D-Wave Quantum (QBTS) Stock Performance: A Look At Thursday's Drop

Table of Contents

Thursday saw a significant drop in D-Wave Quantum (QBTS) stock price, leaving investors scrambling to understand the cause and its future implications. This article delves into the reasons behind this market downturn, examining factors impacting QBTS's performance and offering insights for investors navigating the often-volatile world of quantum computing stocks. The unpredictable nature of this emerging market makes understanding these fluctuations crucial for informed investment strategies.

Analyzing Thursday's QBTS Stock Decline

Potential Factors Contributing to the Drop

Several factors could have contributed to Thursday's QBTS stock decline. Unraveling the precise cause often requires a multifaceted analysis:

-

News and Press Releases: A thorough examination of news releases and press surrounding D-Wave Quantum is necessary. Any negative news concerning the company's technology, financial performance, or partnerships could trigger immediate sell-offs. For instance, delays in product development, revised financial projections, or unexpected challenges in securing further funding could significantly impact investor sentiment. Lack of significant positive news also contributes to a negative outlook.

-

Overall Market Sentiment: The broader market context is vital. Was Thursday's decline part of a wider correction in the technology sector? Examining the performance of the Nasdaq Composite and other technology indices on that day provides crucial context. If the entire technology sector experienced a downturn, the QBTS drop might reflect a general market trend rather than company-specific issues. Similarly, a negative trend within the quantum computing sector itself, impacting competitors like IonQ or Rigetti, could also influence QBTS's performance.

-

Investor Sentiment and Trading Volume: Analyzing trading volume alongside price fluctuations offers insights into the intensity of the decline. High trading volume coupled with a sharp drop suggests increased selling pressure. Conversely, a significant drop with low trading volume might point towards a smaller group of investors selling their shares, indicating less widespread panic. Understanding the magnitude and speed of the sell-off helps paint a clearer picture of the market's reaction.

-

Analyst Ratings and Price Target Adjustments: Any significant downgrades by financial analysts or adjustments to price targets for QBTS stock could contribute to negative investor sentiment. Analyst opinions heavily influence market perception, and a sudden shift in outlook can trigger a sell-off. Monitoring analyst reports is crucial for understanding shifts in investor confidence.

Comparing QBTS Performance to Competitors

Understanding how D-Wave Quantum performed relative to its competitors within the quantum computing space, such as IonQ and Rigetti, provides crucial context. A comparative analysis helps determine whether the drop was unique to QBTS or indicative of a broader trend within the quantum computing sector. Charts showing the daily performance of QBTS against these competitors would illuminate this comparison visually. This comparative analysis allows investors to distinguish between company-specific problems and industry-wide fluctuations.

Long-Term Implications for D-Wave Quantum Investors

Assessing the Risk and Reward

Investing in quantum computing stocks, including QBTS, presents both substantial risks and potential rewards. The technology is still in its early stages, meaning significant volatility is inherent. Factors to consider include:

- Technological Uncertainty: The long-term success of quantum computing technologies is not guaranteed. Technological hurdles and unexpected challenges could impact the growth trajectory of D-Wave Quantum.

- Market Competition: The quantum computing field is highly competitive. The emergence of new players and technological breakthroughs by competitors could impact D-Wave Quantum's market share.

- Regulatory Landscape: Government regulations and policies concerning the quantum computing industry could influence the future development and market adoption of the technology.

Future Outlook for QBTS

Despite the risks, several factors could positively impact QBTS's stock price:

- Product Launches: Successful launches of new quantum computing products and services could significantly boost investor confidence and drive stock prices.

- Strategic Partnerships: Collaborations with major technology companies or research institutions could increase D-Wave Quantum's market reach and credibility.

- Technological Advancements: Significant breakthroughs in quantum computing technology could solidify D-Wave Quantum's position in the market and attract further investment.

Strategies for Managing Risk

Investors can mitigate risks associated with QBTS by employing several strategies:

- Diversification: Spread investments across multiple asset classes, including stocks, bonds, and other sectors, to reduce reliance on any single company or industry.

- Stop-Loss Orders: Set stop-loss orders to limit potential losses if the stock price falls below a predetermined level.

- Thorough Due Diligence: Conduct comprehensive research and analysis before making any investment decisions. Understand the company's financial position, technology, and competitive landscape.

Conclusion

Thursday's drop in D-Wave Quantum (QBTS) stock price highlights the volatility inherent in the emerging quantum computing market. Several factors, from market-wide sentiment to company-specific news, likely contributed to the decline. Understanding both the short-term fluctuations and the long-term potential of D-Wave Quantum is crucial for informed investment decisions. The potential rewards are significant, but careful risk management is essential.

Call to Action: Understanding the factors influencing D-Wave Quantum (QBTS) stock performance is paramount for informed investment decisions. Continue researching QBTS and the broader quantum computing market to make sound judgments based on thorough analysis and a diversified investment strategy. Stay updated on future developments concerning D-Wave Quantum stock and the broader quantum technology landscape to navigate the exciting, yet volatile, world of quantum computing investments.

