D-Wave Quantum (QBTS) Stock: An Investor's Guide To Quantum Computing.

Table of Contents

Understanding D-Wave Quantum and its Technology

D-Wave Quantum is a leading developer of quantum computing systems, specializing in a type of quantum computing known as quantum annealing. Unlike gate-based quantum computers, which aim to perform universal quantum computations, D-Wave's systems are designed to excel at solving specific types of optimization problems. Quantum annealing leverages the principles of quantum mechanics to find the lowest energy state of a system, effectively solving complex optimization problems far more efficiently than classical computers can.

This technology finds applications in various sectors:

- Logistics: Optimizing supply chains, delivery routes, and resource allocation.

- Financial Modeling: Developing more accurate and efficient risk management models, portfolio optimization, and fraud detection systems.

- Materials Science: Discovering and designing new materials with improved properties, accelerating the research and development process.

- Artificial Intelligence: Enhancing machine learning algorithms for faster and more effective training.

D-Wave's advantage lies in its ability to tackle complex optimization problems that are intractable for classical computers. The company has forged partnerships with major organizations, demonstrating the real-world impact of its technology. These collaborations showcase the practical applications of D-Wave's quantum annealers and contribute to the validation of its technology's capabilities in diverse fields.

Analyzing QBTS Stock Performance

Analyzing QBTS stock performance requires considering historical trends alongside factors influencing its price fluctuations. (Insert chart/graph of QBTS stock performance here). The stock's price has shown significant volatility, reflecting the inherent risks and rewards associated with investing in a company at the forefront of a nascent technology.

Key factors influencing QBTS stock price include:

- Market Sentiment: Investor confidence in the quantum computing sector and D-Wave's progress significantly impact the stock price. Positive news regarding technological advancements or new partnerships can boost the stock, while negative news or setbacks can lead to declines.

- Technological Advancements: Successful development of new quantum annealing processors or improvements in performance directly affect the company's valuation and investor interest.

- Competition: The emergence of new players in the quantum computing landscape, both in gate-based and annealing approaches, adds a layer of competitive pressure.

Relevant financial metrics for evaluating QBTS include revenue growth, earnings, and market capitalization. (Insert relevant financial data here) Investors should closely monitor these metrics and compare them to D-Wave's competitors to gain a comprehensive understanding of the company's financial health and growth trajectory. The historical data provides a basis for understanding trends and projecting future performance, though inherent uncertainties remain.

Assessing the Risks and Rewards of Investing in QBTS

Investing in QBTS involves substantial risks. It's crucial to acknowledge the inherent volatility associated with investing in a high-growth, early-stage technology company. Market uncertainties, technological hurdles, and competitive pressures pose significant challenges.

Potential market disruptions could impact QBTS, such as breakthroughs in classical computing algorithms or the emergence of superior quantum computing technologies. The competitive landscape is dynamic, and D-Wave's position within it remains subject to change.

However, the potential rewards are equally significant. The long-term growth potential of the quantum computing market is substantial. Successful development and widespread adoption of D-Wave's technology could lead to significant returns on investment. The potential for groundbreaking advancements across multiple industries makes QBTS a potentially high-reward, albeit high-risk, investment.

Diversification Strategies and Risk Mitigation

Diversification is crucial when investing in QBTS. Holding QBTS as a small part of a larger, well-diversified portfolio helps mitigate the risk associated with this volatile stock.

Strategies for mitigating risk include:

- Dollar-cost averaging: Investing a fixed amount of money at regular intervals, regardless of the stock price.

- Diversification into ETFs: Investing in Exchange Traded Funds that track the broader technology or quantum computing sector reduces reliance on a single stock.

- Understanding your risk tolerance: Assessing your comfort level with potential losses before investing in QBTS is vital.

Consider other companies in the quantum computing sector, including those developing gate-based quantum computers or related technologies, to diversify further.

