D-Wave Quantum (QBTS) Stock Crash: Unpacking Monday's Sharp Decline

Table of Contents

Analyzing the Immediate Triggers of the QBTS Stock Decline

The sharp decline in QBTS stock price on Monday wasn't an isolated event; it stemmed from a confluence of factors, primarily related to the company's recent performance and broader market sentiment.

Post-Earnings Report Market Reaction

The QBTS stock crash followed the release of the company's latest earnings report. This report, covering [Specify Quarter, e.g., Q1 2024], revealed key metrics that fell short of analyst expectations and investor hopes, triggering a sell-off.

- Specific financial results: [Insert specific data points, e.g., Revenue was $X million, compared to analyst expectations of $Y million; Net loss was $Z million]. A detailed breakdown of these figures should be included here, referencing the official company report.

- Comparison to previous quarters: [Compare Q1 2024 results with Q4 2023 and Q1 2023 results, highlighting any significant discrepancies and percentage changes. This will provide context for the market's reaction].

- Analyst forecasts: [Mention specific analyst forecasts and how the actual results deviated from them. Reference specific analysts and their firms if possible]. The significant gap between the predicted QBTS earnings and actual results likely fueled the negative market reaction.

Keywords: QBTS earnings, Q1 results, financial performance, revenue shortfall, profit margins, D-Wave Quantum financials.

Wider Market Sentiment and Downturn

The QBTS stock decline wasn't solely attributable to its earnings report. A broader market downturn, particularly affecting technology stocks, contributed significantly to the sell-off.

- Correlation with overall market indices: [Explain the correlation between the drop in QBTS and major market indices like the NASDAQ or S&P 500. Did the overall market experience a downturn on that day? Did QBTS underperform the market or move in line with the general trend?]

- Performance of competitor stocks: [Analyze the performance of other quantum computing companies on the same day. Did they also experience a decline, suggesting a sector-wide issue, or did QBTS underperform its peers?] This will help determine if the decline was specific to D-Wave or part of a wider trend in the quantum computing investment space.

- General investor sentiment: [Discuss the prevailing sentiment among investors regarding the technology sector and quantum computing in particular. Was there a general sense of risk aversion or pessimism leading to the sell-off?]

Keywords: Market volatility, tech stock downturn, overall market conditions, sector-specific risks, quantum computing investment sentiment.

Long-Term Factors Contributing to QBTS Stock Volatility

Beyond the immediate triggers, several long-term factors contribute to the inherent volatility of QBTS stock and the quantum computing sector as a whole.

Competition in the Quantum Computing Market

D-Wave Quantum faces intense competition from established tech giants and emerging startups in the burgeoning quantum computing market.

- Key competitors: [List the major competitors of D-Wave Quantum, including IBM, Google, IonQ, and Rigetti. Briefly describe their strengths and market positions].

- Technological advancements from rivals: [Discuss recent technological advancements by competitors that could pose a threat to D-Wave's market share and technological leadership]. This analysis helps determine the competitive landscape and potential threats to D-Wave’s future growth.

- Market share dynamics: [Analyze the current market share distribution among key players in the quantum computing industry. Highlight D-Wave's position and potential challenges in maintaining or expanding its share].

Keywords: Quantum computing competition, market share, technological innovation, competitive advantage, D-Wave competitors.

Challenges in Commercializing Quantum Computing Technology

Commercializing quantum computing technology presents significant hurdles that contribute to the sector's volatility.

- Technological hurdles: [Discuss the significant technical challenges in scaling up quantum computers, achieving fault tolerance, and developing practical applications].

- High development costs: [Highlight the substantial investment required for research, development, and manufacturing of quantum computing hardware and software]. This underscores the inherent risks involved in this sector.

- Limited applications currently available: [Explain that the current applications of quantum computing are limited, and widespread adoption is still some years away. This impacts investor confidence and stock valuation].

Keywords: Commercialization challenges, technological risks, scalability issues, return on investment, quantum computing applications.

Investor Sentiment and Speculative Nature of the Stock

The price fluctuations of QBTS stock are heavily influenced by investor sentiment and speculation.

- High valuation compared to revenue: [Analyze the current valuation of D-Wave compared to its current revenue. A high valuation based on future potential rather than current profitability can make the stock susceptible to sharp price swings].

- Investor expectations vs. reality: [Discuss how investor expectations about the pace of technological progress and market adoption may not align with the current realities of the quantum computing industry, contributing to volatility].

- Potential for overvaluation: [Explore the possibility of QBTS being overvalued based on current market conditions and the long-term challenges facing the company].

Keywords: Speculative investing, stock valuation, investor psychology, market sentiment, QBTS stock valuation.

Conclusion

The D-Wave Quantum (QBTS) stock crash on Monday resulted from a complex interplay of factors, ranging from disappointing earnings reports (revealing a shortfall in QBTS earnings relative to expectations) to broader market trends and inherent challenges in the quantum computing sector. Understanding these contributing elements – from the specifics of the QBTS earnings report to the competitive landscape and the challenges of commercialization – is crucial for investors navigating the volatile landscape of quantum computing investments.

Call to Action: Stay informed about the evolving situation with D-Wave Quantum (QBTS) and other quantum computing stocks. Continuously monitor financial reports, market analyses, and industry developments to make informed decisions about your investment portfolio in the rapidly developing quantum computing landscape. Learn more about mitigating risk in quantum computing investments and developing a robust investment strategy for this volatile but potentially highly rewarding sector.

