as logistics, finance, and materials science. Its architecture allows for the construction of larger-scale quantum processors compared to current gate-based systems.

- Limitations: Quantum annealing's focus on optimization problems limits its applicability compared to the more general-purpose gate-model quantum computers. It may not be suitable for all quantum algorithms.

Competitive Landscape Analysis

D-Wave faces stiff competition from giants like IBM, Google, and Rigetti Computing. These companies are pursuing gate-based quantum computing, a different but potentially more versatile approach. However, D-Wave distinguishes itself through:

- Early Market Entry: D-Wave has been a pioneer in the field, possessing years of experience and a significant head start in deploying quantum annealing systems.

- Focus on Practical Applications: D-Wave focuses on delivering commercially viable quantum computing solutions, collaborating with industry partners on real-world applications.

- Scalability: D-Wave has consistently improved the size and capabilities of its quantum processors, demonstrating advancements in scalability.

Real-World Applications and Partnerships

D-Wave's quantum annealing technology already finds practical applications across diverse sectors:

- Logistics Optimization: Companies use D-Wave's systems to optimize supply chain routes, reducing transportation costs and improving delivery times.

- Financial Modeling: D-Wave's technology aids in portfolio optimization, risk management, and fraud detection.

- Materials Science: Researchers utilize D-Wave systems to design new materials with improved properties.

- Partnerships: D-Wave has forged partnerships with major corporations and research institutions, accelerating the development and adoption of its technology. These partnerships validate the practical value of D-Wave's approach and strengthen its market position.

Financial Performance and Investment Considerations

Analyzing QBTS Stock Performance

Analyzing QBTS stock requires a careful evaluation of D-Wave's financial performance, including revenue growth, profitability, and investor sentiment. While still a relatively young company, D-Wave's financial data should be closely monitored to assess its progress towards sustained profitability and market penetration. Tracking stock price trends, analyst ratings, and news related to financial performance is crucial for making informed investment decisions.

Risk Assessment and Potential Returns

Investing in QBTS carries significant risks:

- Technological Uncertainty: The quantum computing field is still evolving, and the long-term viability of quantum annealing compared to gate-based approaches remains uncertain.

- Competition: Intense competition from larger players could impact D-Wave's market share and profitability.

- Market Adoption: Widespread adoption of quantum computing technologies might take longer than anticipated, affecting D-Wave's revenue growth.

However, the potential rewards are also considerable:

- First-Mover Advantage: D-Wave's early market entry and established technology could translate into significant market leadership.

- Growing Demand: The demand for quantum computing solutions is expected to increase exponentially across various industries.

- Technological Breakthroughs: Future advancements in quantum annealing could further enhance D-Wave's competitive position.

Conclusion: Is D-Wave Quantum (QBTS) a Smart Quantum Computing Investment in 2024?

D-Wave Quantum, with its unique quantum annealing technology, holds a strong position in the burgeoning quantum computing market. While it faces significant competition and technological uncertainties, its early market leadership, focus on practical applications, and growing partnerships indicate considerable potential. The QBTS stock presents both substantial risks and potential for high returns.

Therefore, an investment in D-Wave Quantum (QBTS) should be carefully considered as part of a diversified portfolio. Conduct thorough due diligence, including analyzing financial reports, assessing the competitive landscape, and understanding the inherent risks before making any investment decision. D-Wave Quantum’s potential as a leading quantum computing stock is undeniable, but careful consideration of its unique strengths and challenges is paramount.

Featured Posts

-

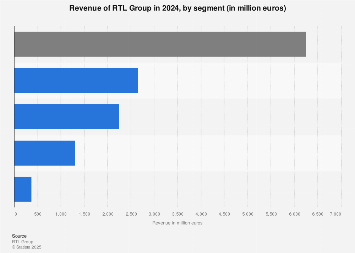

Analyzing Rtl Groups Progress Towards Streaming Profitability

May 21, 2025

Analyzing Rtl Groups Progress Towards Streaming Profitability

May 21, 2025 -

Abn Amro Analyse Van De Stijgende Occasionverkoop In Relatie Tot Autobezit

May 21, 2025

Abn Amro Analyse Van De Stijgende Occasionverkoop In Relatie Tot Autobezit

May 21, 2025 -

Lorraine Kelly Reacts To David Walliams Controversial Comment

May 21, 2025

Lorraine Kelly Reacts To David Walliams Controversial Comment

May 21, 2025 -

Echo Valley Images Reveal Details Of The Upcoming Sweeney Moore Thriller

May 21, 2025

Echo Valley Images Reveal Details Of The Upcoming Sweeney Moore Thriller

May 21, 2025 -

Dimokratiki Rodoy Synaylia Kathigiton Dimotikoy Odeioy

May 21, 2025

Dimokratiki Rodoy Synaylia Kathigiton Dimotikoy Odeioy

May 21, 2025

Latest Posts

-

Njwm Saedt Thlatht Laebyn Yndmwn Lmntkhb Amryka Lawl Mrt

May 22, 2025

Njwm Saedt Thlatht Laebyn Yndmwn Lmntkhb Amryka Lawl Mrt

May 22, 2025 -

Mfajat Bwtshytynw Thlathy Jdyd Fy Tshkylt Mntkhb Amryka

May 22, 2025

Mfajat Bwtshytynw Thlathy Jdyd Fy Tshkylt Mntkhb Amryka

May 22, 2025 -

1 3

May 22, 2025

1 3

May 22, 2025 -

Qaymt Mntkhb Amryka Ttjdd Bdm Thlatht Laebyn Tht Qyadt Bwtshytynw

May 22, 2025

Qaymt Mntkhb Amryka Ttjdd Bdm Thlatht Laebyn Tht Qyadt Bwtshytynw

May 22, 2025 -

Thlatht Laebyn Yndmwn Lawl Mrt Lmntkhb Amryka Bqyadt Bwtshytynw

May 22, 2025

Thlatht Laebyn Yndmwn Lawl Mrt Lmntkhb Amryka Bqyadt Bwtshytynw

May 22, 2025