The Future of D-Wave Quantum and QBTS Stock

D-Wave's future plans focus on continuing technological advancements in quantum annealing, expanding its partnerships, and developing new applications for its systems. The long-term outlook for quantum computing remains highly positive, with industry forecasts projecting substantial growth in the coming years. (Include specific industry forecasts and expert opinions here).

Anticipated technological advancements include:

- Improved qubit coherence times, resulting in more accurate computations.

- Increased qubit count, allowing for the solution of even more complex problems.

- Development of new algorithms and software tools to enhance the usability of D-Wave's systems.

The potential for new applications and markets for D-Wave's technology is substantial, potentially driving significant growth in the future. The projected growth of the quantum computing market directly impacts the long-term prospects of QBTS stock.

Conclusion

Investing in D-Wave Quantum (QBTS) stock offers a unique opportunity to participate in the revolutionary world of quantum computing. However, the potential for high rewards comes with considerable risk. This guide has highlighted the company's technology, stock performance, and the risks and rewards involved. Thorough research and a well-defined investment strategy, including diversification, are absolutely crucial before making any investment decisions related to QBTS stock or other quantum computing investments. Remember to carefully consider your risk tolerance and conduct thorough due diligence before investing in this high-growth, high-risk sector.

Featured Posts

-

International Response To Pahalgam Terror Attack Switzerlands Official Statement

May 21, 2025

International Response To Pahalgam Terror Attack Switzerlands Official Statement

May 21, 2025 -

Malta Seger Foer Jacob Friis En Kampig Start Pa En Ny Era

May 21, 2025

Malta Seger Foer Jacob Friis En Kampig Start Pa En Ny Era

May 21, 2025 -

Ryanairs Growth Threatened By Tariff Wars Company Announces Buyback Plan

May 21, 2025

Ryanairs Growth Threatened By Tariff Wars Company Announces Buyback Plan

May 21, 2025 -

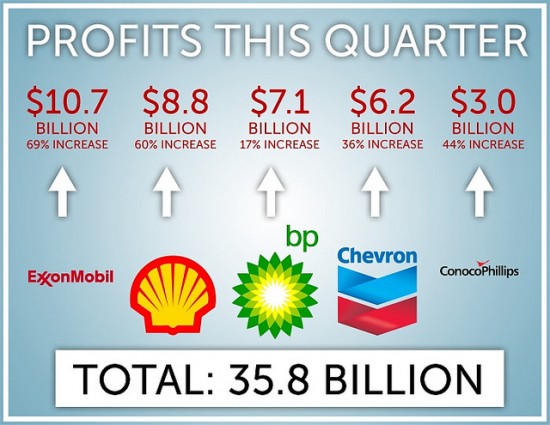

Reps Vow To Recover 1 231 Billion More From 28 Oil Firms

May 21, 2025

Reps Vow To Recover 1 231 Billion More From 28 Oil Firms

May 21, 2025 -

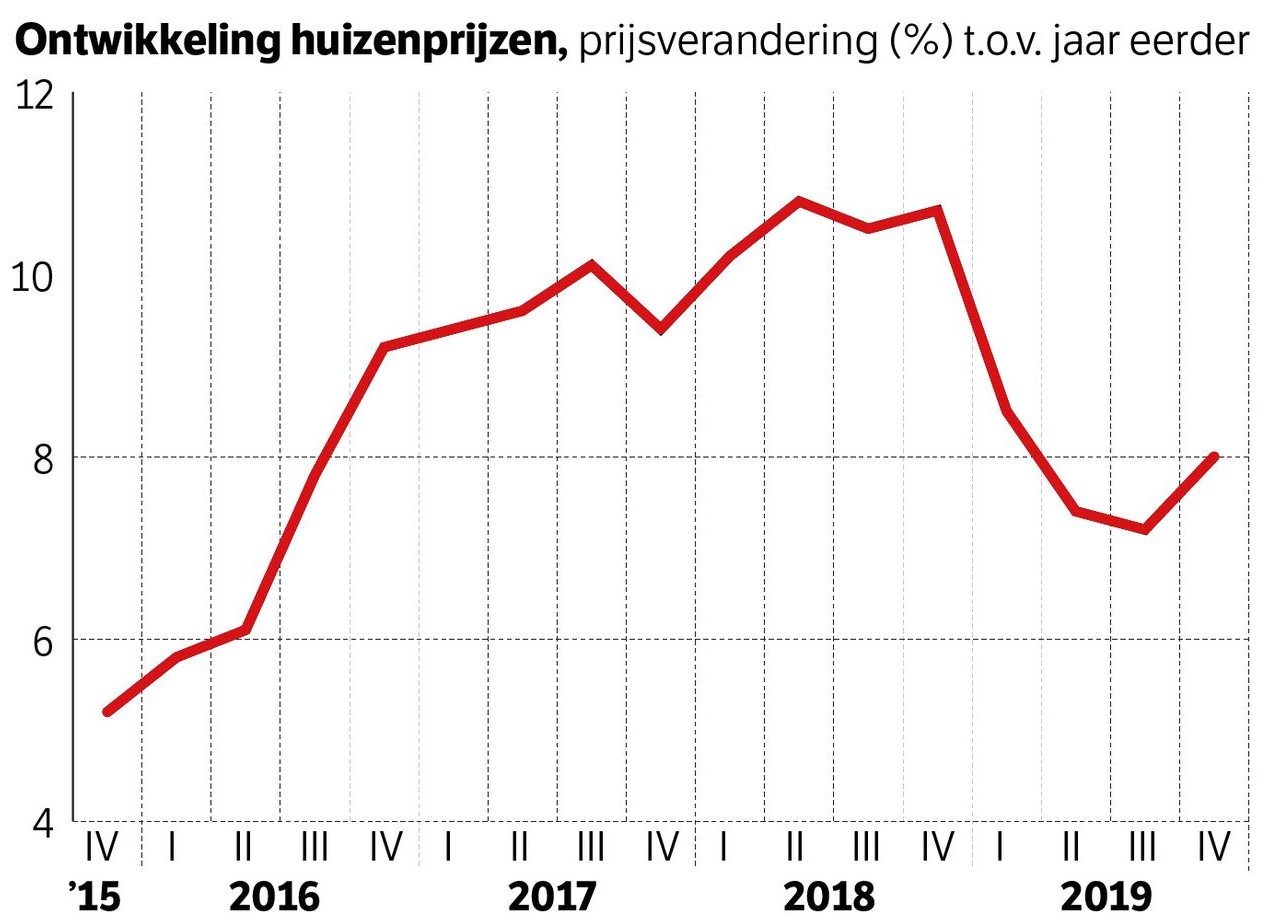

Stijgende Huizenprijzen Abn Amros Verwachtingen Voor 2024

May 21, 2025

Stijgende Huizenprijzen Abn Amros Verwachtingen Voor 2024

May 21, 2025

Latest Posts

-

Lazios Late Fight Secures 1 1 Draw Against 10 Man Juventus

May 22, 2025

Lazios Late Fight Secures 1 1 Draw Against 10 Man Juventus

May 22, 2025 -

Me Bwtshytynw Thlatht Wjwh Jdydt Fy Mntkhb Amryka

May 22, 2025

Me Bwtshytynw Thlatht Wjwh Jdydt Fy Mntkhb Amryka

May 22, 2025 -

Njwm Saedt Thlatht Laebyn Yndmwn Lmntkhb Amryka Lawl Mrt

May 22, 2025

Njwm Saedt Thlatht Laebyn Yndmwn Lmntkhb Amryka Lawl Mrt

May 22, 2025 -

Mfajat Bwtshytynw Thlathy Jdyd Fy Tshkylt Mntkhb Amryka

May 22, 2025

Mfajat Bwtshytynw Thlathy Jdyd Fy Tshkylt Mntkhb Amryka

May 22, 2025 -

1 3

May 22, 2025

1 3

May 22, 2025