D-Wave Quantum (QBTS) Stock Performance In 2025: A Deep Dive

Table of Contents

Analyzing D-Wave's Technological Advancements and Market Position in 2025

D-Wave Quantum is a pioneer in the field of quantum annealing, a specific approach to quantum computing. Their current technological capabilities center around their Advantage™ system, a powerful quantum annealer. To accurately predict QBTS stock performance in 2025, we must consider their planned advancements. Their competitive landscape includes giants like IBM and Google, as well as smaller players like Rigetti. D-Wave's success will depend on its ability to maintain a competitive edge.

- New quantum annealing processor releases and their impact on performance: The release of even more powerful annealing processors will be crucial. Increased qubit count and improved connectivity will directly influence the performance of their systems, attracting more customers and potentially boosting QBTS stock value.

- Progress in hybrid quantum-classical computing solutions: D-Wave’s focus on hybrid systems that combine classical and quantum computation is key. The seamless integration of these two computational paradigms will be a significant factor in determining their market competitiveness.

- Expansion of partnerships and collaborations: Strategic alliances with major players in various industries can open new markets for D-Wave's technology, driving revenue and influencing QBTS stock positively.

- Development of new quantum applications and their market potential: The identification and development of commercially viable applications for quantum annealing, such as optimization problems in logistics, finance, and materials science, is paramount for D-Wave's future success and QBTS stock valuation. The ability to demonstrate real-world value will be a key driver.

Impact of Industry Trends on QBTS Stock Price

The quantum computing industry is experiencing significant growth, attracting substantial investment. Government initiatives and funding programs worldwide are playing a crucial role in accelerating research and development in this sector. These macroeconomic factors significantly influence the valuation of quantum computing stocks like QBTS.

- Government funding for quantum research and its impact on QBTS: Increased government funding for quantum computing research directly benefits companies like D-Wave, fostering innovation and driving technological advancements. This translates into potential growth for QBTS stock.

- Emerging applications of quantum computing and their market potential: As quantum computing technology matures, the range of potential applications expands. The successful commercialization of these applications will directly impact the industry's growth trajectory and the valuation of companies like D-Wave.

- Competition from other quantum computing companies and its effect on QBTS valuation: The competitive landscape is dynamic, with significant players emerging. D-Wave's ability to differentiate itself and establish a strong market position will be essential for its long-term success and the performance of QBTS stock.

- Overall market sentiment towards quantum computing investments: Investor confidence and market sentiment are pivotal. Positive sentiment and increased investment in the quantum computing sector will undoubtedly benefit D-Wave and impact QBTS stock positively.

Financial Performance and Key Indicators of D-Wave Quantum

Analyzing D-Wave's financial health—revenue, profitability, and debt levels—is critical for predicting future stock performance. Key financial indicators, such as the P/E ratio and revenue growth, offer insights into the company's financial stability and potential for future growth. Understanding their business model and its long-term sustainability is crucial.

- Analysis of D-Wave's financial statements: A careful review of D-Wave's financial reports, including revenue, expenses, and profitability, is essential to understand their financial health and potential for future growth.

- Comparison with key financial metrics of competitors: Benchmarking D-Wave's financial performance against its competitors helps gauge its relative position within the market and predict its future trajectory.

- Assessment of D-Wave's long-term financial sustainability: Evaluating the sustainability of D-Wave's business model and its ability to generate consistent revenue and profits over the long term is crucial for predicting the long-term prospects of QBTS stock.

- Potential for future profitability and revenue growth: Analyzing market trends, technological advancements, and competitive landscape to project future revenue growth and profitability is essential for a comprehensive assessment of QBTS's investment potential.

Risk Factors Affecting QBTS Stock Price in 2025

Investing in QBTS carries inherent risks. The quantum computing market is volatile, and several factors could negatively impact D-Wave's growth and the price of its stock.

- Technological risks and potential delays in development: Technological challenges and unforeseen delays in the development of new quantum computing technologies could impact D-Wave's progress and negatively affect QBTS stock.

- Competition from established tech giants: The intense competition from established tech giants with substantial resources poses a significant challenge to D-Wave's market share and growth prospects.

- Market fluctuations and overall economic conditions: Broader market fluctuations and overall economic conditions can significantly impact investor sentiment and the valuation of even the most promising companies, including D-Wave.