Featured Posts

-

Australian Ultramarathon Britons Fight Against The Odds

May 21, 2025

Australian Ultramarathon Britons Fight Against The Odds

May 21, 2025 -

Peppa Pigs Mummys Pregnancy A Baby Gender Reveal

May 21, 2025

Peppa Pigs Mummys Pregnancy A Baby Gender Reveal

May 21, 2025 -

Peppa Pig Meets The Baby 10 Episode Cinema Experience This May

May 21, 2025

Peppa Pig Meets The Baby 10 Episode Cinema Experience This May

May 21, 2025 -

Raw 5 19 2025 A Mixed Bag Our Top Moments And Low Points

May 21, 2025

Raw 5 19 2025 A Mixed Bag Our Top Moments And Low Points

May 21, 2025 -

Peppa Pigs Mum Reveals Babys Gender The Internet Reacts

May 21, 2025

Peppa Pigs Mum Reveals Babys Gender The Internet Reacts

May 21, 2025

Latest Posts

-

Matt Lucas And David Walliams Cliff Richard Musical One Big Snag

May 21, 2025

Matt Lucas And David Walliams Cliff Richard Musical One Big Snag

May 21, 2025 -

Gangsta Granny A Critical Look At The Narrative Structure

May 21, 2025

Gangsta Granny A Critical Look At The Narrative Structure

May 21, 2025 -

Gangsta Granny Comparisons To Other Childrens Literature

May 21, 2025

Gangsta Granny Comparisons To Other Childrens Literature

May 21, 2025 -

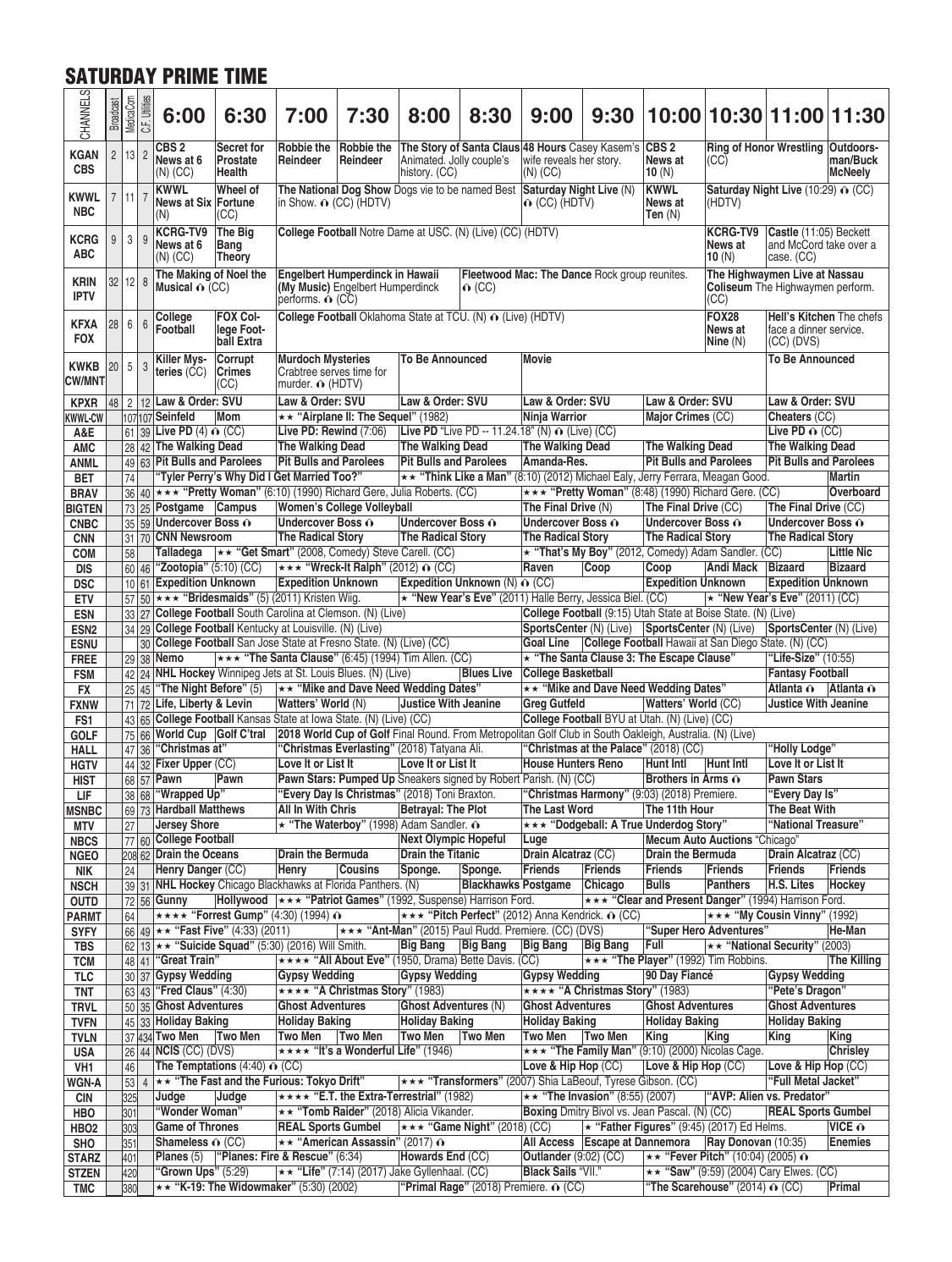

Complete Sandylands U Tv Listings And Airtimes

May 21, 2025

Complete Sandylands U Tv Listings And Airtimes

May 21, 2025 -

The Enduring Popularity Of Gangsta Granny

May 21, 2025

The Enduring Popularity Of Gangsta Granny

May 21, 2025