Featured Posts

-

Wwe News Rumors On Ronda Rousey Logan Paul Jey Uso And Big Es Relationship Status

May 21, 2025

Wwe News Rumors On Ronda Rousey Logan Paul Jey Uso And Big Es Relationship Status

May 21, 2025 -

Abn Amro Aex Stijging Na Positieve Kwartaalresultaten

May 21, 2025

Abn Amro Aex Stijging Na Positieve Kwartaalresultaten

May 21, 2025 -

Resilience And Mental Wellness From Setback To Success

May 21, 2025

Resilience And Mental Wellness From Setback To Success

May 21, 2025 -

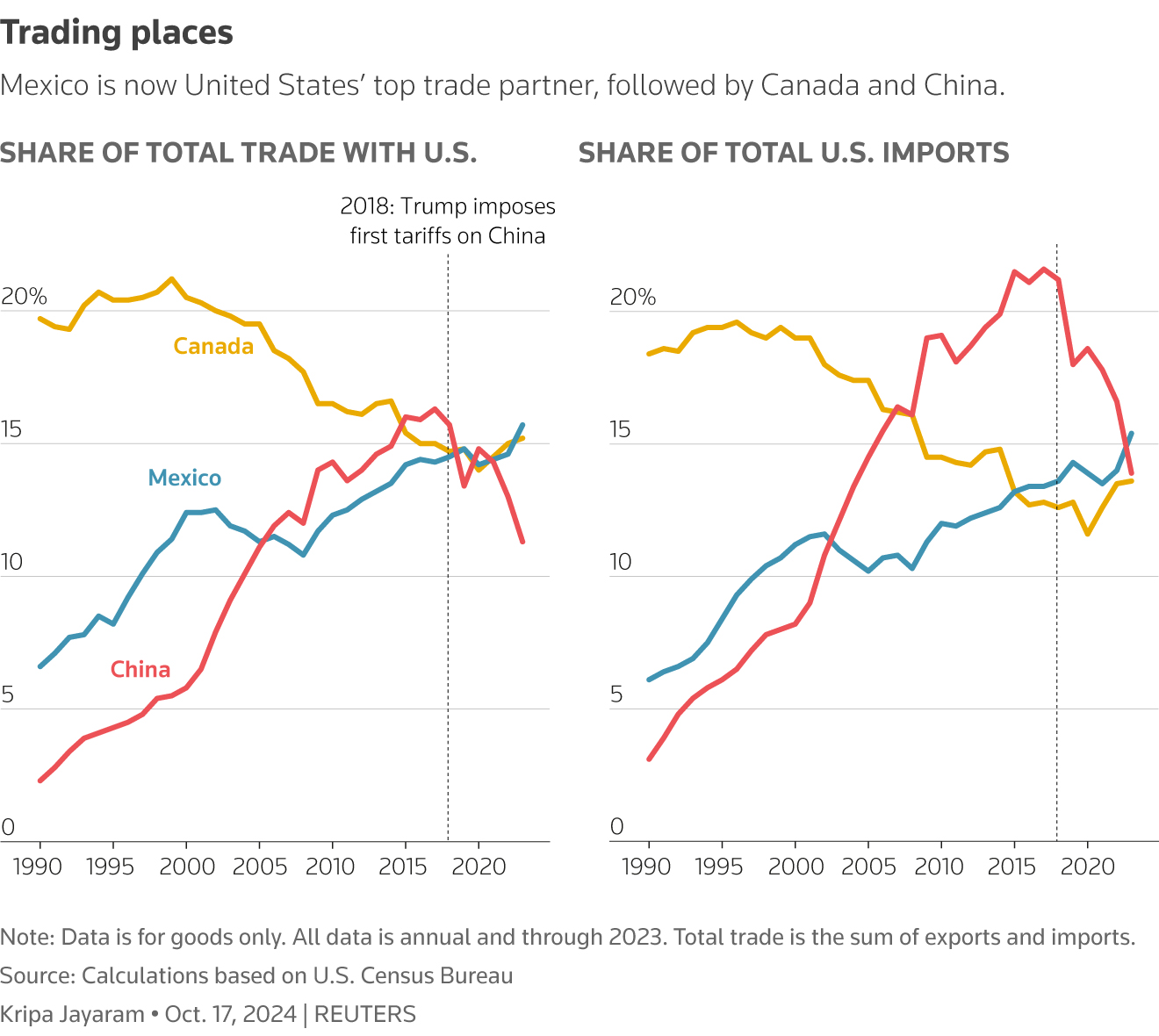

Dispute Over Us Tariffs Canada Rebuts Oxford Report Findings

May 21, 2025

Dispute Over Us Tariffs Canada Rebuts Oxford Report Findings

May 21, 2025 -

Hotel Fire Tweet Leads To Jail Sentence For Tory Councillors Wife Appeal Pending

May 21, 2025

Hotel Fire Tweet Leads To Jail Sentence For Tory Councillors Wife Appeal Pending

May 21, 2025

Latest Posts

-

Manchester Citys Pep Guardiola Succession Arsenal Legend In The Frame

May 22, 2025

Manchester Citys Pep Guardiola Succession Arsenal Legend In The Frame

May 22, 2025 -

Ea Fc 25 Fut Birthday Which Cards Are Worth It A Tier List

May 22, 2025

Ea Fc 25 Fut Birthday Which Cards Are Worth It A Tier List

May 22, 2025 -

Defining The Sound Perimeter Music And Shared Experience

May 22, 2025

Defining The Sound Perimeter Music And Shared Experience

May 22, 2025 -

Ea Fc 25 Fut Birthday Tier List Top Players To Target

May 22, 2025

Ea Fc 25 Fut Birthday Tier List Top Players To Target

May 22, 2025 -

Sound Perimeter Musics Role In Building Connection

May 22, 2025

Sound Perimeter Musics Role In Building Connection

May 22, 2025