- Regulatory hurdles and geopolitical factors: Regulatory changes and geopolitical factors could create uncertainties and challenges for D-Wave's operations and growth trajectory.

Investing in D-Wave Quantum (QBTS) in 2025 – A Final Outlook

Predicting the future performance of D-Wave Quantum (QBTS) stock in 2025 requires a comprehensive analysis of its technological progress, the overall quantum computing industry trends, its financial health, and the inherent risks involved. While D-Wave holds a pioneering position in quantum annealing, competition is fierce, and the market remains volatile. Therefore, a balanced approach considering both potential growth and significant risks is necessary. Thorough research is essential before making any investment decisions. Stay informed about D-Wave Quantum (QBTS) stock performance and make well-informed investment decisions. Learn more about D-Wave Quantum (QBTS) stock and its potential for future growth today!

Featured Posts

-

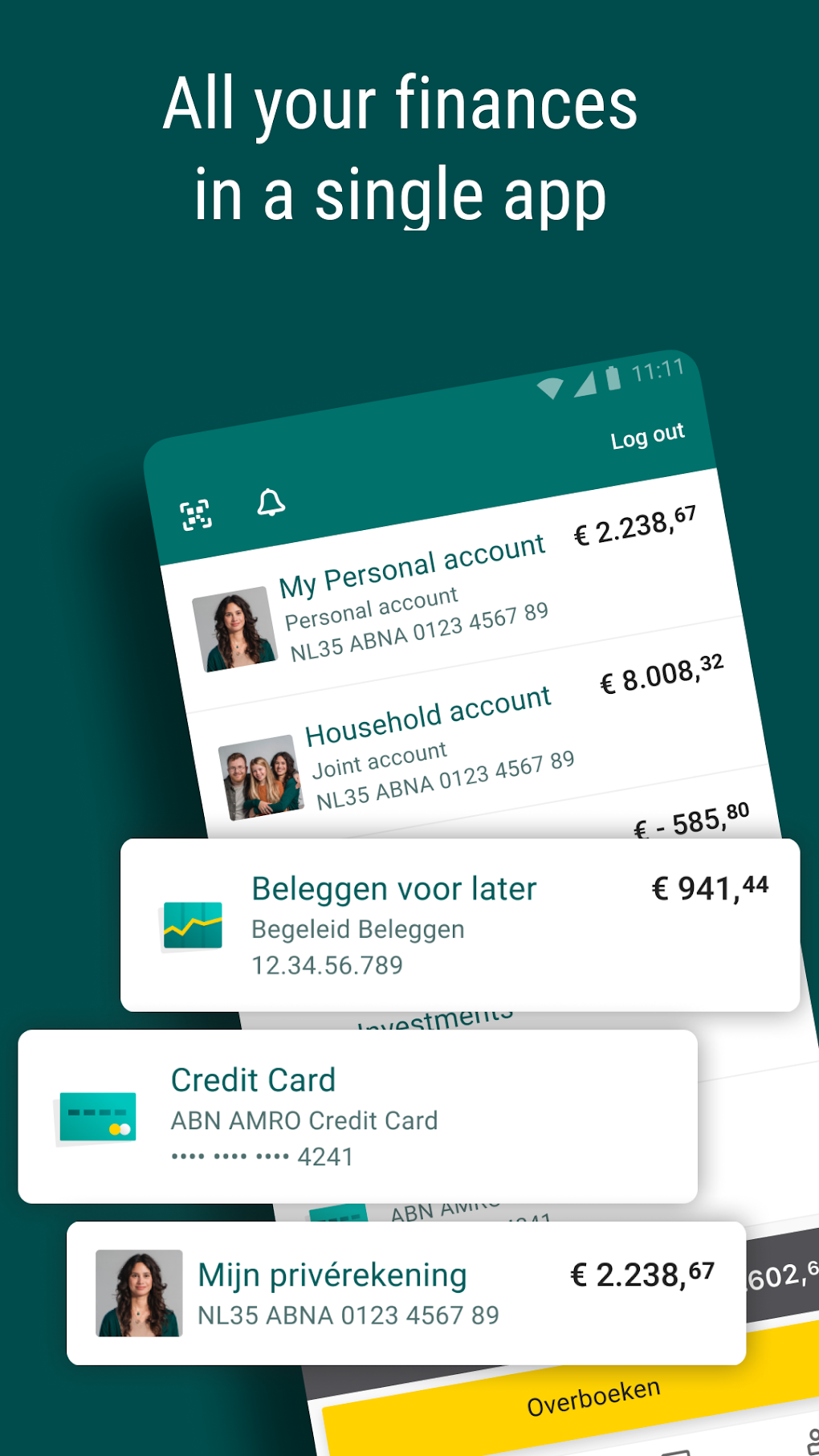

Abn Amro Import Van Voedingsmiddelen Naar Vs Gehalveerd Door Heffingen

May 21, 2025

Abn Amro Import Van Voedingsmiddelen Naar Vs Gehalveerd Door Heffingen

May 21, 2025 -

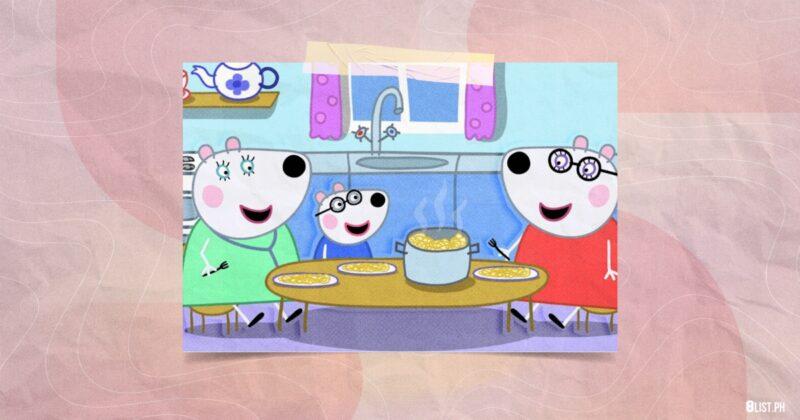

Its A Peppa Pigs Mummys Gender Reveal

May 21, 2025

Its A Peppa Pigs Mummys Gender Reveal

May 21, 2025 -

Nuffys Dream Touring With Vybz Kartel

May 21, 2025

Nuffys Dream Touring With Vybz Kartel

May 21, 2025 -

Looney Tunes Cartoon Network Collaboration 2025 Animated Short Announced

May 21, 2025

Looney Tunes Cartoon Network Collaboration 2025 Animated Short Announced

May 21, 2025 -

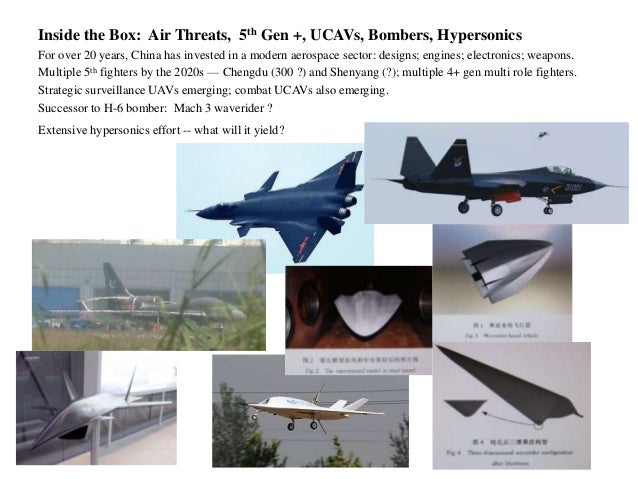

Switzerland Issues Statement On Prc Military Activities

May 21, 2025

Switzerland Issues Statement On Prc Military Activities

May 21, 2025

Latest Posts

-

Gangsta Granny A Critical Look At The Narrative Structure

May 21, 2025

Gangsta Granny A Critical Look At The Narrative Structure

May 21, 2025 -

Gangsta Granny Comparisons To Other Childrens Literature

May 21, 2025

Gangsta Granny Comparisons To Other Childrens Literature

May 21, 2025 -

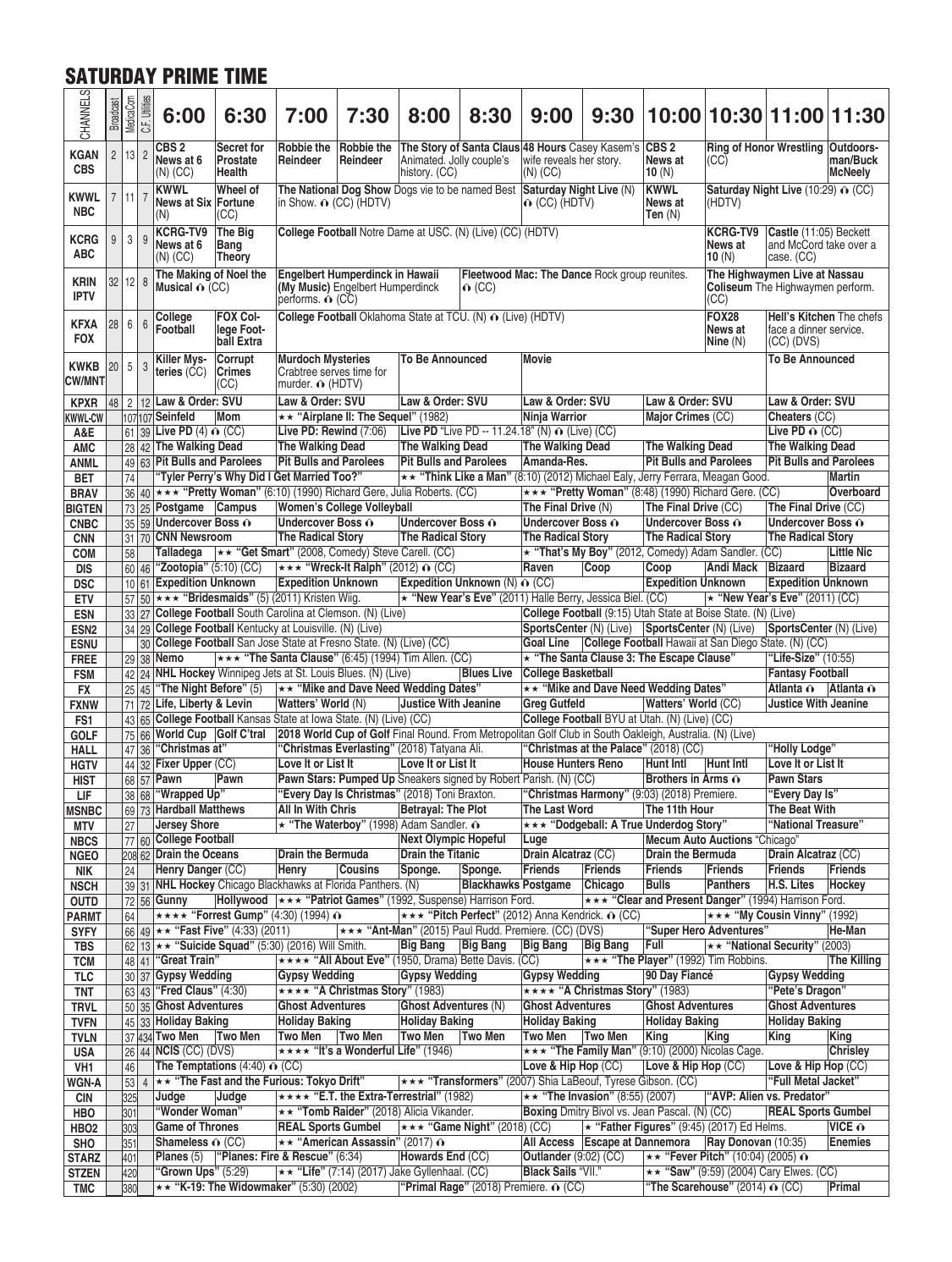

Complete Sandylands U Tv Listings And Airtimes

May 21, 2025

Complete Sandylands U Tv Listings And Airtimes

May 21, 2025 -

The Enduring Popularity Of Gangsta Granny

May 21, 2025

The Enduring Popularity Of Gangsta Granny

May 21, 2025 -

Is Gangsta Granny Suitable For All Ages A Parental Guide

May 21, 2025

Is Gangsta Granny Suitable For All Ages A Parental Guide

May 21, 2025